As the price of Bit continues to soar, the traditional financial market has welcomed an "uninvited guest" - MicroStrategy (MSTR). The company, which was once focused on business intelligence software, has now transformed into a "super bull" in the Bit market. As of November 2024, MicroStrategy holds about 331,200 Bits, with a market value of about $3 billion.

MicroStrategy has used innovative financial means such as issuing convertible bonds and additional share offerings to introduce the huge capital of the traditional bond market into the Bit ecosystem. This strategy has sparked vastly different evaluations in the capital market: Some call it the "miracle of modern financial innovation", skillfully integrating traditional and crypto assets; others criticize it as the "epitome of high-leverage speculation", believing that the risks have been greatly amplified. Just as MSTR's stock price was soaring along with Bit, Citron Research issued a short statement, casting a shadow over this capital feast. Is MicroStrategy's aggressive strategy the lighthouse of industry transformation, or the abyss of hidden crisis? This article will analyze the full picture of this capital experiment.

The Bit Surge and the Super Bull Effect of MicroStrategy

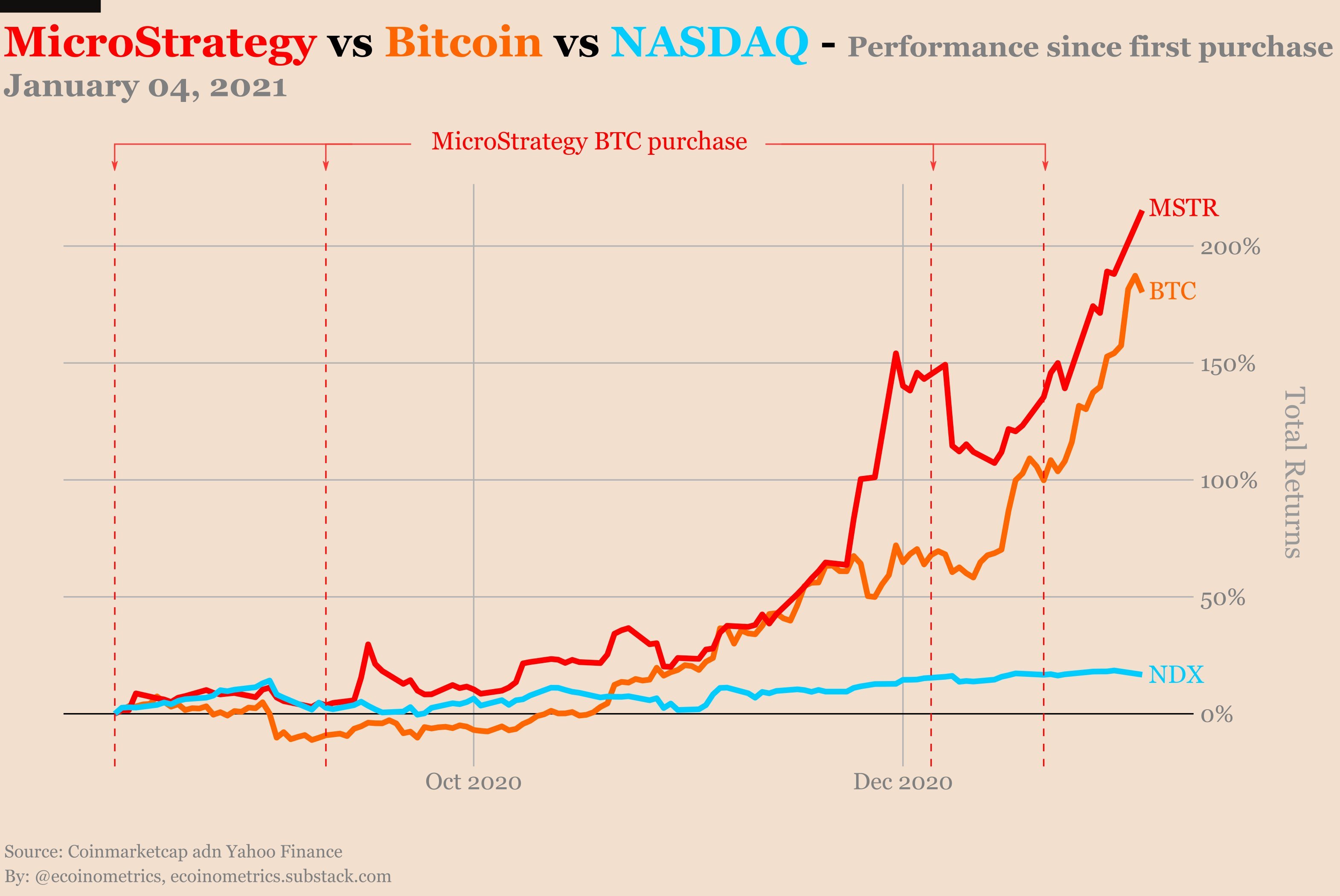

With the continued surge in the Bit market, its heat wave has quickly spread to related US stock targets, triggering an unprecedented capital frenzy. Within a month, the stock price of MicroStrategy (MSTR) soared more than 200%, Marathon Digital (MARA) and Riot Platforms (RIOT) rose 180% and 150% respectively, and Coinbase (COIN) also gained over 120%. These stocks, with different Bit exposure logics, collectively depict the prosperous scene of US stock Bit concept stocks. As the "super bull" of the Bit market, MicroStrategy is leading the Bit-related concept stocks through its unique strategy, transforming the high volatility of Bit into financial leverage in the capital market.

The uniqueness of MSTR lies in the fact that it is not a traditional technology company, nor a simple Bit mining company or trading platform, but has positioned itself as the spokesperson for Bit by holding a large amount of Bit directly. Since 2020, MicroStrategy has embarked on a bold adventure: raising funds through bond issuance, additional share offerings, and fully purchasing Bit. Under the leadership of Chairman Michael Saylor, the company, which was originally focused on business intelligence software, has become the listed company with the largest Bit holdings globally, with the value of its Bit holdings exceeding $30 billion. MSTR's risky move not only tightly linked its stock price to Bit, but also attracted great interest from the traditional capital market in its strategy.

This close correlation has led investors to view MSTR as a magnifying glass for Bit prices. Compared to directly purchasing Bit, investing in MSTR stocks can indirectly share the dividends of Bit price increases, while avoiding the technical thresholds and security risks of directly holding Bit. This convenience, combined with MSTR's unique capital operation model, has made it an important channel for investors to enter the crypto market. But this amplification effect is not solely dependent on market sentiment, but has complex financial logic behind it, and can even be seen as the result of Michael Saylor's clever use of financial instruments to compete with the traditional capital market.

Premium Issuance and Capital Flywheel: MSTR's Wealth Leverage

A key feature of MSTR's stock price is its "premium" effect - the company's market value is far higher than the market value of the Bit it holds.

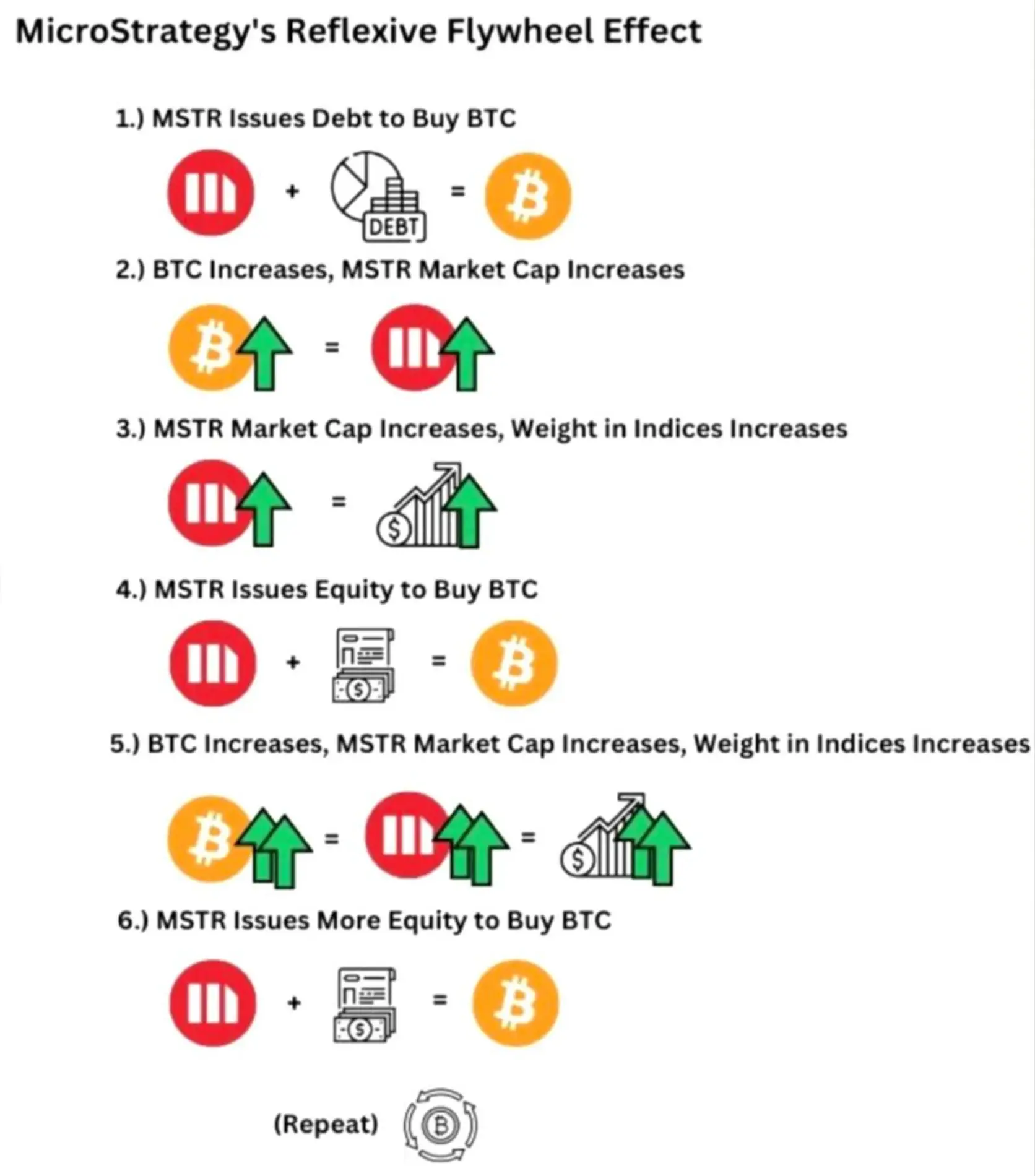

The formation of this premium is inseparable from a strategy used by MSTR called "premium issuance". Utilizing the high volatility of its stock price, MSTR issues stocks to raise funds when the premium is relatively high, and then uses the funds to further purchase Bit. This strategy forms a closed loop:

Bit price rises → MSTR stock price rises accordingly → Company raises funds at low interest rates → Purchases more Bit → Stock price continues to rise.

This mechanism, known as the "Reflexive Flywheel Effect", not only helps the company quickly accumulate Bit assets, but also deeply binds its stock price performance to Bit gains, creating greater growth expectations for the market.

The core highlight of this flywheel effect lies in the amplification effect of the "MSTR stock premium" on Bit purchases. For example, when the NAV (net asset value) premium reaches 2.74, for every additional share of MSTR issued, the funds obtained can purchase an amount of Bit equivalent to 2.74 times its net value. This mechanism allows MSTR not only to rapidly expand its Bit holdings, but also to maximize the "leverage effect", making the scale of its balance sheet far exceed market expectations.

At the same time, the positive correlation between MSTR and Bit prices (recently reaching a historical high of 0.365) further strengthens this effect. The rapid growth in market value has led to MSTR being included in more US stock indices, attracting a large influx of passive capital. This index buying pressure has exacerbated the "asset net value premium", forming a unique "index flywheel effect", where the volatility of crypto-currencies and traditional financial markets is deeply bound through active investment and passive flows in the capital market.

Furthermore, MSTR has also introduced capital from the traditional bond market by issuing convertible bonds, providing more flexible support for its Bit purchase plan. Compared to ordinary bonds, convertible bonds offer investors a dual choice of capital protection and stock price growth returns. For example, in February 2021, MSTR issued $1.05 billion in zero-coupon convertible bonds with an initial conversion price 50% higher than the stock price at the time of issuance. This low-cost financing method not only reduces the company's financial burden, but also attracts a large number of professional investors due to its high volatility. These funds are quickly converted into Bit holdings, forming a unique "capital funnel" connecting the traditional finance and crypto markets.

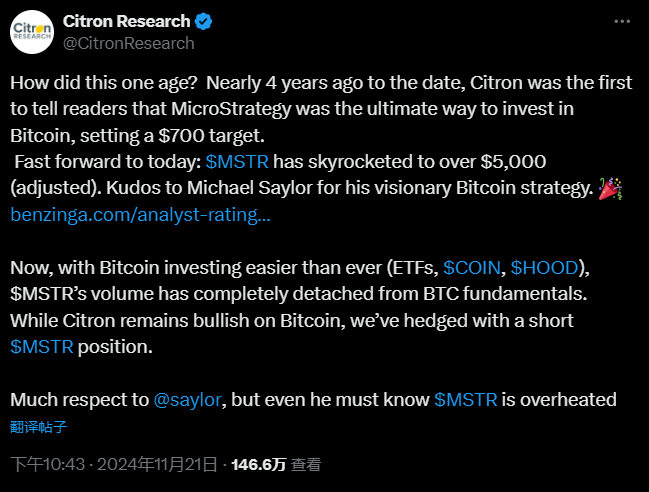

All of this is inseparable from Michael Saylor's financial acumen and his passionate belief in Bit. Under his leadership, MSTR has continuously refreshed market records through bond and stock financing, tightly binding the traditional finance and crypto-currency markets. However, this aggressive strategy has also sparked widespread controversy. Recently, Citron Research has questioned MSTR's premium model, arguing that this strategy heavily dependent on Bit prices hides huge risks, and has issued a short statement. This move has led to a significant drop in MSTR's stock price in the short term.

Does Citron's short behavior reveal the potential risks of MSTR, or does it actually prove the unique value of its financial strategy? More importantly, in the environment of violent fluctuations in Bit prices, can MSTR's business model withstand the dual test of time and the market?

Citron's Short: Short-term Game or Value Questioning?

Citron Research's short targeting of MicroStrategy (MSTR) this time not only appears precise, but is also particularly noteworthy given its special background. In 2020, when MicroStrategy first incorporated Bit as an important part of its balance sheet, Citron was one of the earliest institutions to recommend that investors buy MSTR. At the time, Citron boldly stated that MSTR provided a "smart alternative" that allowed investors to indirectly hold Bit through a listed company, without facing the security and liquidity challenges of directly holding Bit. This bullish view was even seen as a rare positive evaluation of the crypto market by Citron, and also helped many investors capture the bountiful returns brought by MSTR's subsequent rounds of rallies.

However, this time, Hindenburg Research has turned the tables and become the "gravedigger" who openly questions the MSTR model. From a certain perspective, it is precisely because Hindenburg Research was once a staunch supporter of MSTR that its criticism of the current high-premium model carries more authority. Hindenburg Research believes that MSTR's valuation has deviated from the value of its actual Bit holdings, as Bit investment has become easier than ever before (one can now buy ETFs, COIN, and HOOD), MSTR's trading volume has completely decoupled from the fundamentals of Bit. The premium is mainly due to the market's blind optimism about its "flywheel effect", which is entirely dependent on the unilateral rise in Bit price. Once the market sentiment reverses, this premium may evaporate quickly.

However, Hindenburg Research's short may not be driven by long-term logic, but more likely a short-term game targeting market sentiment. In its past operations, Hindenburg Research has repeatedly utilized the market sentiment of high-volatility targets, released short reports to create panic sentiment, and thus quickly pushed down stock prices. In the 2020 Nikola case, Hindenburg Research triggered a stock price crash by publicly questioning its business model, and then quickly closed its position and profited. Similar operations have also occurred in cases such as Valeant. For MSTR, its highly volatile stock price and investors' sensitive sentiment towards Bit provide Hindenburg Research with an excellent opportunity for short-term operations.

This strategy has indeed had an impact on MSTR's stock price in the short term. On the day of Hindenburg Research's announcement, MSTR's stock price plummeted more than 20% intraday and closed down over 16%, temporarily triggering market concerns about its high-premium model. As of the time of writing, MSTR's stock price has rebounded 6%. In addition, when shorting MicroStrategy, Hindenburg Research chose a rather clever strategy: on the one hand, it clearly stated that it is bearish on MSTR's stock price, while on the other hand, it maintains a bullish stance on Bit itself. This "double-faced attitude" is not accidental, but the result of careful design.

The Bit investor community is mainly composed of retail investors, many of whom are "die-hard bulls" with extreme faith in Bit. These retail investors have demonstrated strong counterattacking capabilities in the GameStop event, using joint actions to "short squeeze" institutional investors and forcing them to cover their positions at a huge cost. Hindenburg Research has obviously learned this lesson and chosen to "draw a clear line" between shorting MSTR and Bit itself when shorting MSTR, avoiding directing the retail investors' anger towards itself. This strategy can be seen as a precise grasp of market sentiment: MSTR's premium model is closely related to the fluctuation of Bit price, but Hindenburg Research's report cleverly directs the spearhead towards MSTR's financial structure and valuation issues, rather than challenging the long-term value of Bit as an asset.

This clever strategy not only reduces the risk of "overall bearishness" but also allows Hindenburg Research to focus on the high volatility and high valuation of MSTR's stock price without damaging the market sentiment of the Bit market. However, whether this strategy can continue to be effective in the market remains to be observed.

High-wire act: Will MSTR be the next Luna?

Hindenburg Research's short announcement has thrust MSTR into the center of public attention, but unfortunately, Hindenburg Research did not release an official short report, and there is no detailed logical deduction to refer to. So, based on the existing data alone, MSTR's flywheel seems more like a capital magic trick: left foot on the right foot, spinning faster and faster. In a bull market, this flywheel is almost a perfect tool for spiraling upwards, but the higher it flies, the closer it may be to collapse. After all, how safe is MSTR?

This flywheel may seem complex, but the logic is quite simple: use money to buy Bit, Bit goes up, the stock price follows, issue more shares or bonds to get more money, and then continue to buy Bit. So, Bit goes up again, the stock price goes up again, and this cycle looks like a perpetual motion machine. However, unlike the essence of a bubble, MSTR's trump card is the real gold and silver of Bit assets, rather than the "left hand printing money, right hand buying" false prosperity like Luna. The collapse of Luna was due to the lack of any anchor asset for UST, relying entirely on market confidence and 20% false returns, while MSTR's Bit is not only a hard asset, but also has far higher market acceptance than UST. This makes MSTR's flywheel more like a bold investment experiment in a bull market, rather than just a simple accumulation of risks.

Secondly, its debt is loose and has a long time horizon, with the main repayment not due until 2027, meaning it will face almost no repayment pressure in the next three years. Moreover, its financing costs are enviably low, with the debt due in 2027 having an interest rate of 0%, and the subsequent few bonds having interest rates of only 0.625% to 2.25%. More importantly, MSTR's average Bit holding cost is only $49,874, while the current Bit price has already nearly doubled, forming a natural risk buffer of nearly 100% in unrealized gains. Even in the worst-case scenario of a 75% plunge in Bit price to $25,000, MSTR would not need to sell its assets, as its off-balance-sheet leverage has no margin call mechanism. Creditors can only choose to convert the bonds into MSTR shares, and cannot directly force the company to sell Bit to repay debt.

Now, the answer is negative. At least in the next three years, MSTR's flywheel still has sufficient momentum to keep spinning. But this does not mean there is no risk. MSTR's entire model is highly dependent on Bit's price performance, and if the Bit market remains depressed until 2027, the company may have to sell some Bit to repay debt. At the same time, its reliance on market confidence also means that any major sentiment fluctuations could have an impact on its stock price and financing capabilities.

The Diverse Ecosystem of Bit-Related Stocks in the US Market

Not surprisingly, MicroStrategy is not the only controversial Bit-related stock in the US stock market. Bit's price fluctuations have never been an isolated phenomenon in the digital currency field, but have permeated the stock market through various forms, giving rise to a group of Bit concept stocks, whose positioning and logic of rise and fall are not entirely the same. MicroStrategy is the most controversial among them, but other types of Bit concept stocks also play an important role.

From an investment logic perspective, Bit-related stocks in the US market can be roughly divided into three categories: direct holding, mining, and service.

First is the direct holding type, represented by MicroStrategy. By issuing bonds and additional shares to directly purchase Bit, converting it into a part of the company's balance sheet. This model directly links its stock price to the fluctuations in Bit price, and even amplifies the rise and fall. But MSTR does not participate in Bit mining or trading business, it is more like an alternative to a "Bit ETF", providing a convenient way for traditional investors who want to gain exposure to Bit. In addition to MicroStrategy, there are also:

- Galaxy Digital Holdings Ltd. (GLXY): Galaxy Digital is a financial services company focused on cryptocurrency investment, trading, and asset management. As of November 2024, the company's assets under management have exceeded $3 billion.

- Tesla Inc. (TSLA): Tesla holds about 10,500 Bits, with an initial total value of $336 million, accounting for 0.05% of the Bit supply.

Mining-type concept stocks are quite different. Marathon Digital (MARA) and Riot Platforms (RIOT) are the two major leaders in this field. They build large-scale mining facilities to earn Bit revenue in exchange for computing power. The rise and fall of mining-type stocks is not only affected by Bit price, but also closely related to mining operating costs, especially electricity costs and equipment update cycles. Compared to MSTR, this type of stock has more complex risks, as they not only face the volatility of Bit prices, but also need to consider the impact of mining difficulty, energy price fluctuations, and policy changes.

- Marathon Digital Holdings (MARA): As one of the largest Bit coin mining companies in the United States, Marathon Digital continues to expand its number of mining machines and computing power. As of November 2024, the company's total computing power has reached 20 EH/s.

- Riot Platforms (RIOT): Riot Platforms operates large-scale mining farms in Texas, focusing on Bit coin mining business. The company plans to increase its total computing power to 15 EH/s within the next two years.

- Hut 8 Mining Corp (HUT): Hut 8 Mining, headquartered in Canada, operates multiple mining farms in North America, focusing on mining Bit coin and Ethereum. As of November 2024, the company holds more than 10,000 Bit coins.

- Bitfarms Ltd. (BITF): Bitfarms operates multiple mining farms in Canada and the United States, focusing on Bit coin mining. The company plans to increase its total computing power to 8 EH/s by 2025.

Finally, there are service-oriented concept stocks, represented by Coinbase (COIN). These companies do not directly hold Bit coins, nor do they participate in mining, but rather profit from market activity by providing services such as trading, custody, and payment. Coinbase's business model is more akin to traditional finance, with revenue mainly dependent on trading volume and user activity. When the Bit coin market is booming, these stocks typically perform well, but they have relatively lower volatility and are more affected by regulatory policies. Another example is Block Inc. (SQ): formerly known as Square, Block supports the purchase and sale of Bit coins through its Cash App application and provides merchants with solutions to accept Bit coin payments.

Although these concept stocks are closely related to Bit coin, their investment logic and risk characteristics are vastly different. Direct holding-type (such as MSTR) have the largest fluctuations due to their direct correlation with Bit coin prices; mining-type stocks have the dual risk of energy costs and equipment investment; service-oriented companies, while having a stable revenue source, their growth is highly dependent on market enthusiasm.

Conclusion

MicroStrategy's story is not only about a company's successful experiment in betting on Bit coin, but also a microcosm of the integration of traditional finance and the emerging cryptocurrency market. In the midst of the global capital market's continuous adaptation to the wave of digital assets, MSTR, with its unique financial strategy and high-leverage model, has become a key bridge connecting these two domains. However, the future of this model is still full of uncertainty: will it become a replicable success story, or will it disintegrate due to market volatility and high risk? Regardless of the answer, the insights and controversies brought by MicroStrategy provide valuable references for the mainstream adoption of cryptocurrencies, and add more possibilities to the future of the capital market.