Bitcoin has been hitting new all-time highs, with the latest price around $99,000, approaching the $100,000 mark, and market sentiment has been heating up accordingly. More and more investors are predicting that Bitcoin will continue to rise in the near future, pointing to even higher targets, and some even believe its long-term value will far exceed this level. However, while Bitcoin prices have hit new highs, the Altcoin market has fallen into a slump, with the prices of many small coins shrinking significantly in the short term, and market capital flow is clearly tilted towards Bitcoin.

VX: TTZS6308

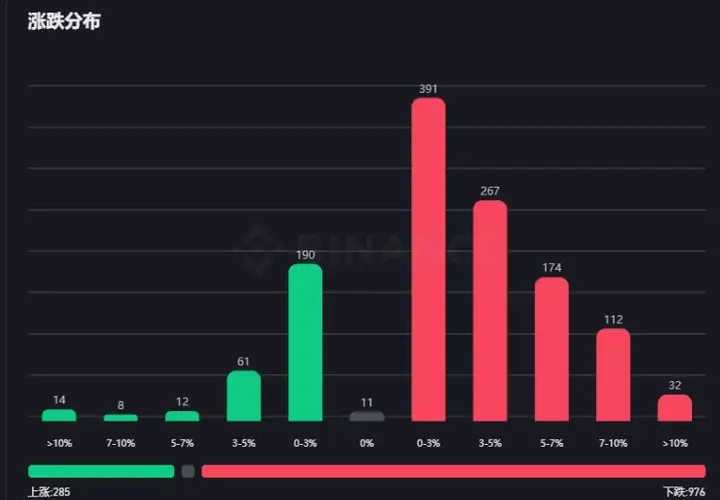

Currently, among all the tokens listed on Binance, the number of rising tokens is 285, while the number of falling tokens is as high as 976. Many investors complain that when Bitcoin rises, Altcoins fail to rise in sync, and when Bitcoin retraces, the decline of Altcoins is more severe. This has resulted in many retail investors' accounts suffering greater losses due to heavy positions in Altcoins, and they have even experienced asset shrinkage in this round of the Bitcoin bull market.

This phenomenon has raised a series of questions for investors: should they continue to chase the rising Bitcoin in the backdrop of its continuous rise? Or should they take the opportunity of the low Altcoin prices to timely replenish some projects with potential?

Capital Flow in the Market: Are MEME coins also sucking the blood of Altcoins?

In this bull market, if there is any track that can match the rise of Bitcoin, it would be MEME coins. From NEIRO to MOONDENG, to PNUT, there are "god-level" projects breaking through $50 million in market cap from zero every day, attracting a large amount of capital to chase them. On-chain data shows that there is little evidence of whales and big players increasing their holdings of Altcoins, while their support for MEME coins is ubiquitous. Especially in the Solana ecosystem, a large amount of capital is flowing into MEME coins, further squeezing the overall market cap and prices of Altcoins.

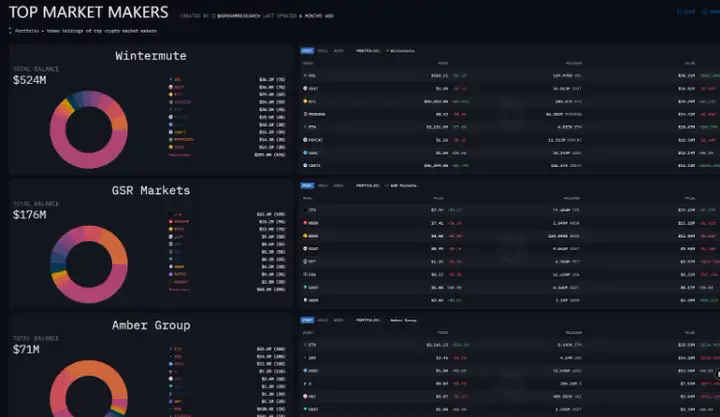

This can be seen from the holdings of mainstream crypto market makers.

According to Arkham's data, the top 10 crypto market makers have most of their holdings concentrated in Bitcoin and MEME coins. For example, QCP Capital, Flow Traders, and Cumberland have over 70% of their positions in Bitcoin. While large market makers like Wintermute and GSR Markets have more than half of their holdings tilted towards the Solana ecosystem and MEME coins.

Currently, the superimposed capital attraction effect of MEME coins and Bitcoin has made the Altcoin market perform weakly, with both liquidity and confidence being squeezed. In the short term, this trend is difficult to reverse. Most of the liquidity in the market is firmly absorbed in these two areas, leaving less and less space for Altcoins. For Altcoin investors, this is undoubtedly a severe challenge, but it may also be an opportunity to layout for future rebounds.

Looking back at history, how might the future trend of Altcoins be?

The wheels of history always repeat, yet always bring something new. Currently, market capital is obviously tilting towards Bitcoin, but this does not mean that the "blood-sucking effect" will continue indefinitely. In fact, whenever Bitcoin has risen consecutively and broken through important highs, market capital often flows back to the Altcoin sector, seeking those undervalued gems. This rhythm of "Bitcoin leading, Altcoins following" has been repeatedly played out in the past few bull markets, becoming a major rule of capital flow in the market.

By reviewing the past, it can be seen that whenever Bitcoin enters a stage-wise top, the Altcoin market is often inevitably "sucked" and even falls more sharply during the retracement. However, the adjustment of Bitcoin is often the starting point for the rebound of Altcoins. This rhythm has been repeatedly played out in the previous bull market, providing important reference significance for the current market.

Which tracks and mainstream cryptocurrencies are worth deploying?

Currently, the prices of many Altcoins are at low levels, and history has shown that this is often the golden window to layout potential projects. Especially those with technological innovation, ecosystem support, and long-term growth logic, they are more likely to stand out in the future capital inflow. In addition to the classic tracks like DeFi, emerging fields such as RWA, Bitcoin ecosystem, DePin, and AI are becoming the focus of investors' attention, bringing new possibilities for the future market growth.

DeFi: Aave, UNI, LINK

Bitcoin Ecosystem: STX, ORDI, SATS

DePin (Decentralized IoT): HNT, IO

RWA: OM, Pendle

AI and Blockchain: TAO, WLD

With the inauguration of the Trump administration, market expectations for crypto industry policies have also risen rapidly. The Trump team has always been known for promoting economic growth and attracting investment, and their attitude towards the crypto market is more friendly. If more positive policies are introduced in the future, such as crypto tax relief, corporate blockchain application incentives, and a more relaxed regulatory framework, this will inject new growth momentum into the Bitcoin and Altcoin markets, and may even trigger a broader capital inflow, driving the prosperity of the entire crypto market.

When deploying for the future, it's best to wait for the right opportunity. When Bitcoin's uptrend takes a breather, the market's focus may shift to those Altcoins with technological innovation and real application prospects. Emerging tracks like RWA, DePin, and AI are incubating the next growth momentum, and many quality projects are currently in the "discount zone". With the potential push of policy incentives, the low tide of the Altcoin market may be the best window for deployment.