Currently, BTC is oscillating in a narrow range between $97,000 and $99,000, as if it is gathering strength, while the altcoin market shows no signs of waiting and has quickly taken the spotlight.

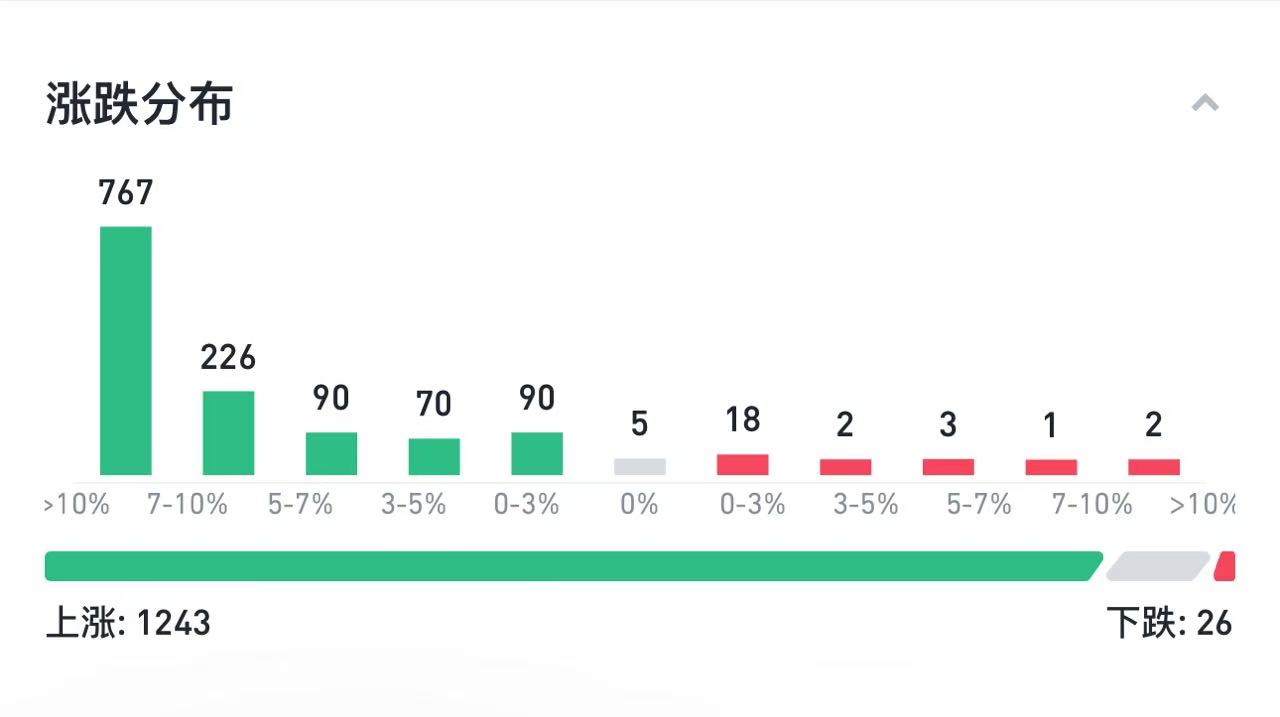

According to Binance data, more than 1,240 tokens have seen their prices soar, with 758 of them recording gains of over 10%, showcasing a rare frenzy in the altcoin market.The center of this wave is undoubtedly Ethereum (ETH), Dogecoin (DOGE), and XRP. Not only have they exhibited strong price performance, but they have also become the benchmarks for the entire altcoin market, bringing substantial returns to investors.

At the same time, the market has also welcomed more "pleasant surprises." Kraken has added 19 new tokens, including BNB and a series of meme coins, demonstrating the exchange's emphasis on the altcoin ecosystem. On the other hand, the announcement of the SEC chairman's upcoming resignation has further boosted market confidence with the expectation of policy relaxation. Under these favorable conditions, the altcoin market seems to have begun laying the groundwork for a larger-scale prosperity.

However, does this mean that the "altcoin season" has officially begun?Reviewing past bull market cycles, whenever Bitcoin's market dominance reaches a high point and gradually declines, altcoins tend to take over and dominate the market. Currently, Bitcoin's market dominance is at a relatively high level, and some funds have flowed into star assets like ETH and DOGE, suggesting a trend that the altcoin market may have quietly opened its curtain.

An unprecedented crypto market drama is unfolding, let's delve into the logic and future trends behind this weekend's frenzy.

BTC Price Heading Towards $127,000: "Crazy" Prediction or Inevitable Trend?

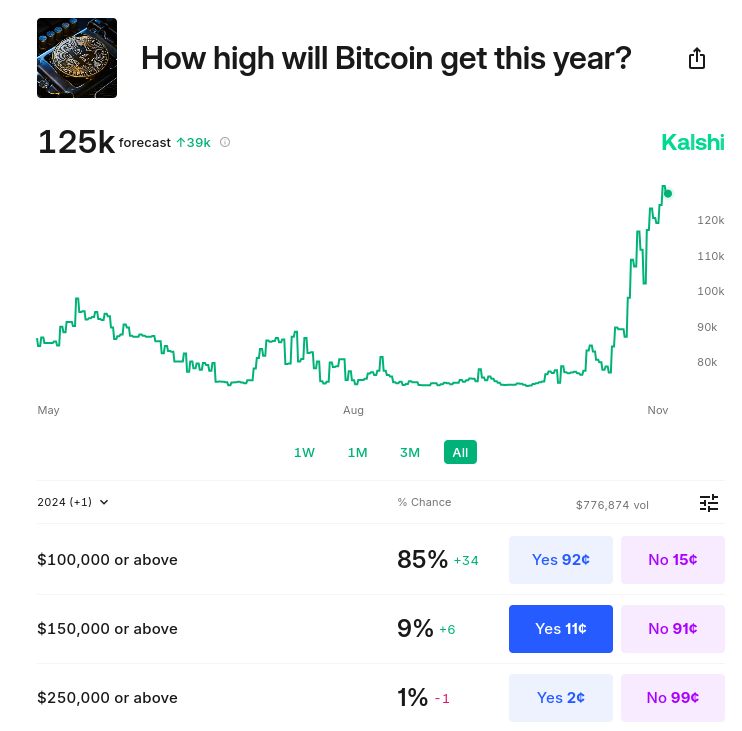

According to data from the betting platform Kalshi, the probability of Bitcoin reaching or exceeding $100,000 by December 31st is 85%, and the probability of it reaching $150,000 is also 9%. Even more aggressive market bets believe that Bitcoin could break through $250,000.Combining various expectations, Kalshi's average forecast suggests that Bitcoin may climb to $125,000 in early 2025.

This optimistic sentiment has quickly sparked heated discussions. Trader Kobeissi Letter commented on the X platform that "the prediction market is starting to seriously consider the potential for Bitcoin to break above $100,000." He further described these figures as "astounding and bold."

Since reaching a new high in March 2024, the price of Bitcoin has almost not experienced a significant correction, steadily rising. This unidirectional trend has led some analysts to suggest that the market may need a pullback to consolidate the upward momentum, but the current market environment does not show any signs of slowing down.The psychological barrier of $100,000 is still an important resistance level for Bitcoin in the current cycle, and once broken, it will have a profound impact on market confidence.

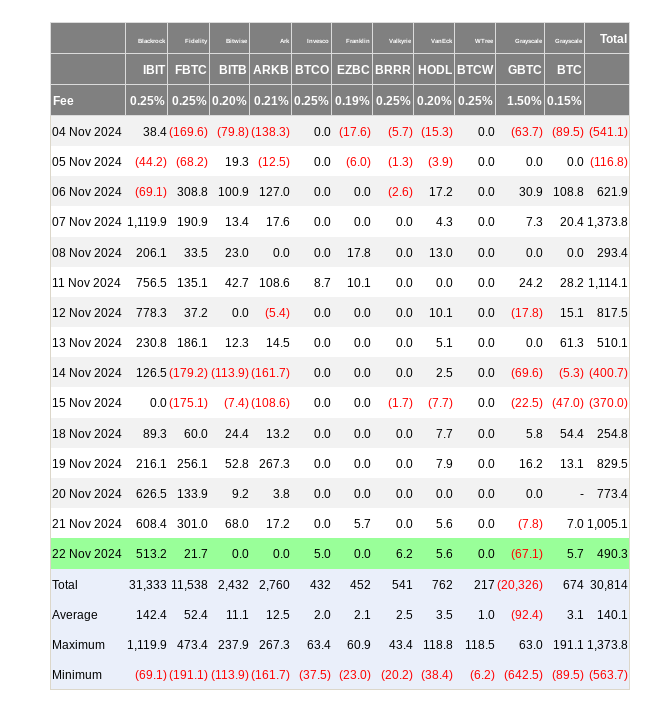

On the other hand, the continuous inflow of institutional capital is becoming the core driver of the market's rise.According to the weekly report "The Week Onchain" by the on-chain analysis company glassnode, since the launch of the spot Bitcoin ETF, the ETF has absorbed more than 90% of the selling pressure from long-term holders (LTH). This indicates that institutional demand has provided strong support to the market.However, the report also warned that "as unrealized profit levels continue to rise, we may see an increase in long-term holder selling activity, and this selling pressure may temporarily exceed the absorption capacity of the ETF."

Data shows thatwithin the past five trading days as of November 22nd, the US spot Bitcoin ETF recorded its highest weekly inflow since its launch, with total assets under management (AUM) exceeding $100 billion.This indicates that institutional investors are not only continuing to increase their positions, but are also further strengthening Bitcoin's position as a long-term value reserve.

On the technical level, the upward momentum of Bitcoin remains strong. Market sentiment, institutional capital inflows, and the push from ETFs have collectively built multi-layered support. Although some voices believe that the market may see short-term adjustments, the medium and long-term trends suggest that the breakthrough of $100,000 is imminent. Once broken, the price target of $127,000 or even higher will become the next focus. For Bitcoin's future, such predictions may no longer be "crazy," but are approaching reality.

Bitcoin Dominance Peaks, the Altcoin Season Begins

Previously, MarsBit had predicted that Bitcoin's market dominance might have approached the top at 62%, and the curtain of the altcoin season was about to be raised. The recent market performance seems to have confirmed this view. After reaching a high of 62%, Bitcoin's market dominance has quickly retreated, and as of the time of writing, it has dropped to 58.5%.

Recommended reading: Bitcoin approaches $100,000, should you chase BTC or accumulate altcoins?

The current market trend shows thatBitcoin's dominance may have peaked, and the era of altcoins is quietly arriving. As the "leader" of altcoins, Ethereum not only exhibits a strong medium and long-term upward trend driven by technical upgrades and market sentiment, but is also seen as the key force to lead the full-blown altcoin season.As funds gradually flow from Bitcoin to more innovative projects, and investors' attention to technology-based assets heats up, Ethereum is at the forefront of the new market prosperity and is likely to become the core engine driving the altcoin market into a comprehensive boom cycle.

Ethereum (ETH): The Long-Term Value of the Smart Contract Platform

As of the time of writing, the price of Ethereum (ETH) is $3,460, up more than 46% in the past month, with an impressive performance.The market generally believes that Ethereum will see a more persistent upward trend in 2025, becoming an undeniable force in the bull market.

The technical chart shows thatEthereum is forming a three-year ascending triangle compression pattern, a typical bullish signal that suggests its target price may reach $16,000.Ethereum is still the most used smart contract platform in terms of transaction volume, and the continuous improvement of its functionality and efficiency, as well as the upcoming Ethereum upgrades, will lay the foundation for its price to break through the historical high.

ETH/BTC Quarterly Return Rate

The flow of market funds has also created a favorable environment for Ethereum.After Bitcoin entered a high-level consolidation phase, a large amount of capital has gradually rotated from Bitcoin to Ethereum. This trend has led analysts to generally expect that ETH may return to its historical high before the end of the year.

Furthermore, Benjamin Cowen, the CEO and founder of ITC Crypto, posted on the X platform on November 23rd, stating that based on historical data, Ethereum typically exhibits a positive quarterly return rate relative to Bitcoin in the early stages after a Bitcoin halving. This pattern may provide further bullish signals for Ethereum's price in early 2025.

Dogecoin (DOGE): Continued Eruption of Meme Culture

As of the time of writing, Dogecoin (DOGE) is priced at $0.46, with a gain of over 16% in the past 24 hours.Binance data shows that DOGE's spot trading volume reached $3.5 billion, surpassing Bitcoin's $3.3 billion and Ethereum's $1.95 billion, demonstrating its high heat in the market.

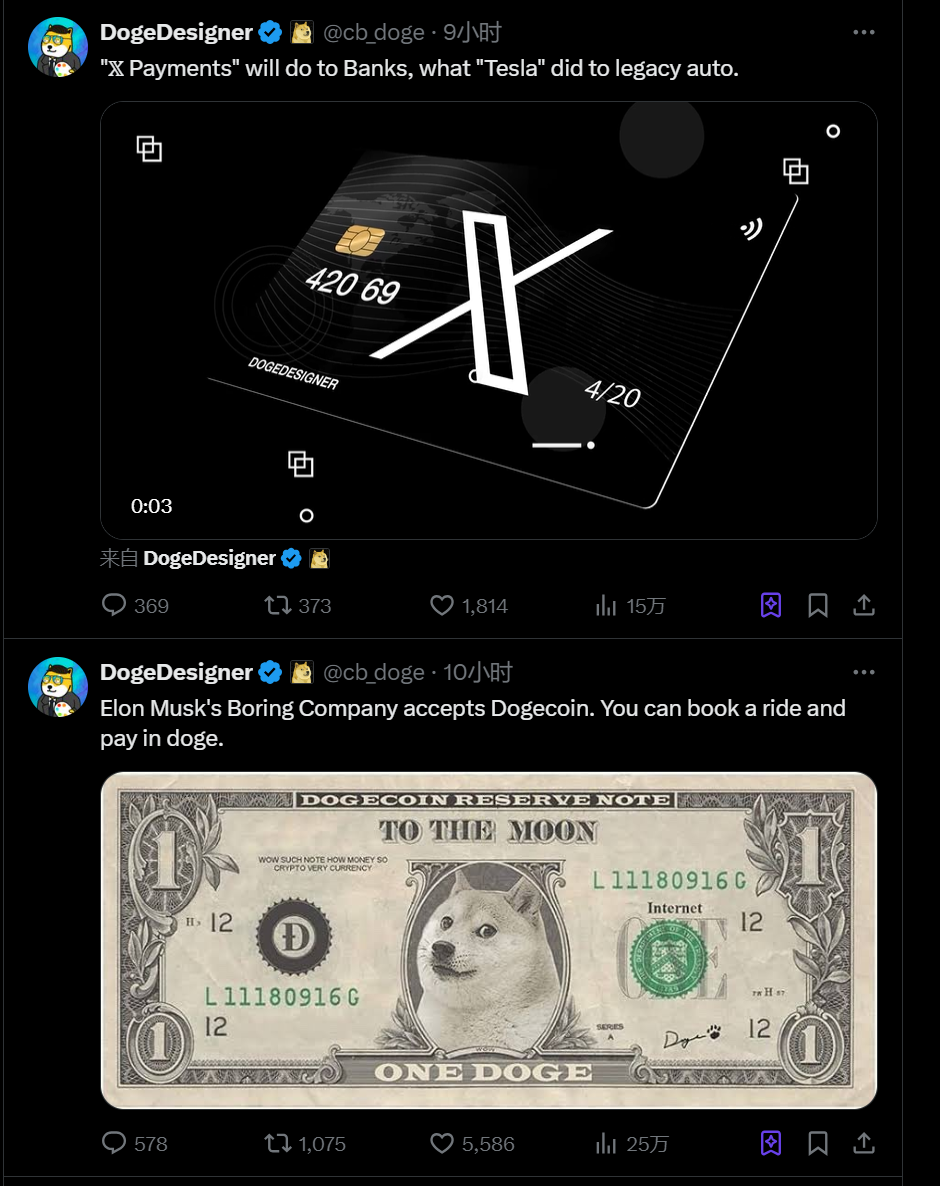

This upward trend may be driven by news related to Musk. According to DogeDesigner, a Dogecoin UI designer who interacts frequently with Musk, on the X platform, "Musk's Boring Company has started accepting Dogecoin payments, and users can use DOGE tokens to book ride services." Stimulated by this news, DOGE quickly rose 7.6% within an hour, stabilizing around $0.46. CNN also reported that the Boring Company has launched a service supporting DOGE payments, allowing customers to use Dogecoin to pay for rides on the Las Vegas transportation system Loop. This further strengthens the practical application scenario of DOGE as a payment tool.

From a technical perspective, Dogecoin has recently broken through the key resistance level of $0.43, and the target price range may expand to $0.65 to $1. Analysts believe that if the DOGE price breaks through $0.73, it may challenge higher targets in the first quarter of 2025.

On the monthly chart, the trend of DOGE follows a repeatable target trend based on Fibonacci lines. According to historical data, DOGE's gain in 2021 exceeded 732% compared to 2018. Based on the Fibonacci expansion model, the expected target range for 2025-2028 is $2.90 to $3.60.

This strong upward expectation is highly consistent with DOGE's performance in previous bull markets. As a representative asset of meme culture, Dogecoin, with its high popularity and the continued expansion of its practical applications, remains one of the most attractive investment targets in the current market.

XRP: The Comprehensive Revival of a Veteran Cryptocurrency

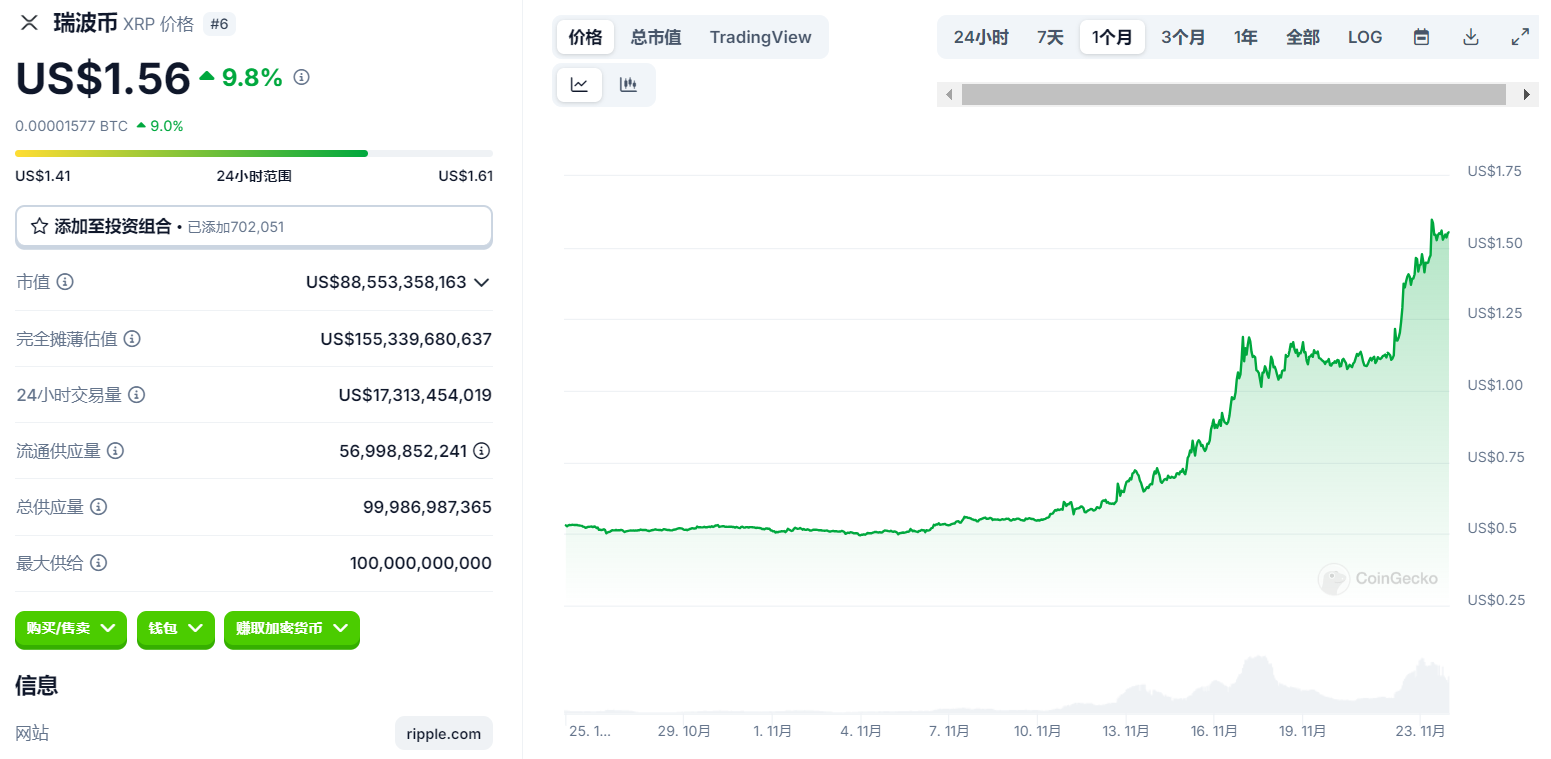

Over the past month, XRP has performed remarkably, becoming the best-performing asset among the top ten cryptocurrencies by market capitalization, with a cumulative increase of over 210%.

This strong performance is closely related to important progress in the regulatory field. On Thursday, Gary Gensler, the chairman of the U.S. Securities and Exchange Commission (SEC), announced that he will step down on January 20, 2025, which is the inauguration date of the newly elected President Donald Trump. This news was seen by the market as a signal that the four-year legal battle between Ripple and the SEC is nearing its end. Although the two parties seemed to be close to a settlement in the summer of 2024, the SEC's appeal of the 2023 ruling extended the litigation further. The market generally speculates that the long-standing controversy can only be truly resolved after Gensler and the current SEC leadership leave office.

Gensler's resignation statement quickly triggered a significant rebound in the price of XRP. On Thursday evening, the price of XRP was still hovering below $1.2, but after the news was released, it quickly rose, breaking through $1.4 on Friday, and exceeded $1.6 earlier today, a gain of 35% in just a few days.

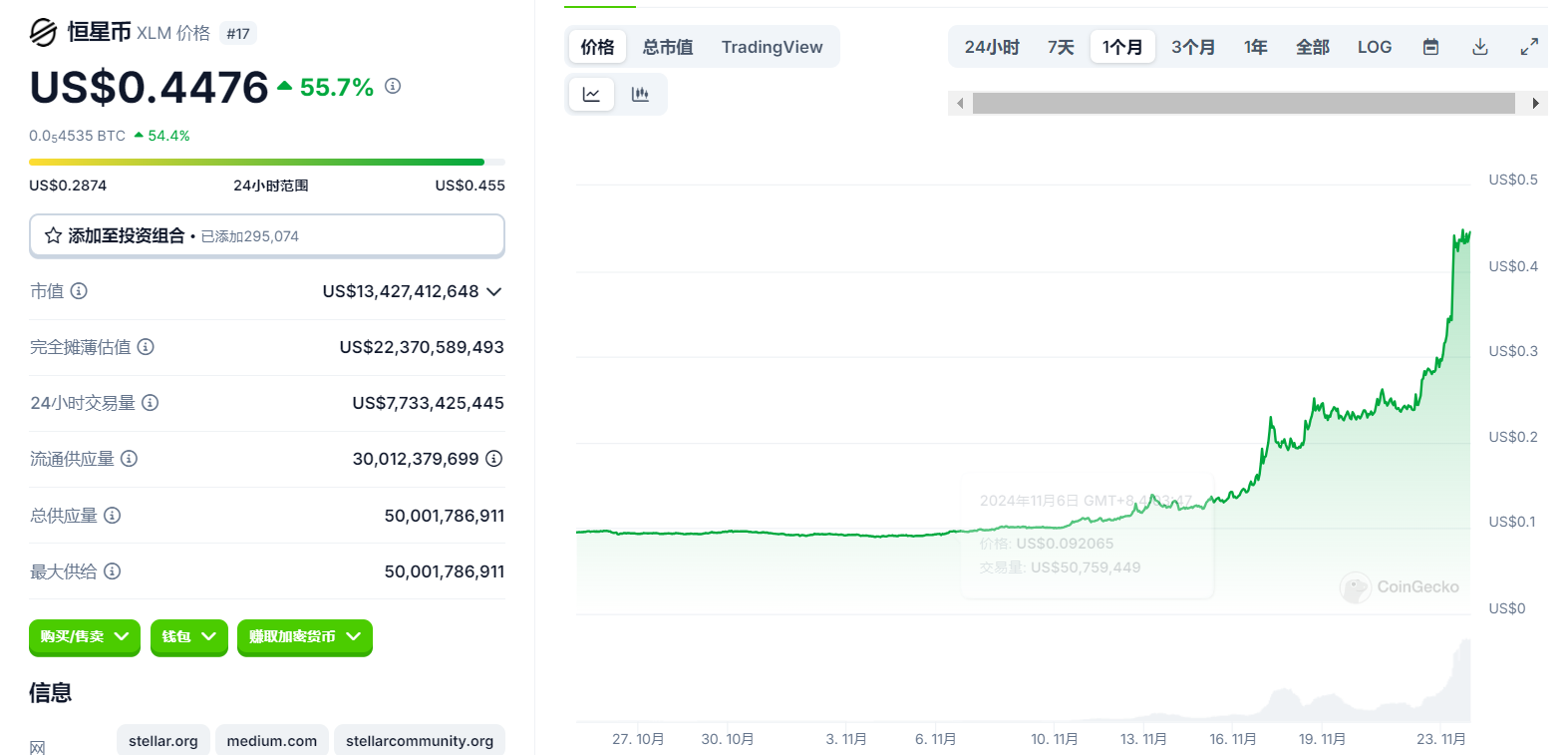

XLM has gained nearly 400% in the past two weeks

The strong performance of XRP has also driven the comprehensive recovery of other veteran cryptocurrencies. Stellar (XLM) has gained nearly 400% in the past two weeks, while assets like Litecoin (LTC) have also seen significant increases. The collective rebound of these veteran cryptocurrencies not only reflects the high market sentiment, but also highlights investors' re-evaluation of the value of technologically sound assets in the bull market.

As the dispute between Ripple and the SEC nears its end, XRP not only consolidates its market position as a veteran cryptocurrency, but also becomes a representative asset for the rebuilding of confidence in the crypto market. Accompanied by the recovery of other veteran cryptocurrencies, the strong performance of XRP may foreshadow that more crypto assets will experience a new round of glory in the upcoming bull market.

Weekend Event Review: The "Dual Effect" of Policies and Institutions

1. SEC Leadership Turmoil and Policy Relaxation Expectations

This week, the U.S. Securities and Exchange Commission (SEC) saw major personnel changes, with Chairman Gary Gensler and Commissioner Jaime Lizárraga both announcing their resignations.Lizárraga announced on November 22 that he will step down on January 17, 2025, and a few days later, newly elected President Donald Trump will begin his second term.

At the same time, Gensler announced that he will resign as SEC chairman on January 20. This decision marks the potential end of his tough regulatory policies.During his tenure, the SEC has taken more than 100 enforcement actions against the crypto industry and has always maintained a hostile attitude towards blockchain and cryptocurrency technology. Although Gensler stated in his statement that he is "proud to have ensured the global best standards of the capital markets," the market generally believes that his departure may bring more policy relaxation for the crypto industry.

2. Controversy over the Extended Detention of Tornado Cash Developers

The future of privacy protection technology is once again under scrutiny. Tornado Cash developer Alexey Pertsev was ruled by the court to continue pre-trial detention, raising industry concerns about the rights of privacy technology developers. In a post on the X platform on November 21, Pertsev expressed disappointment with the decision, saying that the detention has affected his ability to prepare an appeal.

The regulatory authorities' continued focus on Tornado Cash has been evident since 2022, when the protocol was sanctioned for alleged money laundering.However, in the first half of 2024, the usage of Tornado Cash has rebounded significantly, with its total accepted deposits reaching $1.8 billion, a 45% increase compared to 2023. This growth reflects the revival of user demand for privacy protection technology, and also places these technologies in a dilemma between regulation and free development.

3. Allianz Acquires a Quarter of MicroStrategy's $2.6 Billion Convertible Bonds

The changing attitude of traditional financial institutions has also become a highlight this week. Allianz Group, the second-largest insurance company in Europe, announced that it has purchased nearly a quarter of the $2.6 billion convertible bonds issued by MicroStrategy, with a total investment of about 24.75%.

According to anonymous analyst Petruschki's data shared on the X platform, this investment was completed by several Allianz subsidiaries, including Allianz Global Investors Luxembourg (14.34%) and Allianz Global Inv Of America LP (6.64%). This action marks the growing interest of traditional financial institutions in crypto assets, further injecting optimism into the market.

4. Kraken Adds 19 New Tokens: A Signal of Open Listing Strategy

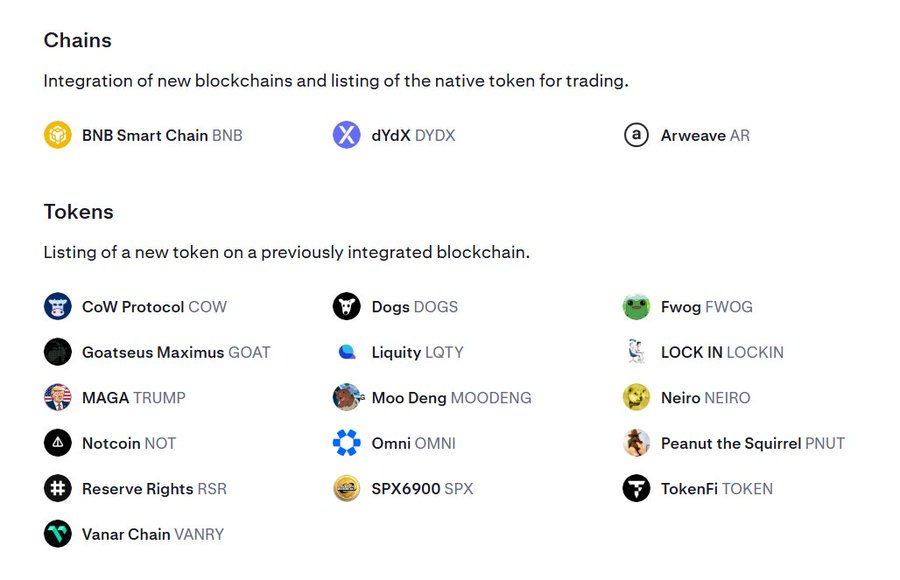

Kraken, the second-largest cryptocurrency exchange in the U.S., added 19 new tokens this week, including the Binance platform token BNB, TON, and various meme coins like DOGS. This move is particularly noteworthy, as BNB was previously identified by the SEC as a security. Kraken's decision to list these assets reflects its keen judgment of policy relaxation and its forward-looking layout.

The types of tokens listed on Kraken this time cover a wide range, from platform tokens to technology-based assets and sentiment-driven meme coins, addressing the diversified market demand. Especially the concentrated listing of meme coins, which shows Kraken's strategic advantage in capturing market sentiment fluctuations. Analysts point out that the listing of BNB not only may attract Binance users, but also is an important attempt to compete for a share of the platform token market.

This move may become a signal of industry transformation, driving more exchanges to emulate similar strategies. In the future, as the policy environment becomes clearer, the trend of exchanges opening up to list more coins is expected to improve market liquidity and inject new growth momentum into the altcoin ecosystem.

The bull market curtain is rising, and a new era is about to begin

BTC is steadily advancing towards $100,000, the altcoin market is experiencing a full-scale recovery, and the dual support of policy tailwinds and institutional capital are injecting sustained momentum into this market frenzy. From the technological wave led by ETH, to the payment revolution sparked by Dogecoin, to the regulatory breakthrough of XRP, each positive factor is paving new tracks for the future of the entire crypto market.

Even more exciting is that the shift in the US regulatory environment has released greater imagination for the market. The inflow of funds into the spot BTC ETF has hit a new high, with an asset management scale exceeding $100 billion, which attests to the recognition of institutional investors for the prospects of the crypto market. The open exchange strategy has also opened the door for more quality projects to enter the mainstream market.

The resonance of policy relaxation, technological breakthroughs, and capital inflows, as all the positive factors gradually converge, the curtain of the bull market is slowly rising, and a new era belonging to the crypto market is quietly arriving.