With Trump's continued appointment of crypto-friendly agency heads, from the Commerce Secretary to the much-maligned SEC Chairman Gary Gensler's resignation, the Trump administration's new SEC appointee is expected to significantly relax restrictions on the crypto industry, which is a major positive for Bitcoin.

VX: TTZS6308

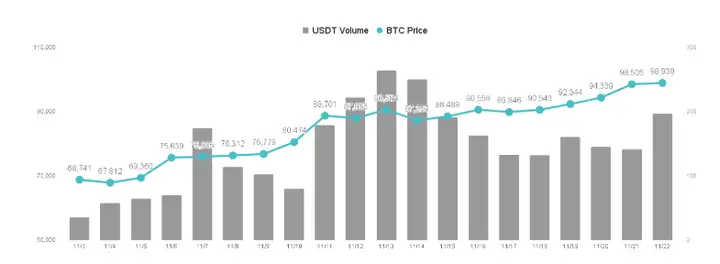

The gains of other small and medium-sized cryptocurrencies are not as strong as Bitcoin, as it is institutional investors buying Bitcoin spot ETFs behind the scenes. Wall Street can be said to be frantically chasing Bitcoin, with net inflows for 5 trading days last week, reaching as high as $100 million on Thursday, a remarkably strong rally, undoubtedly driven by the rise in Bitcoin spot ETF prices. In other words, the market's gains are largely driven by the frenzy of institutional investors, while retail investors are relatively calm.

Research reports also point to Bitcoin continuing to rise, with analysts quite optimistic about the crypto market outlook, suggesting that Bitcoin will firmly hold above $10,000, and may even reach $12,000 this year. However, Bitcoin has surprisingly seen a pullback when it was just $200 away from $10,000, further dipping below $96,000 in the early hours of today.

Where are the risks in the crypto market now? Will there be a crash?

The biggest potential risk in the market - "The US economy falls into recession"

To analyze the risks in the crypto market, we first need to look at the possibility of a pause in interest rate cuts or a reversal of the loose monetary policy. Currently, we do not see any signs of a policy shift, as the focus is no longer on the inflation index, which has a confirmed and sustained downward trend. The health of the job market is now the Fed's primary concern, as the traditional off-season for the US tourism industry is approaching, and there is not much momentum in job creation. Maintaining stable employment is the top priority.

The "pace of rate cuts" has become the key factor. Considering that the Fed will soon enter a rate-cutting cycle, and the financial reports of the new season in the US stock market have not been as good as expected, the actual consumer strength in the US is not as strong as imagined. The current rally is only a result of the capital flowing back to the US and parking in the stock market after Trump's election, creating an inflated stock price.

In fact, the US economy is not as robust as in previous quarters, as evidenced by the Fed's recent rate cut policies. At the last FOMC meeting, all members voted in favor of a rate cut, indicating that a rate cut of one notch per quarter is almost a foregone conclusion, meaning there is no interest rate policy risk now, and the authorities will only gradually cut rates.

As the market no longer expects the Fed to reverse its interest rate policy, the crypto market has also rallied on this expectation. However, zero interest rate risk is not enough to drive such a high rally in Bitcoin. The real driving force behind it is the expected relaxation of the crypto industry policy by the Trump administration. Gold was a hot investment commodity not long ago, but its gains have now been far outpaced by Bitcoin, as investors are overly anticipating the Trump government's opening of the crypto option market or high-leverage tools.

Against this backdrop, we believe we should focus more on risk and adopt a more conservative strategy to deal with the overheated market. The biggest risk in the investment market right now is only one - "US economic recession". Now that the US election is over, the government no longer needs to beautify employment data through massive spending.

Assuming the US does fall into recession (which is unlikely), even consecutive rate cuts may not save the market, as we saw the crypto market crash in 2020 despite rapid rate cuts. This could be a turning point for Bitcoin prices, and the timing is difficult to predict. It is recommended that everyone moderately adjust their investment positions to diversify risks, and it is not advisable to over-bet on the market at the moment.