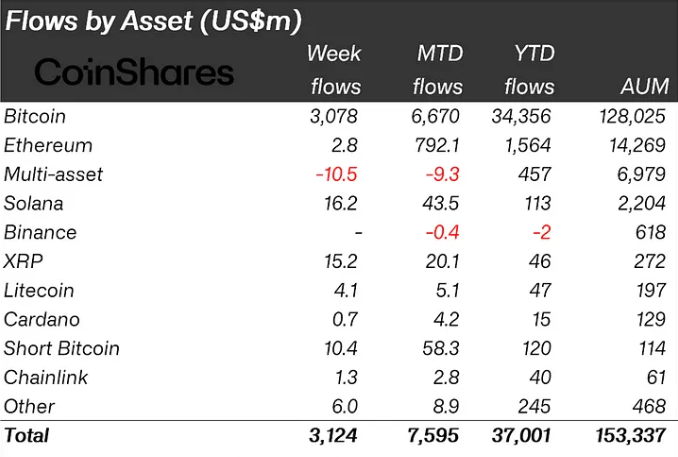

Cryptocurrency investment inflows recorded a record weekly inflow of $3.12 billion last week. This surge has pushed the inflow since the beginning of the year to an unprecedented $37 billion, emphasizing the increase in Bitcoin's dominance and the revival of interest in digital asset investment products.

This occurred as Bit coin (BTC) set a new record high, with the peak price reaching $99,588 on Binance.

Bit coin, the highest cryptocurrency inflow ever

Bit coin led the way with an inflow of $3.078 billion last week, recording the strongest performance to date. Despite reaching an all-time high price, the surge in interest has expanded to short Bit coin investment products, recording a weekly inflow of $10 million. Notably, this short Bit coin inflow reached $58 million, the highest since August 2022.

The recent $3.12 billion inflow shows a sharp increase compared to previous weeks, continuing a strong upward trend. For reference, the previous week saw an inflow of $2.2 billion, which increased due to the Republican election momentum and Federal Reserve easing.

The week before that saw an inflow of $1.98 billion due to post-election momentum. This consecutive inflow emphasizes the increased confidence among investors despite market resilience and economic uncertainty.

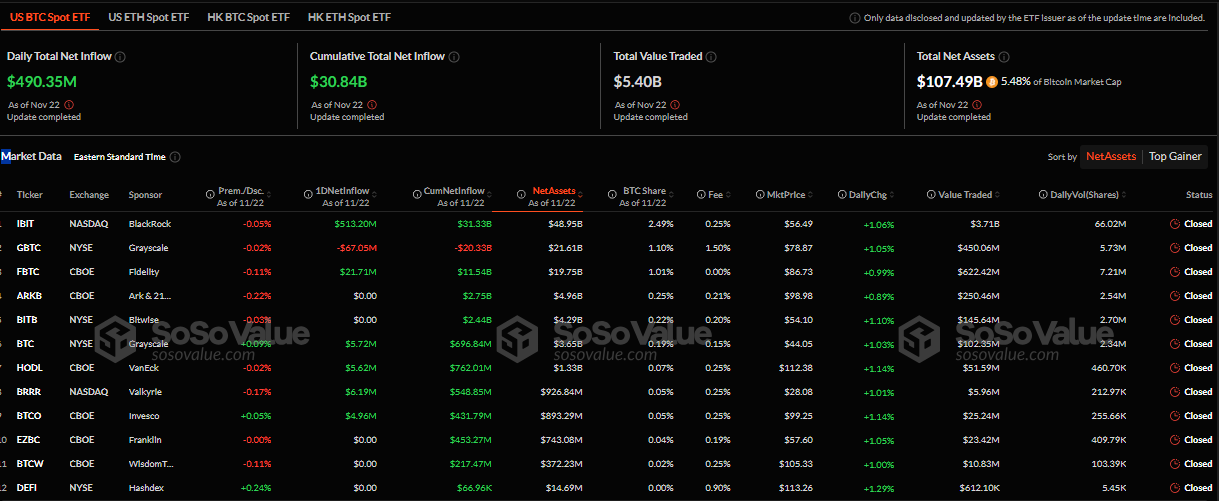

However, the adoption of Bit coin ETFs (exchange-traded funds) is driving the rise in Bit coin. According to SoSoValue data, the cumulative net inflow into Bit coin ETFs reached $30.84 billion as of the market close on Friday, November 22.

"While all eyes were on MSTR, ETFs quietly absorbed over 10 times the Bit coin mined last week. Pac-man mode has been activated." – Eric Balchunas, Bloomberg Intelligence ETF Analyst

Amid the growing optimism, Balchunas recently mentioned that US spot ETFs have a 98% chance of surpassing Satoshi as the world's largest Bit coin holder. Similarly, analysts predict Bit coin's upward trend could extend to $115,000 by this year-end. Whale activity and long-term holders are fueling the current rally.

Microstrategy's Michael Saylor, as a Bit coin advocate, hinted at the possibility of expanding the company's Bit coin holdings, further strengthening institutional trust in the asset.

The contrasting fates of Solana and Ethereum

Solana (SOL) emerged as a strong competitor among altcoins, recording an inflow of $16 million last week, significantly outpacing Ethereum's $28 million. However, based on the year-to-date metric, Solana still lags behind Ethereum, which remains the dominant altcoin with a substantially higher total inflow.

Solana's recent success may be attributed to the increased optimism around Solana-based ETFs. The applications from various companies, including VanEck, 21Shares, and Bitwise, have led to a surge in investor confidence in the Solana ecosystem.

These ETFs are expected to expand access to Solana's technology for both retail and institutional investors, as they await SEC (Securities and Exchange Commission) approval.

While Bit coin and the broader cryptocurrency market continue to rise, the optimism is being maintained with caution. Market observers, such as CryptoQuant, warn against excessive enthusiasm and the possibility of price corrections following Bit coin's recent surge. Other skeptics, like Justin Bons of Cyber Capital, have raised concerns about the vulnerability of cryptocurrencies to liquidity risks.

Meanwhile, analysts predict sustained growth driven by ETFs, institutional adoption, and strong market sentiment. However, warnings about excessive leverage positions and liquidity risks suggest that adjustments may occur after this bullish phase. The longevity of this momentum depends on regulatory developments, market sentiment, and macroeconomic factors.