According to the Crypto Bubbles chart showing the price performance of the top 100 tokens by market capitalization in the past 7 days, three major tracks have stood out:

Legacy public chains: Representative projects include XLM, ADA, DOT, etc. These former star projects have once again attracted market attention thanks to their stable ecosystem foundations and continuous technical upgrades.

DeFi (Decentralized Finance): Protocols such as DYDX and UNI have performed impressively, benefiting from the demand for hedging under regulatory uncertainty and the recovery of on-chain trading volume.

GameFi Metaverse: Blockchain gaming projects such as SAND, MANA, and AXS have rebounded strongly, becoming the biggest surprise in the market this week.

In particular, the strong rise of GameFi is particularly noteworthy. After the 2021 boom, the GameFi sector has long been in a slump, and was even nearly forgotten during the crypto market downturn. The gaming innovations of the past two years have tended towards a lightweight viral transmission model, mainly relying on the combination of Telegram mini-games and MEME culture, which is quite different from traditional Web3 games. However, this rebound of GameFi seems to be more than just a result of market rotation, and may signal a deeper trend change.

Three main drivers behind the rise of GameFi

1. Catalytic effect of capital reallocation

As the valuations of other hot sectors become saturated, the low valuation and high elasticity of GameFi have attracted capital inflows.

In the past week, the overall market capitalization of the GameFi sector has grown by over 35%, and trading volume has surged by more than 150%. In contrast, the DeFi and legacy public chain sectors have already experienced multiple rounds of rallies, leaving limited room for further upside. Given the "low base" characteristic of GameFi projects, they have become an ideal investment target in the current context of capital seeking high returns. The opportunities brought by low valuations and high elasticity have made GameFi projects highly attractive to capital.

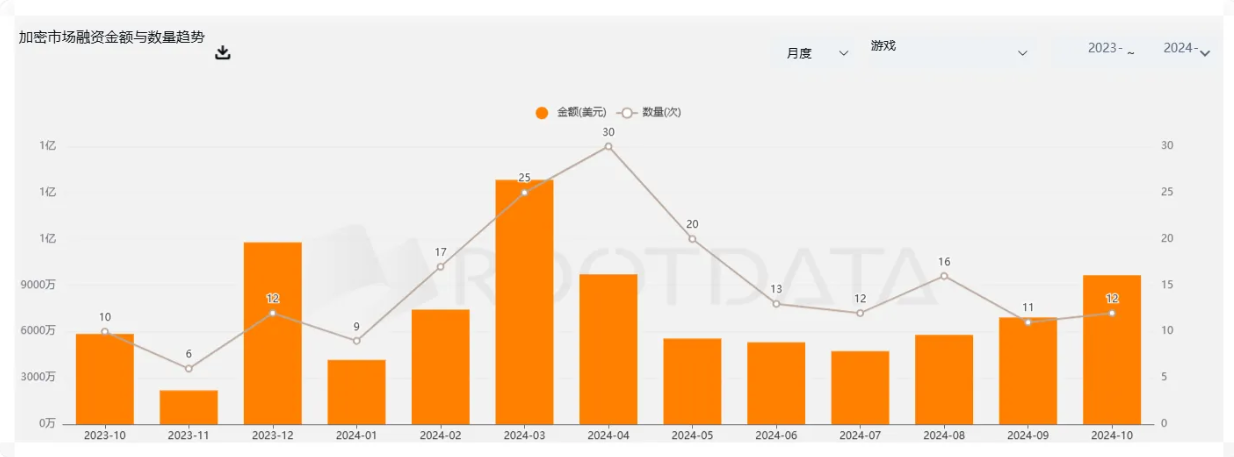

According to the latest data from Rootdata, the amount and number of crypto market financing reached a peak in March 2024, with financing amount close to $100 million and financing frequency reaching 30 times, reflecting the market's high attention to the blockchain gaming sector. Furthermore, the financing amount and volume have continued to rise in recent weeks, especially in October 2024, indicating that the market's enthusiasm for the GameFi sector is gradually recovering. This also indirectly suggests that GameFi, as an undervalued sector, has attracted a large amount of capital reallocation.

2. Gradual improvement of the technical ecosystem

In 2021, GameFi projects were often criticized for "pie-in-the-sky" promises, with game experiences far behind traditional 3A games. However, the continuous progress of underlying blockchain technologies has made the GameFi ecosystem more mature:

- The widespread adoption of Layer 2 technology has significantly reduced on-chain transaction costs and improved game interaction speeds, optimizing the player experience.

- Advancements in cross-chain asset trading have provided higher liquidity and security for in-game virtual assets, increasing player confidence and stickiness.

- Technical upgrades by project teams: For example, the Axie Infinity community has initiated a proposal to upgrade the Axie & Land smart contracts through a hard fork. This proposal enables a safer way for Axie asset holders to delegate their assets, greatly reducing the risks for asset owners - similar technical upgrades have greatly improved the user experience.

3. Imagination-filled narratives

People often say that the most urgent need in the web3 industry is for products that can be implemented, not just DeFi floating in the sky. Vitalik has also stated that simply issuing tokens and operating exchanges means the failure of the industry. GameFi itself is a combination of DeFi+Non-Fungible Token+Blockchain Game, making the originally dry DeFi more vivid, and providing real-world application scenarios for the Non-Fungible Token technology. GameFi's governance model also provides an opportunity for the implementation of DAO organizations. Combined with the current metaverse concept, AR and VR are also expected to become part of GameFi's AAA titles. Therefore, GameFi remains a narrative full of imagination within the industry.

From phenomenon to reflection: The future evolution of GameFi

Although the rebound of GameFi is exciting, it does not mean that the challenges have been overcome. The current market focus is on the core question: Can GameFi shake off the label of hype and achieve long-term sustainable development with "game experience as the core"?

Based on current trends, the future development of GameFi may focus on the following directions:

- Cross-platform asset circulation and the big financial ecosystem: Currently, the virtual assets of most GameFi projects are still limited to specific platforms, lacking cross-platform value. To address issues such as low user activity and unstable capital, the future development of GameFi will focus on promoting the free circulation of Non-Fungible Token assets across different games and platforms, and establishing a larger financial ecosystem through cross-chain bridges, multi-platform compatibility, and decentralized account management. This will increase the liquidity and utility of player assets, enhancing user stickiness and the overall stability of the financial ecosystem.

- Immersive gaming experience: Diversification, AI-driven, and AR/VR integration: The future of GameFi not only needs to innovate in finance, but also needs to break through in game content and experience. Generative AI can enhance the dynamism and personalization of games, and combined with VR/AR technology, provide players with more immersive and realistic gaming experiences. This combination will create differentiation and uniqueness, improving player engagement and long-term retention. The immersive experience of "Ready Player One" may no longer be a fantasy, but gradually becoming a reality.

- Full on-chain games and autonomous worlds: Full on-chain games will put all game logic, data, and assets on the blockchain, emphasizing decentralization and transparency. Autonomous Worlds will become an important form of full on-chain games, providing a completely transparent gaming environment and effectively solving the problem of cheating.

- Introduction of traditional game IPs: The blockchain extension of traditional game IPs is another major trend in GameFi. For example, Axie Infinity has borrowed from the gameplay of "Pokémon", while The Sandbox has ported classic games to the blockchain. These successful cases prove the potential of strong IPs, and in the future, more classic games may realize value expansion through the blockchain, becoming an important competitive advantage for future GameFi.

Non-Fungible Token vs. MEME: Mutual decline or mutual prosperity?

In the previous bull market, GameFi was closely connected with Non-Fungible Token, almost forming a binding relationship. However, with the development and refinement of the industry over the past three years, this association has gradually weakened. The pricing of Non-Fungible Token in GameFi is now more dependent on project popularity and economic models, while blue-chip Non-Fungible Tokens like Punk and BAYC have fallen into a slump, and their once social attributes now seem to have become an embarrassing constraint. It is worth mentioning that during the Bitcoin ecosystem's boom period, Bitcoin Non-Fungible Token also briefly heated up, but ultimately it was just a fleeting phenomenon in the Non-Fungible Token track.

At the same time, memecoins have been constantly rising, attracting a large amount of market attention. Even many Non-Fungible Token holders believe that "memecoins have stolen the life of Non-Fungible Token".

Non-Fungible Token and memecoins share many similarities, and these similarities have allowed both to quickly accumulate a large user base in the market. First, the entry barriers for both are relatively low, and the understanding cost is also relatively simple. Non-Fungible Token can be simply seen as "small pictures", while memecoins are usually associated with Internet meme culture, simple, easy to understand, and easy to spread. The investment threshold is also low, as Non-Fungible Token can sometimes be minted for free (free mint), only requiring the payment of gas fees; while memecoins, due to their prices often being only a few decimal places, can be easily participated in even by small investors.

MEME is more like the NFT Pro max version, with higher liquidity, a more FOMO atmosphere, and a more meme-filled community culture.

According to a survey conducted by CoinGecko in August this year, about 54% of the participants believe that Non-Fungible Tokens (NFTs) cannot recover in this cycle, with 29.5% of the participants firmly believing that NFTs cannot recover in this cycle, and 24.7% still bearish on the NFT market.

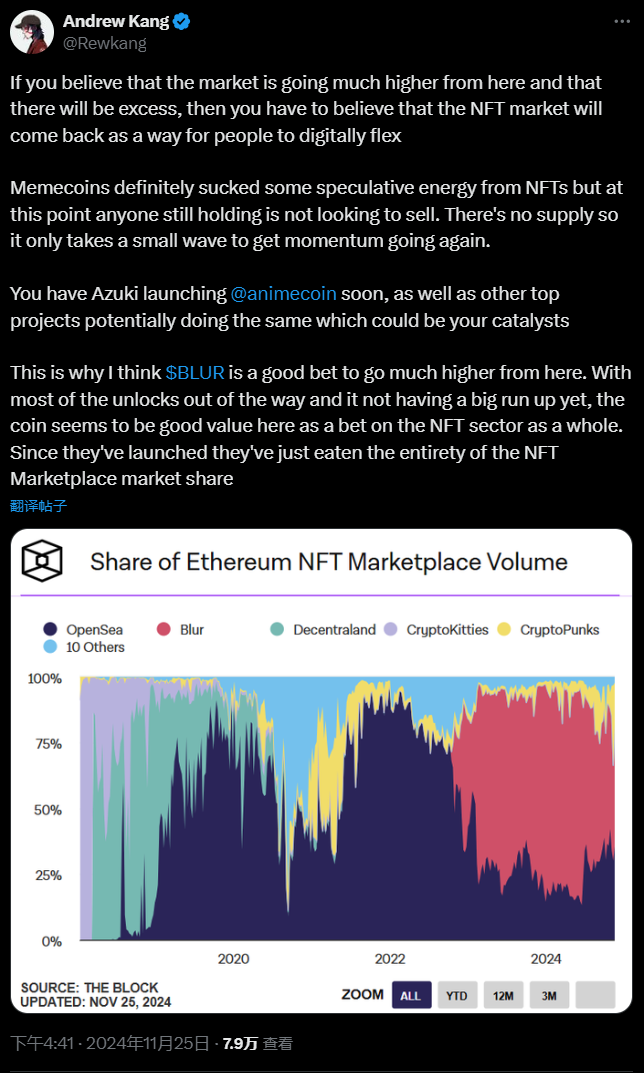

Andrew Kang, a partner at Mechanism Capital, has stated thatif the future market sees a significant upswing accompanied by overheating, then the Non-Fungible Token (NFT) market may make a comeback as a way for people to flaunt their identity.Although the rise of memecoins has indeed diverted some of the speculative heat from the Non-Fungible Token (NFT) market, those who currently hold Non-Fungible Tokens (NFTs) are not in a hurry to sell, and the market supply is scarce, so a small wave of enthusiasm could drive the entire momentum. Azuki is about to launch AnimeCoin, and other top projects may also follow suit, which could become catalysts for the recovery of the Non-Fungible Token (NFT) market.

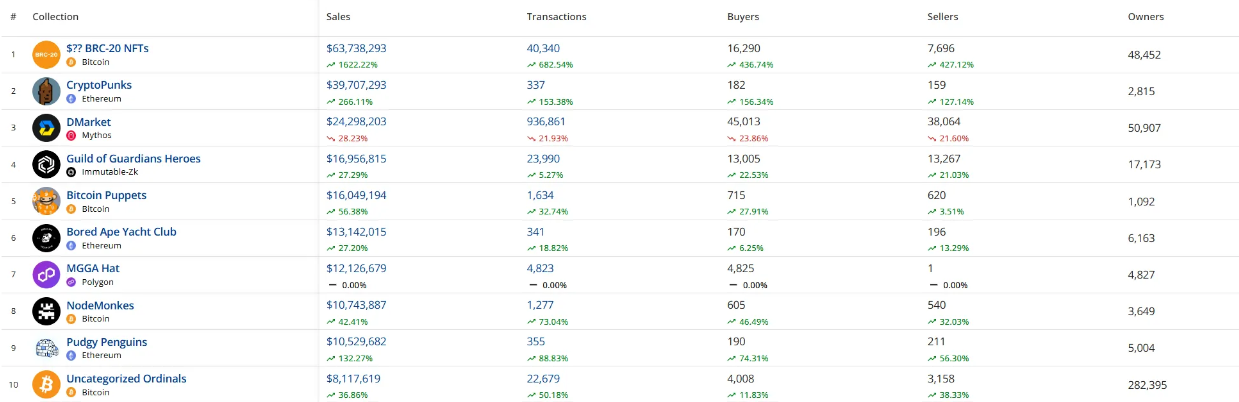

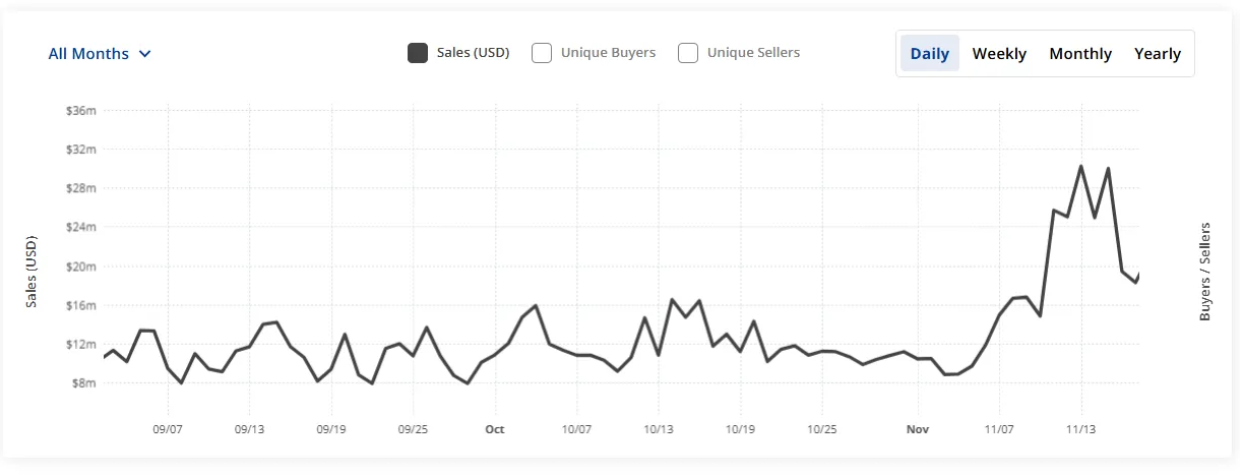

According to Cryptoslam data, the trading volume and number of traders of the top Non-Fungible Tokens (NFTs) have seen a significant rebound in the past 30 days, which may be a signal that the recovery of Non-Fungible Tokens (NFTs) is quietly underway.

Non-Fungible Tokens (NFTs) and memecoins each satisfy different types of market demand: Non-Fungible Tokens (NFTs) represent identity, collection, and long-term value, while memecoins represent short-term high returns and the release of collective emotions.Whenever market sentiment is high and speculative demand surges, memecoins, with their easy-to-understand, low-threshold, and high-liquidity characteristics, attract a large influx of funds and become the focus of attention. However, when the speculative heat gradually subsides and investors begin to focus on long-term holding value again, Non-Fungible Tokens (NFTs), with their artistry, scarcity, and community consensus, re-enter the market's field of vision and become the object of investors' pursuit.

This cyclical alternation also benefits from the rotation of capital and attention between different asset types. When the memecoin craze reaches its peak, liquidity and attention will gradually flow out, and the Non-Fungible Token (NFT) market can take advantage of this gap to re-accumulate user interest through innovative projects or the introduction of new features.Therefore, Non-Fungible Tokens (NFTs) and memecoins are not entirely mutually exclusive, but rather take turns attracting market attention and meeting the needs of investors in different cycles, thereby achieving alternating brilliance.Understanding this logic can help investors better adjust their strategies in the face of market fluctuations and seize the opportunities brought by each rotation.

Conclusion: New Opportunities in Rotation

From the strong rebound of GameFi to the potential recovery of Non-Fungible Tokens (NFTs), we can see that the characteristics of the crypto market are constantly being reshaped: capital, hot spots, and narrative logic, all of these elements are constantly flowing and alternating, forming the cyclical rise and fall of different sectors. After experiencing undervaluation and dormancy, GameFi has once again become the focus of the market, thanks to the gradual improvement of its technical ecosystem and its unique narrative. Meanwhile, Non-Fungible Tokens (NFTs) and memecoins have also found their respective market opportunities in the rotation, meeting the different investment needs of short-term speculation and long-term collection.

The crypto market is not a single-path growth, but a multi-dimensional rotation game, where each sector may become the next explosion point in a specific market cycle.Future investors should learn to find patterns in these changes, and at each rotation node, they should be able to quickly identify new opportunities and capture the growth dividends in the changes. In the evolving process of GameFi, Non-Fungible Tokens (NFTs), and memecoins, those who can understand the logic behind the rotation will have the opportunity to lead the next market explosion.