You can make life-changing money in the next 6 months

BUT this bull market is different from most

If you're serious about becoming financially free

Use this Bull Market Volatility Trading Guide:

In this guide, you'll learn how to profitably trade;

-Good news

-Bad News

-Neutral News

I'll even share a full bull market trading strategy PDF in the end. Let's begin:

High volatility is often caused by news events. To benefit from this;

1. Spot them early using a list of upcoming potential events. Example:

-Major economic data

-Fundamental analysis

-Institutional buying/ Selling

After receiving the news,

2. Categorize it in one of 3 environments:

-Positive Volatility Event: Price increases + market optimism

-Negative Volatility Event: Sharp price drops + market fear

-Neutral Volatility Event: Minimal impact on prices

This decides how we trade.

3. Don't Get Trapped

Fakeouts are your biggest enemy here.

I've designed a system to avoid them and will release a full guide on Breakouts VS Fakeouts in a couple of days.

Make sure you have notifications on for this.

I'll explain every condition and give you guidelines

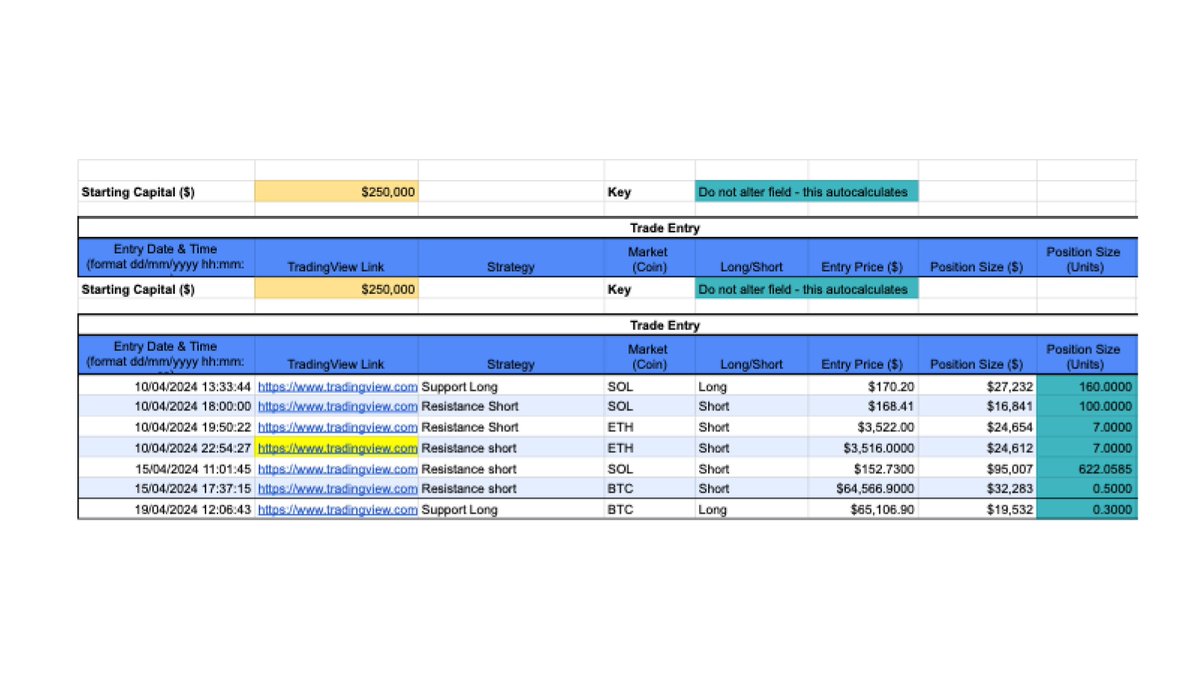

But to use them to make money, you need to have your own journal full of insights like this:

You'll be able to download my journaling tool from my Telegram soon. Now let's refine your system:

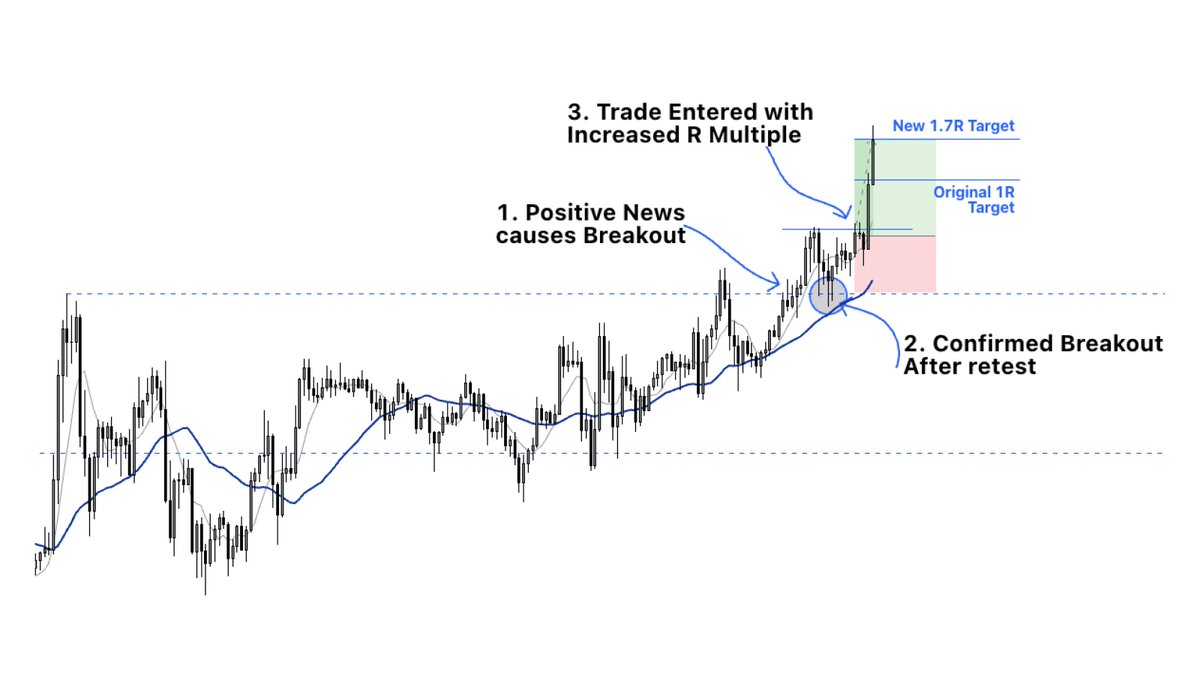

Event Type: Positive Volatility

If your journal shows that your strategy performs well in these conditions, you can;

-Increase Risk

-Hold Longs Longer

-Increase Profit Targets

This will result in more profits by making some simple strategy changes

For example: A major institution adds $BTC to its balance sheet and the market volatility increases.

If your momentum longs work best in these conditions, you can increase your usual target from 1R to 1.7R based on your journal data.

This is the best way to capitalize on the… x.com/i/web/status/18614159136...

Event Type: Negative Volatility

You can apply the same theory as above for these but trade it to the downside

For example:

If negative news fills the timeline and your support level breaks, you can risk 2.5% of your account (instead of 1%) on a short trade to make more money

Some traders don't trade high-volatility events well.

So they do the opposite of the above.

They'll reduce risk or completely avoid trading for that day.

Event Type: Neutral Volatility

This is the most underestimated volatility environment but is actually the most challenging.

If you can't clearly read sentiment despite a news event incoming, you won't be able to form a directional bias.

So to survive these conditions,

-Don't increase risk unnecessarily

-Don't change your strategy unless your data suggests

-Don't aim for larger profit targets and follow your confirmation triggers

This also ensures you have enough capital to bet more when you're more confident.

This guide works best for;

-Economic data releases

-Major institutional news

-Coins trending on 𝕏 (Example- a memecoin being listed by a big exchange)

But to make money in any of the 3 news environments, you need a profitable trading strategy first.

I've just shared my Multiplier Strategy PDF

This is a proven way to increase your Risk: Reward and is how I've caught monster longs on $BTC this bull run.

Download your PDF + Data collection guide now.

Expires in 24 hours:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content