Author: Tiger Research

Key Points

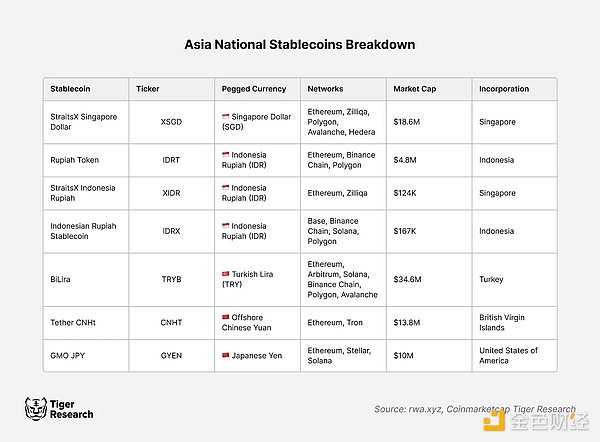

Growth of Asian stablecoins: Some Asian countries are developing stablecoins pegged to local currencies to maintain monetary sovereignty and reduce reliance on the US dollar in global trade. These stablecoins improve the efficiency of cross-border payments and align with the national financial strategies of countries like Singapore and Indonesia.

Case studies show: Projects like XSGD have paved the way for stablecoin adoption, enabling faster transactions, lower costs, and reduced currency conversion fees. However, challenges remain, with limited usage and market adoption of smaller stablecoins like XIDR.

Key steps for wider adoption: To unlock the full potential of national stablecoins, governments should focus on feasibility studies, running pilot projects, and establishing clear regulatory frameworks. Collaboration between the public and private sectors is crucial to overcome technical, regulatory, and operational hurdles.

1. The Evolving Dynamics of Stablecoin Adoption

Currently, most stablecoins are pegged to the US dollar (USD), reinforcing the dollar's dominance in the global financial landscape. However, Asia has begun to shift towards issuing stablecoins pegged to local currencies. This shift aligns with a broader global economic trend, as many countries seek to reduce their reliance on the US dollar in trade, investment, and financial transactions.

The core question this report aims to explore is: Why are some Asian countries still issuing non-US dollar stablecoins, despite the dollar's dominance? To answer this, we will examine the benefits of national stablecoins, highlight key case studies, and explore how non-US dollar stablecoins are playing an increasingly important role in Asia's financial landscape.

2. The Benefits of National Stablecoins

The primary motivation for issuing national stablecoins is to maintain monetary sovereignty. By pegging stablecoins to their domestic currencies, countries can ensure their monetary policies align with national economic goals. This can better control economic and political outcomes. Countries can better manage external economic pressures, which is particularly important during periods of foreign exchange market volatility.

Many Asian countries, especially those that have experienced currency crises, are particularly sensitive to these issues. This makes stablecoins an attractive tool for enhancing economic stability and resilience. However, most countries prioritize developing central bank digital currencies (CBDCs) over privately issued stablecoins.

CBDCs provide governments with more direct control over monetary policy and the financial system, making them easier to regulate than private stablecoin alternatives. Currently, only a few countries allow the issuance of stablecoins. Most are still developing regulatory frameworks and considering implementation.

However, restricting the proliferation of US dollar-pegged stablecoins like USDT and USDC remains a challenge. It is estimated that in South Korea, around 10% of trade is conducted through US dollar stablecoins, and these transactions are often not recorded in official statistics. Recognizing these practical constraints, governments are accelerating efforts to develop policies to help them compete effectively in the global stablecoin market.

3. Case Studies: Non-US Dollar Stablecoin Projects in Asia

3.1. Singapore Dollar (XSGD)

XSGD, issued by StraitsX, is a Singapore dollar-backed stablecoin that runs on Ethereum and has expanded to 4 other networks. With a market cap of over $18 million, XSGD has quickly become one of the most trusted stablecoins in Asia, as it is established under the Payment Services Act of the Monetary Authority of Singapore (MAS).

Users can use XSGD to top up their Grab App wallets. Source: blockhead.co

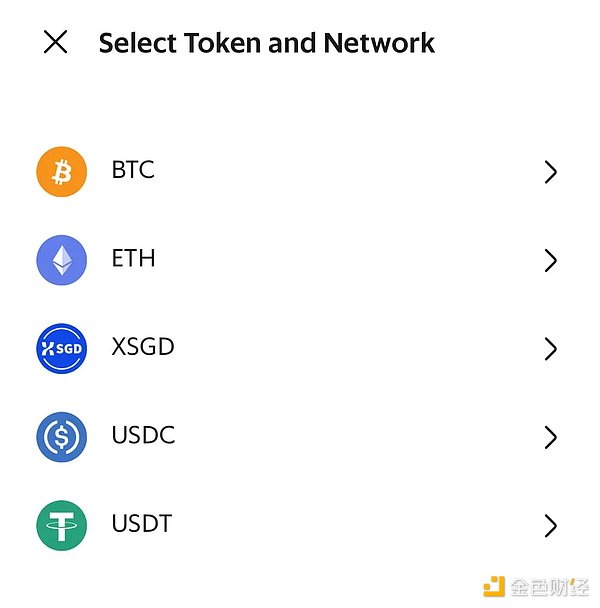

XSGD enables seamless cross-border transactions of the Singapore dollar, benefiting businesses and traders operating in Southeast Asia. In 2024, the Singapore super app Grab will allow users to top up their digital wallets with cryptocurrencies, including XSGD, expanding its utility in everyday transactions. By using a stablecoin pegged to the Singapore dollar, companies can avoid converting to US dollars, saving on exchange fees and improving transaction speeds.

3.2. Indonesian Rupiah Token (IDRT)

IDRT, issued by PT Rupiah Token Indonesia, is a stablecoin pegged to the Indonesian Rupiah (IDR). With a market cap of over $4.8 million, it operates on Ethereum and Binance Chain networks. Although the Indonesian government does not promote specific stablecoins, it has expressed support for blockchain technology, which is part of its broader goals of enhancing financial inclusion and supporting the digital economy.

Source: rupiahtoken.com

IDRT is widely used on various CEXs and DEXs, such as Binance, Uniswap, and PancakeSwap, allowing users to trade and invest using a currency pegged to the Indonesian Rupiah. This accessibility on popular exchanges has expanded IDRT's role in the decentralized finance (DeFi) ecosystem, making it a practical tool for users seeking exposure to the Indonesian currency in the cryptocurrency space.

3.3. Indonesian Rupiah (XIDR)

The XIDR ecosystem. Source: StraitsX

XIDR, also issued by Xfers, is pegged to the Indonesian Rupiah and is part of the broader StraitsX ecosystem, which includes XSGD. Although XIDR's market cap is relatively small at $124,960, it shows growth potential, especially as Indonesia integrates blockchain solutions into its financial infrastructure.

Compared to IDRT, the XIDR ecosystem is more extensive, supporting multiple DeFi platforms, institutional custody solutions, and a wider range of personal wallet options, which may give it broader utility across decentralized finance and institutional trading. While XIDR has a presence in multiple domains, its market cap is lower than IDRT's. This may be because IDRT has established a stronger foothold in the space earlier. In the future, XIDR could play a crucial role in Southeast Asia's financial landscape, providing fast and efficient payment services to online merchants across the region.

3.4. Indonesian Rupiah Stablecoin (IDRX)

IDRX, developed by PT IDRX Indo Inovasi, is a stablecoin pegged to the Indonesian Rupiah that can operate on multiple blockchain networks, including Base. Its primary goal is to connect traditional finance and Web3 by providing a stable digital representation of the Indonesian national currency.

Source: IDRX

Similar to other stablecoins, IDRX aims to enable decentralized finance applications, facilitate cross-border payments and remittances, and provide stability to hedge against cryptocurrency market volatility. Although still in the early stages, IDRX has already partnered with Indodax, the largest cryptocurrency exchange in Indonesia. While it lacks advanced features like a fair trade mechanism, the project shows immense potential for widespread adoption and functional expansion, further strengthening its role in Indonesia's evolving digital economy.

3.5. BiLira Turkish Lira (TRYB)

BiLira (TRYB) is a Turkey-based stablecoin pegged to the Turkish Lira, an Ethereum-based stablecoin that can provide insights into the Asian market. With a market cap of around $34.6 million, BiLira's operations are not directly regulated, posing higher risks, but it fills a gap in cross-border payments involving the Turkish Lira. Additionally, BiLira's developers have launched their innovative cryptocurrency exchange, BiLira Kripto, providing users with more channels to trade and transact using the Turkish Lira-backed stablecoin.

However, given the persistent instability of the Turkish Lira against the US dollar, currently, 4% of Turkey's GDP is used to purchase stablecoins. This poses a significant challenge for local stablecoins like BiLira to compete with dominant currencies like the US dollar.

3.6. Tether CNHt (Renminbi)

Tether CNHt is pegged to the offshore Renminbi (CNY) and is a stablecoin for international trade by Chinese enterprises. Although China has strict regulations on cryptocurrency activities, CNHt allows enterprises to settle transactions in Renminbi without exchange rate fluctuations, providing a solution for traders who wish to transact in Renminbi.

However, it is worth noting that Tether CNHt competes with China's official digital Renminbi (also known as e-CNY), which has seen wider adoption in China. The digital Renminbi is strongly promoted by the Chinese government, integrated into the domestic financial system, and is favored by both retail and institutional traders due to its legal status and the support of the People's Bank of China. Furthermore, its recent integration with Huawei's HarmonyOS NEXT operating system has significantly improved its accessibility, further consolidating its position in China's digital finance ecosystem.

In comparison, Tether CNHt is positioned for the offshore market and international transactions, providing an alternative to the US dollar-pegged stablecoins. In terms of domestic usage, the digital Renminbi is increasingly used for everyday transactions, such as retail payments in Beijing and Shanghai. This widespread adoption makes it more popular in mainland China compared to private stablecoin alternatives like CNHt.

3.7. GMO JPY (GYEN)

GMO JPY (GYEN) is a stablecoin issued by the regulated entity GMO Trust, headquartered in the United States. GYEN is pegged to the Japanese Yen (JPY) and runs on Ethereum, with a market capitalization of $10 million. Unlike other major stablecoins targeting retail or emerging markets, GYEN is designed to serve institutional clients, providing a more secure and regulated alternative for enterprises transacting in Japanese Yen. Bitstamp is one of the first CEXs to accept GYEN, marking its progress in the crypto industry.

Legally, the stablecoin complies with New York's strict financial regulations, ensuring high transparency and consumer protection. Although GYEN is not regulated by Japanese law and is currently not allowed to be used in Japan, Japan's positive attitude towards the development of blockchain and fintech suggests the potential for regulatory adjustments that could integrate assets like GYEN into the country's digital finance ecosystem.

4. Key Considerations and Conclusion

4.1. Key Considerations

As interest in national stablecoins grows across Asia, governments and businesses are exploring concrete steps to integrate these digital currencies into their economies. The table below outlines the key use cases, associated benefits, and challenges of national stablecoin adoption.

The table below highlights the fundamental elements required for successful national stablecoin adoption. Monetary sovereignty is a core driver, as stablecoins provide countries with a way to reduce reliance on foreign currencies and strengthen control over their domestic monetary systems. This is particularly important for countries facing currency volatility or external economic pressures.

Regulatory compliance and consumer trust are equally crucial. Governments must establish clear frameworks to ensure transparency and prevent abuse, while businesses need to provide secure, user-friendly systems to earn public trust. Stablecoins also offer a path to improve financial inclusion, extending digital financial tools to underserved populations, especially in areas with limited banking services.

Finally, cross-sectoral collaboration is essential. Strategic partnerships between governments, fintech companies, and traditional financial institutions will determine how well stablecoins can be integrated into existing ecosystems. By comprehensively addressing these issues, countries can lay a solid foundation for stablecoin adoption that aligns with their economic and social priorities.

4.2 Conclusion

National stablecoins present a unique opportunity for Asian countries to strengthen financial sovereignty, improve currency management, and modernize payment systems. By pegging stablecoins to local currencies, governments can create digital tools that align with domestic priorities and provide secure, efficient alternatives to traditional systems.

However, stablecoin adoption must follow a structured approach, including rigorous feasibility assessments, pilot programs, and transparent regulatory frameworks. Through strategic collaboration between public institutions and private enterprises, national stablecoins can lay the groundwork for sustainable economic growth and innovation. This, in turn, can pave the way for future applications such as cross-border trade and regional cooperation.