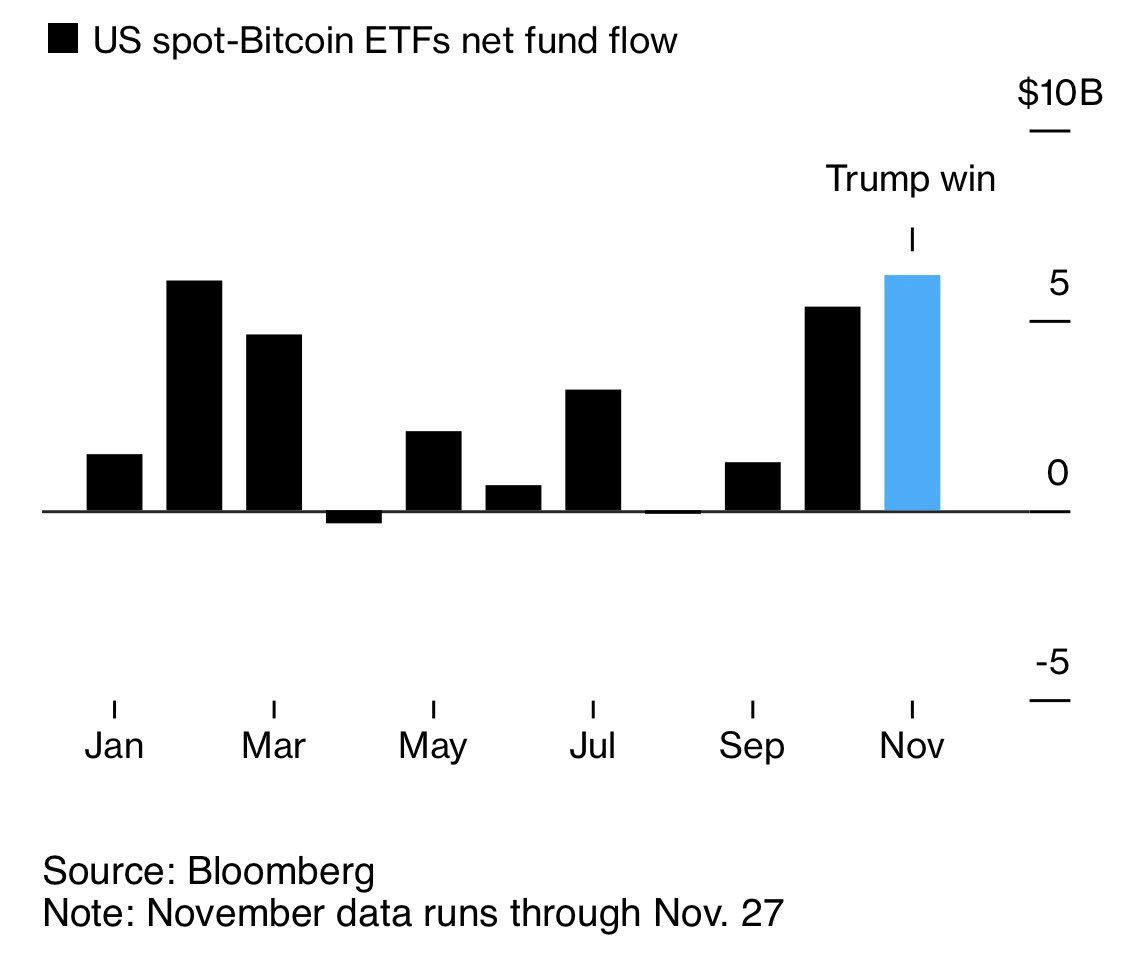

The physical BTC ETF (exchange-traded fund) had a groundbreaking month in November. The net inflow reached an unprecedented $6.2 billion. This financial product provides institutional investors with an indirect way to access BTC. It broke the previous record set earlier this year.

The optimism driving these inflows is in line with President-elect Donald Trump's pro-crypto policies. This has boosted investor confidence in digital assets and related financial products.

The Trump trade frenzy, leading to concentrated buying of BTC ETFs

After the approval of a physical BTC ETF in January, this financial product recorded a net inflow of $6.2 billion in November. According to data collected by Bloomberg, the US physical BTC ETFs surpassed the $6 billion peak in February.

"The physical BTC ETFs are set to break the monthly inflow record... $6.2 billion in November alone. The previous high was $6 billion in February," said Nate Geraci, president of The ETF Store.

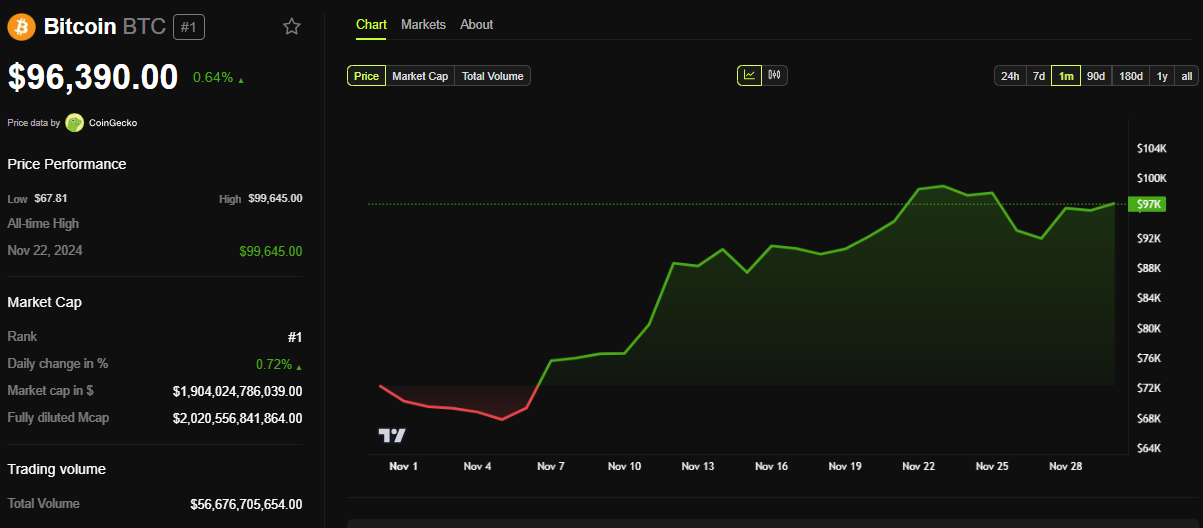

Donald Trump's election victory was a key catalyst for the record-breaking inflows. His administration promised a favorable regulatory environment for cryptocurrencies. It plans to reverse the restrictive policies implemented during the Biden era.

The announcement of plans to establish a strategic BTC reserve and appoint crypto-friendly regulators further strengthened market sentiment. This has propelled BTC towards $100,000.

This optimism has extended to physical BTC ETFs. In the immediate aftermath of the election, they recorded the single-day largest inflow of $1.38 billion. BlackRock has emerged as a leader in this space, recording over $1 billion in a single day. This reflects the significant interest from institutional investors seeking regulated exposure to BTC.

In addition to the record-breaking inflows, BTC ETFs have witnessed rapid accumulation of holdings. They are nearing 1 million BTC. Analysts predict that these ETFs could surpass the estimated holdings of BTC's creator, Satoshi Nakamoto, by the end of the year. This milestone will solidify their dominance in the market.

BlackRock's iShares BTC Trust (IBIT) stood out with record-breaking trading volume. It recently surpassed gold-based ETFs in the market. This shift indicates an increasing preference for digital assets among traditional investors. ETFs from Fidelity and Bitwise also experienced notable inflows, further expanding BTC's mainstream finance adoption.

Beyond BTC, ETH... Expectations for more physical ETFs have increased

The Trump administration is expected to open up additional opportunities for crypto-based financial products. The crypto market has already witnessed options trading on BTC ETFs. The recent approval by the Options Clearing Corporation (OCC) paved the way for options trading on BTC ETFs. These developments have provided investors with additional tools to hedge and speculate on BTC price movements.

Matt Hougan, Chief Investment Officer at Bitwise, described these advancements as potential game-changers. Specifically, they will enable institutional investors to enter the crypto space with greater confidence. This trend aligns with the broader movement of institutions adopting BTC as a strategic asset amid favorable regulatory signals.

"A pro-crypto regulatory environment will provide a shield for institutional investors who have long wanted to allocate to this space. This is a game-changer," Hougan posted on X.

As ETFs play a crucial role in BTC adoption, their continued growth can sustain BTC's upward trajectory. Forecasts suggest BTC could reach new all-time highs, and some models are targeting $117,000 if the current momentum persists. At the time of writing, BTC is trading at $96,390, up 0.64% since the start of the Friday session.

The record-breaking inflows into US physical BTC ETFs in November reflect the convergence of political and regulatory events with investor sentiment. Trump's pro-crypto stance has reignited enthusiasm among investors, driving milestones in both price and adoption.

As these ETFs gain significance, they are reshaping the landscape of BTC investment and paving the way for greater mainstream acceptance of the pioneering cryptocurrency within the financial system.