In recent years, stablecoins have gradually evolved from auxiliary tools on digital asset trading platforms to an important part of the global fintech ecosystem. It has not only changed the traditional financial system's payment and settlement methods, but is also driving financial inclusion globally. In a sense, stablecoins are becoming the true "killer application" in the Web3 payment field. This article will, based on the "Stablecoins: The First Killer Application" report, delve into the market forces, challenges, and future development paths behind it.

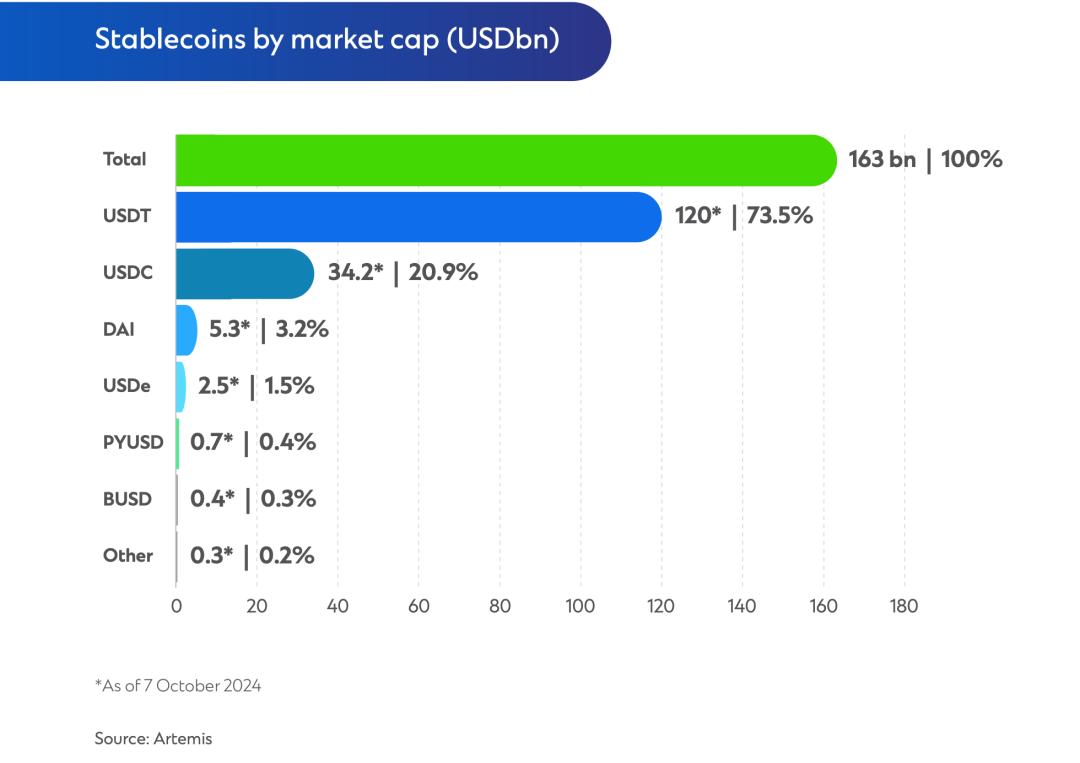

Market share of major stablecoins

I. A key opportunity for cross-border payments: From the slow SWIFT to 24/7 real-time settlement

Currently, cross-border payments are facing the dilemma of low efficiency in the traditional system, especially the payment system based on the inter-bank communication network (such as SWIFT), which is expensive and has a long settlement time. In this case, stablecoins have shown their unique advantages: low transaction costs, 24/7 real-time settlement, and higher transparency, making them an important alternative solution for cross-border payments, especially for SMEs and emerging market countries. The report mentions that by 2024, the global cross-border payment market will still not be able to effectively reduce costs and improve efficiency, and the speed of retail payments will even decline, providing a key market entry point for stablecoins.

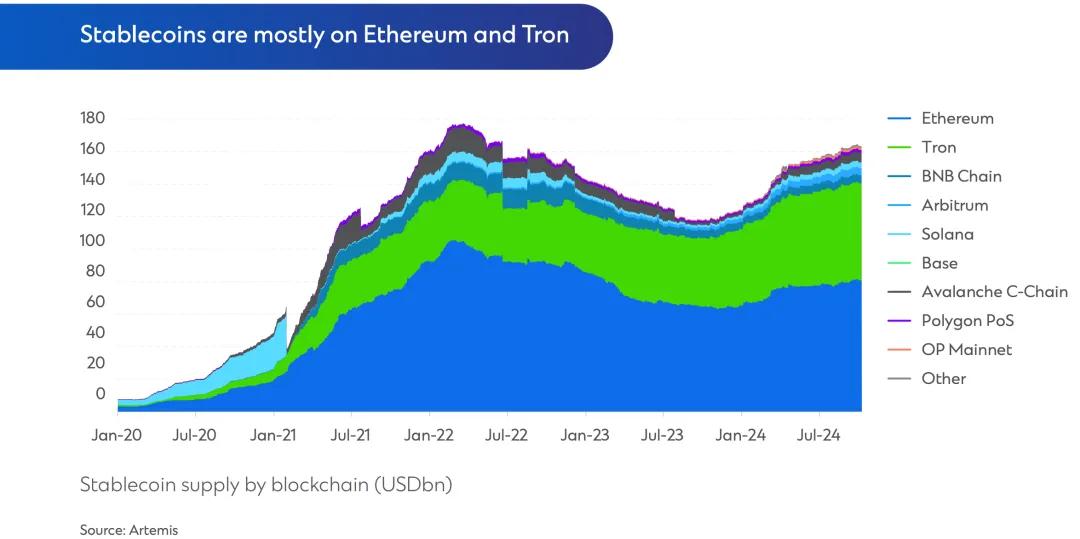

It is worth noting that the payment infrastructure based on blockchain technology, such as Ethereum and TRON, not only supports the efficient circulation of stablecoins, but also introduces a mechanism similar to "Gas fees" to differentiate the priority of transactions, which is unprecedented in the traditional financial field. Similar to the "dynamic pricing" model of airline tickets, users can pay different fees to accelerate settlement, and this mechanism undoubtedly provides more imagination space for the future financial system, and also helps enterprises more effectively manage liquidity needs in the payment process.

Scale distribution of stablecoins on different chains

II. The rise of "other uses": From speculative tools to bridges for financial inclusion

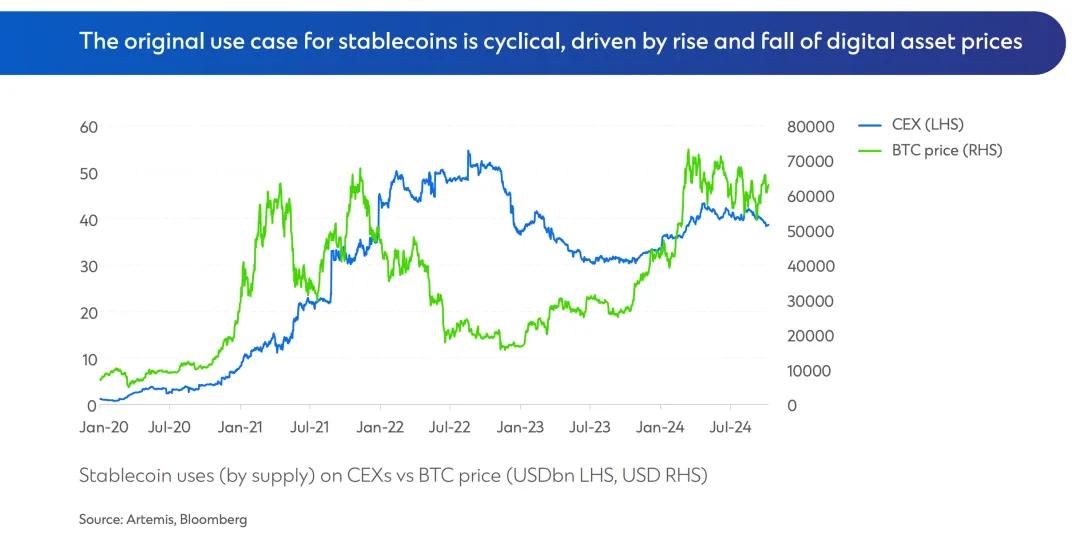

The charts depicted in the report clearly show the evolution of stablecoin application scenarios: Stablecoins were mainly used for cryptocurrency trading on centralized exchanges (CEX) in the early days, but now their main application areas have gradually shifted to "other uses", including payments, remittances, trade settlement, and asset management, especially with a significant increase in adoption in emerging markets. Data shows that "other uses" currently account for about 50% of stablecoin trading volume, meaning that stablecoins have gradually broken through the speculative applications within the exchanges and evolved into a tool to serve the real economy.

The relationship between the usage of stablecoins on centralized exchanges (CEX) and the price of Bitcoin

In this transformation process, the concept of financial inclusion is embodied. The report mentions that the World Bank estimates that about 1.4 billion people worldwide are still "unbanked", and stablecoins provide these people with a channel to store value and make cross-border payments without a bank account. This capability is particularly applicable to developing countries, where traditional financial systems have limited service coverage. Stablecoins, through DeFi and digital wallets, help these groups obtain a better financial service experience.

III. The potential of non-US dollar stablecoins: An attempt to break the US dollar monopoly in globalization

Although currently 99.3% of stablecoins in the market are pegged to the US dollar, the report points out that the potential market for non-US dollar stablecoins is also gradually developing, especially stablecoins pegged to the Euro and gold are gradually gaining attention. In some economies with high foreign exchange volatility, such as Turkey, stablecoins can provide users with a relatively stable value storage tool, thereby reducing the risks brought by the instability of the local currency. The development of non-US dollar stablecoins not only provides global users with more asset choices, but also helps alleviate the high dependence of the global financial system on the US dollar, which is crucial for the financial sovereignty and monetary policy flexibility of various countries.

However, the expansion of non-US dollar stablecoins is not without challenges. Taking the Turkish Lira as an example, although the Lira-pegged stablecoin is attractive to some local users, its own high volatility is still an issue that cannot be ignored. Whether non-US dollar stablecoins can truly grow and develop depends on the stability of the underlying assets and the market's ability to price their risks.

IV. Stablecoin regulation: From the gray area to the path to legalization

The future of the stablecoin market largely depends on the regulatory attitudes of the world's major economies. The report mentions that during the Biden administration, although three bills related to stablecoins have been introduced, the progress has been slow. It is expected that under a Trump administration, the regulation of stablecoins will be accelerated, paving the way for more banks and financial institutions to enter this field. This regulatory legalization will greatly enhance the market's trust in stablecoins and promote the further expansion of stablecoin applications.

Especially in a country like the United States, which has the status of a global financial center, if the stablecoin regulatory framework is clarified, more banks can legally issue stablecoins, which will bring an order of magnitude growth in the market scale of stablecoins, and will also drive their large-scale application in cross-border payments, asset management, and trade settlement.

Aiming's Perspective: Opportunities and Challenges in the Future

Aiming believes that the globalization path of stablecoins is not only a technological innovation, but also a major supplement to the traditional financial system. The applications of cross-border payments and financial inclusion will be important breakthroughs for stablecoins, and effective regulation and innovative application scenarios will determine their future direction.

In the future, Aiming will continue to closely monitor the regulatory dynamics of the world's major economies, not only the United States, but also the trends in important financial markets such as Europe and Asia. At the same time, we will also closely track the development of non-US dollar stablecoins, especially innovative projects that may be pegged to local currencies. We are well aware that stablecoins have huge potential in promoting financial inclusion, especially in providing alternative payment and storage means for the unbanked population. By providing clients with the most cutting-edge compliance advisory and market insights, we are committed to helping Web3 payment companies find the best application paths globally.