In the October Unchained Crypto interview, Solana co-founder Anatoly stated that by observing key indicators such as active addresses, TVL, DeFi sectors, Meme hype, and developer ecosystems, he has noticed that Base is gaining momentum and becoming the strongest L2 in the Ethereum ecosystem. In late November, Metamask founder Dan released the Meme token $CONSENT on both Base and Solana on the same day, further sparking comparisons between Solana and Base in the crypto market.

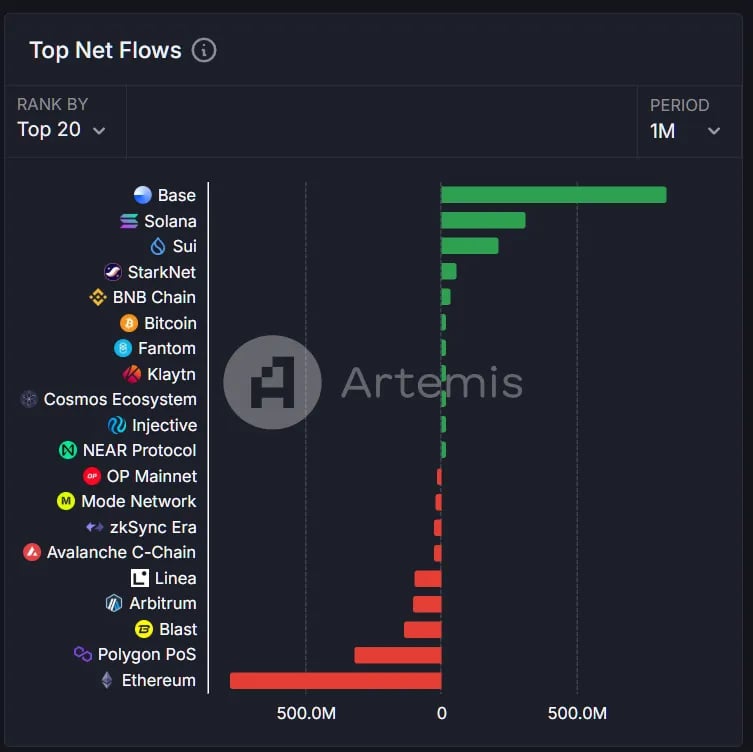

According to Artemis data, last month, Base had a net capital inflow of $835 million, ranking first among all public chains, while Solana had $313 million, less than half of Base.

The sense of capital is the most sensitive, and capital will gather where there are more opportunities. With the decline in Solana MEME hype, the next choice of capital is undoubtedly Base chain. Unlike many other L2 projects, Base currently clearly states that it does not plan to issue a native token. This measure is in stark contrast to those projects that have attracted capital by issuing tokens. The growth of Base is entirely dependent on the inherent value and ecosystem building of its platform, and the inherent value of Base will be more reflected in its leading ecosystem projects on the chain.

Derivative leader project SynFutures

As the leading DeFi derivative protocol, SynFutures is about to airdrop and TGE. By doing the right thing at the right time, the heat of the Base ecosystem will bring more attention and adoption to SynFutures, and SynFutures will also contribute to the rapid growth of Base, forming a positive flywheel. Its token F will also carry more value and potential brought by the Base ecosystem.

Since its launch in 2021, SynFutures has processed over $200 billion in trading volume. Its products have evolved to V3, and V3 Oyster AMM is the first unified AMM and permissionless on-chain order book in the industry.

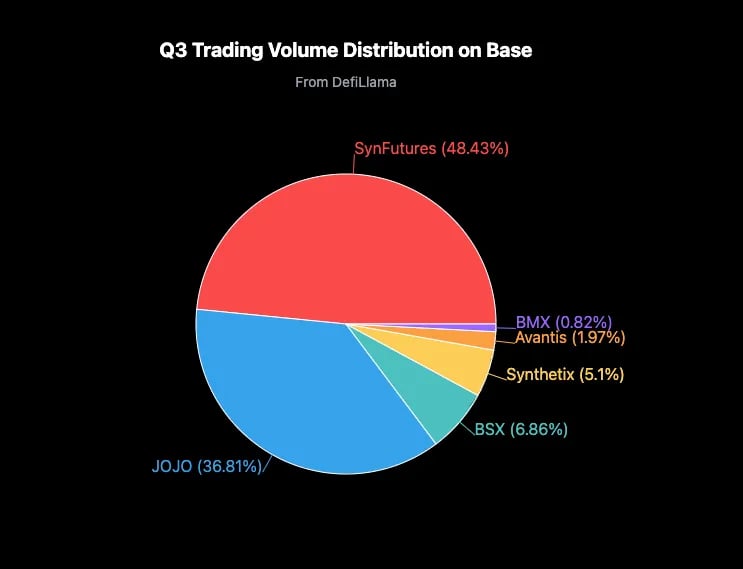

After integrating with the Base chain in July, benefiting from its mature products, large community, and strong cooperation resources, it quickly became the top-ranked derivative protocol on the Base chain in terms of trading volume. It took only 10 days after launching on Base to exceed $100 million in trading volume, and its Q3 trading volume accounted for nearly 50% of the Base network.

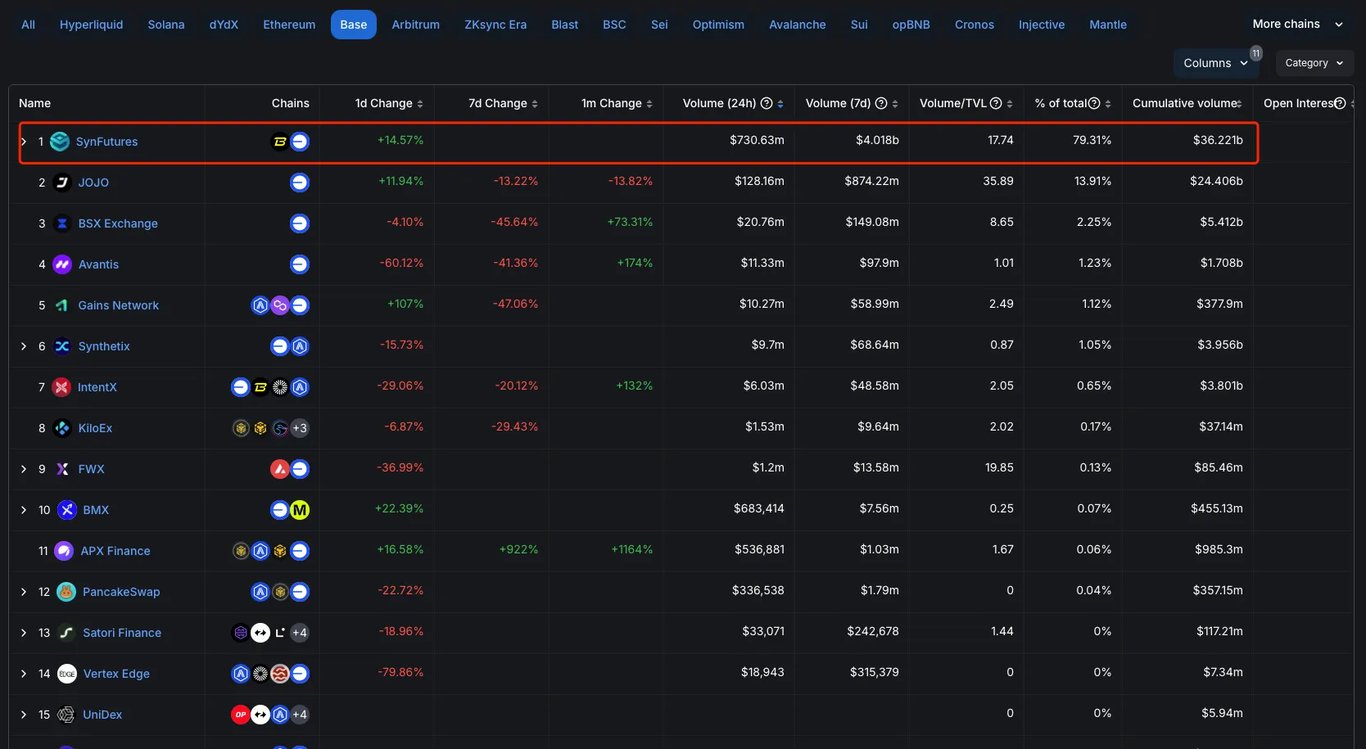

With a cumulative trading volume of over $35 billion, a daily trading volume of over $200 million, and a single-day trading volume of over $910 million on November 12, it currently accounts for more than 70% of the daily derivative trading volume on the Base chain, which is 6 times that of the second-ranked project.

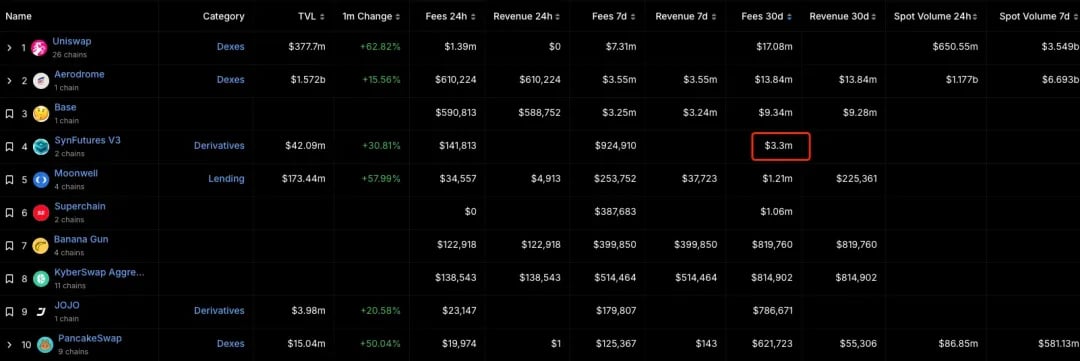

With only contract trading, SynFutures' fee revenue has exceeded $3.3 million in the past 30 days, ranking 3rd on the protocol (the 3rd place is the Sequencer of the Base network). The strong profitability is also the foundation for SynFutures to operate in a healthy manner in the long term and continuously innovate and iterate.

Mechanism and Innovation of SynFutures V3

The Oyster AMM model of SynFutures V3 allows adding liquidity in a specified price range and increases capital efficiency by leveraging. Unlike the spot market liquidity model of Uniswap V3, the Oyster AMM adopts a margin management and liquidation framework customized for derivative trading volume, ensuring the safety of LPs and the protocol. A very important point of the Oyster AMM model is that it also introduces two-way liquidity, allowing the use of only one token to add liquidity without the need for a 1:1 provision of two-way assets. Liquidity providers can list any trading pair, such as meme coins paired with each other or any asset paired. This mechanism brings more flexibility and choice to the ecosystem.

The oAMM itself is a deployed on-chain open-source smart contract with a permissionless feature. Without complex pre-communication and review for listing, anyone can add any trading pair at any time. Whether it's the project party or the holders, they can create their own Token's trading pair on SynFutures and add liquidity in 30 seconds. This brings more options to the ecosystem and enhances responsiveness.

By supporting users to provide liquidity at specified price points, SynFutures realizes on-chain limit orders, simulating order book trading behavior and greatly improving capital efficiency. This model is more in line with the habits of market makers on centralized trading platforms and can attract more active market makers to participate, thereby improving trading depth and efficiency, providing a trading experience close to CEX.

Unlike the off-chain order book of dYdX, the oAMM is deployed on-chain, with all data being open, transparent and verifiable, completely decentralized, and without worrying about black box operations or fake transactions.

Compared to the Vault model of GMX and the application chain model of dYdX, SynFutures makes up for the shortcomings of the two while maintaining high efficiency and high performance, and is naturally integrated into the asset ecosystem of the underlying public chain. As the technology iterates, this advantage will be further expanded.

Perp Launchpad Injects New Vitality into On-chain Asset Issuance

Over the past year, asset issuance has become the most attractive track, from Runes, Glyphs to the hot Pump.fun, proving the strong appeal of "innovative gameplay + wealth effect". The Base chain has outstanding performance in the token issuance platform, with great development potential.

Under the mature framework of SynFutures V3, the launch of the industry's first perpetual contract Perp Launchpad has opened up a new chapter for on-chain asset issuance and trading, injecting more vitality into the DeFi market and helping Base maintain a leading position in the fierce public chain competition!

For example, if a MEME project party uses its Token to create a contract market on SynFutures, it not only can provide more trading methods and choices, but also can drive arbitrage capital to enter through the spot and contract price difference, increasing the token's visibility and the number of holders, amplifying the wealth effect. More importantly, the control of the contract market is in the hands of the community, and the project party and supporters can benefit from providing liquidity, breaking away from the dependence on centralized exchanges and forming a healthier ecological cycle. In the past few years, the initiative of the spot market has returned to the on-chain liquidity pool, and in the future, the control of the contract market will also return to the community and the on-chain, and be rewarded through SynFutures. And these can only be realized under the V3 model framework of SynFutures, which allows setting value ranges, supports single-sided liquidity, allows adding liquidity in 30 seconds, and runs entirely on-chain, which is a unique advantage and moat that any other competitors find difficult to imitate.

The planned spot aggregator may become the Jupiter of the Base chain

SynFutures and Jupiter have many similarities, both were established in 2021, both have passed market testing and emerged from the most brutal bear market, being profitable leading DeFi protocols. It is very rare that they both issued tokens only after long-term stable operation and continuous iteration, and used token issuance as a driver for the project to enter the next stage. Token issuance is a node in their long-term strategy, or a new beginning, rather than some projects using token issuance as a goal. The difference is that Jupiter initially chose to do on-chain spot aggregation, while SynFutures chose the derivatives track. However, they have arrived at the same destination, with Jupiter issuing tokens and then starting to layout the derivatives track, achieving remarkable results; SynFutures will also launch a spot aggregator after the TGE, which is exactly what the Base chain lacks, a influential spot aggregation trading product. The synergy between on-chain trading volume and asset issuance allows SynFutures not only to provide trading liquidity for Base, but also to participate in the asset issuance process, occupying the largest value capture entry on the chain. Once the spot function is launched, SynFutures will further consolidate its market position with the dual advantages of spot and derivatives trading.

Track Comparison: How Much is a Reasonable Valuation for SynFutures

SynFutures has already announced its token economics, with a total of 10 billion F tokens. Then, based on its positioning in the ecosystem as the "Jupiter of the Base chain", what would be a reasonable valuation? The FDV of Raydium, the largest spot DEX on Solana, is $3 billion, and the current largest spot DEX on the Base chain is $2 billion, with a ratio of 3:2. CoinGecko shows that the FDV of Jupiter on Solana is $11.2 billion, but since the team has announced the destruction of 30% of their holdings, the actual figure is $7.84 billion. Based on the 3:2 ratio of spot DEXs, the FDV of SynFutures would be around $5.22 billion. However, SynFutures' spot part has not yet been launched, so we can use a multi-dimensional approach to arrive at a reasonable valuation: referring to the FDV of the Jupiter token when it was first launched, which is likely to be more reasonable, which is $5 billion, then the reasonable valuation of SynFutures would be $3.33 billion. The FDV of Drift Protocol, another well-known derivatives trading platform on Solana, is $1.36 billion. Using the 3:2 ratio alone, the result is $900 million. But SynFutures' V3 and Perp Launchpad clearly have greater advantages and growth potential, so averaging the conclusions drawn from comparing Jupiter and Drift, the current reasonable valuation of SynFutures is around $2.1 billion. As a project backed by Coinbase, Base has gained strong support in the market, and the possibility of Base chain tokens being listed on Coinbase is much greater than other chains. If it can be listed on Coinbase like Aero, the valuation of F will be further enhanced. In addition, with the continued rise of the Base chain and the launch of SynFutures' spot aggregation trading, the FDV will also rise, and may even surpass Jupiter, after all, Web3 is the place where miracles are created.

Industry Prospects and Future Thinking

From a macro perspective, the development of the Base network has injected new vitality into the on-chain derivatives market, and SynFutures is the most promising project in this field. Its innovative Perp Launchpad model not only promotes the marketization of on-chain assets, but also provides users with more diversified trading options. This model may become the mainstream trend of on-chain trading in the future, further consolidating SynFutures' leading position in the market. The launch of spot aggregation trading will help SynFutures gradually occupy the two most promising tracks in the Base ecosystem - derivatives trading and spot trading. This dual layout will bring more users and trading volume to SynFutures, driving the long-term sustainable development of the platform. For investors, the launch of the SynFutures token not only reflects the value of its own ecosystem, but may also indirectly carry the growth dividend of the Base network. This token opportunity in the "coinless network" ecosystem may be the most scarce potential breakthrough in the current market.