Ethereum (ETH) whales are on the move again. However, this time they are not selling cryptocurrencies for some period of the year. Instead, on-chain data shows notable ETH accumulation, and retail investor interest is also increasing.

What does this mean for ETH? BeInCrypto reveals all the details and analyzes the potential impact of these developments on the Ethereum price.

Ethereum small investors, big buyers

On November 29, the net inflow of Ethereum whales was 28,680 ETH, but today it has surged to 80,130 ETH. Net inflow measures the difference between the coins accumulated and sold by whales.

Positive net inflow indicates that whales are buying more tokens than they are selling, which is generally a strong bullish signal. Conversely, negative net inflow indicates an increase in sales, which often means a price decline.

According to the latest data, Ethereum whales have accumulated around 51,450 ETH, or about $188 million, in just two days. If this buying trend continues at a similar pace, the price of ETH could exceed $3,700.

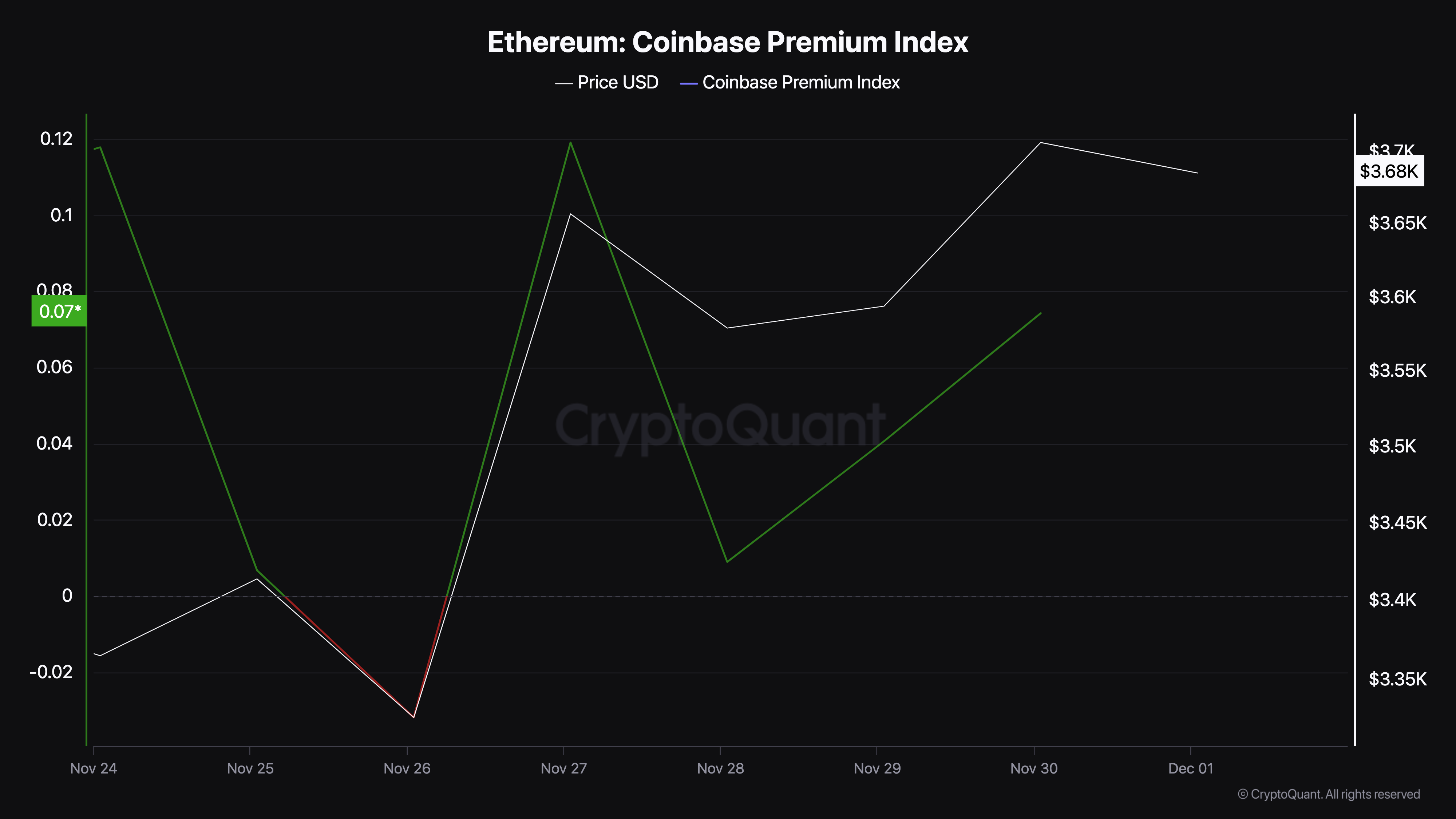

In addition to whales, CryptoQuant data shows that the Coinbase Premium Index has increased. This index measures the difference between the ETH/USD price on Coinbase and the price on Binance.

Negative values indicate selling pressure, especially from US investors. Conversely, positive values indicate increased buying pressure, which is the trend currently observed for ETH.

If US investors continue to accumulate ETH, this increasing demand could push the cryptocurrency's price higher and support the previously mentioned upside potential.

ETH Price Prediction: Will Strong Support Push It Above $4,000?

Based on the daily chart, the Parabolic Stop and Reverse (SAR) indicator is below the price of ETH. Parabolic SAR is a technical indicator used to determine the direction of an asset's price.

When the indicator's dotted line is above the price, it represents resistance, making it difficult for the asset to rise higher. However, in the case of Ethereum, the indicator is below the price, suggesting strong support for the cryptocurrency to maintain its upward momentum.

Additionally, BeInCrypto has observed the formation of a bullish flag pattern, where buyers have overwhelmed sellers. Considering this positioning, the price of ETH could reach $4,000.

However, it is important to note that Ethereum whales could play a role in this prediction. If these major stakeholders continue to increase, ETH could reach the mentioned target.

On the other hand, if whales stop buying, this prediction could be invalidated. In that case, Ethereum could drop to $3,425.