Author:David Canellis

Translator: Baihua Blockchain

We have already learned to "endure" the violent fluctuations of Bit.

We seem to have become accustomed to the expectation that even in a rampant bull market, we are bound to encounter a major correction, shattering our hopes, dreams, and wallet balances.

Therefore, the idea that Bit could suddenly plummet 50% while charging towards six-figure or even higher prices is perfectly understandable.

Is this expectation reasonable?

First, it needs to be clarified that Bit does have the "tradition" of plummeting about 80% from the bull market peak to the bear market bottom. This has been the case in almost every cycle since Bit's first major rally in 2011.

However, this article is not about discussing retreats in a bear market (for this, you can refer to our previous analysis). Instead, we will focus on corrections during a bull market, as we are currently experiencing.

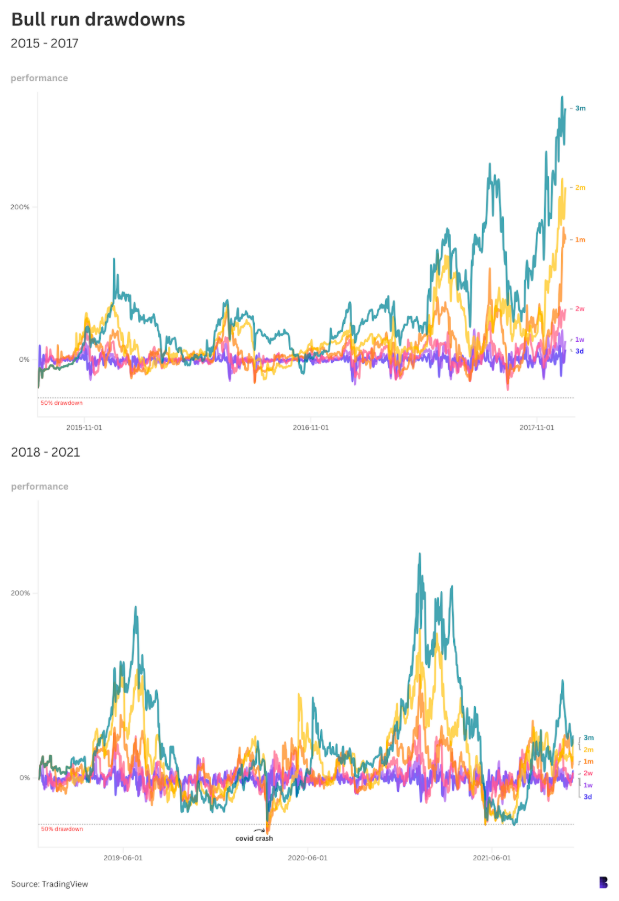

The chart below shows Bit's price performance over six different time spans, ranging from three days to three months, presented in a rolling manner from the cycle's starting point (bottom) to the historical high (peak).

Each line represents a time span. For example, the dark purple line represents the percentage difference between each daily low and the opening price three days prior, while the green line represents a similar comparison on a three-month cycle.

The dashed line at the bottom represents a 50% retracement level. As shown, during the bull market from August 2015 to December 2017, there was never such a significant correction.

In this cycle, the largest correction occurred towards the end of September 2017, with a 40% drop in two weeks.

However, in the subsequent bull market from 2018 to 2021, there were three major corrections exceeding 50%.

One of them was the market crash triggered by the COVID-19 pandemic in March 2020, when the stock market experienced a series of "Black Mondays".

Bit dropped 50% or more across almost all time spans, with only the three-month time span slightly below 50% at 47%.

The other two significant corrections occurred in May and July 2021, when Bit fell from over $60,000 to $30,000. However, over the next four months, Bit quickly rebounded to a new high near $69,000.

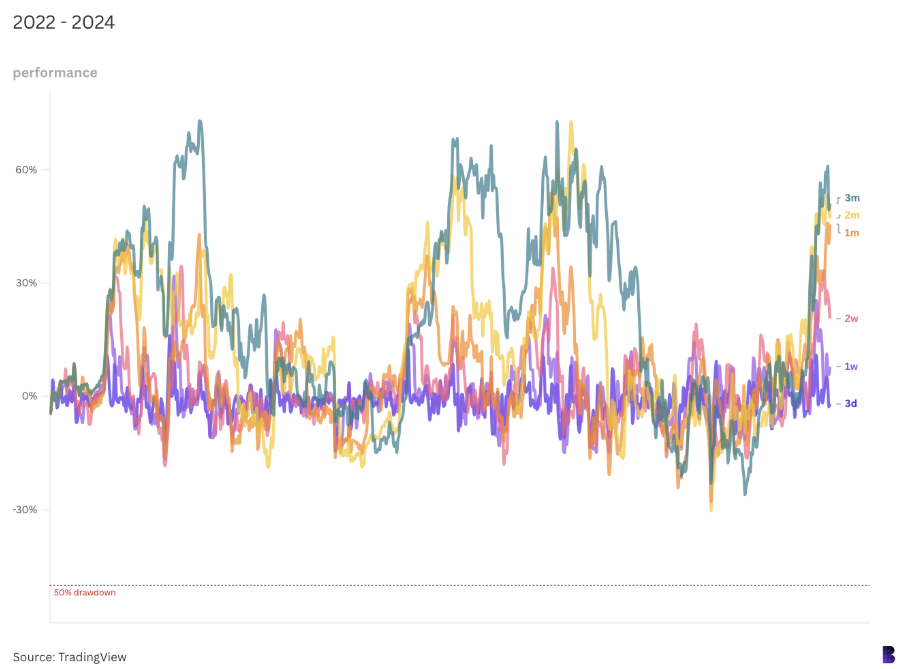

This latest correction has been relatively mild, with the most notable adjustment in the bull market occurring in the first week of August.

Bit dropped 30% across multiple time periods, from over $70,000 in June to a low of $49,200.

Of course, this does not mean that Bit has lost its volatility. I still believe that future market conditions will continue to be turbulent.

It is worth noting that the most brutal retreats have historically occurred at the end of a bull market.

Therefore, the longer the bull market lasts without a significant correction, the more uncertain the future outlook becomes - and this is the unique "thrill" of investing in Bit.