Table of Contents

ToggleLarge holder activities drive market trends

The XRP price has surged 430% in the past 30 days, reaching its highest level since 2018, surprising many traders in the crypto community (Crypto Twitter). This rally began in early November, as the Republican victory in the US election reignited investors' confidence in US crypto-related assets (such as XRP and Ripple Labs).

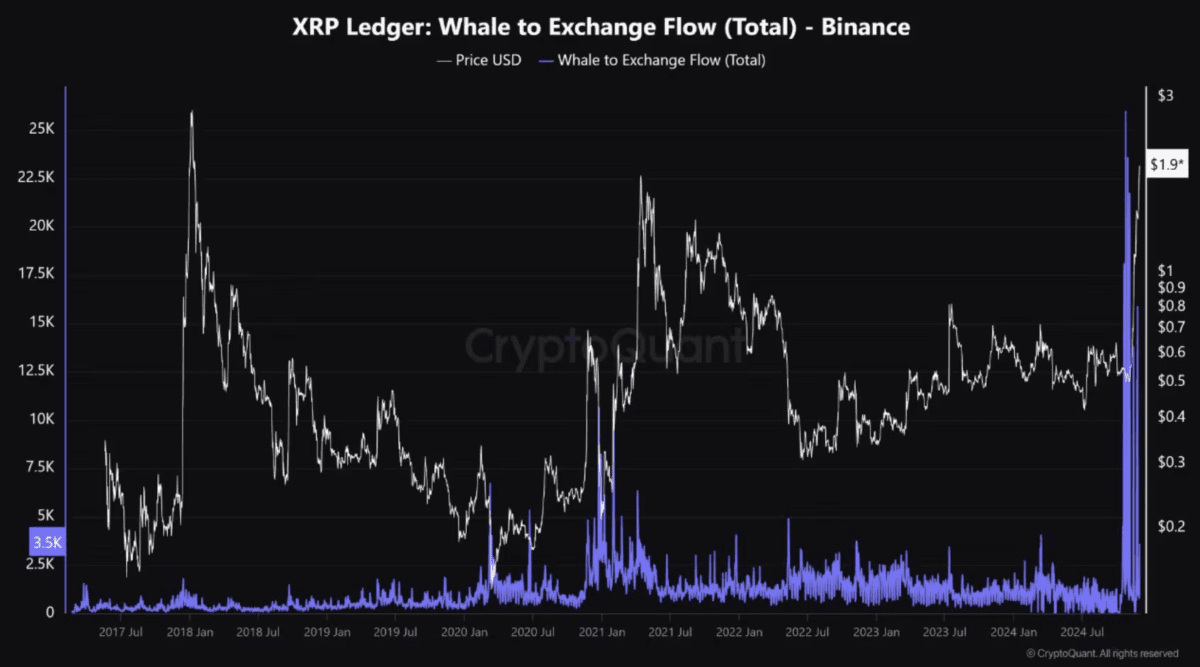

According to CryptoQuant data, large holders (commonly known as "whales") played an important role in this price surge. The flow of funds between large wallets and exchanges has remained at a high level over the past month, with activity volume several times higher than any other period.

The buying or selling pressure of whales can have a significant impact on the market, and tracking these trends can help assess market sentiment. For example, when the inflow of tokens to exchanges (Exchange Inflows) increases significantly, it may indicate that whales are preparing to sell, which is often seen as a bearish signal. When a large amount of tokens flow out of exchanges, it may suggest that whales are accumulating, which is considered a bullish sign.

However, Woominkyu, an analyst at CryptoQuant, pointed out in an article on Monday that such whale activities usually coincide with the short-term price peaks (Local high), as mature market participants tend to sell their assets when retail investors rush in.

The correlation between price peaks and whale trading activities

Woominkyu noted that historical data shows that large whale transactions to exchanges (marked by red circles) are often closely related to the price peaks of XRP. This suggests that whales tend to transfer large amounts of XRP to exchanges for sale at short-term or cycle highs.

Woominkyu further added:

"The recent large inflow of funds from whales to exchanges coincided with XRP price reaching a short-term high of around $2.3. This may indicate that whales are preparing for potential profit-taking or increased market activity."