In 2024, the crypto market seemed to return to the raging bull market of 2017, with the fever sweeping across the entire digital asset world. The market sentiment led by BTC is no longer a lone battle, this time, the old-fashioned Layer 1 projects have surged to new highs, and every inch of the market is burning. From BNB to XRP, to TRON and ETH, the so-called "Altcoins" that were once seen as "shitcoins" are now breaking historical highs at an amazing speed, ushering in their own golden age.

All of this seems to be the explosion of pent-up demand from the past few years, and the market sentiment has quickly turned optimistic, with capital flowing back into these projects with strong technical foundations. Just like the market frenzy in 2017, this time, the surge of the old-fashioned Layer 1 projects is not just a doubling of prices, but a profound transformation of the entire crypto ecosystem and market landscape.

The current crazy rise in the crypto market is no longer the solo performance of BTC, but the joint appearance on the stage of multiple projects with strong ecological support, ushering in their own frenetic moment.

BTC sets a new record, kicking off a volatile adjustment before the next surge

BTC's performance is truly remarkable. In the past few days, the BTC CME futures and the Binance 0328 delivery contract have both broken through the psychological barrier of $100,000, leading the entire market into a new round of frenzy. However, BTC's surge is not an overnight success, the high-level volatility is its preparation for the next take-off. This round of volatile adjustment has not only not weakened the market's enthusiasm for BTC, but has also fully prepared for its future breakthrough.

BTC: What's the next target? $100,000 is just the beginning

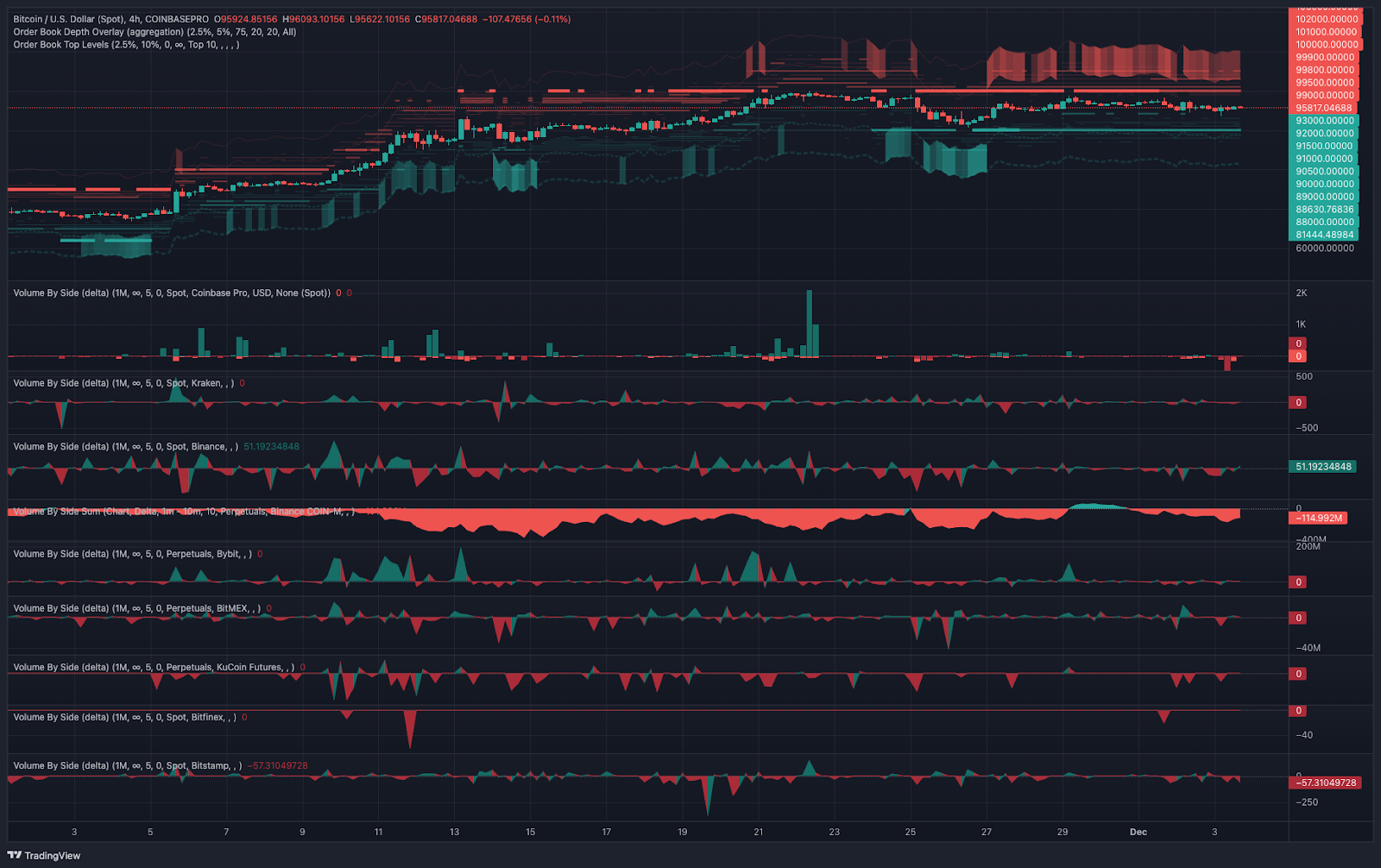

BTC/USDT, 4-hour chart

After breaking through $99,600, although the market experienced a brief pullback, this adjustment did not cause panic. On the contrary, many investors saw it as an opportunity to buy the dip and actively entered the market. From the price fluctuations in early December, BTC has retreated slightly in the short term, but most market participants remain optimistic and are seeking new entry opportunities.

On December 3rd, BTC briefly fell below $93,600, however, from the trading data, different types of market participants are still interested in BTC, and they are using the pullback period to make purchases. At this time, the BTC market is forming a relatively stable range, with clear support and resistance levels, which will help it accumulate energy during this stage and prepare for the next wave of uptrend.

During the US trading session on the same day, South Korean President Yoon Seok-yeol announced a state of emergency and temporarily withdrew, which led to a lack of liquidity in the South Korean market, causing BTC to fall below $65,000 on the Upbit exchange, while on the Binance exchange, the BTC price remained around $95,000. Although this market volatility caused short-term fluctuations, it did not undermine investor confidence, but rather made them more convinced that this is a "healthy adjustment period".

Reviewing the bull markets of the crypto market in 2017 and 2021, the adjustment periods after each major surge were the prelude to violent rallies.

Now, BTC's price is completing this correction and gradually preparing for the next breakthrough to $100,000. This time, the market's target is no longer psychological levels like $50,000 or $60,000, but directly aiming for a higher target - breaking the historical high of $200,000. The realization of this goal no longer seems out of reach.

Catalysts for the violent surge: Institutional capital and policy tailwinds

BTC's recent violent surge is not accidental, but driven by multiple factors, with the continuous inflow of institutional capital undoubtedly being one of the key catalysts.

Especially in early December, MicroStrategy announced the purchase of 15,400 BTC at a price of $95,976 per BTC, totaling $1.5 billion. This move not only provided strong support for BTC's price, but also once again demonstrated the firm confidence of institutional investors in BTC. On the same day, the listed company Marathon announced plans to raise $800 million through a private convertible note offering, with the funds to be used specifically for the purchase of more BTC. These series of actions indicate that institutional capital is constantly flowing into the BTC market, which has profound significance for the rise in BTC's price.

In addition, another potential catalyst for the rise in BTC's price is the upcoming voting decision by Microsoft shareholders on December 10th. At that time, Microsoft shareholders will decide whether to add BTC to the company's balance sheet. If the vote is passed, it will mark an important step forward in BTC's mainstream corporate asset allocation, further consolidating its position as "digital gold".

At the same time, there are also rumors in the market that the US may establish a BTC strategic reserve, and some Middle Eastern countries are also planning to establish similar reserves. Once this news is confirmed, it will undoubtedly inject more support and momentum into BTC's long-term trend.

In addition to the support of institutional capital and policy tailwinds, the sustained demand for BTC spot ETFs is also an important factor driving the rise in BTC's price. According to SoSoValue data, the capital inflow into BTC spot ETFs reached $3.38 billion from November 21 to November 25, and the capital inflow at the beginning of December remained strong, with inflows exceeding $100 million for three consecutive days. The capital inflow into spot ETFs indicates that the market's confidence in BTC remains strong, and this trend is expected to continue to drive the rise in BTC's price in the coming months.

ETH: The second engine of the crypto market

Among all Altcoins, ETH is undoubtedly one of the most promising assets. In 2024, ETH's performance is impressive, not only making significant breakthroughs on the technical level, but also showing unprecedented growth momentum in market sentiment and capital inflows.

As the second largest cryptocurrency by market capitalization, ETH closely follows BTC, but its widespread application in areas such as Decentralized Finance (DeFi), smart contracts, and Non-Fungible Tokens (NFTs) has made it a core asset in the crypto market that cannot be ignored.

Since the beginning of 2021, the price of ETH has generally shown an upward trend, although it has experienced several adjustments and consolidations, the upward momentum of ETH has never changed.Currently, ETH is breaking out of its price triangle pattern, with its sights set on higher levels. With the continued growth of on-chain activity, ETH's price is expected to break through $4,000 and move towards the $10,000 target.

ETH: Institutional capital inflow propels ETH into a new stage

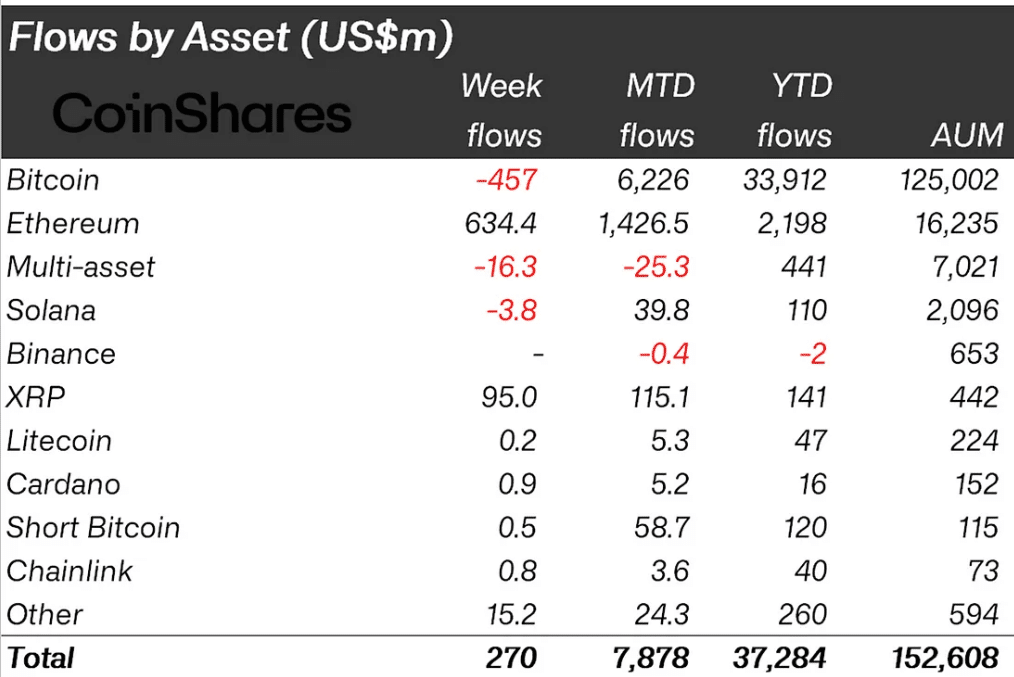

This year, the capital inflow into ETH has hit a new high, reaching a cumulative $2.2 billion to date, surpassing the historical record of 2021. Particularly in recent times, the capital inflow into ETH has reached $634 million, significantly boosting market sentiment and reflecting the strengthening of investor confidence.

The main driver of this surge is the strong performance of ETH ETFs. As an investment tool, ETFs have become a popular choice for investors, as they provide opportunities to participate in ETH investment without the need to hold digital currencies directly. With the continuous influx of capital into ETH ETFs, the interest of institutional investors has become increasingly strong, further accelerating the market's attention to ETH.

Although market volatility still exists, the overall trend of Ethereum remains bullish, and the participation of institutions has laid a more solid foundation for the future growth of ETH. This is consistent with the overall growth trend of the crypto ETP market, with Ethereum and Bitcoin leading the inflow of funds in the cryptocurrency field.

Particularly noteworthy is that the net inflow of ETH spot ETFs has also seen a significant increase, reaching $242.3 million in the recent period, with net inflows for six consecutive days.BlackRock's ETHA ETF has performed particularly well, with a single-day net inflow of $559.2 million, while Fidelity's FETH ETF has also shown strong performance, with a single-day net inflow of nearly $200 million. Overall, the total net assets of ETH spot ETFs have risen to $11.3 billion, further demonstrating the market's recognition of the importance of Ethereum as a crypto asset and its sustained growth interest.

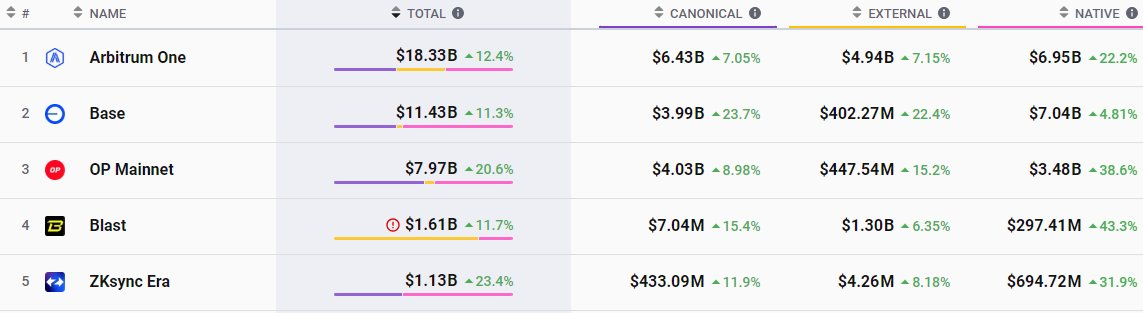

The Thriving Ethereum Ecosystem: Record-Breaking TVL, New Highs for Layer-2

According to Lookonchain, in the past week, Ethereum has attracted as much as $4.81 billion in capital inflows, directly driving a significant increase in its total locked value (TVL). Ethereum's Layer-2 network has also reached a new high, with a total TVL of $51.5 billion, a year-on-year increase of 205%, demonstrating strong market vitality.

At the same time, the performance of the Ethereum ecosystem cannot be ignored. The TVL of the Base network increased by $302 million during the same period, further reflecting the significant improvement in the liquidity and scalability of the Ethereum network. These capital inflows not only have brought the DeFi TVL back to the high point of November 2021, but also have promoted a higher degree of diversification and scalability of the Ethereum ecosystem, with the addition of liquidity staking options, Bitcoin DeFi integration, and the synergistic contributions of Solana and other Layer-2 networks.

All of this indicates that Ethereum's technical and ecological advantages are attracting more capital and users, helping it maintain a leading position in the DeFi field, while injecting new momentum into the entire crypto market.

BNB: The Rise from Exchange Platform Token to Ecosystem Hegemon

Since his release from prison, CZ has maintained a low profile, and with recent rumors that Trump may pardon CZ, allowing him to return to Binance, BNB experienced a violent surge after 8 pm last night.

Over the past 24 hours, BNB has risen by more than 18%, with a 24-hour trading volume of $5.2 billion, and is currently priced at $760. It has broken through the historical high of 2021 and set a new record high.

Since 2024, BNB's price performance has shown remarkable resilience and explosiveness. Although the market once had doubts about the prospects of the Binance ecosystem and platform tokens, BNB has now broken through various doubts and become an undeniable force in the crypto market.

BNB's surge is not only due to the growth and technological innovation of the Binance exchange, but more importantly, its deep deployment in areas such as DeFi and Non-Fungible Tokens. With the expansion of the Binance Smart Chain (BSC) ecosystem, BNB has gradually transformed from a simple exchange platform token to a core asset of a powerful blockchain ecosystem. Whether it's DeFi applications, cross-chain bridges, or decentralized applications, BNB is constantly expanding its application scenarios in the market.

With the continuous rise of BNB, it has also gradually surpassed the traditional "exchange token" positioning and become a core pillar of the entire crypto ecosystem. The market generally believes that BNB will continue to strive for higher goals in the coming years, and it is even possible to become the second-largest crypto asset, competing with Bitcoin and Ethereum.

XRP: Regulatory Clouds Disperse, Market Confidence Rebounds

The rise of XRP is undoubtedly the biggest highlight of the crypto market in recent times. Over the past 2 months, the price of XRP has seen an amazing surge, increasing from a market cap of $30 billion to nearly $150 billion in just over a month, with the highest price reaching $2.9, a new high in seven years.

The core driving force behind this surge is undoubtedly the significant progress in the Ripple lawsuit with the U.S. Securities and Exchange Commission (SEC). As the market's optimistic expectations for the Ripple case have grown stronger, XRP has gradually shaken off the long-term regulatory shadow and embraced new market opportunities.

The dissipation of regulatory uncertainty has given investors more confidence, especially with the gradual introduction of financial products such as spot ETFs, leading to an explosive growth in market demand for XRP.

This surge is not only a recognition of XRP as a payment tool, but also the market's full expectation of its future potential after breaking through the regulatory bottleneck.

TRX Reaches a New All-Time High After Seven Years

As of now, the token price of Tron (TRX) has soared from $0.21 to $0.43, setting a new all-time high of $0.4, surpassing the peak in June 2018. Within just one month, the price of TRX has increased by 157%, and has risen nearly 9 times from the bottom in the past two years, demonstrating the market's strong recognition of its potential.

This surge is particularly noteworthy, as Tron has performed excellently, becoming the only top-ranked cryptocurrency to achieve a single-day gain of 104% when Bitcoin (BTC) fell to $93,000.

Tron's explosion is not accidental, but driven by its deep technical advantages and market demand.

First, due to Tron's critical role in stablecoin payments, it has become one of the most utility-driven blockchains in the crypto industry. According to TronScan data, the Tron network has processed over $196 billion in Tether (USDT) token transactions, with a daily trading volume even higher than Visa. This data reflects Tron's huge advantages in the fields of payments and settlements, especially in stablecoin transactions and cross-border payments.

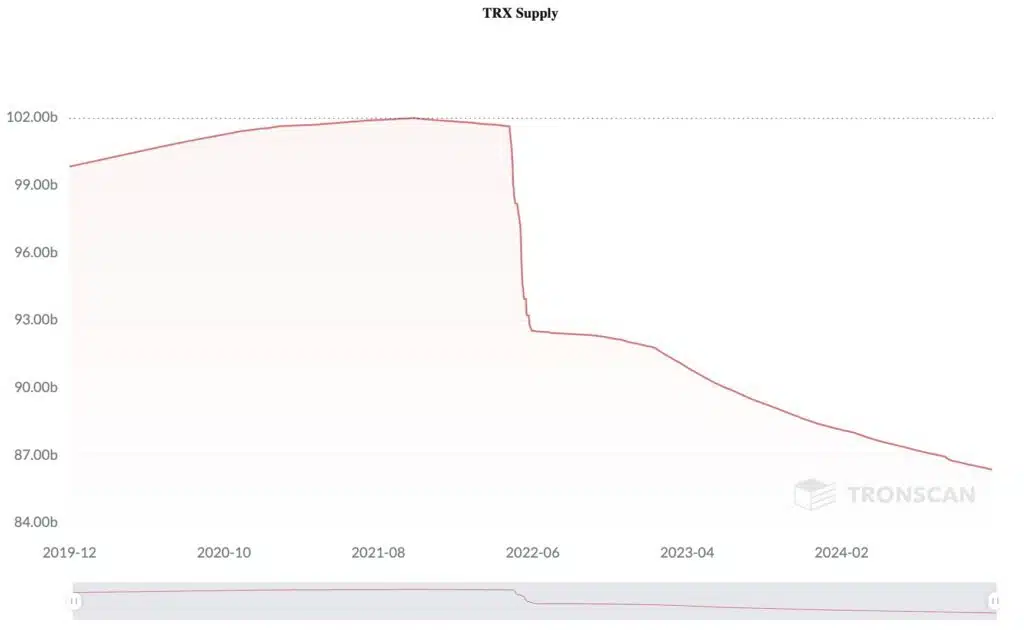

Furthermore, Tron is a highly deflationary token, with its circulating supply continuously decreasing. According to data, the total circulating supply of Tron tokens exceeded 101 billion in 2022, but has now dropped to 86 billion. As the Tron ecosystem continues to grow and decentralized applications become more widespread, the deflationary effect of Tron will be further strengthened, driving up the value of its token.

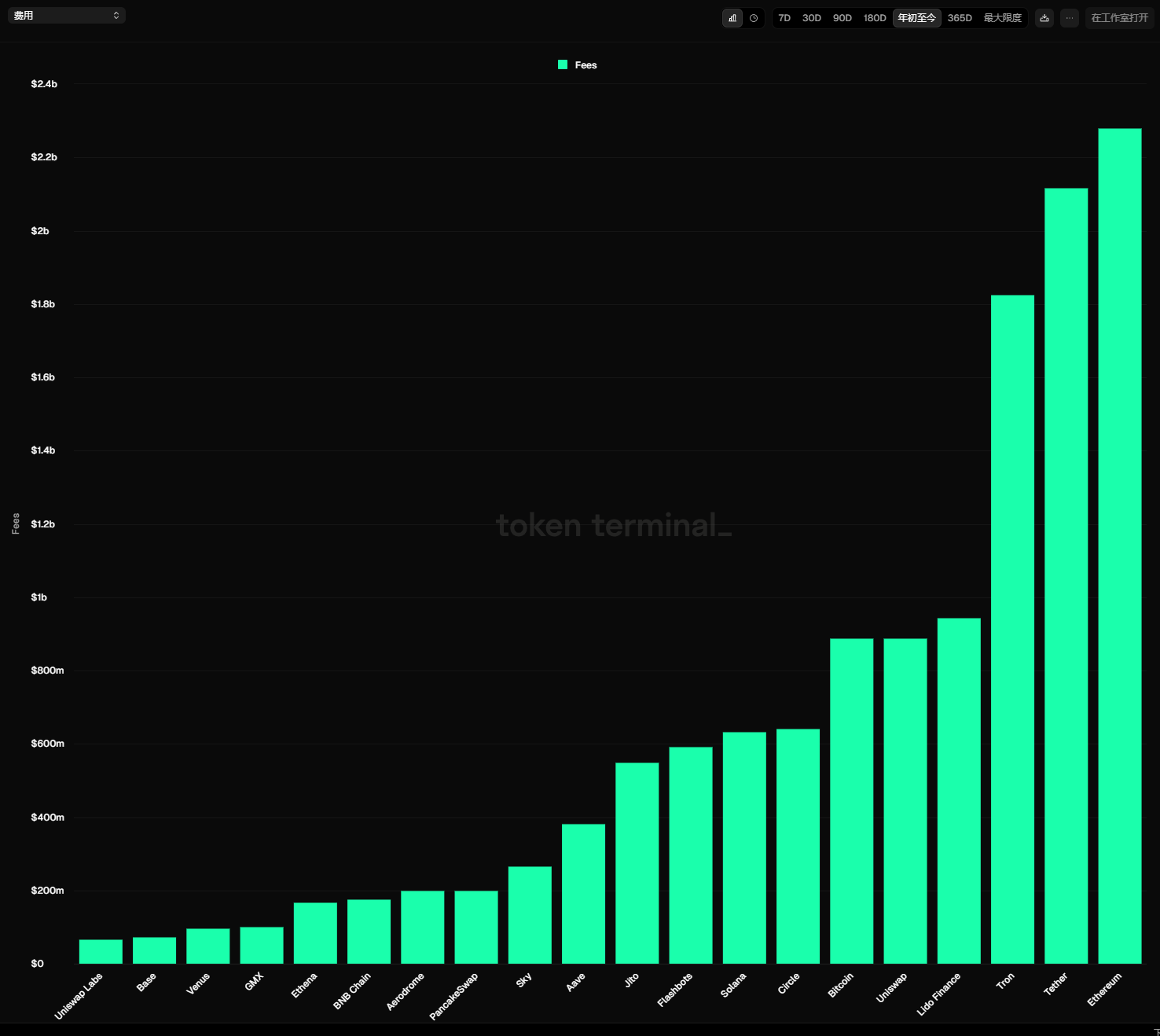

Tron's success is not only due to technological progress, but also its strong revenue performance, which has won market recognition. This year, Tron's revenue has exceeded $1.75 billion, making it the third-largest blockchain project after Ethereum and Tether. This figure demonstrates Tron's economic strength in the blockchain industry and also proves its huge potential as a decentralized finance (DeFi) platform.

It is worth mentioning that Tron also has a rapidly growing young meme coin ecosystem - sunpump. As Solana has shown, these meme coins can not only enhance the value of the blockchain, but also drive the expansion of the entire ecosystem. Tron is supporting meme coin projects to further enrich the application scenarios of its platform, increase its market appeal, and enhance the liquidity of its token.

Epilogue: The "Summer" of the Bull Market Has Just Begun

The current Altcoin market is experiencing an unprecedented and violent bull market. This time, the performance of Altcoins is more dazzling than ever, from BNB to XRP, Ethereum, and many other projects, the entire market is undergoing a profound transformation. Led by BTC, Altcoins have taken the baton one after another, ushering in a wave of skyrocketing prices.

This is not only a reconfiguration of capital, but also a reshaping of the Altcoin market landscape. In the next few years, we will witness the rise of more Altcoins, their technological innovation, market application, and institutional support will bring unprecedented growth to the Altcoin market. For investors, this is a golden age full of opportunities, and grasping this violent bull market may become a turning point in their wealth.