The price of SHIB continues to show high volatility amid mixed technical signals. Over the past 7 days, SHIB has risen 19.01%, maintaining its position as the second-largest meme coin by market capitalization after Doge.

The coin's technical indicators are painting a complex picture. The RSI has cooled from overbought levels, and whale accumulation has decreased, suggesting the possibility of a short-term correction. However, the strong EMA indicators still leave substantial upside potential, making SHIB's next price move particularly important for traders.

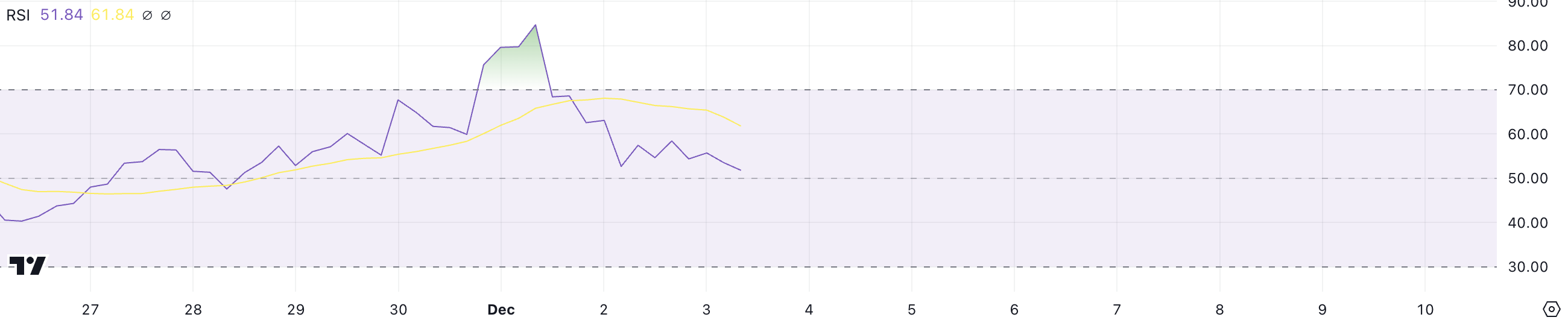

SHIB RSI Exits Overbought Territory

The decline in SHIB's RSI from 85 to 51.8 indicates that the buying momentum has cooled significantly. When the RSI was at 85, SHIB was in an overbought state, with buyers dominating the market.

The current RSI of 51.8 suggests a balance between buying and selling pressure, reflecting the situation after traders have taken profits.

The RSI reaching nearly 90 at SHIB's peak represented an unsustainable extreme overbought condition. The current decline to 51.8 suggests a healthy correction phase rather than a trend reversal. Readings between 40-60 generally indicate stable market conditions.

This cooling could lead to short-term price adjustments, but it does not signal the end of the uptrend. It helps prevent market fatigue and enables more sustainable price growth.

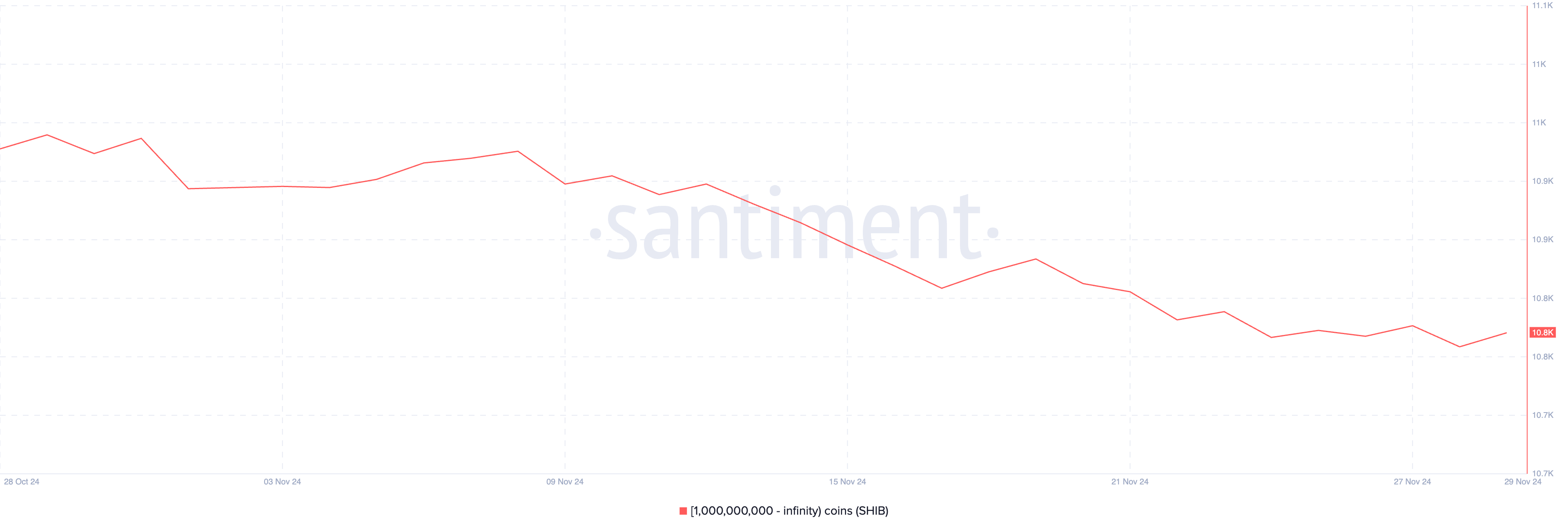

Whale Investors Have Stopped Buying SHIB

The decreasing number of SHIB whales indicates that large holders have been realizing gains or reducing their exposure during the recent price surge.

Whales, with their substantial holdings, can significantly impact the market and often set the trends that smaller investors follow. Their gradual exit suggests caution about the current valuation levels of SHIB.

The decrease in the number of wallets holding at least 1 billion SHIB from 11,013 to 10,858 indicates that 155 major holders have reduced their positions in the past month. The redistribution of tokens from large to smaller holders typically generates selling pressure and may suggest weakening bullish sentiment.

However, this redistribution also means that SHIB ownership is becoming more decentralized. This could be healthy for long-term price stability, despite the short-term selling pressure.

SHIB Price Forecast: Up to 17% Correction Anticipated

The fact that SHIB's price has fallen below the shortest EMA (moving average) line indicates a loss of momentum in the recent uptrend.

The long-term EMAs are still maintaining an upward trajectory, but the price movement below the fastest-moving average suggests that short-term downward pressure is increasing.

The price is now at a critical juncture, and significant price swings in either direction are possible. A downside scenario could test SHIB's price at the support levels of $0.000026 and $0.000023, representing a 17.8% decline.

Conversely, if buying pressure regains control, SHIB's price could retest the recent highs of $0.000033 and potentially surge to $0.000040, providing a 42% upside from the current levels.