Master Translator Discusses Hot Topics:

The market was exceptionally lively yesterday, especially the Korean market, where BTC plunged by 60,000 won, which was simply astonishing. As of now, I personally believe this sharp drop is more due to panic selling in the domestic market triggered by the political turmoil in Korea, coupled with system issues at Upbit, and even the possibility of a chain of liquidations cannot be ruled out.

What's worth pondering is that this incident has actually revealed a bigger problem: is BTC a safe-haven asset or a risk asset?

Looking at the price movements alone, BTC is clearly a risk asset, as its volatility is like a roller coaster. But let's not forget BTC's global liquidity, which gives it a safe-haven property. After all, you can't just use the Korean won to exchange for US dollars and freely circulate globally, can you?

However, the reaction of the Korean market is puzzling. Why would investors choose to dump BTC first when political turmoil arises? Are they preparing to exchange the won for US dollars?

I personally think that the crypto market's hedging capability is stronger than traditional currencies. For example, after the Russia-Ukraine conflict, the redemption ability of BTC and USDT was far superior to national currencies. As for why Korean investors choose to dump during a crisis, this is really hard to understand.

Although I haven't figured out this problem yet, one thing is certain: this 30% plunge has triggered widespread panic and a chain reaction. It is precisely because of this that the market has rebounded quickly. After all, retail investors are not used to such sharp needle pricks, and they start to counterattack vigorously after the panic.

As for why the Korean market fell so hard while the global market reacted less, there are a few reasons: first, the difficulty of arbitrage trading against the Korean won is higher than against the US dollar. Secondly, this crash only lasted 13 minutes, unlike the previous continuous selling waves.

Furthermore, the trading volume of the Korean market is relatively small, so its impact is limited. Of course, if this flash crash had occurred during the Asian trading session, it might not have been so small. Every time we talk about "opportunities and risks coexisting", it is truly proven and vividly presented!

Looking at BTC's recent trend, I personally feel that this week is a bit like a special week of needle-pricking rebounds, as the Fed officials' speeches continue to stimulate market volatility.

The pre-crash on Monday can also be seen as a preemptive market operation. Based on my previous analysis, BTC will correct to the 93,800-94,666 range, which is still relatively stable, and it has not yet completely broken below this level.

I have taken several medium-term long positions in the 94,000-94,666 range. When BTC first touched 93,800, it rebounded quickly and then fell again. In the short term, below 93,800 is a good support level, and low-level longing is the most reasonable strategy at the moment.

Unlike the unilateral downtrend, each support level now has a relatively strong rebound, and the lower the retracement, the more violent the rebound. The short-term volatility is relatively large, and if you don't timely take profits or cut losses, you may get stuck at a certain point. Like the short sellers who didn't take profits in batches in time, they are also easily devoured by the rebound after the needle-pricking.

As for the medium-term, it is difficult for BTC's adjustment to reach 85,755 in one fell swoop, as the support around 90,000 is very strong. For short sellers who want to make a profit of thousands of points in the medium to long term, the difficulty of the overall pattern and the challenge of mentality are not as easy as the short-term operations.

So low-level longing is still the most reasonable strategy in the current market, and the game of risks and opportunities is still ongoing. Speaking of which, don't forget that today's market is the harvested retail investors. Sometimes, not looking at the market, but looking at the mentality, is the greatest wisdom in trading.

Master Translator's Trend Outlook:

Resistance Levels:

First Resistance: 96,750

Second Resistance: 98,000

Support Levels:

First Support: 95,000

Second Support: 93,700

Today's Suggestions:

Despite the sharp decline, the current rebound strength is relatively strong. Therefore, from the perspective of yesterday's decline, we can now turn to the perspective of chasing the rebound.

Market buying demand is still active. Expect to retest the highs and re-enter the important uptrend channel that has been marked. If the price falls back below 94.7K~95K, the downside risk will increase.

At this time, you should maintain the current position and gradually improve the bottom, and pay attention to the trend of the 20-day moving average, observe whether there is resistance testing of the uptrend channel. In today's operation, you can still maintain a rebound perspective in the short term, but if BTC fails to enter the uptrend channel, you should pay attention to the trading volume and turn to short-term short.

It is not easy to enter the market during the stage of sharp decline, so it is best to observe the chart and wait for the rebound signal during the decline period, and confirm whether the K-line is stabilized above the moving average before considering entering the market.

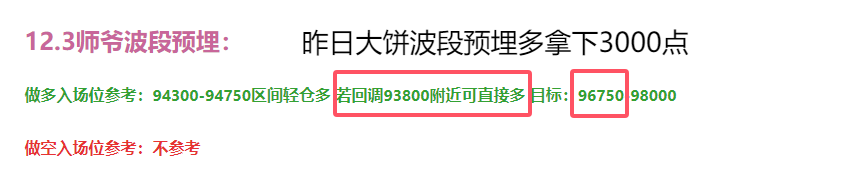

Master Translator's Wave Preset on 12.4:

Long Entry Levels: 92,800-93,300-93,550 area can be lightly longed. If it retraces to 92,450-91,900 area, you can long directly. Target: 95,000-96,750

Short Entry Levels: Not Considered

The content of this article is exclusively planned and published by Master Translator Chen (public account: Coin God Master Translator Chen), who is the same name across all platforms. If you want to learn more about real-time investment strategies, unwinding, spot, short, medium, and long-term contract trading methods, operation techniques, and K-line knowledge, you can join Master Translator Chen's learning and exchange group, which has already opened a free fan experience group, community live broadcasts, and other high-quality experience projects!

Warm Reminder: The only public account (as shown in the image above) that this article is written by is Master Translator Chen. All other advertisements at the end of the article and in the comments are not related to the author! Please be cautious in identifying the authenticity, and thank you for reading.