Author: Tanay Ved, Matías Andrade Source: Coin Metrics Translation: Shan Ouba, Jinse Finance

Key Points:

Ethereum has 34.4 million ETH staked (28% of current supply), while Solana's active staking supply is 297 million SOL (51% of current supply), due to lower entry barriers for delegators.

Ethereum has a larger validator set with 1.07 million validators, while the more hardware-intensive Solana has 5,048 validators but over 1.21 million delegators.

Ethereum's nominal staking yield is 3.08% (2.73% real after inflation), serving as the benchmark for the on-chain economy. Solana offers higher yields at 11.5% (12.5% real), but due to different reward structures, delegators earn less than validators.

Ethereum's ongoing issuance results in an annualized inflation rate of 0.35%, while EIP-1559 burns often lead to deflationary periods. Solana follows a time-based inflation schedule, currently at 4.7% annualized and stabilizing at 1.5%.

Introduction

Ethereum and Solana are two of the largest Proof-of-Stake (PoS) blockchain networks, each employing different methods to reach consensus and protect their ecosystems. Both rely on staking, requiring participants to commit their native tokens ETH or SOL to validators who play a crucial role in maintaining network integrity. To incentivize honest participation, stakers can earn staking rewards, aligning their behavior with the network's best interests.

This yield enhancement makes them attractive as cash-flow generating assets, serving as a benchmark rate in the on-chain economy, similar to US Treasuries in traditional finance. In this week's State of the Network, we examine Coin Metrics' new staking yield and inflation metrics to understand the staking mechanics and network economics of Ethereum and Solana, and concretize their staking ecosystems.

Ethereum Staking Overview

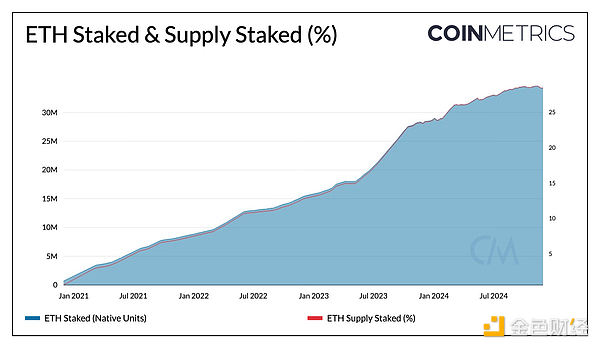

Since the introduction of the Beacon Chain (consensus layer) in December 2020, the Ethereum network currently has 34.4 million ETH staked. Of the current 12.04 million ETH supply, 28% is staked (also referred to as the staking ratio), while 72% remains unstaked, held in smart contracts and externally owned accounts. Although the staking ratio grew rapidly from 14% to 28% after the Shapella upgrade, it has remained around 28% as staking demand has cooled.

Source: Coin Metrics Network Data Pro

To become a validator on the Ethereum network, participants must contribute 32 ETH as collateral, or provide smaller amounts of ETH to staking pools or exchanges that manage staking operations. This 32 ETH is also known as the validator's maximum effective balance, which will be changed to a maximum of 2048 ETH in the upcoming Pectra upgrade. Ethereum currently has 1.07 million active validators, a number expected to decline as validator consolidation progresses.

Ethereum Staking Yield Analysis

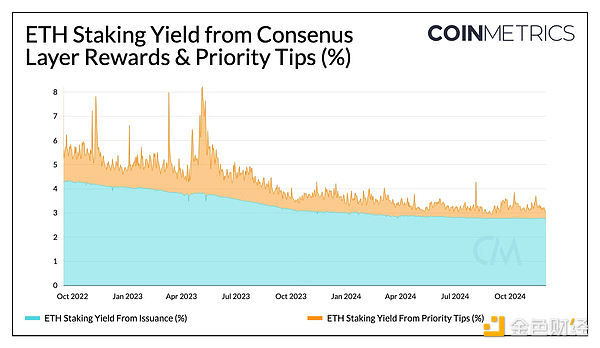

Currently, the nominal staking yield for ETH is 3.08%, while the real (inflation-adjusted) yield is 2.73%. As the amount of ETH staked increases, Ethereum's base staking yield has declined over time. These rewards come from two main sources, reflecting Ethereum's modular design: Consensus Layer Rewards and Execution Layer Rewards.

Validators receive Consensus Layer rewards for their role in protecting the network, including attesting and proposing new blocks. These rewards are funded through newly issued ETH, contributing to network inflation and forming a more predictable revenue stream. On the other hand, Execution Layer rewards are related to changes in block space demand, including priority fees and Maximum Extractable Value (MEV). During periods of increased activity, such as in March when block space demand spiked, the real staking APY soared to 6.2% and exceeded 5% on August 5, 2024, benefiting from higher priority fees, thus including Execution Layer rewards.

Source: Coin Metrics Network Data Pro

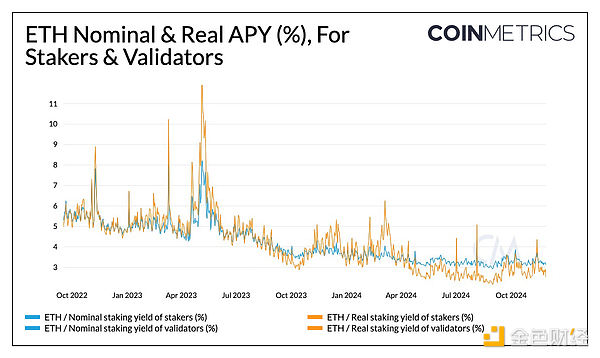

ETH Staking Yield as an On-Chain Benchmark Rate

Staking yields can be evaluated in nominal or real (inflation-adjusted) terms to assess the returns for participating in Ethereum's consensus process. This helps stakers or investors understand their true rate of return and compare it to holding unstaked ETH. More broadly, the ETH staking yield serves as a benchmark rate for the on-chain economy, similar to how US Treasury yields are referenced in traditional finance. It provides a way to compare risk-free rates and staking yields, highlighting opportunities in both the on-chain and off-chain ecosystems.

Source: Coin Metrics Network Data Pro

This staking yield may further enhance the appeal of ETH in investment vehicles like ETFs, as regulatory easing could pave the way for staked-ETH ETFs. The ETH staking yield also underpins several DeFi primitives, such as liquid staking tokens used as yield-bearing collateral, and stablecoin and re-staking ecosystems (e.g., EigenLayer) like Ethena's USDe.

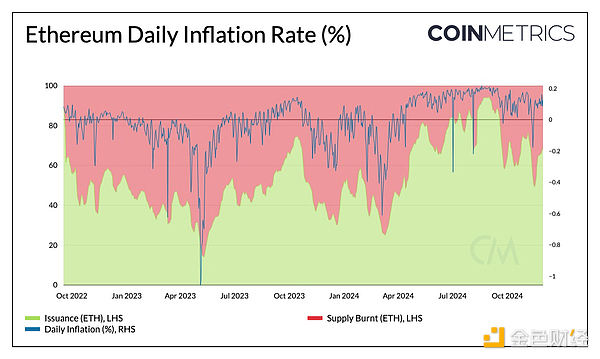

Source: Coin Metrics Network Data Pro

Ethereum's economic design and staking incentives are closely intertwined, with staking incentives influenced by network activity, transaction fees, and the ETH inflation rate. The more activity on the mainnet and Layer-2s, the higher the transaction fees, leading to more ETH being burned through the EIP-1559 mechanism, potentially resulting in deflationary periods. When the burn exceeds the issuance, the real, inflation-adjusted yield becomes more attractive. Ethereum's current daily inflation rate is 0.00096%, annualizing to 0.35%, as issuance slightly exceeds the burn.

Solana Staking Overview

Solana employs a "Delegated Proof-of-Stake" (DPoS) consensus mechanism. This allows both validators and delegators (SOL holders who contribute stake to validators) to stake SOL. These tokens collectively constitute the validator's "stake", which determines their influence in the consensus process and their ability to validate blocks.

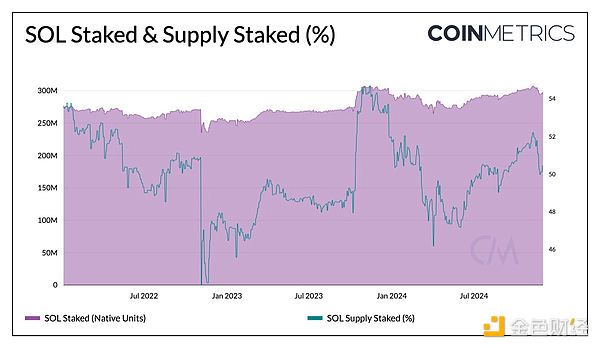

Unlike Ethereum, Solana has no minimum balance requirement for participating in staking. This low barrier has resulted in a relatively high staking ratio of 51%, with 297 million SOL out of the current 589 million SOL supply actively staked. Active staking is calculated based on validators and delegators who have received rewards in the most recent epoch, excluding those who did not earn rewards or exited before the epoch ended.

Source: Coin Metrics Network Data Pro

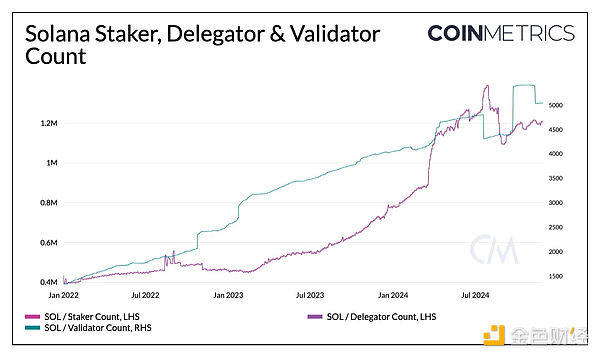

As a result, Solana has 1.22 million stakers, with 1.21 million being delegators. However, the number of validators is much lower at 5,048. This may be because running a Solana validator requires high-performance infrastructure and a large amount of SOL staked. The network uses a leader-based consensus process, where individual validators are assigned to process blocks based on a rotation schedule. Leadership is determined by stake weight, ensuring validators with more stake have greater influence.

Source: Coin Metrics Network Data Pro

Solana Inflation and Staking Yield Dynamics

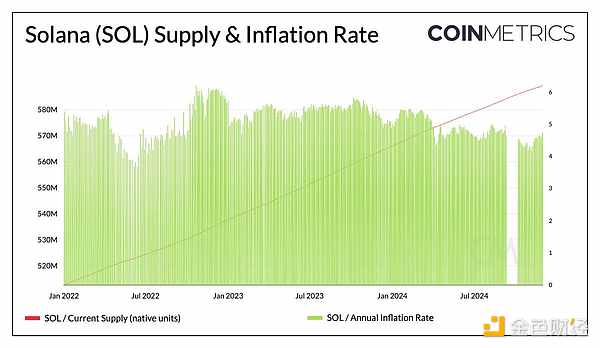

Solana uses an inflation model to allocate staking rewards, with new SOL issued on each epoch (approximately 2-3 days). This results in the "spikes" in new issuance shown in the chart below. Starting in 2021, the inflation rate was 8%, and is expected to decrease by 15% annually, currently at 4.7%.

The main source of staking revenue comes from the inflation rewards allocated under this plan, supplemented by 50% of the base fees, all priority fees, and MEV. It is also worth noting that 92% of the staking on Solana uses the Jito validator client, which provides additional off-protocol economic incentives for validators through tips. While Solana has also seen growth in liquid staking protocols like Jito and Marinade, their adoption rates are still relatively low compared to Ethereum.

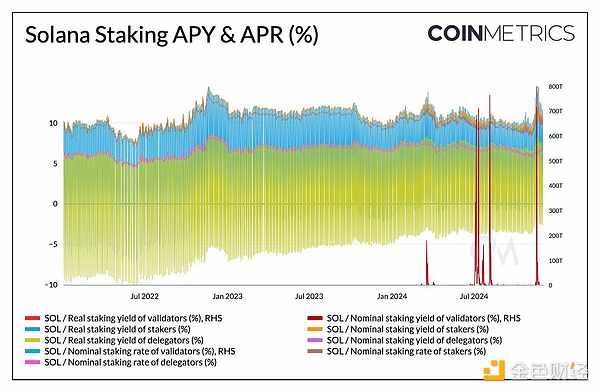

Source: Coin Metrics Network Data Pro

The nominal staking APY on Solana is currently 11.5%, while the actual (inflation-adjusted) APY is 12.5%. These yields have recently increased, driven by a surge in priority fees as Solana network activity increased in November. As shown in the chart below, delegators' yields are lower (currently around 6.7%) as they only receive rewards from new issuance, while validators benefit from issuance, fees, commissions charged to delegators, and their own staked SOL. This structure highlights the additional incentives for running validators, which come with higher operating costs, favoring validators with the largest stakes.

Source: Coin Metrics Network Data Pro

Conclusion

The staking mechanisms of Ethereum and Solana reflect their different design philosophies. Ethereum's modular architecture separates execution and consensus, while Solana's delegated proof-of-stake (DPoS) model integrates these functions with a high-performance infrastructure. This results in fewer validators on Solana but higher staking rates, due to a lower barrier to entry for delegators. As Ethereum and Solana networks mature, their staking ecosystems and economic models will continue to evolve, shaping network usage, issuance, and staking rewards to meet the growing needs of their ecosystems.