Author: Big Dog

On January 3, 2009 at 18:15:05, Satoshi Nakamoto wrote the headline of the front page article of The Times "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks" in the Genesis Block of Bitcoin.

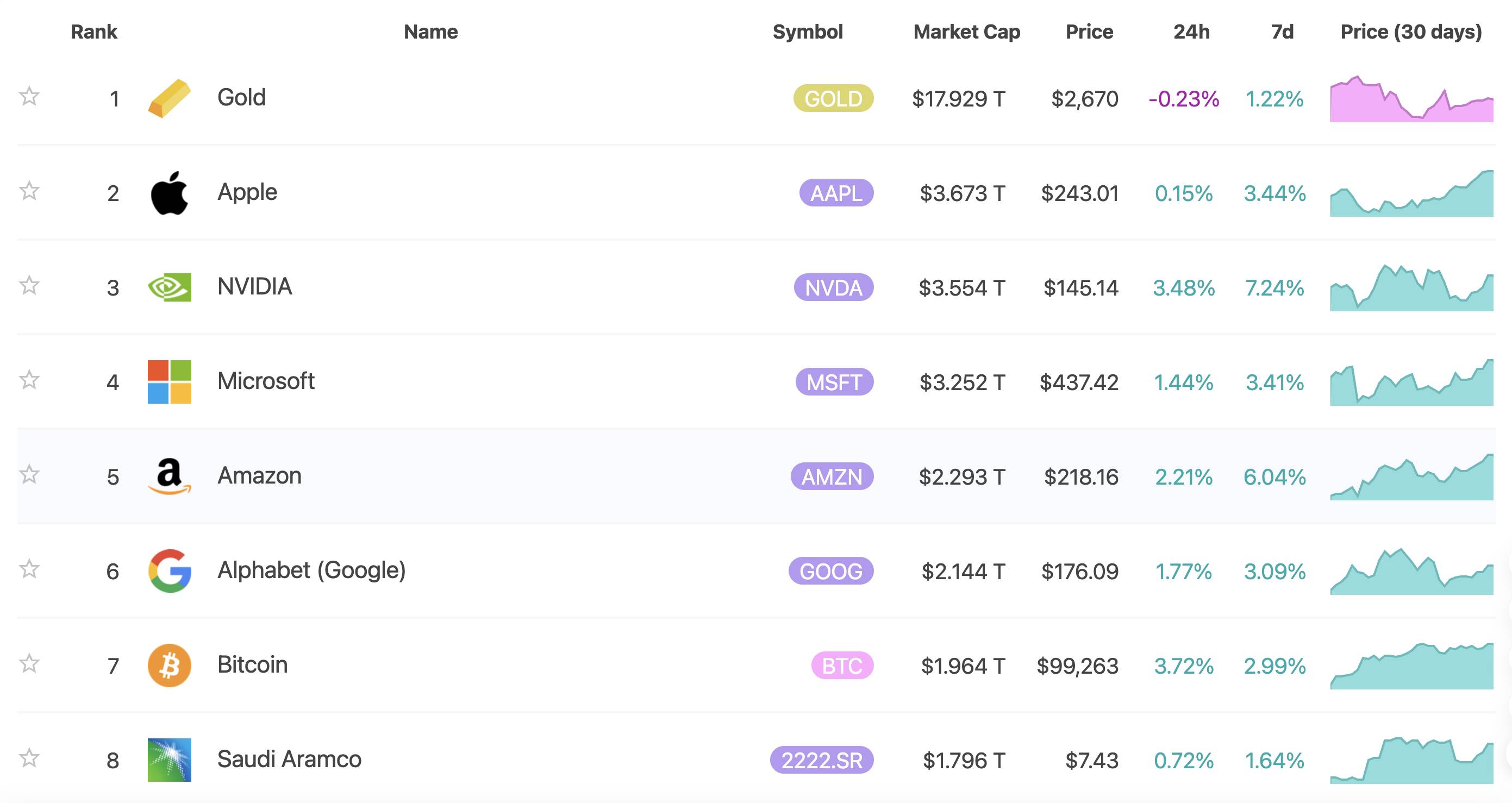

Who would have thought that this digital asset born in the shadow of the financial crisis would break through the historic milestone of $100,000 on December 5, 2024, becoming a financial giant with a market capitalization of nearly $2 trillion.

From being worthless initially, to exchanging 10,000 Bitcoins for two pizzas in 2010; to Bitcoin being about to break $10 in 2011 celebrated by early participants; to the first breakthrough of $10,000 in 2017 causing a global sensation, and to the approval of the Bitcoin spot ETF and its listing on the US stock market in 2024... This "Internet bubble" once scoffed at has now become the "digital gold" that financial giants like BlackRock and Fidelity are scrambling to chase.

Each transformation of Bitcoin has amazed people and rewritten people's perceptions of currency, value and wealth.

So the question is, do you hold Bitcoin? Have you held on to your Bitcoin?

Recently, many crypto traders and practitioners have received similar messages like "Congratulations, have you gotten rich recently?" At this time, they can only embarrassingly reply "Not bad, not bad", and others think they are being modest, only you are secretly crying.

There are two heartbreaking and surprising facts: This is a bull market exclusive to Bitcoin, and most retail investors no longer hold Bitcoin.

Why has Bitcoin outperformed this cycle?

Top-level conspiracy

This is a top-level conspiracy with a script that has been arranged in advance.

Let's go back to 4 a.m. on January 11, 2024, when the US Securities and Exchange Commission (SEC) approved 11 Bitcoin spot ETFs, including BlackRock's IBIT.

Perhaps as Wang Chuan said, "The significance of January 10, 2024 in the history of world currencies may be comparable to August 13, 1971 (Nixon announced the decoupling from gold) and January 18, 1871 (German unification, leading to the adoption of the gold standard by European countries and the US in a few years)."

The approval of the spot ETF opened the floodgates for institutional capital to enter, and from then on, Bitcoin is Bitcoin, and other cryptocurrencies are others.

As of November 21, in just 10 months, the Bitcoin ETF has attracted a cumulative inflow of $100 billion, equivalent to 82% of the size of the US gold ETF, and is just a step away from surpassing it.

Bitcoin is no longer a speculative market dominated by retail investors, but is gradually being dominated by traditional financial institutions, whether Wall Street financial institutions, listed companies in various countries, or even some sovereign governments, are staging a scramble to buy in.

The most representative player in this battle is the US-listed company MicroStrategy (MSTR).

MSTR's original main business was enterprise analysis software. In August 2020, under the leadership of Chairman Michael Saylor, MSTR announced that it would spend $250 million to purchase 21,454 BTCs, becoming the world's first listed company to implement a Bitcoin capital strategy.

MSTR's strategy of buying Bitcoin is to borrow at an interest rate of about 1% by issuing stocks and bonds to buy Bitcoin. According to the disclosure, MSTR has issued about 40 Bitcoin purchase announcements in the past four years.

As of now (December 5), MSTR holds over 402,100 Bitcoins, accounting for about 1.5% of the global Bitcoin supply, making it the world's largest listed company Bitcoin holder. MSTR has spent a total of $23.483 billion to purchase Bitcoin, with an average cost of about $58,402, and has an unrealized gain of over $16.7 billion so far.

On November 20, MSTR's stock price once broke through $500, with a market value exceeding $100 billion, and its trading volume even surpassed that of the US stock market leader Nvidia, a more than 40-fold increase from the $12 stock price when it started hoarding Bitcoin in August 2020, becoming a US stock bull.

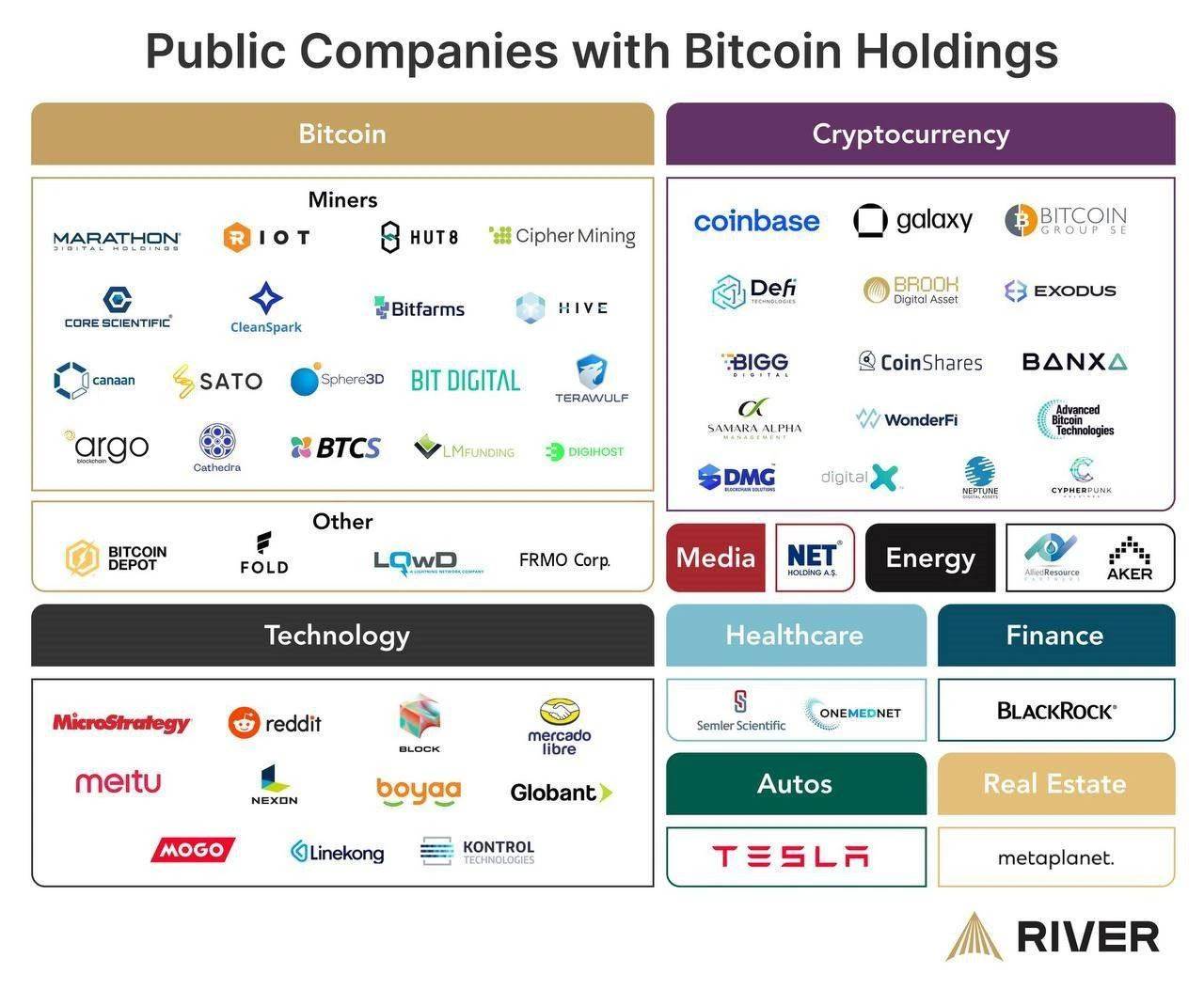

First buy Bitcoin, then issue stocks at a premium on Bitcoin, then issue bonds collateralized by Bitcoin, Bitcoin goes up, the company's stock price goes up, then issue more bonds and stocks to continue buying... Following the demonstration and leadership of MicroStrategy, major listed companies around the world have followed suit, including Japanese listed company Metaplanet, US listed medical company Semler Scientific, German listed company Samara Asset Group, Hong Kong listed company Meitu, and Boyaa Interactive, among others, have all started the mode of hoarding Bitcoin.

Statistics show that more than 60 listed companies have hoarded Bitcoin, and thousands of private companies are also following suit.

MSTR CEO Michael Saylor has become one of the most influential Bitcoin evangelists, promoting Bitcoin everywhere.

Michael Saylor will have a three-minute presentation on the Bitcoin purchase strategy to the Microsoft board of directors, and he has previously stated that if Microsoft converts a portion of its cash to Bitcoin every quarter, it could create trillions of dollars in value for shareholders and increase its market capitalization by hundreds of billions of dollars over the next 10 years.

The Bitcoin ETF has opened the channel, and MSTR has personally bought and promoted, but the real driver of the recent rapid rise of Bitcoin is - Trump.

At the Bitcoin 2024 conference in July, Trump publicly promised to turn the US into the global "crypto capital" and establish a Bitcoin national reserve.

At the end of September, Trump and his three sons, Donald Jr., Eric and Barron, announced their latest startup project, World Liberty Financial. This new company is said to be a decentralized finance (DeFi) currency market platform, launching a proprietary cryptocurrency called $WLFI.

Trump himself has also taken action, becoming the "first US president to buy a burger with Bitcoin".

Trump's assistant, Vice President Vance, is also a "crypto insider". According to his personal financial report, as of 2022, he has Bitcoin worth $100,000 to $250,000 on the crypto exchange Coinbase.

In addition, one of the biggest contributors to Trump's re-election victory, the world's richest man Musk, is also a well-known crypto enthusiast, pushing Tesla to purchase Bitcoin and include it in its financial statements, and he is particularly supportive of Dogecoin, even establishing a government efficiency department called DOGE (Department of Government Efficiency) in the name of Dogecoin.

During the Biden administration, the US Securities and Exchange Commission (SEC) led by Gary Gensler launched an unprecedented crackdown on the crypto industry. From suing Ripple to launching major lawsuits against Binance and its CEO CZ; from designating a large number of cryptocurrencies as unregistered securities and issuing huge fines to various crypto projects, to threatening Coinbase... The US crypto market has been shrouded in a regulatory shadow.

Trump's return to power marks a complete turnaround in US crypto policy, clearing the clouds and removing institutional barriers to the development of cryptocurrencies in the US.

In summary, the elements of this top-level conspiracy script have been pieced together in a series of coincidences:

As the US enters a rate cut cycle, the Bitcoin ETF is approved, and Wall Street giants like BlackRock and Vanguard have joined the Bitcoin interest group, leading a flood of capital into Bitcoin.

MSTR CEO Michael Saylor has become the "Bitcoin Milk King", constantly borrowing and increasing his Bitcoin holdings, causing the price of Bitcoin and the company's stock to spiral upwards, prompting many listed companies to follow suit.

Trump's victory, the new US president himself endorsed Bitcoin, removing institutional barriers, and plans to make BTC a strategic reserve asset for the US.

All plans and actions are prominently displayed, everyone has the opportunity to participate, and all participants will profit... This is the top-level conspiracy, through the ETF products led by Wall Street financial giants, the US is transforming Bitcoin, a decentralized rebel, into a controlled financial instrument.

Perfect Narrative

But the question is, why Bitcoin, and why only Bitcoin?

The narrative charm of Bitcoin lies in its simplicity, no need for technical delivery and irrefutable, like a perfect closed loop, each crisis only strengthens rather than weakens its value proposition.

In 2009, it was born from the ruins of the financial crisis, with the mission of fighting inflation and the banking system; During the 2020 pandemic, the unlimited quantitative easing and money printing by various countries made the scarcity narrative of Bitcoin even more dazzling; In 2022, the Russia-Ukraine war, Bitcoin became a weapon in the invisible financial war, interpreting what a supra-sovereign currency is, and once again verifying the importance of decentralized assets; In 2024, the Fed's interest rate cuts, the escalation of geopolitical turmoil, Bitcoin has once again played the role of a safe-haven asset perfectly.

From the early "digital gold" to the later "supra-sovereign asset" and then to the "Web3 cornerstone", each narrative of Bitcoin has been reinforced in reality.

In the crypto world, we have seen too many grand visions and complex technical solutions, but the ones that have stood the test of time are the simplest Bitcoin. It doesn't need marketing, it doesn't need a roadmap, and it doesn't need the promise of technical upgrades. Its value proposition is as simple and undeniable as the law of gravity: a decentralized, scarce, and immutable value network.

This is why it can only be Bitcoin. Because in a world full of uncertainty, the most precious thing is certainty. Bitcoin provides this certainty: a definite supply, definite issuance rules, and definite operating mechanisms.

Challenging Gold

Now that it has crossed the $10,000 mark, Bitcoin's next step will be to challenge the position of gold.

As of December 5, in the global top 10 asset rankings, gold's market value is the first, reaching $18 trillion, while Bitcoin's market value is $1.98 trillion, surpassing silver and Saudi Aramco, ranking seventh.

Central banks are one of the core buyers of gold, and the successive international political black swans and turbulent regional situations have driven up the demand for gold. In 2022-2023, global central banks have net bought gold for two consecutive years, exceeding 1,100 tons, the largest buyer in the international gold market in the past three years, and the main driver of this round of gold price rise.

Specifically, developed countries like the US and Europe are net sellers of gold, while emerging countries are net buyers. Emerging central banks like China are increasing their gold holdings and reducing their US debt holdings to reduce their dependence on the US dollar system.

The trend of de-dollarization is reshaping the landscape of global reserve assets.

Compared to gold, Bitcoin has disadvantages in terms of cultural consensus and market capitalization, but it also has its unique advantages.

Compared to gold, Bitcoin's supply is more transparent and predictable, and will never exceed 21 million. After the halving in 2024, the daily increase in Bitcoin will drop to 450, with an annual inflation rate of only 0.8%. In contrast, the annual gold production is still around 3,500 tons, equivalent to an inflation rate of 2-3%.

The digital nature of Bitcoin gives it significant advantages in cross-border transfer and storage management, without the need for specialized vaults or complex transportation, a cold wallet can store billions of dollars in assets, which is particularly important in times of geopolitical tension.

Bitcoin does not belong to any country, is not controlled by a single government, is easy to transfer, and has transparent supply, making it an ideal reserve asset supplement.

In the week of Trump's victory, the assets under management of the Bitcoin ETF-iShares (IBIT) under BlackRock reached $34.3 billion, already surpassing the gold trust fund (IAU) under its own brand, and the gold ETF has a history of 20 years.

If Trump really fulfills his promise and makes Bitcoin a strategic reserve for the US, the significance of this signal will far exceed the actual amount purchased. The familiar pattern of the financial system will be rewritten.

Just as the US dollar was once pegged to gold, the US attitude directly determined the fate of the entire Bretton Woods system. Now, the US attitude towards Bitcoin may also trigger a paradigm shift in reserve assets.

We have already seen some preliminary signs, El Salvador has taken the lead in making Bitcoin legal tender, although the scale is small, but it has set a precedent; Some sovereign wealth funds are also quietly deploying Bitcoin investments, such as Singapore's sovereign fund Temasek has invested in multiple crypto-related companies; Bhutan has been actively mining Bitcoin since 2021...

If more countries start to include Bitcoin in their reserve asset allocation, even if only 1-5% is allocated, the demand for Bitcoin will undergo a qualitative leap. After all, the global foreign exchange reserve is over $12 trillion.

With institutional investors continuously absorbing market liquidity through ETFs, the increasing number of long-term holders, the continuous decline in exchange trading volume, and listed companies hoarding Bitcoin, if sovereign reserve demand is added on top, the scarcity premium of Bitcoin will be pushed to a whole new height.

If this is the case, the 21 million Bitcoins are destined to not be enough.