One of the biggest milestones in the history of cryptocurrencies, the first decentralized digital asset, Bitcoin, has surpassed $100,000. Optimism about cryptocurrency regulation, institutional adoption, and consecutive ETF inflows have triggered this long-awaited bull run.

The industry has enthusiastically welcomed this news, and the upward trend continues to progress actively.

BTC Finally Breaks $100,000

Bitcoin's breakthrough of $100,000 was the most anticipated milestone in the cryptocurrency community. For most traders and investors, it was a matter of 'when' rather than 'if'. This asset has enjoyed a substantial bull run since Donald Trump's election victory, and has finally reached this peak.

At the beginning of this year, Bitcoin was trading around $42,000. The asset surpassed its 2021 high after the SEC approved a Bitcoin ETF in the US market in March. Bitcoin eventually set a new all-time high of $75,000 before the election, but this upward momentum has accelerated the growth.

It became clear from early November that the $100,000 breakthrough was approaching. In addition to the regulatory optimism about Trump's re-election, several factors have driven investor confidence.

MicroStrategy added over $6.6 billion in BTC in November alone, firmly maintaining its position as the largest corporate holder of Bitcoin. Major miner Marathon Digital also announced plans to acquire more BTC and expand its portfolio.

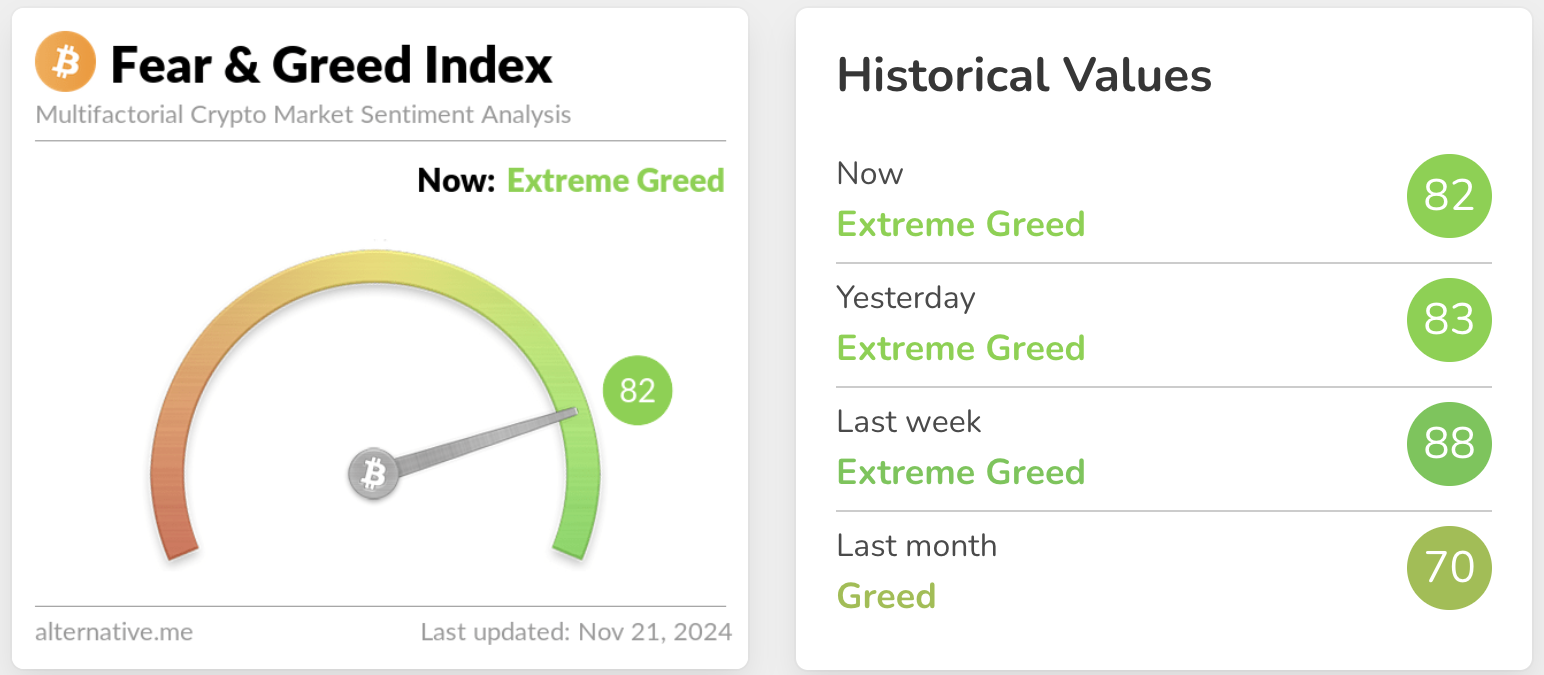

At the same time, whales and long-term holders have fueled Bitcoin's sustained momentum in the final stretch. The Crypto Fear and Greed Index shows that the majority of users expect even more gains from here.

Overall, 2024 has been the most successful year for BTC. After the SEC's approval in January, financial institutions began investing in Bitcoin ETFs at a record pace, exceeding demand for any other ETF in US history. ETFs now collectively hold 5% of the total supply.

As this positively turbulent year comes to an end, one thing is certain about the future: betting on Bitcoin is a good idea.