First of all, congratulations on Bit officially reaching $100,000 today. Let me share a funny story here.

In January 2018, I wrote an article on how to survive a bear market.

That year, I was indeed boastful, and the core sentence (which was heavily mocked by a commentator) in the article was:

"It's just a matter of time before a Bit reaches $50,000.

Since we know Bit will reach $50,000, all our operations should aim to increase the amount of Bit we hold. Why would we want to take profits and cut losses now? Where's the loss?"

The commentator said: "Did the author just clap his hands and conclude that Bit can reach $50,000?"

I forgot to mention that Bit was $11,000 that day.

What happened next was quite amusing -

This commentator had some backbone, as he kept that comment undeleted;

But as Bit broke through $20,000, $30,000, $40,000... and now $100,000, every time it broke a new milestone, people would go there specifically to mock him 😂. This small comment has essentially become a famous tourist attraction.

As a generation of native internet inhabitants, this kind of stubborn fun, coupled with the amazing performance of the internet's magical currency, is naturally comfortable.

----Dividing line----

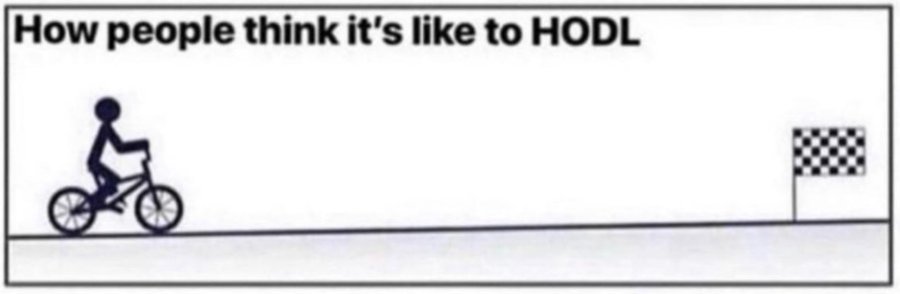

There is a famous image that I believe everyone has seen.

Your imagined HODL

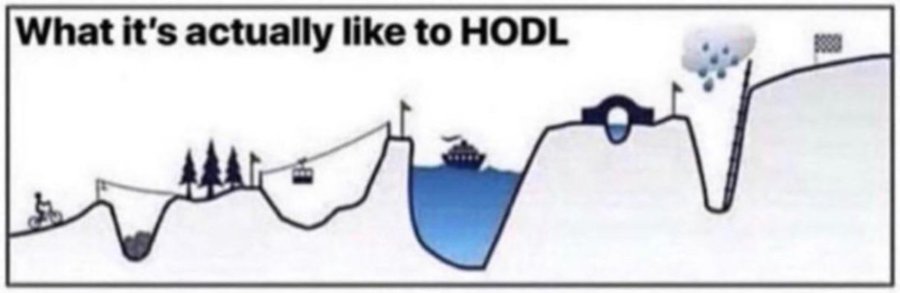

The actual HODL

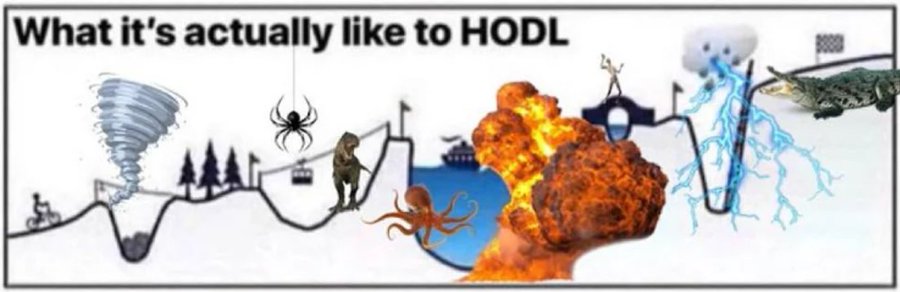

Many people have even corrected that the second image should be:

The actual HODL 2.0

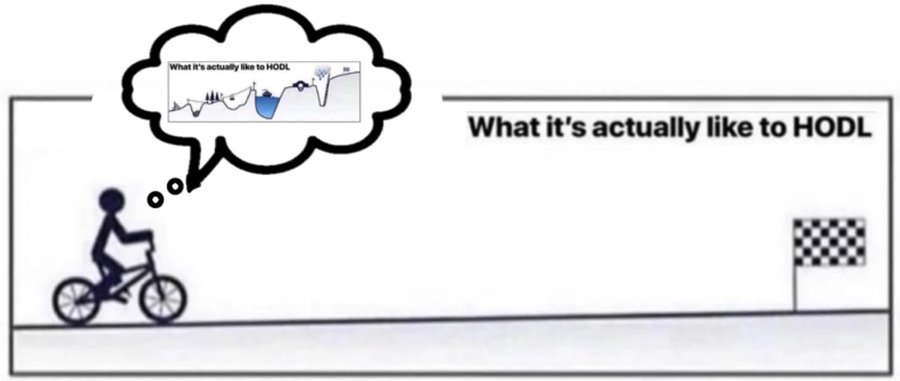

In fact, this meme has a third image that many people don't know about. To be honest, looking back over the years, this is the most touching image for me:

The actual HODL 3.0

Is it? Is HODLing Bit really that simple?

Then why are there still so many people who haven't HODLed?

If it were the me from 18 years ago, I might have answered: You're right, HODLing Bit is really simple, you just need to do one thing: store it in a cold wallet.

But!! Actually, this sentence is only half right.

After wandering in the industry for 7 years, I have finally realized the true meaning.

Now, as the 24-year-old me, I will tell you that the true meaning is:

HODLing Bit is still very simple, but it actually requires three things:

1. Store it in a cold wallet

2. Regularly replenish your faith

3. Live well

The first point, cold wallet, I believe needs no explanation.

The second point is worth discussing.

In fact, I am really grateful to everyone who has been preaching about Bit.

Faith is something that will gradually weaken over time and experience, so you need to replenish your faith every now and then.

Otherwise, your Bit will be lost to the market in countless small and large waves.

No one can establish an "iron-clad ideological imprint" in the flesh, not even Michael Saylor, the boss of Microstrategy, who secretly sold some Bit at the $16,000 bottom, trying to do some tax-avoidance swing trading.

Moreover, the most terrifying thing about the crypto industry is that it always manages to push the ugliest part of the industry to the public.

You can see scammers, clowns, and beggars taking the stage one after another;

You can always see one scam and one Ponzi scheme after another rise and collapse.

From the big VC schemes of the big shots

To the PVPs posted by group friends

It's all thorns and brambles, and it's only natural for you to be full of disappointment in this industry

If you can still maintain a passion, to be honest, I would even doubt your sincerity

So you need to regularly replenish your faith.

Now, it's time for faith.

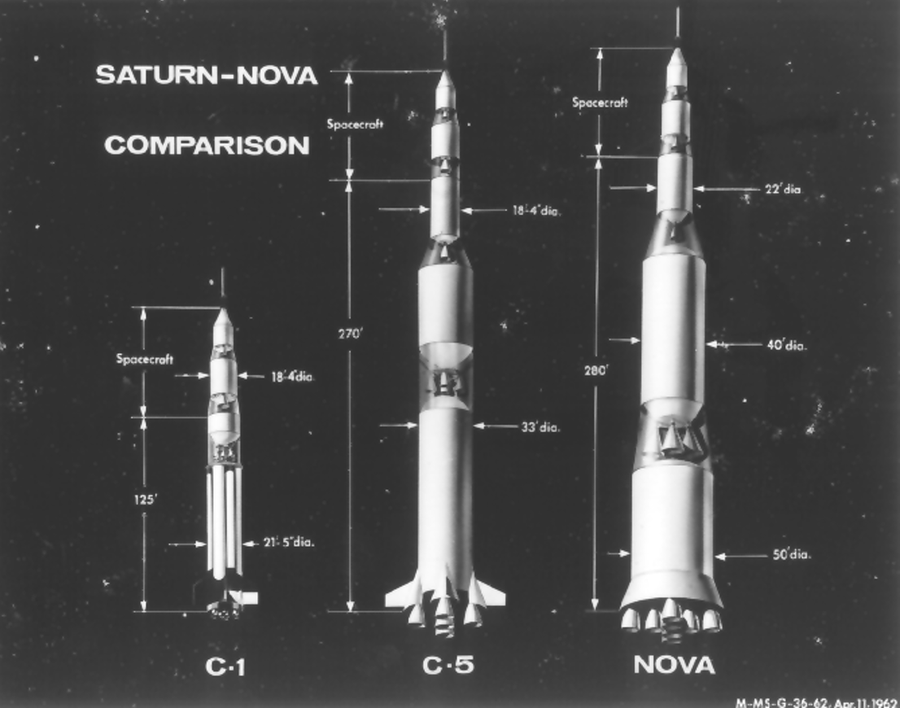

This round of Bit's launch is not a one-off, but like a multi-stage rocket, one after another, interconnected, and taking off step by step.

Pre-stage: The downfall of the three major scammers (SBF, SuZhu, DoKwon) + the Fed's rate hikes and harsh winter, together welded Bit's iron bottom at 16,000.

Subsequently, Bit's rise from the previous round's bottom of 16,000 to the current 101,600 has three major contributors:

First-stage rocket: 16,000-30,000, thanks to Grayscale, which has been sucking up Bit like a python, and has also won a crucial victory in its lawsuit against the SEC.

Second-stage rocket: 30,000-60,000, thanks to ETFs, especially BlackRock and Fidelity, two traditional institutions bringing their users and the hot money of the US stock market into Bit.

Third-stage rocket: 60,000-100,000, thanks to Microstrategy. In fact, key round numbers are very difficult to break through, especially the invisible pressure of various technical indicators, but Microstrategy's faith and determination, using debt and stock sales to directly and forcefully clear the pressure, pushed Bit to the vacuum area.

Next, there is the fourth-stage rocket, which is also the most powerful one:

Considering that Trump has currently nominated crypto-friendly, even crypto-enthusiastic government officials for the new term, the US's Bit strategic reserve proposal is likely to become a reality.

And with the US taking the lead, will Europe, the Middle East, Japan, South Korea, South America, and even China follow suit?

The once unattainable dream of the electronic "gold" has now even become attainable.

Bit's biggest feature - that it won't change - is a quality like gold.

The gold seal of Qin Shi Huang, the golden crown of Tang Taizong, and the golden palace of Ming Taizu are all made of the same gold.

What the Bitcoin network was like in 2017, what it was like in 2021, and what it will be like in 2025 next year - they are all the same Bitcoin.

"Can be predicted" = "Can be trusted" = "Can transcend time"

You can never trust a project that will rug in the next hour, nor can you believe in a protocol that updates a blueprint every 5 years, nor can you be sure that a currently diligent entrepreneur will not become a ruthless CEO in N years.

But you can easily predict what the Bitcoin network will look like 10 years from now, 20 years from now - the answer is that, like gold, it will always be the same.

This is why these countries will make Bitcoin (not others) their "national strategic reserve".

----Dividing line----

You may ask, Teacher Todd, I seem to understand. But we came to this industry to "make a comeback", are you telling me to hold Bitcoin? How much more can Bitcoin appreciate?

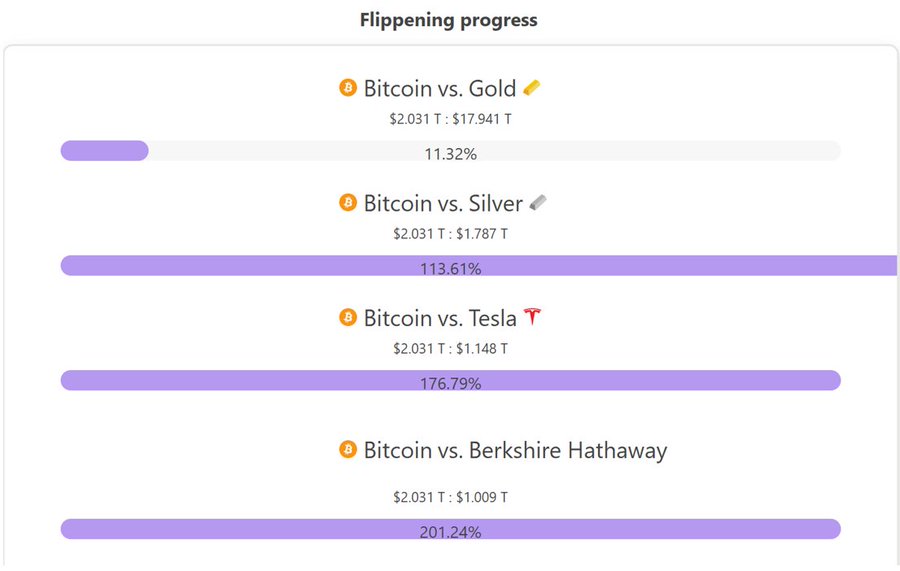

Bitcoin vs Others

To be honest, I can't give you a prediction, and almost no one can give you an accurate prediction.

This is precisely the third point I want to express - live well.

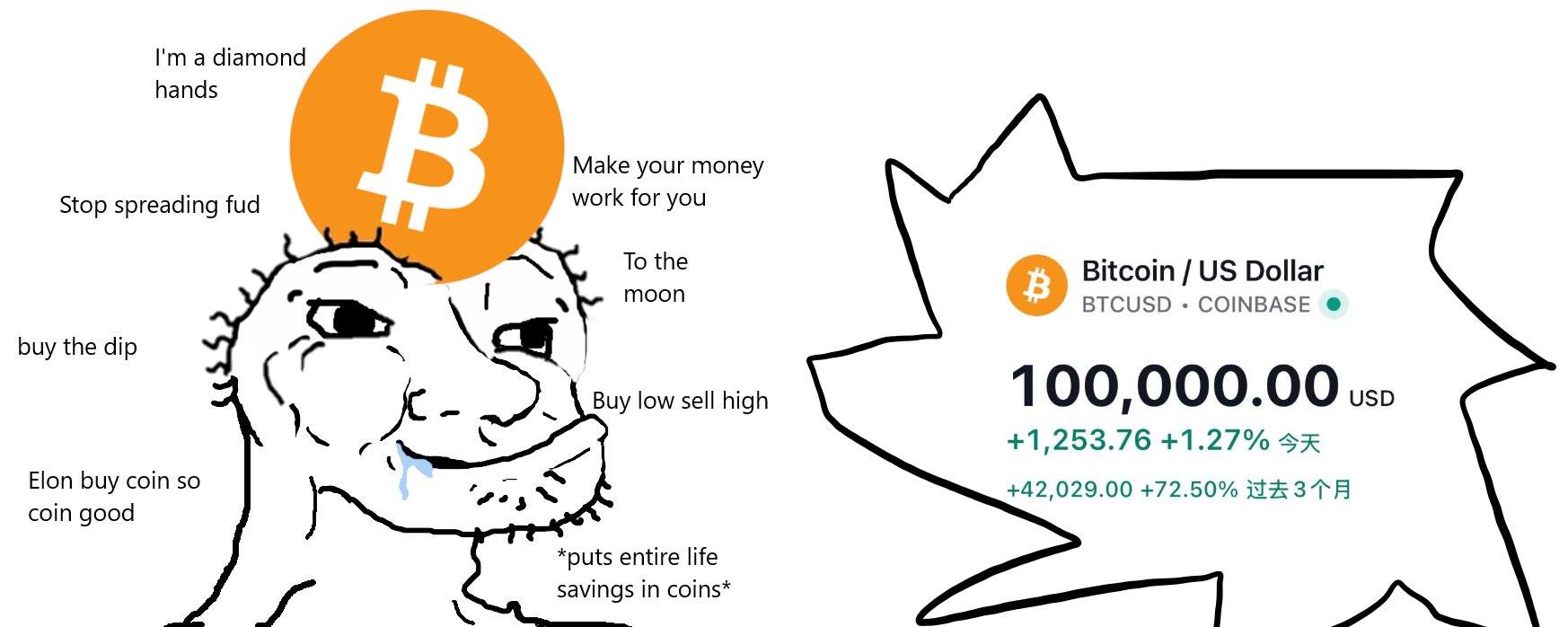

Another major feature of this industry is that it is also good at showing you the most luxurious part.

One moment you can easily earn 1M, 2M;

The next moment, you post a farewell statement;

A few days later, the person is gone, turns out they are traveling the world;

Of course, I haven't dared to mention the lavish lifestyles of the exchange bosses in Singapore and Dubai.

Among them, there are real and fake, with the fake accounting for 75%, the showoffs accounting for 20%, and the truly wealthy accounting for about 5%.

However, these things are too stimulating to the eyes, like a powerful weapon, cunningly drawing out people's discontent and anger.

This is also why memes are born, and of course I will write more about memes when I have the opportunity.

Recently, an account with a big gorilla avatar has again dumped 5M into an XRP contract, drawing countless envious looks. But it was later exposed that they were using a virtual account to trade, with the purpose of tricking others into paying fees.

Do you know how ironic it is when you have faced a fake photoshopped image, silently cried and cursed yourself for being too timid, and then subsequently opened a huge leverage in retaliation?

And the key to HODL is for people to learn to live well.

How to live well:

1. Regularly record yourself in writing

2. Accept the fact that others earn more than you

3. Focus on the present

4. Eat well

5. Set realistic and achievable goals

6. Challenge negative thinking

7. Get good sleep

8. Cultivate positive self-talk

9. Practice gratitude

10. Help others

Only when you have lived your own life well can you hold on to Bitcoin.

If, on the contrary, you have not lived well and have fallen into the emotional trap carefully designed by the Altcoin issuers, and start fantasizing about adopting aggressive strategies to overtake, the ending will be -

Your Bitcoin will all end up in the hands of those Altcoin issuers.

Over the years, I roughly feel that perhaps 95% of people are becoming less and less coin-centric.

There are occasional contrarians, not more than 5%, all of whom are people with extremely auspicious fortunes.

Remember that saying?

"The first time you heard about Bitcoin

is often the most you'll ever own."

Finally, let's review the three true methods to hold Bitcoin:

1. Store in a cold wallet

2. Regularly replenish your faith

3. Live well

Time flies so fast, 7 years have passed, and the exchange rate of Bitcoin to US dollars has increased tenfold.

But 1 BTC = 1 BTC, still the same.

As it was in the past, so it will be in the future.

Please hold (HODL) your Bitcoin, don't wait until Bitcoin reaches $100,000 to understand.