Bitcoin (BTC) has shown extreme volatility in the past 24 hours, shaking the cryptocurrency market. The sharp decline resulted in over $1 billion in liquidations, making it one of the largest sell-offs since the 2022 FTX collapse.

According to Coinglass data, around $900 million in BTC positions were liquidated, with the price plummeting from $100,000 to $90,000 before rebounding to $97,000.

Bitcoin Sees Largest Liquidations Since FTX

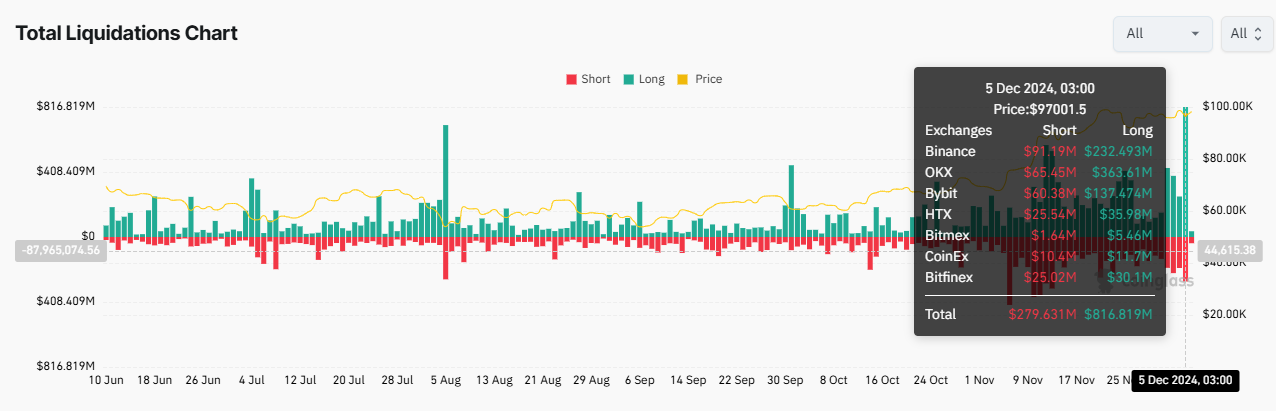

This dramatic liquidation cascade affected over 156,000 traders globally, with $816.819 million in long positions and $279.631 million in short positions being liquidated. Coinglass reports that the single largest liquidation was around $19 million on the OKX exchange.

Analysts are drawing parallels to the FTX crisis. Prominent crypto voice McKenna says this is the largest liquidation event since the FTX bankruptcy, a view supported by several community members.

"Spot buyers are now absorbing the liquidation cascade." - McKenna stated.

Adding to the turmoil, web3 data analytics tool Lookonchain highlighted that Mt. Gox moved 3,620 BTC worth $352.69 million to two new wallets, just hours after BTC breached $100,000.

Speculation that the U.S. government may have sold BTC during this period further fueled market uncertainty.

"Did the U.S. government sell the BTC they sent to Coinbase?" joked one user on Twitter.

Despite these transactions, multiple factors contributed to the large-scale liquidations. BeInCrypto cited profit-taking, large sell orders at key milestones, and excessive leverage positions as the main drivers. Many traders had relied on borrowed funds to bet on Bitcoin's continued rise, exposing them when the price declined.

Financial analyst Jacob King criticized whales for selling their holdings while retail investors succumbed to FOMO, opening leveraged long positions at all-time highs.

"This is what happens when retail investors FOMO into leveraged long positions at all-time highs." - King wrote.

Whales Capitalize on Bitcoin Dip

Amid the chaos, some large investors seized the opportunity. Blockchain analytics firm Lookonchain revealed that a whale bought 600 BTC for $58.85 million during the crash, accumulating a total of 1,300 BTC worth $127 million over the past two weeks. These opportunistic purchases demonstrate Bitcoin's appeal even in times of turmoil.

"After BTC dropped from $100,000, a whale grabbed the opportunity and bought 600 BTC for $58.85 million! Over the past 2 weeks, this whale has accumulated a total of 1,300 BTC worth $127 million." - Lookonchain reported.

Despite the liquidations, some analysts view this event as a necessary correction in Bitcoin's bullish trend, potentially forming a short-term bottom. Others argue that the resumption of whale activity and steady accumulation still point to a robust long-term foundation.

The broader cryptocurrency market mirrored Bitcoin's volatility, with Ethereum and other major coins also experiencing significant liquidations. As traders navigate these conditions, the focus remains on whether Bitcoin can reclaim the crucial $97,000 support level and sustain its historic rally.

According to BeInCrypto data, at the time of writing, Bitcoin is trading at $98,404, down 4% since the start of the Friday session.