The following are the key points from my latest Messari report article.

My latest valuation of the HYPE token (with a maximum supply of 1 billion) is around $13 billion in FDV, which could be higher than $30 billion under appropriate market conditions.

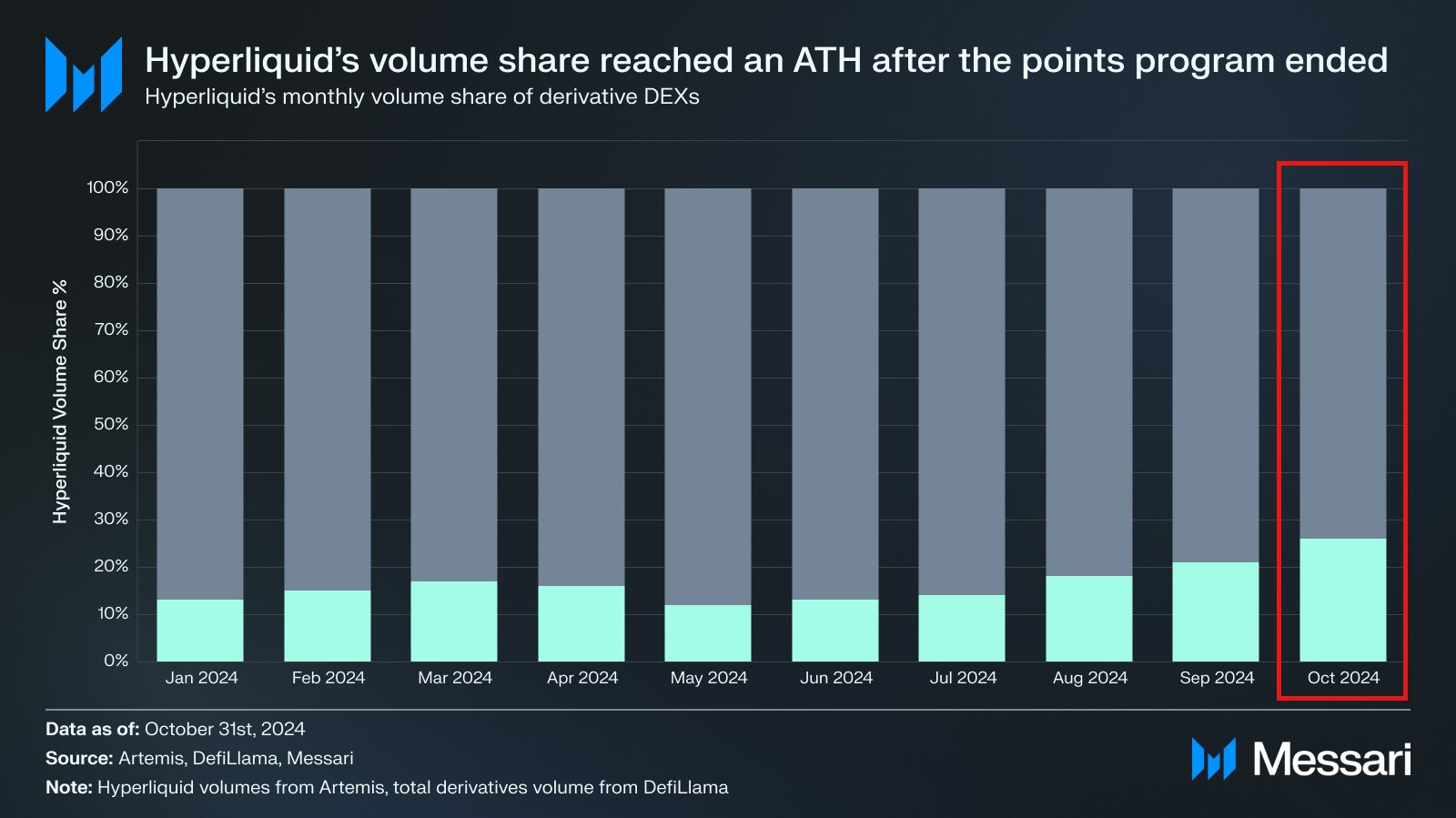

The termination of incentives has not slowed Hyperliquid's growth momentum. We saw market share reach an all-time high in October, with open interest also setting a new record of over $1.5 billion.

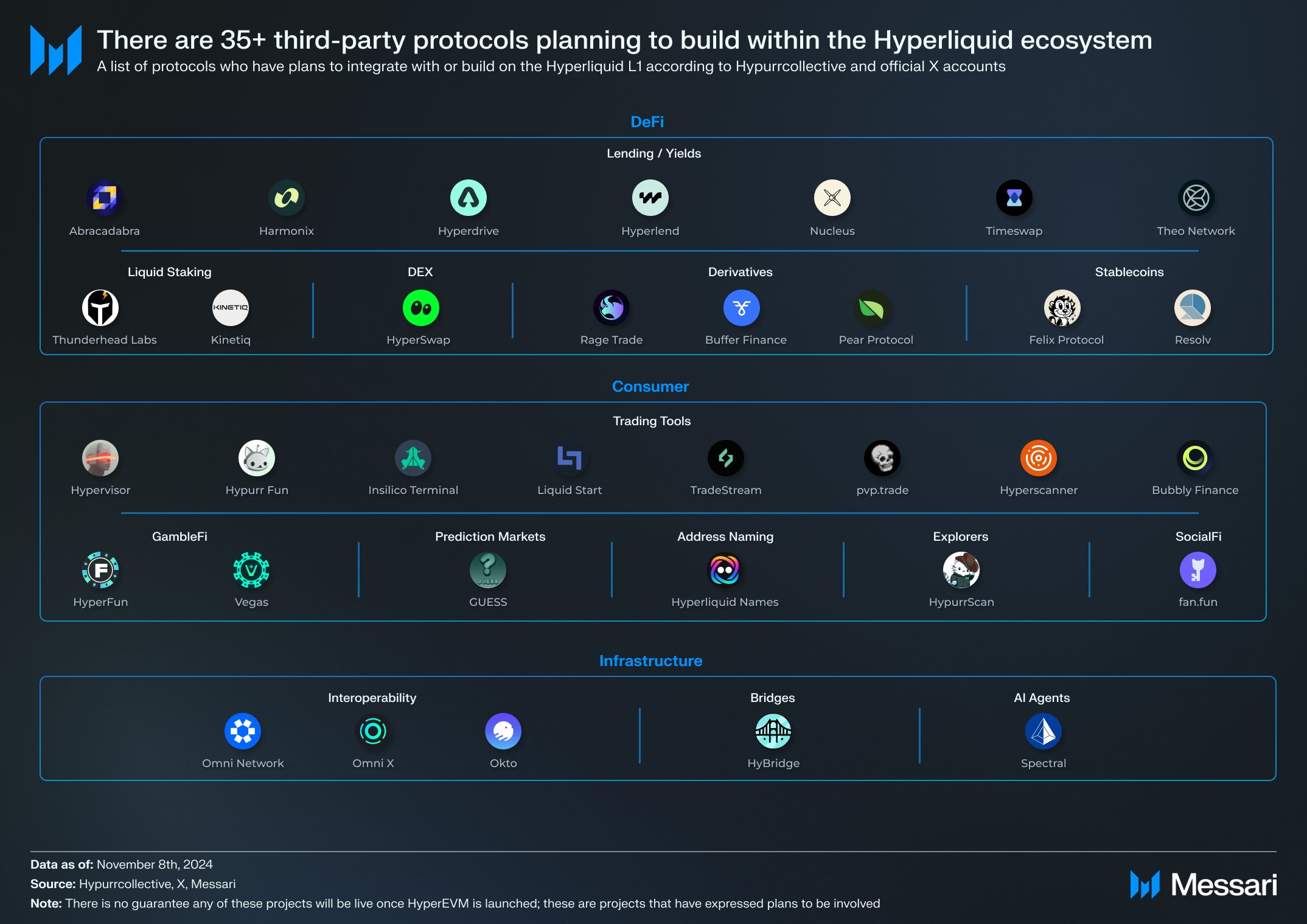

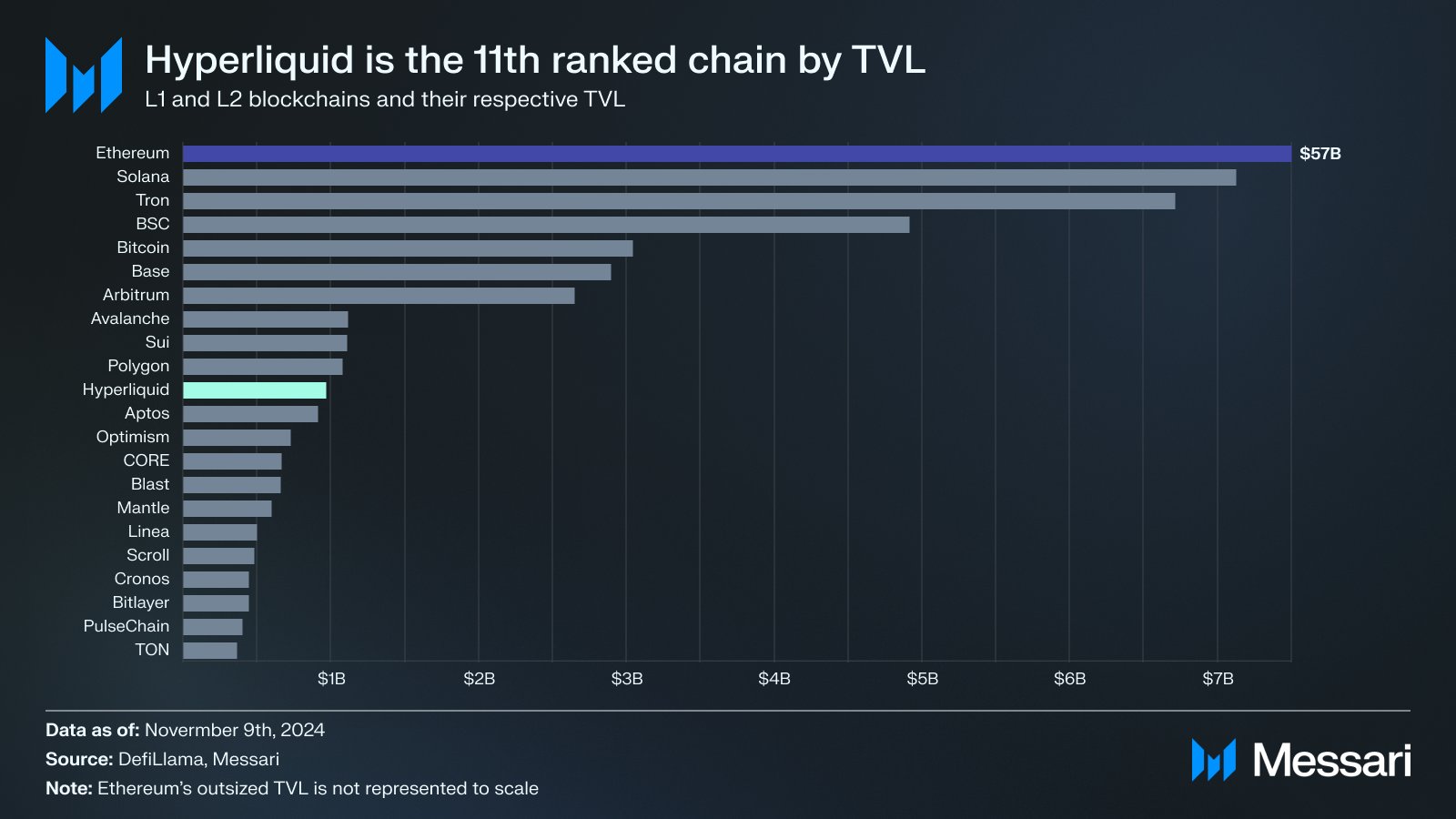

Hyperliquid will also launch HyperEVM through a TGE (Token Generation Event), with over 35 teams planning to participate in this new ecosystem. This makes Hyperliquid closer to a universal L1, moving away from an application chain.

Here is a market chart I created:

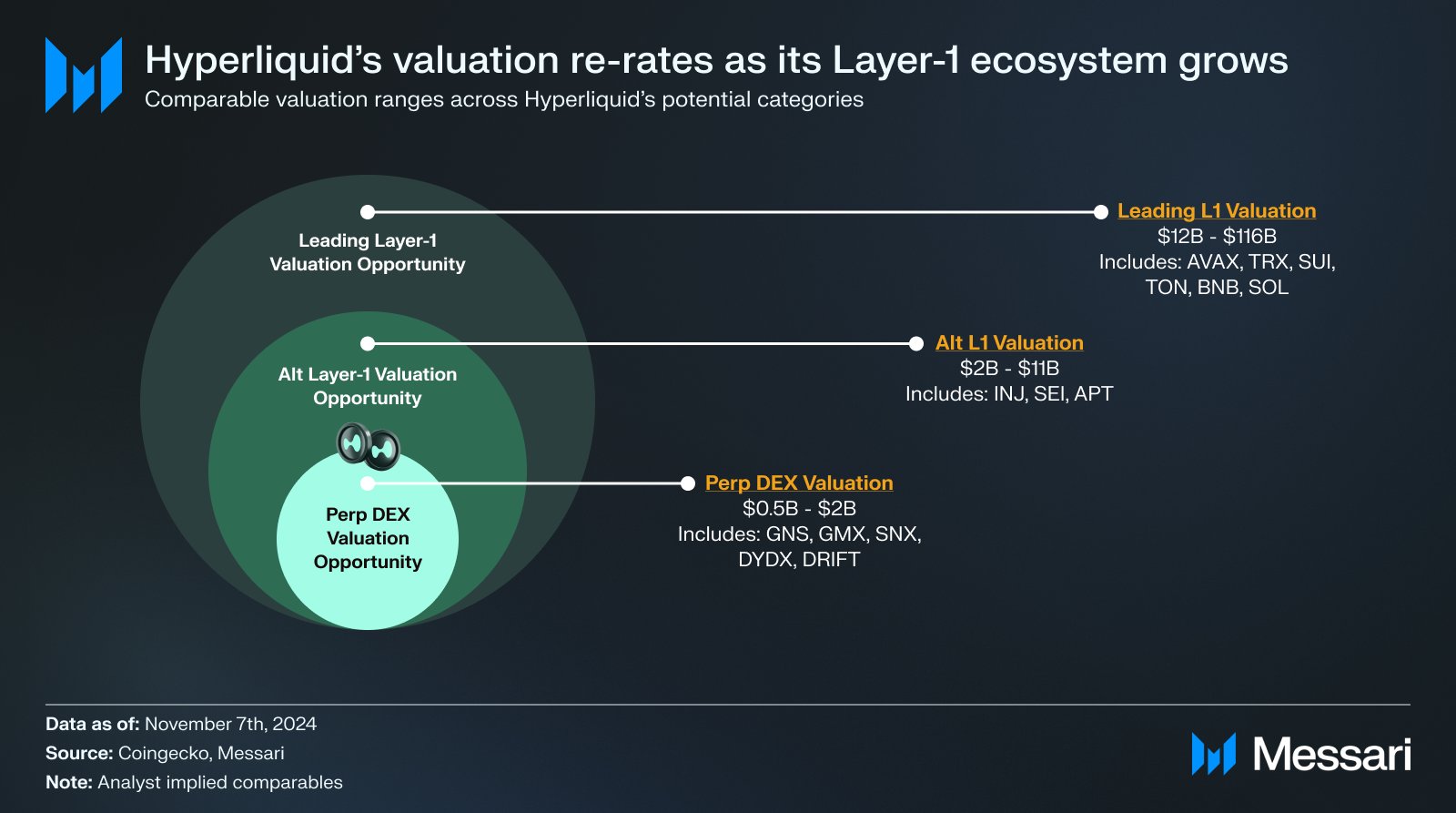

The new Hyperliquid should have a completely new valuation framework. Typically, killer applications and their L1 networks are separate entities. Application fees accrue to the application token, and L1 fees accrue to the network validators. Hyperliquid has consolidated these revenue streams.

Therefore, Hyperliquid not only has the leading perp DEX in the crypto world, but also its underlying L1. We choose the classification and aggregation valuation method to better reflect the vertical integration of this protocol. Let's start with the perp DEX.

I will now go into detail on a key driver.

Our overall view on the derivatives space is highly aligned with Multicoin Capital and ASXN, except for one point, which is Hyperliquid's market share.

I believe the perp DEX market is a winner-take-all market. This is because:

* Any perp DEX can list any perpetual contract, without the problem of blockchain fragmentation.

* Unlike centralized exchanges, using a DEX is permissionless.

* There are network effects flywheel in terms of order flow and liquidity.

I believe Hyperliquid's dominance will only grow stronger. In the base case, we believe Hyperliquid can capture close to half of the on-chain market share.

This will generate $551 million in revenue by 2027. Currently, the trading fees are flowing to the community, so we count them as actual revenue.

Scaling DeFi standards 15x, we arrive at a valuation of $8.3 billion for the perp DEX as a standalone business. If you are an enterprise client, you can see our full model. Now let's look at the L1:

Typically, DeFi application premiums are used to value L1s. As Hyperliquid's activity on its network continues to grow, its valuation may continue to rise.

Note that the opportunity here is growing:

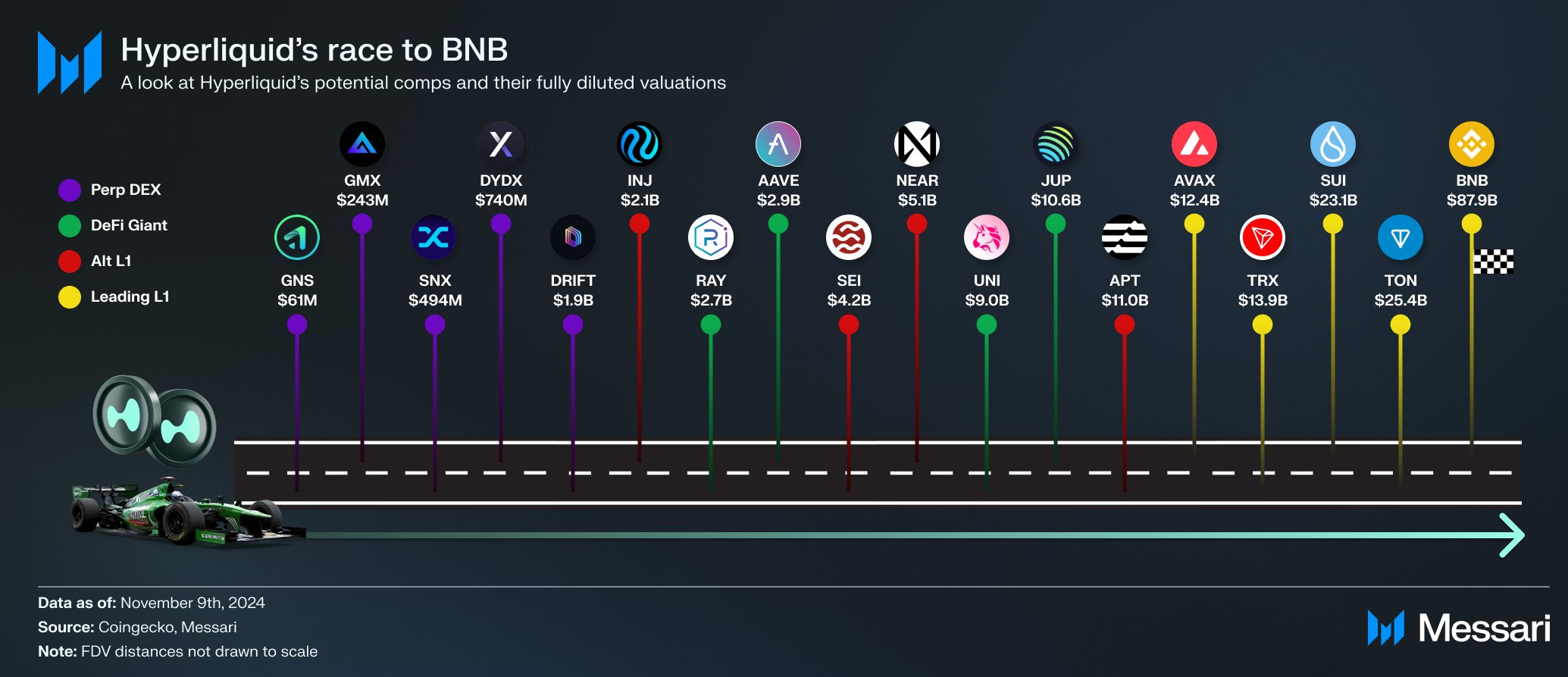

Hyperliquid has already become the 11th largest TVL chain. Valuations of smaller networks like Sei and Injective are $5 billion and $3 billion respectively. Parallel high-performance networks of similar scale, such as Sui and Aptos, are valued at $30 billion and $12 billion respectively.

Given that HyperEVM has not yet been launched, we take a conservative $5 billion L1 premium for Hyperliquid. In fact, if we price the L1 at current market prices, this could be close to $10 billion or higher.

So the base case is:

Hyperliquid's perp DEX is worth $8.3 billion, and the underlying L1 is worth $5 billion. The base case FDV is $13.3 billion. The bear case is around $3 billion, and the bull case is around $34 billion. One point I must emphasize is that we have not yet seen a leading crypto app vertically integrate with an early high-performance alt-L1.