Cardano (ADA) price breakout

ADA has surged from $0.33 to $1.22 in just 30 days, marking a 181.5% increase. While it faced a minor correction in early December, the overall monthly trend remains strongly upward.

The last time ADA reached this price was April 2022, though it still lags behind its all-time high of $2.85 in August 2021.

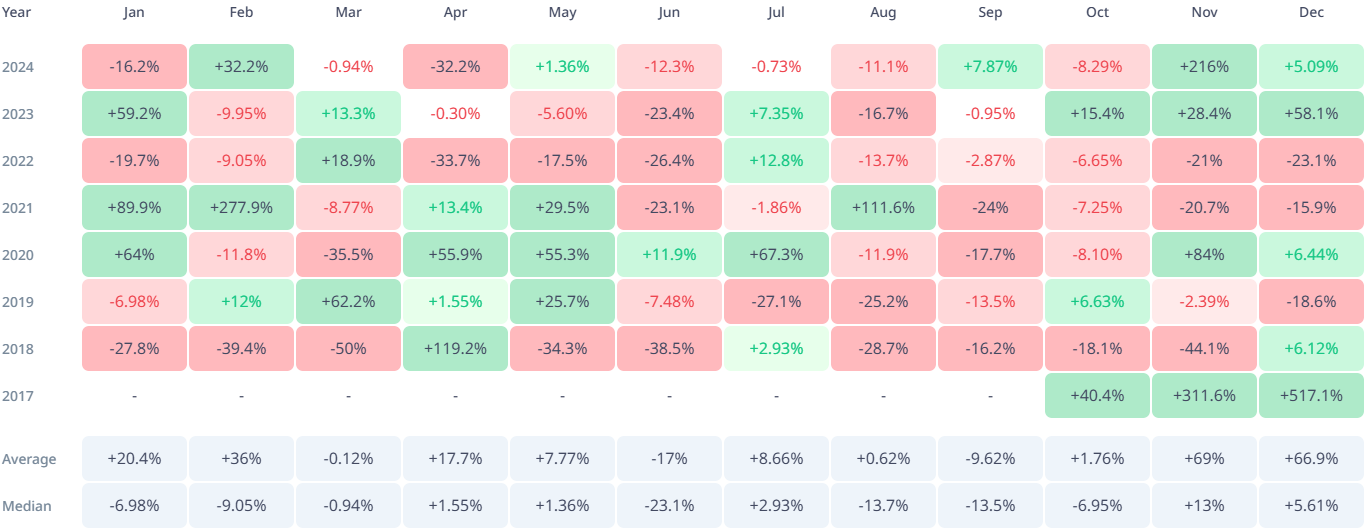

As of today, ADA has outperformed peers like Solana and Ethereum, closing higher on 17 of the past 20 trading days. November 2024 saw a 230% gain for ADA, its best month since August 2021. Futures open interest hit a 40-month high of $1.18 billion on Dec. 3, signaling strong market interest.

According to Santiment, ADA's recent 25% spike is likely to attract more retail investors.

🚀 Cardano has been one of the notable surprise altcoins taking flight during this crypto-wide pump. Now up over +25% in the past 3 days, we may be seeing some retail FOMO coming soon. This has been a long time coming for the patient ADA community. pic.twitter.com/Ph2ZFFKnIU

— Santiment (@santimentfeed) November 8, 2024

ADA reached a significant milestone on Nov. 23, surpassing $1 and pushing its market capitalization above $40 billion for the first time in three years. This surge reflects growing confidence among investors and increased trading activity on major exchanges.

😠 #Cardano, #EOS, and #Tron are 3 once popular assets that have had trading crowds begin to turn on them. Price performance has been particularly rough for these three in 2022, and the capitulation may soon lead to price rebounds to reel them back in. 🎣https://t.co/aUn68ATVEw pic.twitter.com/fY7cXogli0

— Santiment (@santimentfeed) October 5, 2022

Despite ADA's recent rally and notable recovery, its current price remains significantly below its all-time high of over $2.80.

The broader crypto market downturn that followed severely impacted prices, leaving ADA and other major tokens still working toward reclaiming their previous peaks.

Cardano spot ETFs

After the approval of Bitcoin and Ethereum ETFs, several experts have speculated that ADA, XRP and Solana could be the next cryptocurrencies to receive approval for their own ETFs.

While multiple asset managers have already filed with the SEC for ETFs tied exclusively to Solana and XRP, Cardano has yet to see a similar filing.

This has led to discussions about whether Cardano could follow suit and eventually be included in an ETF, potentially boosting its exposure and legitimacy in the broader market.

Cardano blockchain

The Cardano blockchain has demonstrated a robust performance in recent months. A standout achievement includes surpassing 100 million total transactions, as reported by U.Today. These developments underscore Cardano's growing adoption and investor optimism.

Cardano, an open-source blockchain platform, was designed to overcome the scalability, interoperability and sustainability challenges of earlier technologies like Bitcoin and Ethereum.

It employs a proof-of-stake consensus mechanism and features a layered architecture, separating settlement and computation layers.

Recently, Cardano's Hydra protocol, a Layer 2 scaling solution, achieved 1 million transactions per second (TPS). This milestone reflects the platform's growing capabilities.

As users increasingly deploy assets and conduct DeFi transactions on Cardano, the demand for ADA rises due to its role in transaction fees and gas payments.

Charles Hoskinson to lead U.S. crypto policy?

Charles Hoskinson, founder of Cardano, has announced the establishment of a policy office within Input Output to engage in cryptocurrency policy development in the U.S.

In a video shared on X, Hoskinson emphasized his commitment to working closely with lawmakers, administration officials and industry leaders in Washington, D.C., to shape favorable crypto regulations.

“I’m going to be spending quite a bit of time working with lawmakers in Washington DC and quite a bit of time with members of the administration to help foster and facilitate crypto policy alongside other key leaders in the industry,” Hoskinson said.

In a parallel development, the Cardano ecosystem marked a significant milestone with the adoption of the first draft of the Cardano Constitution during the Constitutional Convention held in Buenos Aires, Argentina, on Dec. 5-6, 2024.

The event brought together Cardano enthusiasts, developers, researchers, investors and community members from around the world.

The constitution establishes a framework of "provisions and guardrails" designed to guide Cardano's long-term evolution and governance, reflecting its decentralized ethos.

We’ve come a long way to make today happen.

— Input Output (@InputOutputHK) December 6, 2024

The Cardano Constitution has been accepted, marking a defining moment in this journey toward fully decentralized governance. We still have one further crucial step to take as a community.

Next, in January, the approved text will be… https://t.co/BwKks69o9X

Cardano versus Bitcoin

Charles Hoskinson has recently predicted in a YouTube appearance that Bitcoin could soar to $250,000-$500,000 within the next 12 to 24 months, driven by substantial investment inflows and increasing institutional interest.

Hoskinson highlighted the potential ripple effects on the broader crypto market. Bitcoin's rise to record highs could trigger a domino effect, lifting Cardano (ADA) and other cryptocurrencies alongside it.

This optimistic outlook is supported by the strong correlation between Bitcoin and other digital assets, including ADA, which currently stands at 0.87, according to data from IntoTheBlock.

Furthermore, the rising interest in decentralized finance (DeFi) within the Bitcoin ecosystem may create synergies for Cardano. As Cardano continues to evolve, its focus on scalability, sustainability and a developer-friendly environment positions it to attract innovative projects and developers eager to build cutting-edge solutions.

This alignment of Bitcoin-driven market momentum and Cardano's ongoing platform advancements could amplify the growth and adoption of both ecosystems.

Can Cardano crash again?

Cardano's Total Value Locked (TVL) across DeFi applications surged dramatically in December 2024, climbing from $230 million to over $705 million in just a month.

Investor confidence in Cardano remains high, with CoinGlass reporting significant ADA outflows from exchanges, totaling $98.37 million, as holders move their assets to private wallets.

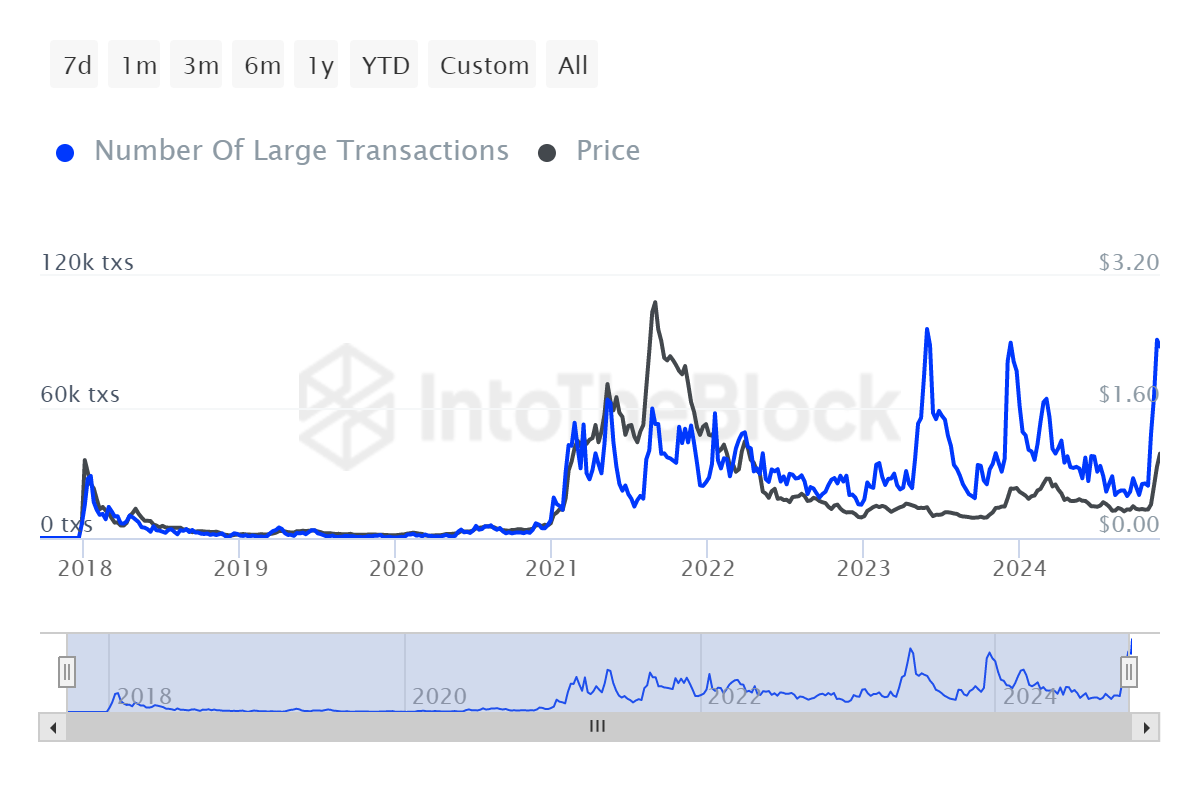

The number of large transaction has also experienced a major spike in December.

Additionally, IntoTheBlock data highlights a sharp increase in whale addresses holding 10 million to 100 million ADA during November, suggesting substantial accumulation by large players.

This momentum has pushed ADA's price above the $1.30 psychological level, with large holders anticipating further gains.

Overall, on-chain data does not currently signal a likelihood of ADA declining below $1, reinforcing optimism in the asset's upward trajectory.

Price forecast: How high can Cardano go?

An X user, in response to the veteran trader, recalled his prediction in 2021, in which Brandt predicted that ADA would dip to $0.10. But instead, it went ahead to set all-time highs of nearly $3.

Cardano's (ADA) technical and market indicators suggest a cautiously optimistic outlook.

ADA: IntoTheMoney

Contracts dominate at 88.57% of ADA holdings, representing $37 billion, indicating strong profitability among holders.

ADA: OutTheMoney

Contracts are at 3.62% ($1.53 billion ADA), while AtTheMoney Contracts comprise 7.81% ($3.29 billion ADA), reflecting a market poised for potential upward movement.

Bollinger Bands show widening, signaling heightened buying momentum. MACD shows a bullish crossover, with the MACD line crossing above the signal line, indicating upward momentum.

RSI at around 50 points to neutral momentum, with room for ADA to rise further before entering overbought territory.

Dan Gambardello, the founder of Crypto Capital Venture, has speculated that Cardano could surge to $3 if it were to receive favorable news, such as an exchange-traded fund (ETF) approval similar to the one XRP recently achieved.

Gambardello based his analysis on consistent patterns from previous market cycles and recent advancements in Cardano’s technology.

Cardano All Time High In 30-60 Days (ADA Linked To Trump SEC Pick)

— Dan Gambardello (@cryptorecruitr) December 4, 2024

Intro 00:00

1,000,000 TPS! 1:35

Trump SEC pick tied to cardano 3:25

Crypto/com 5:00

Important monthly cardano chart 6:05

Potential ADA dip makes sense 7:30

The path to all time high 9:30 pic.twitter.com/lCKKpe8NUa

This could potentially drive a significant price rally, as institutional interest often follows such developments, boosting the token's legitimacy and market confidence.

Based on Cryptorank data, ADA could reach an average growth rate of 66.8% for December, providing a generally bullish month for the coin.

Using the Fibonacci indicator, some analysts suggest that the next major target could be above $2.4, which corresponds to the 1.618 Fibonacci level. If this level is breached, the 2.618 Fibonacci level at $8.30 might be the next key target.

Prominent analyst Ali Martinez thinks that the Cardano price is following a pattern similar to its 2020 performance.

If history repeats, the ADA price might potentially hit $6, according to Martinez.

Most analysts don’t see the ADA price gaining double-digit growth during this cycle. The $10 mark remains a long-term target. However, surpassing the ATH in 2025, trading above $3 seems realistic at this point.