Introduction

At the end of 2023, a series of successful launches bode well for the prospects of Web3 games. Nevertheless, in last year's Outlook report, we expressed concerns about the sheer volume of new game and token releases, and how the challenging Web2 distribution landscape has them all vying for the same limited pool of Web3 users. This competition for player liquidity, combined with the memecoin and recent AI attention monopolies, has led to relatively poor performance of Web3 games this year.

However, objectively, 2024 is also the year with the highest quality of game content. The highly anticipated early access releases of games like Off The Grid and MapleStory Universe (MapleStoryU), as well as some promising updates in ecosystems like Telegram and a wealth of exciting AI innovations, make us more bullish on the industry's future than ever before.

This report will briefly summarize the state of game development across all key areas so far this year, and highlight how we see things unfolding in 2025. The report will also outline three core themes for the coming year: the state of in-game token liquidity, how broader adoption prospects will impact the battle for player liquidity, and the role games will play in the crypto x AI future.

This is a pivotal moment for the gaming industry, with the next 12 months crucial for predicting the next five years. Whether bull or bear, we believe that as the market continues to evolve and mature, those who can best position themselves will find tremendous opportunities.

Annual Review

Web3 Game Financing

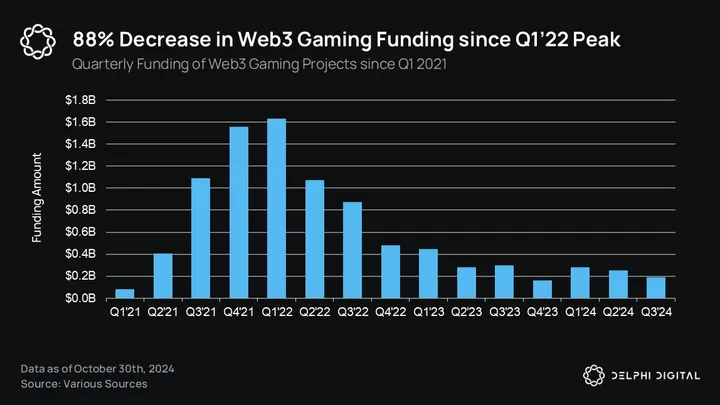

In 2024, Web3 game financing has shown relative resilience, raising $715.5 million by the end of Q3. Web3 game transaction volumes have remained stable, with 135 transactions recorded so far in 2024, on par with the full-year 2021 but down from the 2022 peak of 265 transactions.

While the financing metrics are clearly down from the $4.07 billion total raised in 2022 (the 2024 cumulative raise is only around 43.8% of Q1 2022 levels), it still reflects relatively healthy capital flows in a challenging macroeconomic environment with interest rates at their highest in over 20 years.

Despite the overall decline in funding, the focus has shifted to fewer, higher-quality projects. In 2024, only 8 game projects raised over $20 million, compared to 18 in 2023, indicating investors are becoming more selective.

Due to a lack of unifying narratives like Play-to-Earn (P2E) or the metaverse, many investors lacking the specialized expertise to evaluate deals or with funds not prioritizing games have retreated after sustaining too many losses.

Additionally, financing has clearly shifted towards earlier-stage deals, with fewer late-stage funding rounds. This trend suggests that while a lot of capital was deployed during the 2021-2022 funding frenzy, many projects from that period are still struggling to secure follow-on funding, potentially indicating product-market mismatch or difficulty sustaining growth in the harsh market conditions.

The current environment underscores that a rising BTC price and bullish sentiment will not immediately translate into inflows to the gaming market. However, it also marks a maturing industry that is no longer as susceptible to market volatility, with capital finding teams with stronger fundamentals and more sustainable long-term visions.

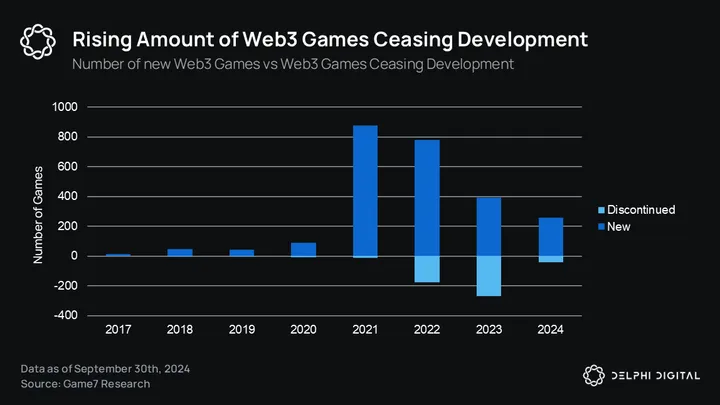

The 2022 and 2023 bear markets have provided the much-needed cleansing, with many underperforming projects halting development. Out of the 2,489 Web3 game projects that received funding tracked by Game7 DAO, 514 have stopped development, with over half (271) ceasing in 2023 alone.

Further regulatory clarity from the Trump administration, as well as increasing compliance with MiCA in the EU market, will provide some much-needed confidence for institutional and retail investors. In contrast to the relatively harsh Web2 gaming financing environment, the increased liquidity and novel value accrual mechanisms offered by Web3 token rounds will remain an attractive value proposition for investors.

Looking ahead to 2025, the trajectory of Web3 game financing will largely depend on the state of the market sector. In a more optimistic scenario, successful token launches by companies like Off The Grid and MapleStoryU on leading exchanges will attract new liquidity and reaffirm the importance of excellent products. This will not only draw more developers and venture capital interest in future industry growth, but also catalyze additional interest in further sub-sectors, such as high-risk on-chain gaming and the intersection of AI and gaming.

If the most anticipated releases at the end of 2024/beginning of 2025 do not go as smoothly as many hope, the bear market scenario will lead to aggressive consolidation, lack of liquidity (except for AI games), and a tough 2-3 year period for game teams. The silver lining here is that the teams that survive will demonstrate their antifragility and strong fundamentals. This will create some interesting bear market buy opportunities for those able to identify the strongest teams with the best products and sustainable token models.

Market Trends

After reaching $7.49 billion in mid-October 2023, the total market capitalization of games has seen significant growth. As of now, the market cap has reached $34.8 billion, up over 360% from the 2023 low, and up 115% from the pre-election $16.16 billion. However, the market is still 10% below the March 2024 peak of $38 billion, and around 43.5% below the previous cycle's peak of $49.96 billion.

According to Game7 data, 66 new game tokens were issued in 2024, bringing the total to 349, a 23.3% increase. Issuance has accelerated significantly compared to 2023, when only 34 new tokens were released, a 94.1% year-over-year increase. The data suggests that many projects that built products during the bear market are now launching TGEs to capitalize on the strong rebound in game market capitalization from the October 2023 low.

The sector has underperformed compared to the meme and AI industries, underscoring the importance of attention markets and sustained "price appreciation" marketing. As we will outline later in the report, the state of game tokens has prompted teams to re-evaluate their listing strategies. Nevertheless, 2025 will undoubtedly be a crowded Web3 gaming market. Whether a series of successful launches and new narratives can turn the tide remains to be seen.

Game Non-Fungible Token (NFT) Market

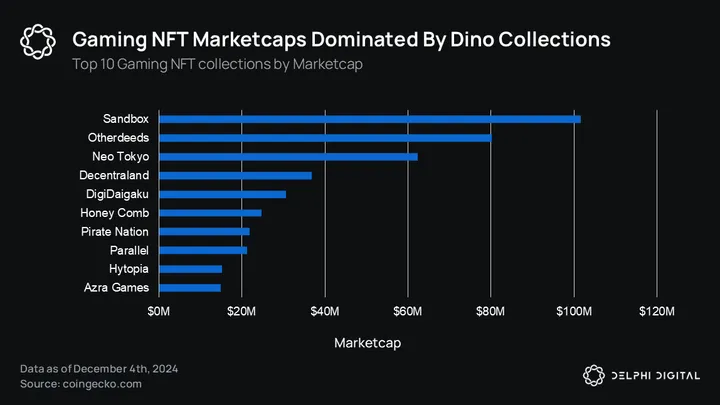

As mentioned earlier, Web3 game Non-Fungible Tokens (NFTs) have shown slight signs of recovery over the past 12 months, with trading volumes increasing significantly since November 2024. Collections like Pirate Nation Genesis Pirates and Hytopia Worlds have seen over 100% quarter-on-quarter growth, while My Pet Hooligan and Infinigods have grown 50% since October 2024. Surprisingly, legacy game NFT collections like Sandbox, Decentraland, and Otherdeed/Otherdeed Expanded (the three metaverse projects that lost much of their hype in 2022) still lead the pack, with Neo Tokyo being the most valuable game NFT collection by market capitalization.

The collection of projects that promise to airdrop tokens continue to perform well, thanks to their unlimited upside potential. This dynamic reflects the strong preference of Web3 investors for assets with speculative upside potential, even in mature markets. The main takeaway from the recent surge in the NFT market is that projects that combine token utility with eye-catching game mechanics are likely to garner the most enduring interest.

Infrastructure

Underlying Blockchains

The role of underlying blockchains in Web3 gaming has gone beyond simply providing the underlying infrastructure, with blockchains increasingly expected to provide additional support and funding (akin to the services provided by publishers in Web2) to remain competitive and attract top-tier teams.

Major networks like Avalanche, Arbitrum, and Ronin are serving as hubs for game developers, with their role extending far beyond the technical layer. For example, Arbitrum has allocated 225 million ARB tokens (worth $234 million) through its DAO to support gaming initiatives, while Xai, Sophon, and SUI have allocated substantial grants to ensure their ecosystems have exclusive games.

However, comparing these grants to the traditional Web2 game publishers is not entirely fair. Web2 publishers typically invest millions or even hundreds of millions of dollars to bring games to market in exchange for ownership, royalties, or a share of early revenues. In contrast, blockchains focus on milestone-based funding, technical support, and network effects to support teams and achieve broader ecosystem goals.

These goals include increasing on-chain activity, indirectly earning fees, and consolidating their position in the increasingly crowded gaming network landscape. As competition between chains intensifies, providing such "value-added services" has become key to maintaining relevance and attracting the best teams.

The Explosion of New Ecosystems

The proliferation of new ecosystems (particularly Layer 2 and Layer 3) focused on gaming has led to an increasing imbalance between the number of networks and the number of games. In 2024, over 104 new L2/L3 networks will be announced, while the number of new games is only 263, indicating a "premium" of ecosystems relative to individual applications.

Ecosystems often appear more attractive as they promise multiple shots on goal by introducing a variety of different applications, including games. While the number of new games decreased from 875 in 2021-2022 to 778, the number of new networks nearly doubled, from 33 to 64. Subsequently, the number of games has continued to decline (391 in 2023 - 263 in 2024), while the number of new networks has increased or remained stable (116 in 2023 - 104 in 2024).

The success of the Steam platform is a good example that highlights the importance of killer applications in driving ecosystem adoption. Steam initially started as a way to digitally deliver updates to millions of players of Valve's flagship games like Half-Life 2, Team Fortress 2, and Counter-Strike. Over time, Valve opened the platform to all developers and continued to add features like the Steam Store, Steam Workshop, and Steam Community for players to view profiles, gradually evolving into the preferred platform for digital game distribution.

As L2 and L3 base technologies continue to improve and become more commoditized, costs are expected to approach zero, while throughput will increase. This gradual shift makes it increasingly difficult for high-performance networks to stand out solely on the basis of technology, underscoring the importance of exclusive killer content in capturing market share.

However, this raises serious concerns about the impact of exclusivity on the games themselves, especially as distribution remains the biggest challenge in Web3. For example, the Epic Games Store's reliance on exclusivity often leads to poor sales, as seen with the recent Alan Wake 2, highlighting the potential risks of limiting game coverage for the sake of ecosystem loyalty.

Gaming Audiences

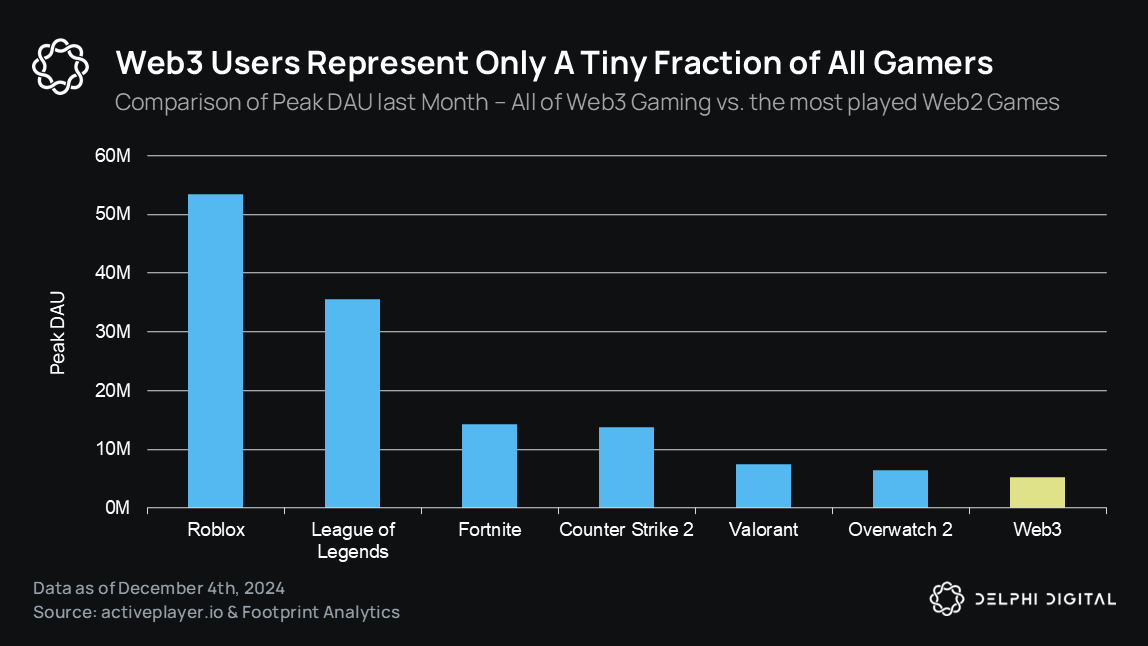

The user numbers of Web3 games have shown a slight but steady growth, with the total number of wallets tracking these games rising to 6 million. While bot activity may inflate these numbers, this growth trend highlights the expanding reach of Web3 games driven by ecosystems like TON and Ronin.

Playoffthegrid (OTG) was the biggest game release of 2024, achieving outstanding success and making AVAX a strong contender in the gaming space.

Currently, Adventureland is in open beta and scheduled for release in 2025, while AVAX is preparing its second premium game and has secured $100 million in funding.

After reaching a brief peak of 82 million transactions per day in July 2023, the daily transaction volume of Web3 games has stabilized at an average of 10-12 million. Since its launch, Playoffthegrid has contributed around 2.5 million transactions per day on the Avalanche subnet, recording a total of 199 million transactions.

Web3 Gaming & AI

Artificial intelligence will be the dominant theme in 2025, and we believe that gaming will play an increasingly important role in the future development of this industry. Gamification experiences, in addition to serving as the perfect testbed for AI primitives, will also help to improve engagement and introduce some much-needed token sinks. The teams that best understand the AI x Gaming equation will be most likely to become the leaders in this space, ensuring market share by providing highly compelling experiences for their associated communities.

Retail and Institutional Interests

In early 2024, there was a surge in the number of token listings, highlighting the mismatch between supply and user growth. With the issuance rate outpacing the adoption of cryptocurrencies, a small subset of buyers was overwhelmed by the abundance of investment choices, exposing the challenge of balancing supply and demand.

In 2024, the competition for player liquidity in Web3 gaming intensified, validating our predictions in last year's YA report. The oversaturation of networks has led to fierce competition for Web3 users, with only a slight increase in the number of Web3 users since the end of 2023. Combined with the struggles of Web2 UA, the limited Web3 audience has forced games and networks to aggressively compete for user attention and engagement.