Source: C Labs Crypto Observer

This research report is also from Chainalysis, which is invested by the FBI:

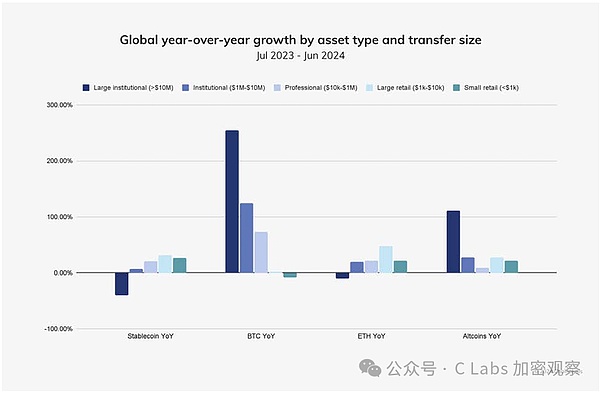

1. Global Trend: Whales Abandon Ethereum

This trend is actually very interesting. For the main capital with a transfer amount of more than $10 million, the decrease in stablecoins is normal, because these main forces are increasing their positions in BTC and Altcoins. However, the main forces have not increased their positions in ETH, but have even less holdings than last year!

Retail investors, on the other hand, are more inclined to buy ETH and Altcoins, and are selling their precious BTC to increase their positions.

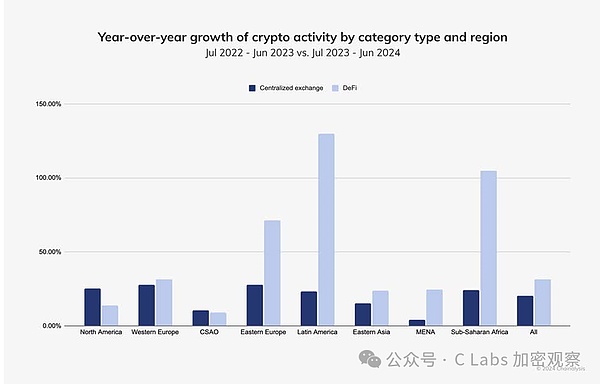

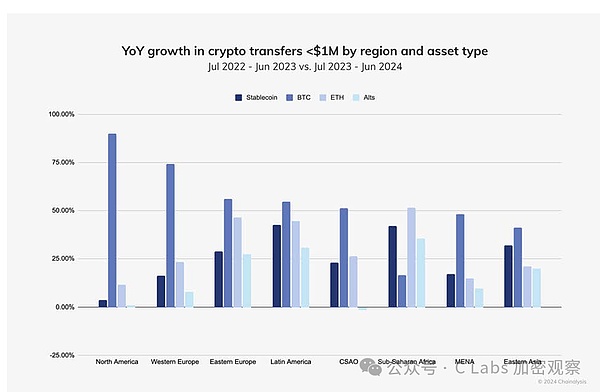

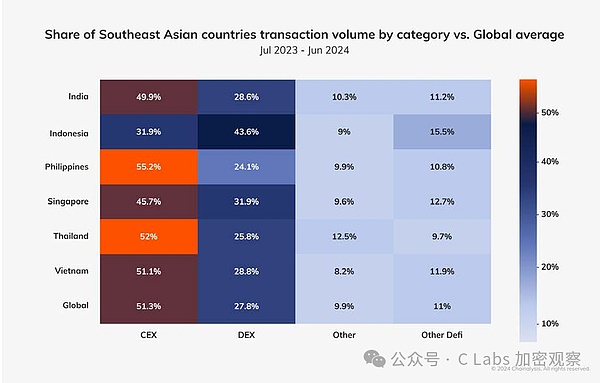

This year can be said to be a year of the great success of Dex (decentralized exchanges). In the vast majority of regions around the world, the growth of Dex has exceeded that of Cex (centralized exchanges).

Only in North America and Central and South Asia (CSAO, including India, Southeast Asia, and Australia), the growth of CEX can suppress DEX, which may be related to the compliance progress of CEX in 2024~

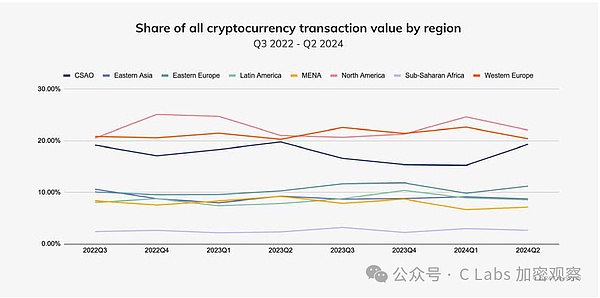

The global cryptocurrency market can be divided into three tiers by geography:

The first tier is North America, Western Europe, and Central and South Asia, each accounting for about 20% of the global market.

The second tier includes East Asia, Eastern Europe, Latin America, and the Middle East (including North Africa), each accounting for about 10% of the global market.

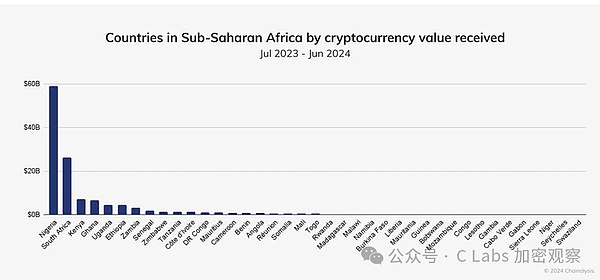

The last and unique tier is sub-Saharan Africa, accounting for less than 3% of the global market, which is a place that no one wants to fight over.

But in fact, a large part of the global liquidity is still in the hands of the Chinese, either using VPNs or scattered around the world, which cannot be statistically accounted for geographically.

Then let's take a look at the characteristics of each global region, starting with North America:

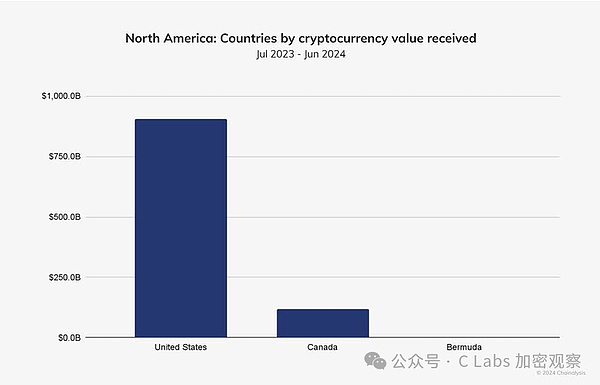

2. North America: The Global Pacemaker

But in fact, the cryptocurrency in Canada is also very powerful, mainly because it looks very sad compared to North America and the United States.

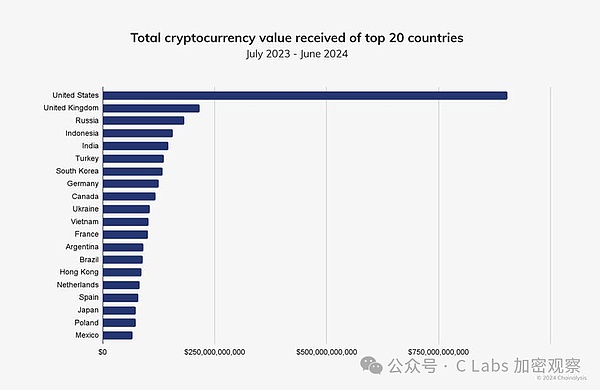

If we take out the global Top20, it would look like this:

Therefore, the key to the global cryptocurrency is the United States, which is in a league of its own. Canada can actually rank 8th globally, which is a pretty good market.

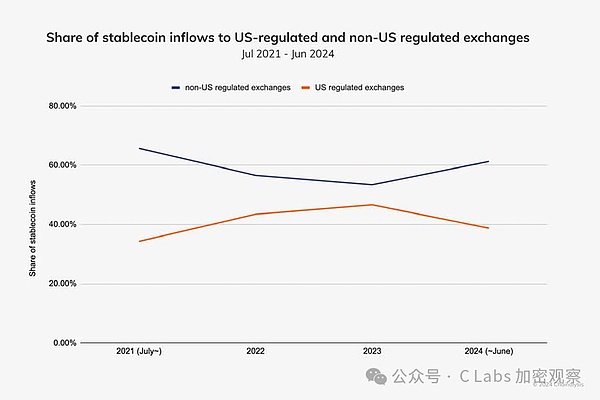

And there is an interesting phenomenon in the North American market: they don't really believe in compliance

In 2024, the share of compliance in the North American market will actually start to decline.

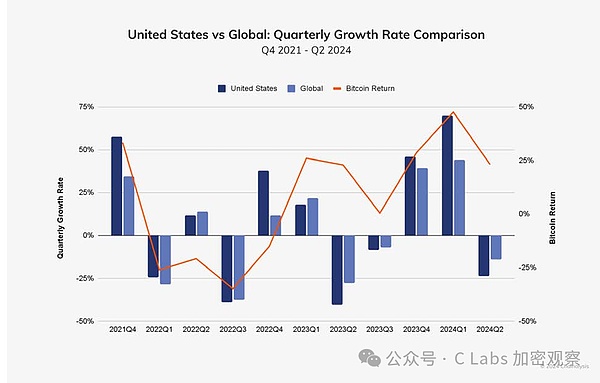

North America also becomes the global pacemaker because of the presence of the United States:

When the US rises, the world rises; when the US falls, the world cries.

3. Latin America: Cryptocurrency Rescues Inflation

Now let's take a look at Latin America, which is actually very interesting, because many people will focus on the progress in Argentina.

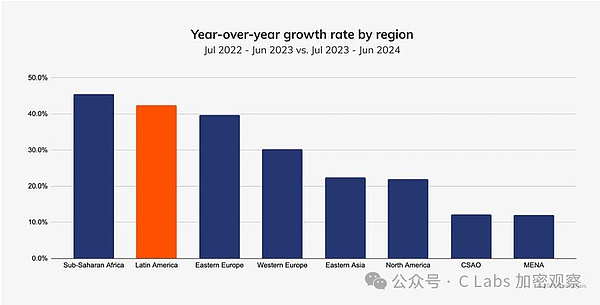

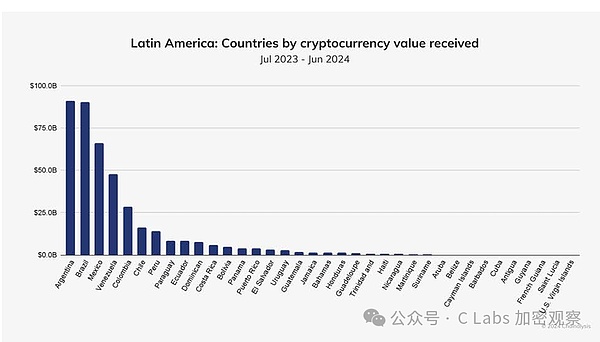

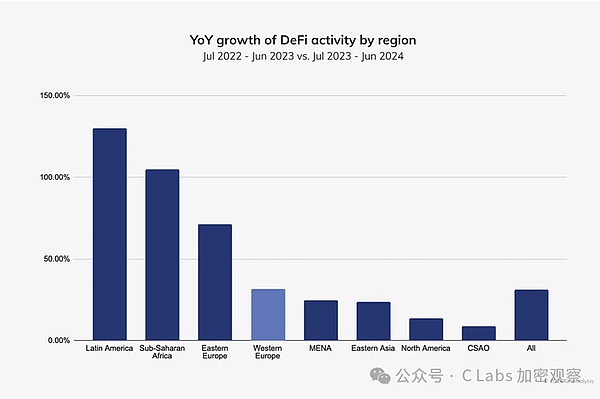

The Latin American market has the second highest growth rate globally, and considering that the first place, sub-Saharan Africa, has a very small base, the performance of South America is actually very impressive.

The Latin American market is mainly driven by the two South American giants: Argentina and Brazil

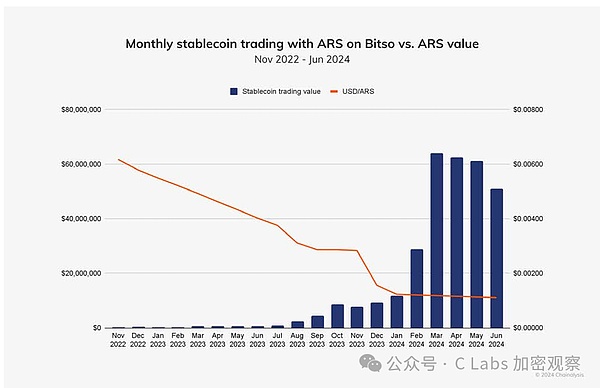

Let's take a look at what's going on in Argentina, where Milei's opening of cryptocurrency and dollar controls amid rampant inflation.

Although a large number of Argentine citizens have exchanged their Argentine pesos for stablecoins:

But from the exchange rate of the Argentine peso, it has been relatively stable in the past year:

It is possible that after years of suffering from inflation, the local people mainly exchange for stablecoins to preserve value, rather than for investment:

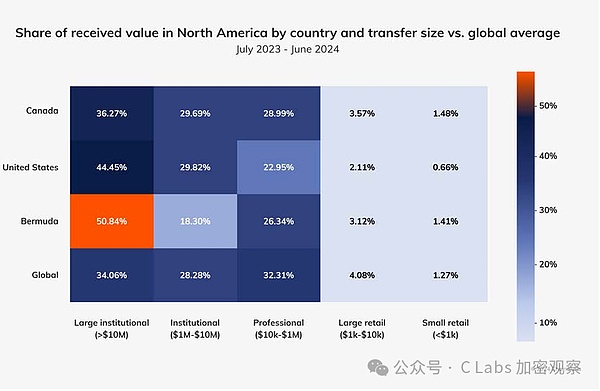

We can compare this to the affluent North America:

Especially in the tax haven of Bermuda, the richer the people, the more they like BTC.

While the Latin American countries with severe currency depreciation are more trusting of the US dollar.

4. Central and Western Europe: The Little Brother of North America

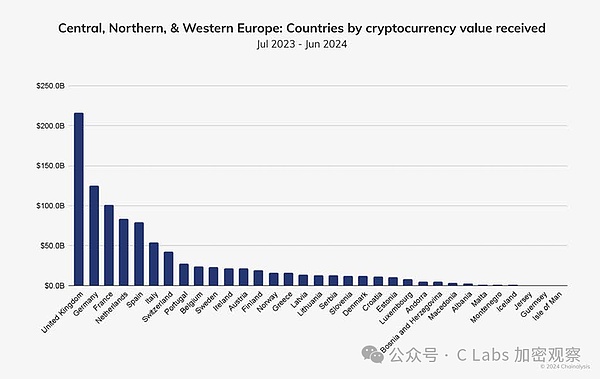

Let's shift our vision to Europe, where the UK is the big boss:

Overall, the investment preferences here are still quite similar to North America:

The whole world is showing this trend: the richer the place, the more they like BTC, and the poorer the place, the more they like Altcoins.

This on-chain mass adoption is mainly driven by the growth rate of users in developing countries, and Central and Western Europe are the most active regions in the developed world in embracing on-chain, with a growth rate barely keeping up with the global average.

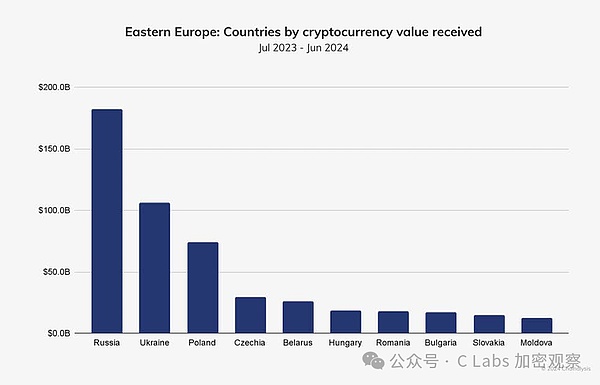

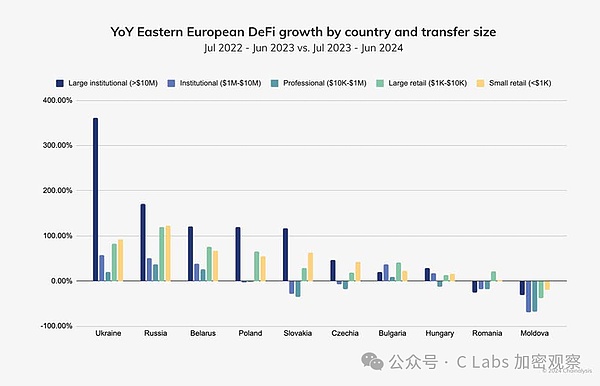

5. Eastern Europe: Growth Under the Shadow of the Russia-Ukraine War

The Eastern European region is also a focus of global attention, and everyone is very concerned about the market development under the shadow of the war.

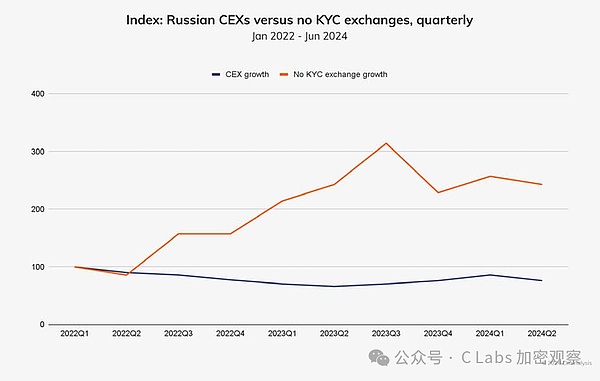

Although Russia has been excluded from SWIFT by the US, it is still maintaining connections with the world through cryptocurrencies.

Especially in Russia, many exchanges don't even require KYC, allowing local residents to avoid sanctions with peace of mind.

These non-KYC ones are mainly on-chain exchanges. As the country suffering the most from the war, large investors in Ukraine decisively transferred a large amount of assets on-chain in 2024, and we don't know how much of that was US aid~

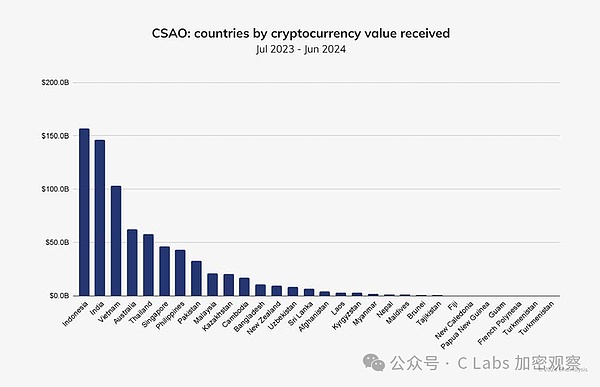

6. Central and South Asia and Oceania: The Most Vibrant Cryptocurrency Market

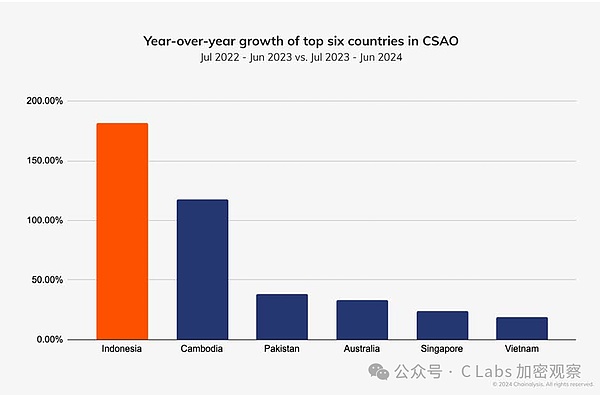

This region has a dense population, but the leader may surprise many people, and it's not India, but Indonesia!

With a population of 600 million, Indonesia has actually surpassed the 1.4 billion population of India in the size of the cryptocurrency market!

Ranking third is Vietnam, with a population of just over 100 million.

Followed by Australia, Thailand, Indonesia, and the Philippines.

Malaysia, which the Chinese teams love, is actually ranked behind Pakistan, which is really surprising.

Why is this region the most vibrant? Because the development of each country has its own characteristics.

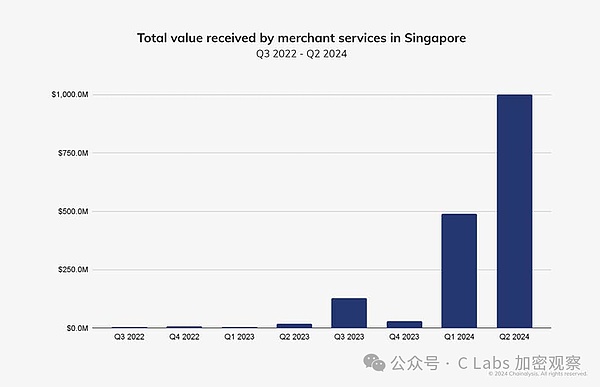

For example, Singapore is focusing on institutional services:

While Indonesia has relied on some mysterious power to achieve over 180% growth year-on-year, surpassing India to become the regional champion:

Why do we say Indonesia's power is mysterious?

Because most of their funds are online, rather than the centralized exchanges that usually require real-name authentication.

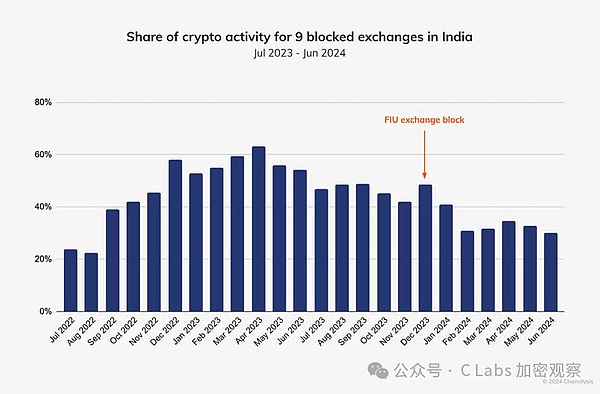

As for why India lost the regional championship, it's because in December 2023, India blocked 9 exchanges in the name of local compliance:

The restricted exchanges include: Binance, HTX (formerly Huobi), Kraken, gate.io, Kucoin, Bitstamp, MEXC, Bittrex, and Bitfinex.

7. East Asia: Rapid Growth in Hong Kong

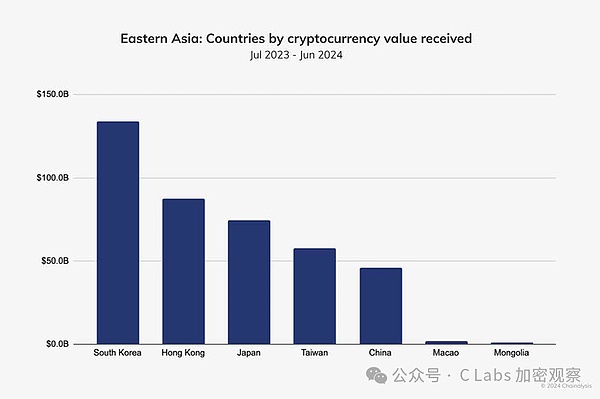

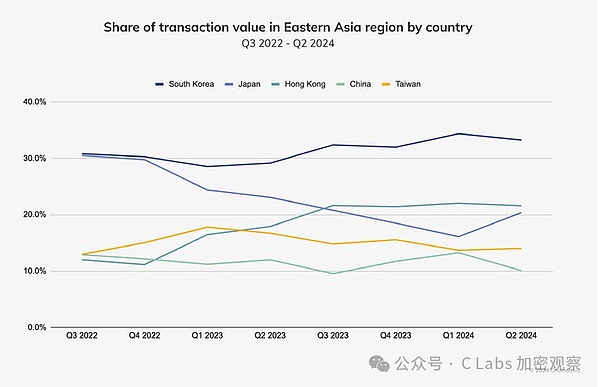

After China's hidden champion walked around the world, South Korea became the regional champion.

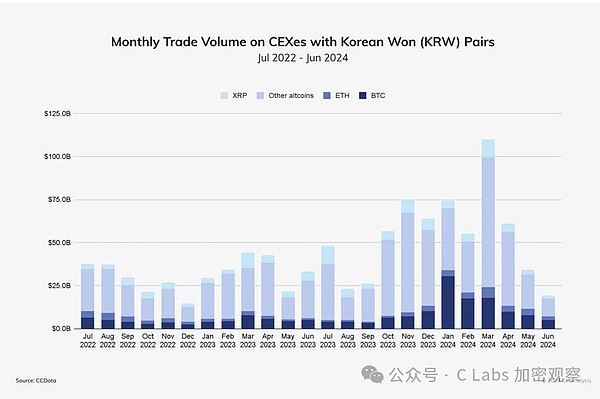

And the Koreans are indeed powerful in CX, they are the only major country in the world where the trading volume of XRP is larger than ETH, and even surpasses BTC in some months.

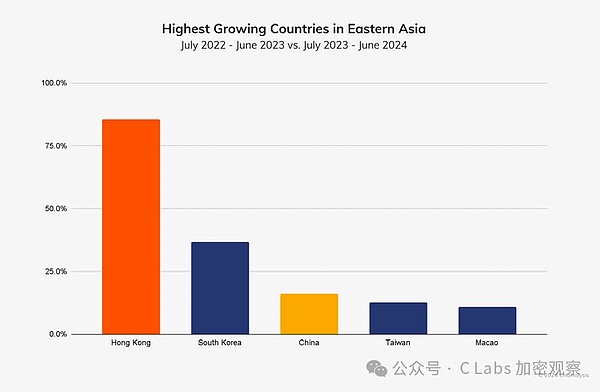

Hong Kong, on the other hand, has surged from 5th place in 2022 to 2nd place, thanks to its new cryptocurrency policies, outperforming Japan and Taiwan.

The annual growth rate is close to 100%

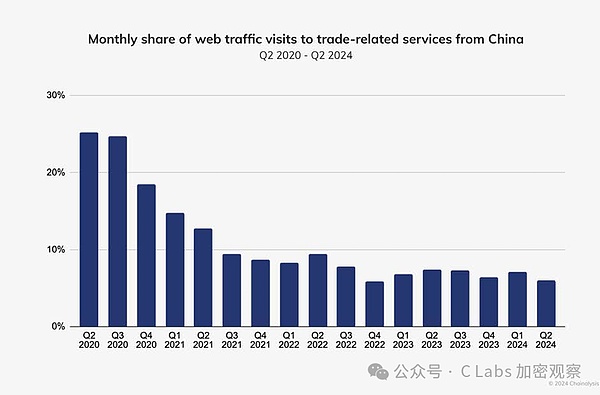

Although Hong Kong is implementing an open cryptocurrency policy, on the other hand, Hong Kong's defense against the mainland is becoming stricter:

The transaction-related traffic from the mainland area has seen a significant decline in 2024 compared to previous years.

And the mainstream exchanges have indeed withdrawn from Hong Kong:

8. Middle East and North Africa: Crypto Saves Inflation Again

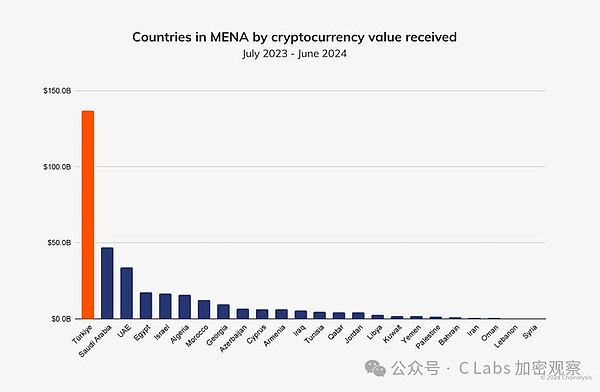

Many people think this region is the domain of Middle Eastern oil tycoons, but that's not the case. The champion is Turkey, which is suffering from hyperinflation, and it's a runaway leader:

So inflation is the best advertisement for cryptocurrencies.

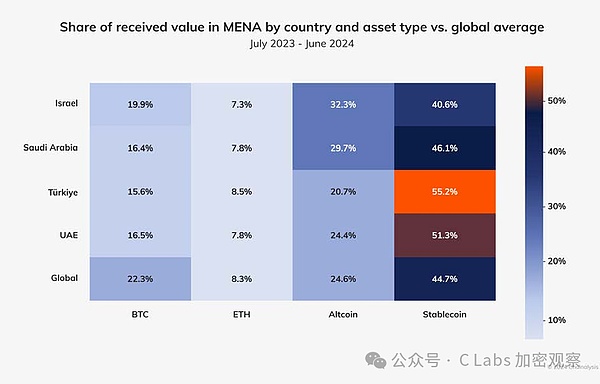

And just like in South America, Turks particularly love stablecoins:

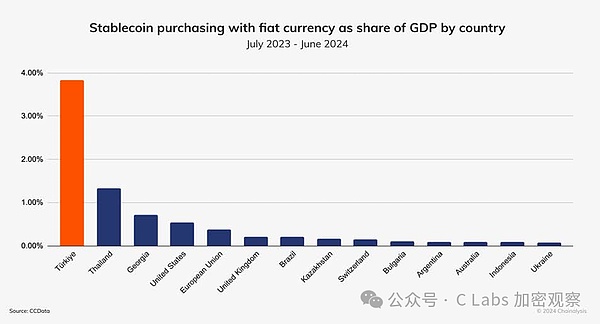

The Turkish people have even replaced 4% of the country's GDP in Lira with US dollar stablecoins:

But interestingly, the exchange rate of the Turkish Lira remained stable in 2024:

So one has to admire the amazing regulatory power of the free market.

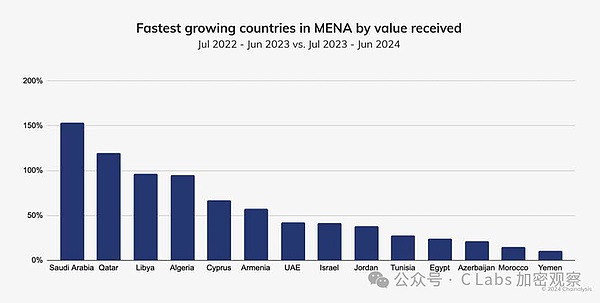

Additionally, the Middle Eastern tycoons are not without strength, they just reacted a bit slowly, and only started entering the market in 2024:

Saudi Arabia and Qatar both saw market growth rates exceeding 100% this year.

9. Sub-Saharan Africa: Fastest Global Growth

The champion in this region is Nigeria, followed by South Africa, while the market size of other countries can be temporarily ignored.