Anton Tkachev, a member of the State Duma of Russia from the New People party, has proposed the strategic accumulation of Bit to strengthen the financial stability of the country.

According to local reports from Moscow, Tkachev officially submitted this proposal to Anton Siluanov, the Minister of Finance.

Will Russia Also Review a Bit Accumulation Plan, Following the US?

In his proposal, Tkachev emphasizes the limitations of traditional currency reserves such as the Dollar, Euro, and Yuan. He mentions that these assets are vulnerable to inflation and international sanctions.

Tkachev also argues that Bit accumulation can serve as an independent alternative, free from the influence of any particular country.

"Dear Anton Germanovich, I request that you evaluate the possibility of making Bit strategic reserves in Russia similar to the state reserves of traditional currencies. If this proposal is approved, I will submit it to the Government of the Russian Federation to request further implementation." (The original text is in Russian)

Russia seems to be considering a more lenient stance on crypto regulation. This may be driven by the regulatory changes in the US following Trump's re-election in early November.

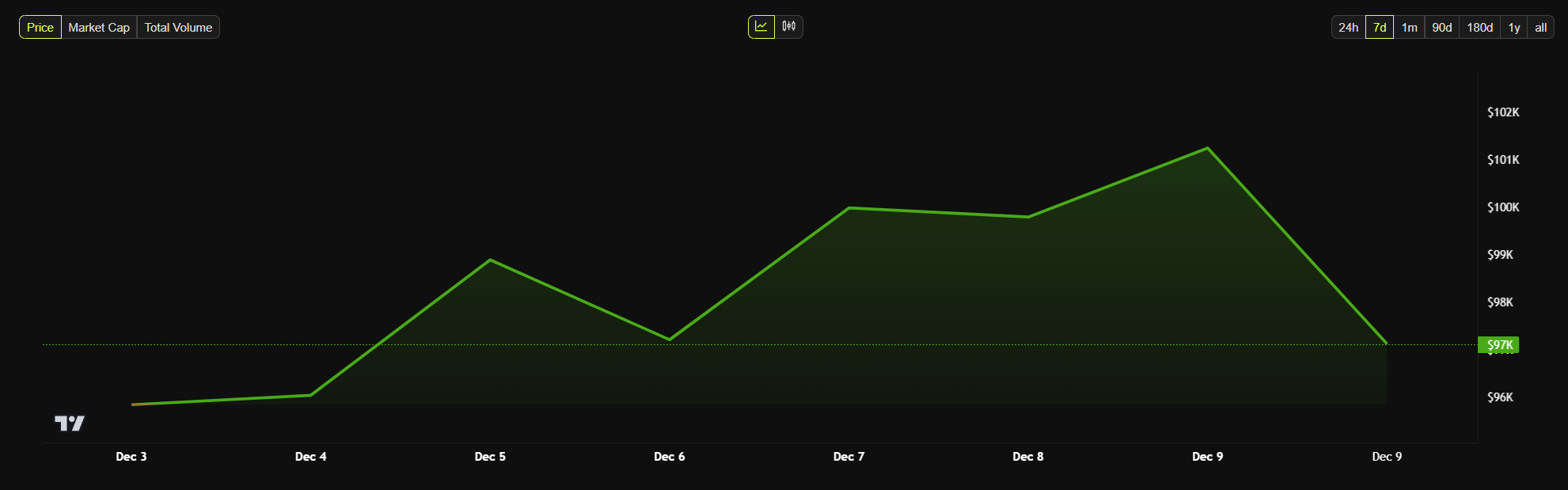

Last week, President Vladimir Putin publicly stated that no one can ban Bit, and it will continue to evolve. This was the final push needed for Bit to reach $100,000 after hovering around $95,000 for a month.

Putin Optimizes Crypto Regulation

In terms of taxation, Russia has recently introduced significant changes to crypto regulation. Crypto transactions are now exempt from value-added tax (VAT). Instead, profits from crypto activities are subject to a 15% personal income tax, similar to securities.

Earlier this year, Russia legalized Bit and crypto mining, a significant regulatory change. However, there are still mining restrictions in certain regions.

Mining is prohibited in the occupied Ukrainian regions of Donetsk, Luhansk, Zaporizhzhia, and Kherson. Siberia has seasonal mining restrictions from December 2023 to March 2031 for power demand management.

Meanwhile, the idea of national Bit reserves is gaining global attention. In the US, Pennsylvania has proposed a bill to allocate 10% of state funds to Bit, as a hedge against inflation and a means of investment diversification.

There is also strong optimism that Trump will establish a national Bit reserve after his inauguration in January. Investment firm VanEck has also joined the campaign supporting the adoption of Bit as a reserve asset.

El Salvador stands out as a pioneer in this field. The country, which established a strategic Bit reserve in 2021, currently holds over $554 million in Bit, with unrealized gains of around 120%.