Author: Ciaran Lyons, CoinTelegraph; Compiled by: Tong Deng, Jinse Finance

After the entire cryptocurrency market plummeted on the daily chart, traders may have more time to take advantage of the buying opportunities of this cycle.

Daniel Cheung, co-founder of Syncracy Capital, said in a post on December 9: "There will be volatility within the month, but the pullback may be a 'buy the dip' scenario that lasts much longer than anyone expects."

Traders "Constantly Seek to Realize Profits"

In this cycle, traders have shifted to a "short-term" trading mentality, "constantly seeking to realize profits." According to CoinMarketCap data, the total cryptocurrency market capitalization fell 5.41% to $344 billion in the past 24 hours.

Cryptocurrency analysis firm Santiment emphasized in a post on December 9 that several Altcoins that had risen sharply since October "crashed today".

Among the top 100 cryptocurrencies, the biggest 24-hour drop was Kaia (KAIA) at 31.3%, Stellar at 28.3%, and Flare at 26.9%.

Santiment said if retail traders "react out of fear" and sell cryptocurrencies too quickly, it could trigger a radical market recovery.

"Assets like TRX, AVAX, DOT, ICP, POL, FIL and TIA are expected to rebound quickly."

Pav Hundal, chief analyst at Swyftx, pointed out that the overall cryptocurrency market pullback "looks like a flash in the pan" and added:

"Traders had heavily bought long leveraged positions before the crash. Once spot market liquidity disappeared, they found themselves in trouble."

He added: "In the past 24 hours, long leveraged positions have experienced an event equivalent to the market's extinction."

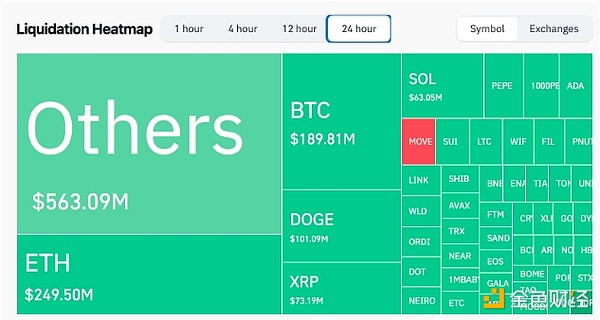

According to CoinGlass data, about $1.58 billion in long positions were liquidated across the cryptocurrency market in the past 24 hours.

About $1.58 billion in long positions were liquidated across the cryptocurrency market in the past 24 hours. Source: CoinGlass

Timing the Cryptocurrency Market is "Extremely Difficult"

Cheung said, "Timing the market is extremely difficult."

"In previous cycles, participants were mostly in a hold-and-buy-the-dip mentality," he said.

"The reality is that timing the market is extremely difficult, and now that so many people believe they can predict the 'top' of cryptocurrencies, I believe the uptrend in cryptocurrencies will last much longer than expected," Cheung said.

A Bitfinex analyst recently said that the short-term decline in Bitcoin prices may not be as deep as the 10% crash last week, as selling pressure has eased significantly since Bitcoin first broke above six figures.

The Bitfinex analyst said on December 9: "Given the significant reduction in realized profits and selling pressure, we can expect future declines to not be as sudden as last week."