The price of Bitcoin (BTC) fell to $94,150 on the morning of the 10th. The total liquidation amount exceeded $1.7 billion, and at the time of writing, BTC is still not fully recovered and is hovering around $97,000.

The cryptocurrency market is tense ahead of several major U.S. economic events this week.

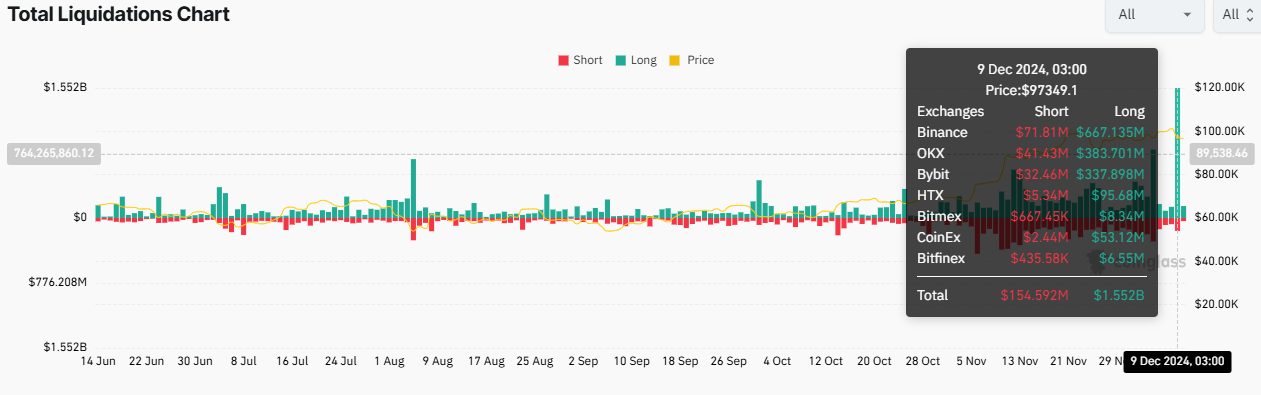

Total Cryptocurrency Liquidations Exceed $1.7 Billion

According to Coinglass data, 583,530 traders were liquidated in the last 24 hours. The total liquidation amount exceeded $1.7 billion. Of this, at least $1.552 billion was long positions, and $154.59 million was short positions.

The massive liquidations occurred after the recent correction in Bitcoin. The leading cryptocurrency recorded an intraday low of $94,150 on the Binance exchange.

The liquidation event has shocked traders and investors, but the market is both optimistic and skeptical. Nevertheless, the popular user Unipcs of X urges caution.

"... [This] was the largest long liquidation event since 2021. Such large-scale liquidation events almost always mark the bottom. This is not the time to panic sell. Nor is it the time to be too greedy or rush to build up leverage. This may be a good time to start scaling up positions with high conviction in spot, to prepare for the next aggressive upward move." - Unipcs, X user

Indeed, caution is warranted given the expected impact of this week's U.S. economic data releases. As reported by BeInCrypto, the U.S. Consumer Price Index (CPI), weekly employment data, and Producer Price Index (PPI) this week could influence Bitcoin sentiment. These U.S. macroeconomic data will reveal the state or health of the U.S. economy.

However, for some, the massive liquidations provided a "healthy cleansing" that cleared the funding ratios of all altcoins. This means that a significant number of leveraged positions were forcibly liquidated due to the sharp market decline.

"The funding ratios of all altcoins have been cleanly reset. This was a healthy cleansing." - Seth, cryptocurrency analyst

Funding ratios are a mechanism used by exchanges to ensure that the perpetual futures market price aligns with the spot market price. The liquidation of many leveraged positions can cause extreme volatility and price distortions in the market. In many cases, this resets the funding ratios to a neutral level.

Analysts believe that such events help remove excessive leverage, speculative positions, and weak hands from the market. This paves the way for healthier and more sustainable price movements in the future. The market can find a more stable footing for growth without the burden of excessive speculation driving the prices.

According to BeInCrypto data, at the time of writing, BTC is trading at $96,682, down nearly 3% since the start of the Tuesday session.