Author: BitpushNews

The cryptocurrency market continued to adjust on Tuesday.

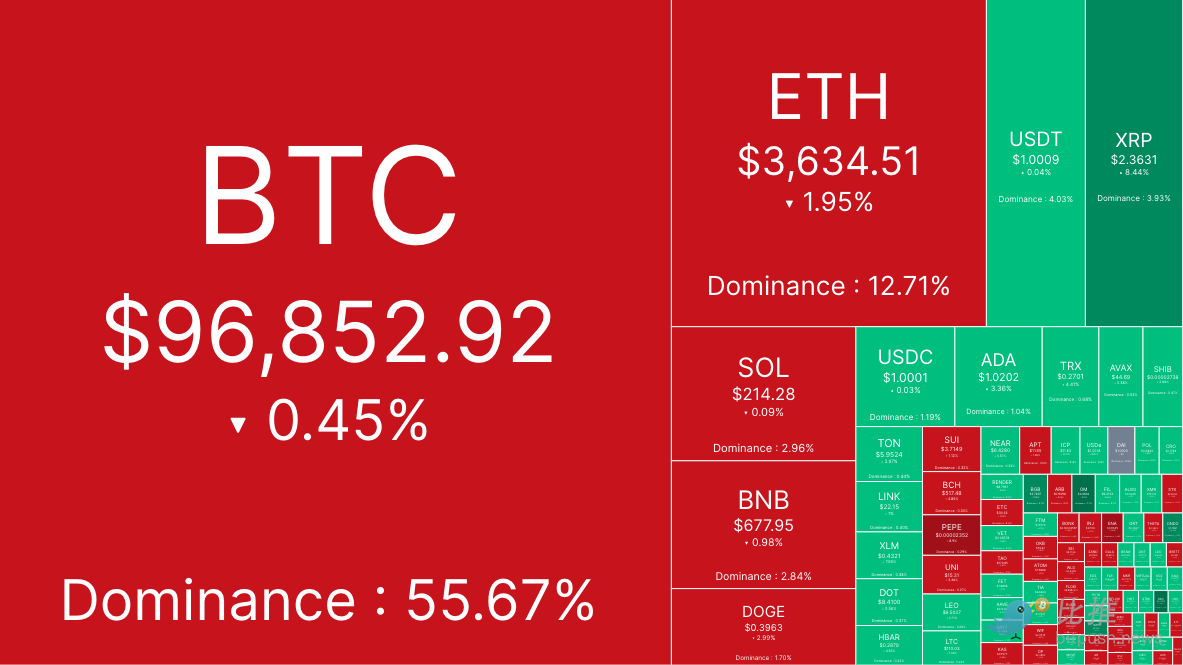

Bitpush data shows that BTC fell 0.45% in the past 24 hours, maintaining above $96,000 as of the time of writing. Altcoins generally fell, while among the established coins, XRP bucked the trend, rising nearly 8% in 24 hours.

Ruslan Lienkha, market manager at Youholder, said the overall market pullback may be in anticipation of the inflation data to be released on Wednesday. He said: "The market expects inflation to rise slightly. However, if the CPI data released is higher than expected, it may exacerbate the ongoing adjustment in the financial markets. In this case, the timing and possibility of the Fed's rate cut will become a key focus for the new year."

"The market is not very confident"

Skew, a famous trader on X, commented: "It looks like the bulls are exiting/taking profits here. Further confirming that $97,700 - $98,000 is a key level for buyers to recoup their costs. This usually means the market is not very confident about the price at the moment, until the price strengthens further."

The crypto technical analysis team More Crypto Online warned that there could be another local low after reaching $94,000 the previous day. Their latest X tweet said: "There is still a possibility of another low. After another low, the white wave d may test $100,000 again."

Bitcoin ETFs unaffected by BTC price fluctuations

Farside Investors data shows that the daily net inflows into US spot Bitcoin exchange-traded funds (ETFs) have continued to reach millions of dollars, with the total inflows on December 9 alone approaching $500 million.

In its latest market report on its Telegram channel, trading firm QCP Capital wrote: "Bitcoin suffered a $150 million hit in long liquidations, plunging $3,000, before rebounding from the key $95,000 support. Currently, the pair is consolidating around $97,000-$98,000, with Altcoins following suit. However, BTC and ETH spot ETFs have been impressive, with net inflows for 8 and 11 consecutive days respectively."

How will the market go from here?

The current market sentiment indicates that the upward trajectory of Bitcoin is far from over. Analysts such as Doctor Profit believe that the recent sideways consolidation is just a temporary pause, and the price of Bitcoin is likely to break through the target of $125,000 to $135,000.

Historical data shows that the price cycles of Bitcoin are quite evident. In past major bull markets, Bitcoin has experienced multiple 20%-30% corrections, only to rebound strongly and reach new highs.

As for Altcoins, Michaël van de Poppe believes that Altcoins are about to emerge from the longest bear market. He believes that with the expected weakening of the US dollar and increased liquidity, Altcoins seem poised for a big rally.

A chart released by Kaizen shows that if compared to the situation in December 2020, when Altcoins fell 30% and then experienced a three-month rebound of over 400%, the recent 25% drop in Altcoins may be a harbinger of explosive growth, if historical data is used as a reference.