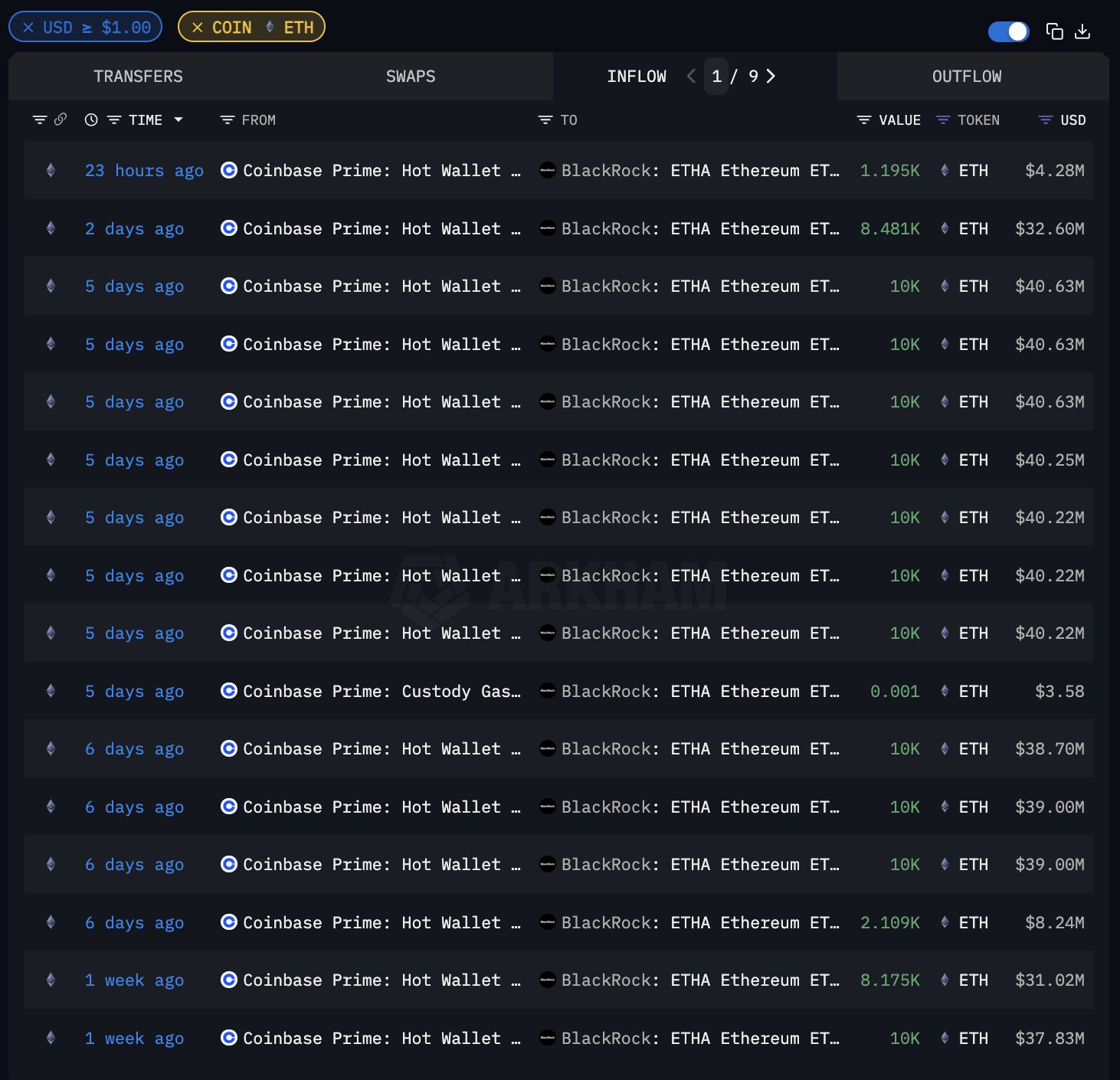

According to data from the Arkham cryptocurrency data tracking platform, the exchange-traded funds (ETFs) of the financial conglomerates BlackRock and Fidelity have purchased $500 million worth of Ethererum in the past two days.

Both companies primarily execute trades through the Coinbase cryptocurrency exchange or the Prime cryptocurrency service platform, according to Arkham data.

BlackRock's (ETHA) and Fidelity's (FETH) Ethereum ETF Spot are the leading ETFs with record capital inflows on November 30. Accordingly, as of December 10, ETHA and FETH have attracted trading volumes of $372.4 million and $103.7 million, respectively.

The U.S. Securities and Exchange Commission (SEC) approved 8 Ethereum ETF Spot funds, including funds from BlackRock and Fidelity, on May 23.

Currently, Ethereum is trading at $3,830. The token price has increased by 5.1% and generated a trading volume of $39.3 billion in the past 24 hours.

VIC Crypto summary

Related news:

Binance "partners" with Circle to expand USDC globally

Binance "partners" with Circle to expand USDC globally

Solmap - Bitmap Version 2.0 on Solana is being shilled by Magic Eden

Solmap - Bitmap Version 2.0 on Solana is being shilled by Magic Eden