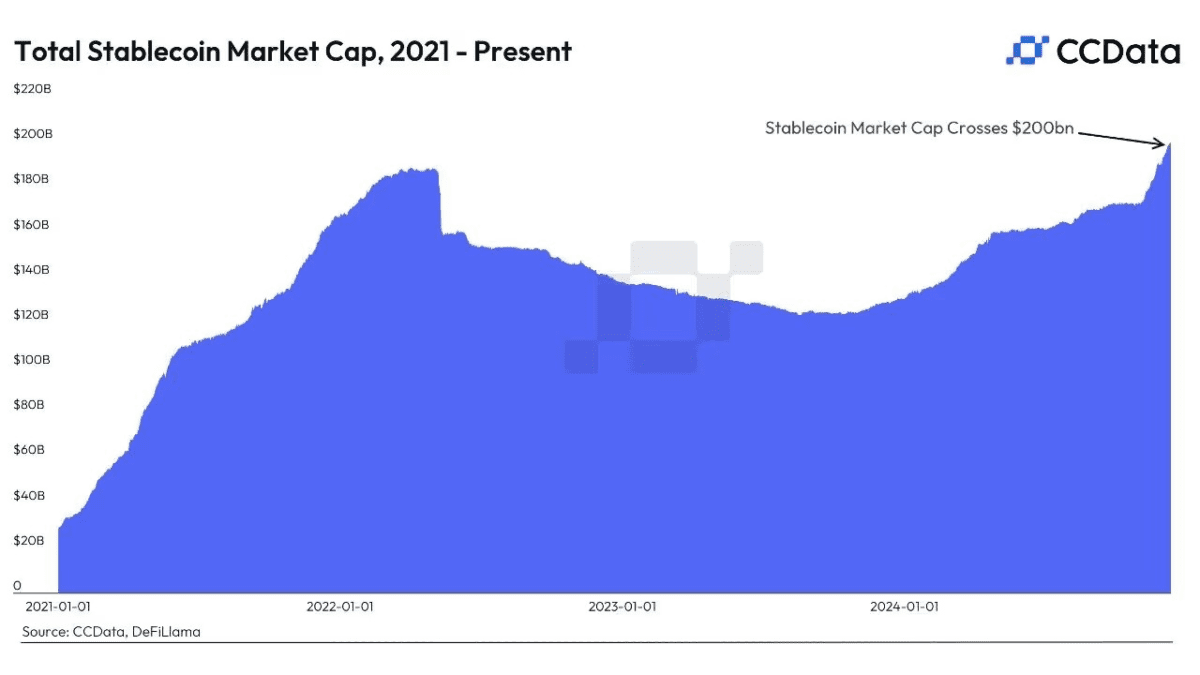

As the demand for stablecoins increases and adoption expands, the total market capitalization of stablecoins surpassed the $200 billion milestone on Wednesday. According to data from CCData and defillama, the stablecoin market has grown by an additional $10 billion in market value over the past two weeks, exceeding the $190 billion record set earlier this year.

As the cryptocurrency market emerges from the bear market, the demand for stablecoins has steadily grown over the past year. Following the victory of crypto-friendly Donald Trump in the previous month's election, the growth of stablecoins has accelerated significantly, with their supply increasing by nearly $30 billion since November 6.

Data from defillama shows that the largest stablecoin by market capitalization is Tether's USDT, with a supply of around $140 billion, up approximately 12% in the past month. On December 10, Tether announced that the Financial Services Regulatory Authority (FSRA) of Abu Dhabi has recognized USDT as an "Accepted Virtual Asset" (AVA) in the Abu Dhabi Global Market (ADGM).

The second-largest stablecoin by market value is USDC, issued by Circle, which has also grown by around 12% in the past month, reaching approximately $41.6 billion. Circle recently established a new strategic partnership with the cryptocurrency exchange Binance to drive the global adoption of USDC.

Actual adoption in payments, savings, and other use cases also helps drive stablecoin growth

In addition to the growth of the cryptocurrency market, the actual application of stablecoins has also contributed to the expansion of this asset class. A report published in September this year shows that the use of stablecoins for payments, remittances, and savings is increasing, particularly in developing countries with rapidly depreciating local currencies and fragile financial systems.

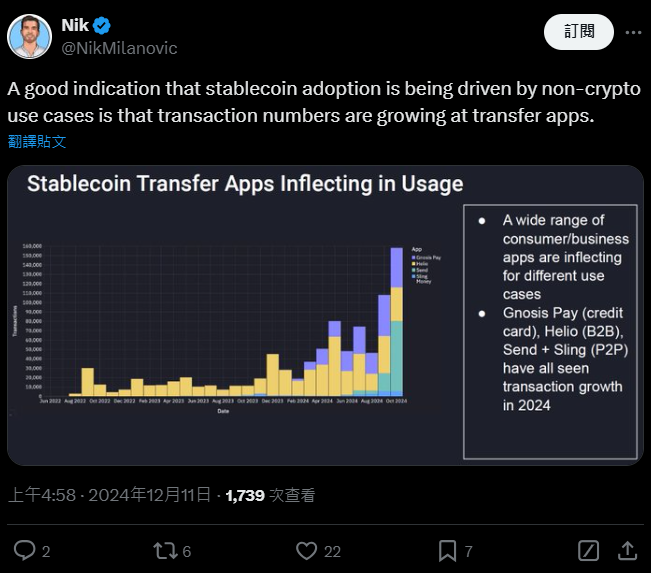

Nik Milanovic, a partner at Fintech Fund, noted that a sign of stablecoin adoption in non-crypto use cases is the rapid growth in stablecoin transactions on money transfer apps, including peer-to-peer payment platforms.

Price-stable, yield-generating tokenized products are also popular. According to defillama, the stablecoin protocol Ethena's USDe, which generates yield by short-selling BTC and ETH perpetual contracts, has grown by nearly 88% in market value over the past month, reaching $5.6 billion and becoming the third-largest stablecoin. The stablecoin USD0 of the emerging DeFi protocol Usual has also surged to $790 million, doubling in size over the same period.

Bitwise predicts stablecoin market cap will double next year

In a report released on Tuesday, digital asset management firm Bitwise predicted that the stablecoin market size will reach $400 billion by 2025, with one key catalyst potentially being the long-awaited passage of stablecoin legislation in the U.S. Congress, which would define rules for businesses and institutions to issue and interact with stablecoins.

The report added that other growth catalysts include popular fintech apps integrating stablecoins into their services, following the example of Paypal's PYUSD stablecoin, as well as the increasing role of stablecoins in global payments and remittances.

Bitwise is not the only one making bullish predictions about stablecoins. In a report last month, Standard Chartered and its digital asset brokerage Zodia Markets forecast that stablecoin adoption will grow significantly, potentially accounting for 10% of U.S. M2 transactions in the future.