Author: Delphi Digital

Compiled by: TechFlow

In 2024, the cryptocurrency market was at a critical juncture: while Bitcoin (BTC) performed strongly, the overall market performance was sluggish until regulatory changes towards the end of the year brought new hope.

The story of cryptocurrencies is being rewritten, and 2025 will usher in a new beginning that may unify the market. Here are the directions for future development.

This report reviews the market's annual performance, revisits our previous predictions, and highlights our outlook for next year.

Read the full 2025 Market Outlook.

Cycle strategy on track

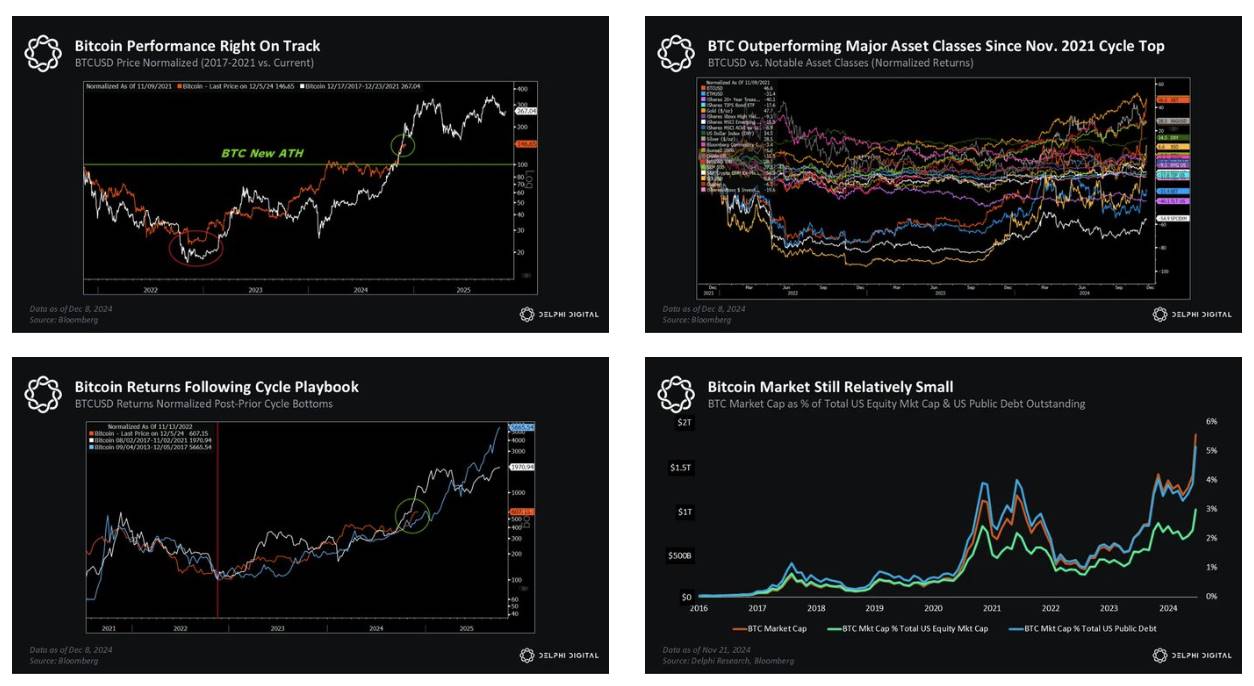

At the end of 2022, we analyzed the reasons why the bear market bottom may have passed.

15 months ago, we began to firmly express confidence in this bull market cycle. Last year's report predicted that BTC would reach a new high in Q4 2024.

At the macroeconomic level, the actual situation is consistent with our expectations.

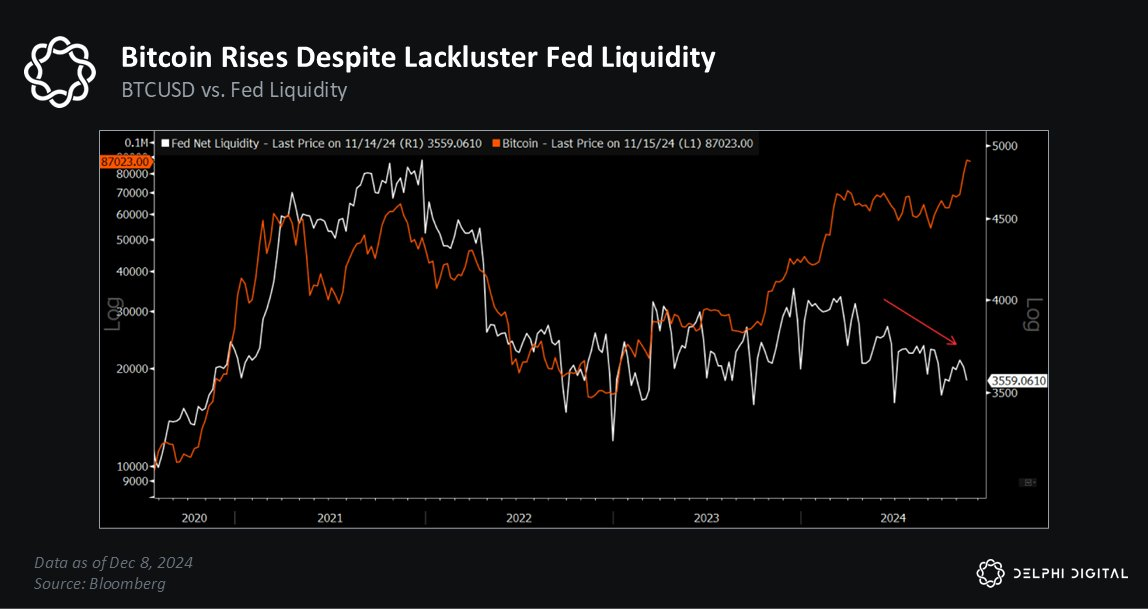

Currently, we understand that the Bitcoin halving is not the main driver of the cryptocurrency market cycle, but the liquidity cycle plays a key role.

At the end of last year, we pointed out the favorable conditions for BTC to ensure a strong first-quarter performance - one of which was the surge in global liquidity we saw in Q4 2023.

We also warned that the market may face higher correction risks from the end of Q1 2024 to the beginning of Q2.

This is because we have observed signs of weakening liquidity momentum in the two major central banks.

BTC has risen over 130% so far this year - and this has been achieved without much support from the Fed.

In fact, the Fed's liquidity has been steadily declining over the past 9-10 months.

Return of optimism

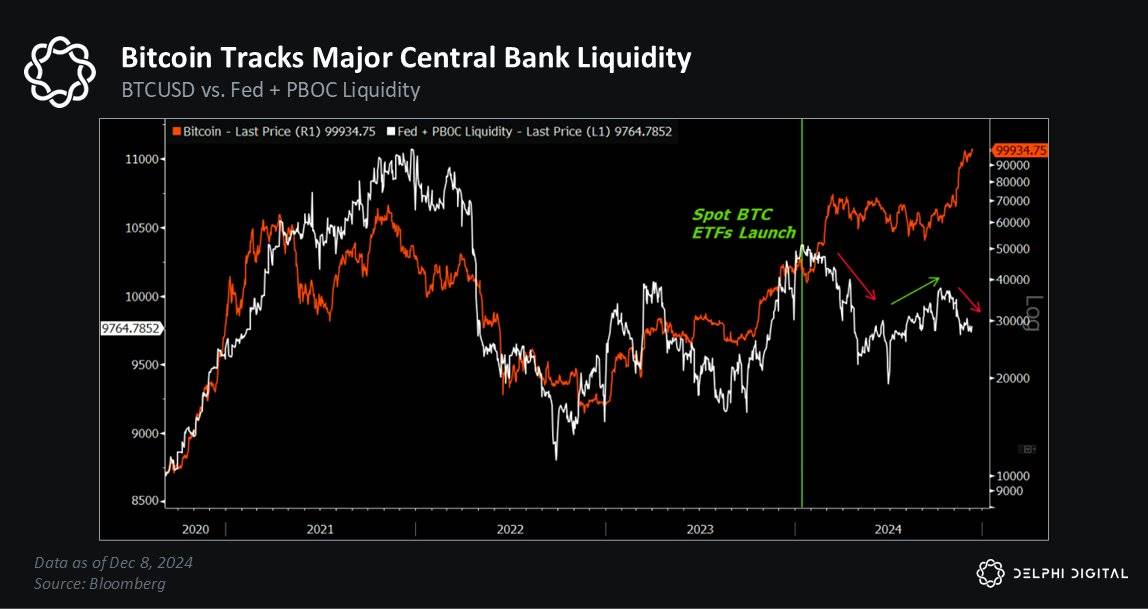

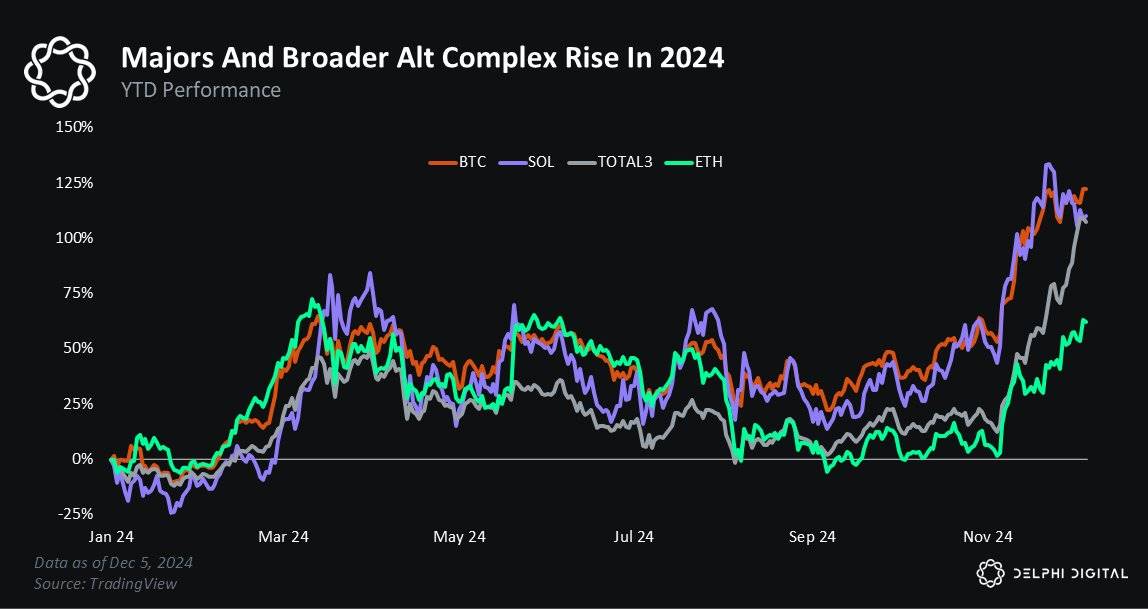

2024 was an unusual year for the cryptocurrency market. On the one hand, most major coins have recovered to historical highs, and the Altcoin market has also performed well overall.

But on Crypto Twitter, many people were in heated debates for most of the year. While Crypto Twitter often exhibits neuroticism, the negative sentiment in 2024 contrasted sharply with the positive price trend.

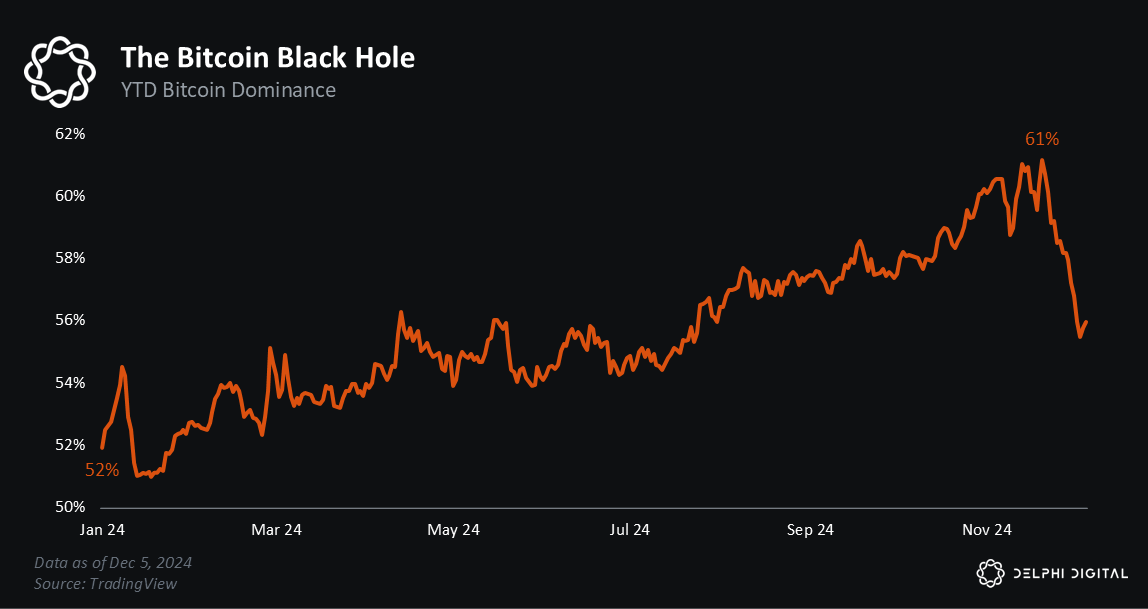

What is the reason for this contrast? First, it is the dominance of Bitcoin: the BTC price has risen 130% so far this year, reaching its highest dominance in three years.

Another reason for the negative sentiment is the divergence in market performance: some coins have risen, some have risen slightly, but most have fallen or remained unchanged.

Although Bitcoin has risen by more than 100%, in an overall declining market, some coins have still achieved significant success, showing the disparity in market performance.

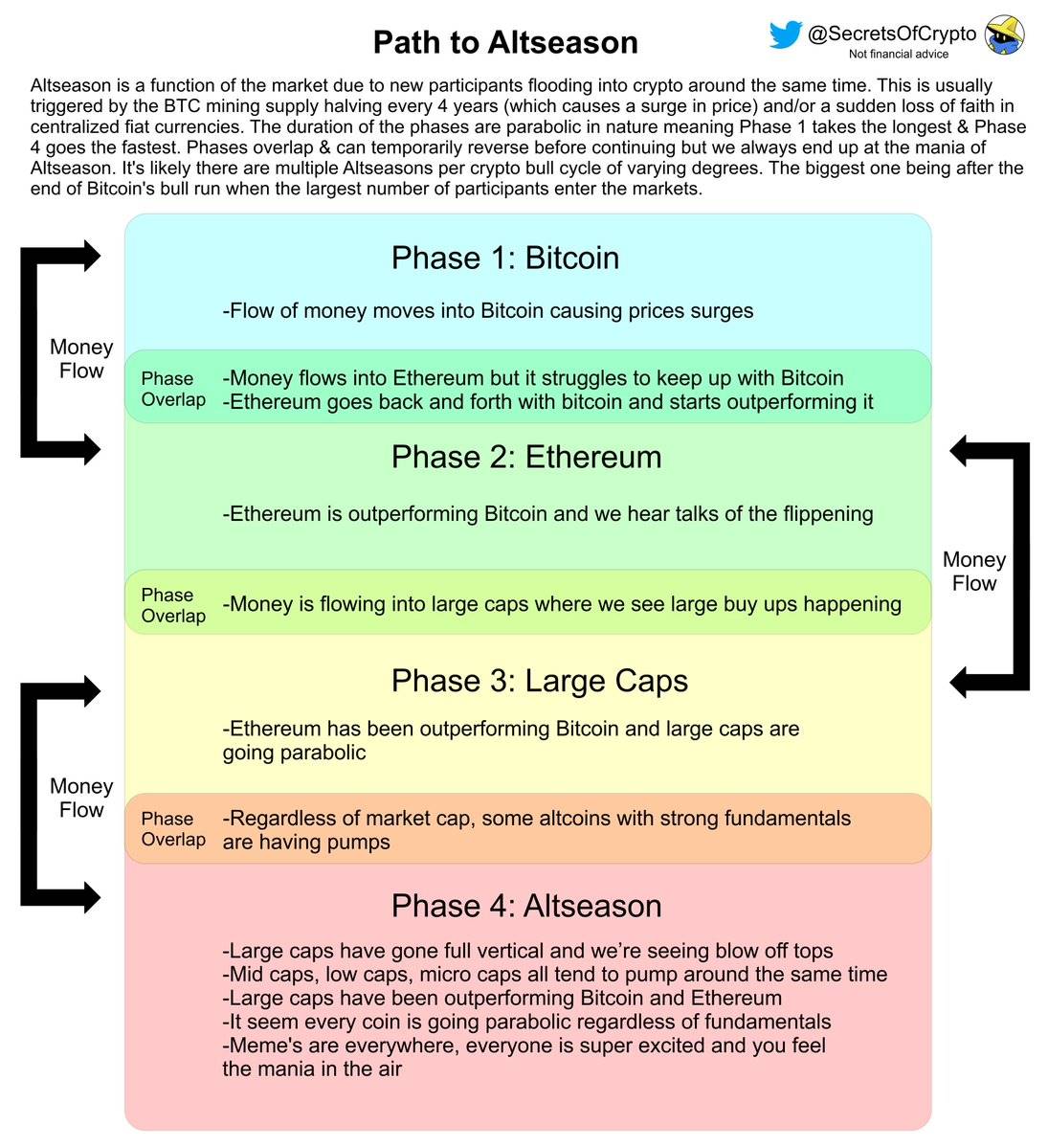

The classic "path to Altcoin season" that many had hoped for did not materialize.

Missing ingredients

As we have mentioned in many of our reports over the past year, the cryptocurrency market is facing a huge supply-demand imbalance.

In short, the demand for cryptocurrencies has not kept pace with the overall growth in cryptocurrency supply. But why?

Excessive token supply

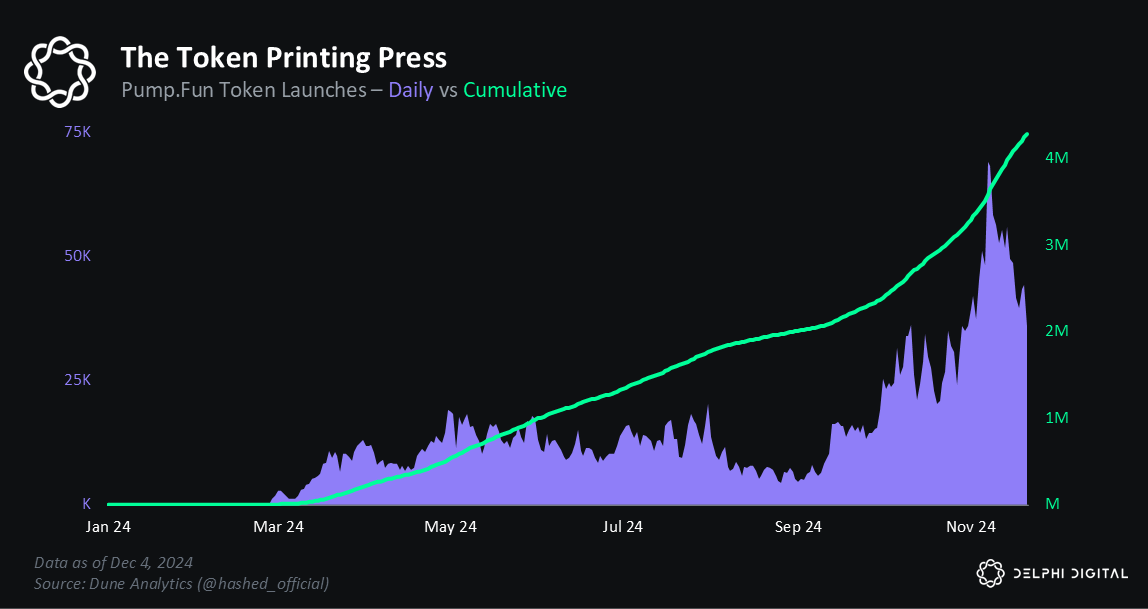

Aggregators list over 10,000 tokens, up from around 1,500 in 2017, a 10-fold increase.

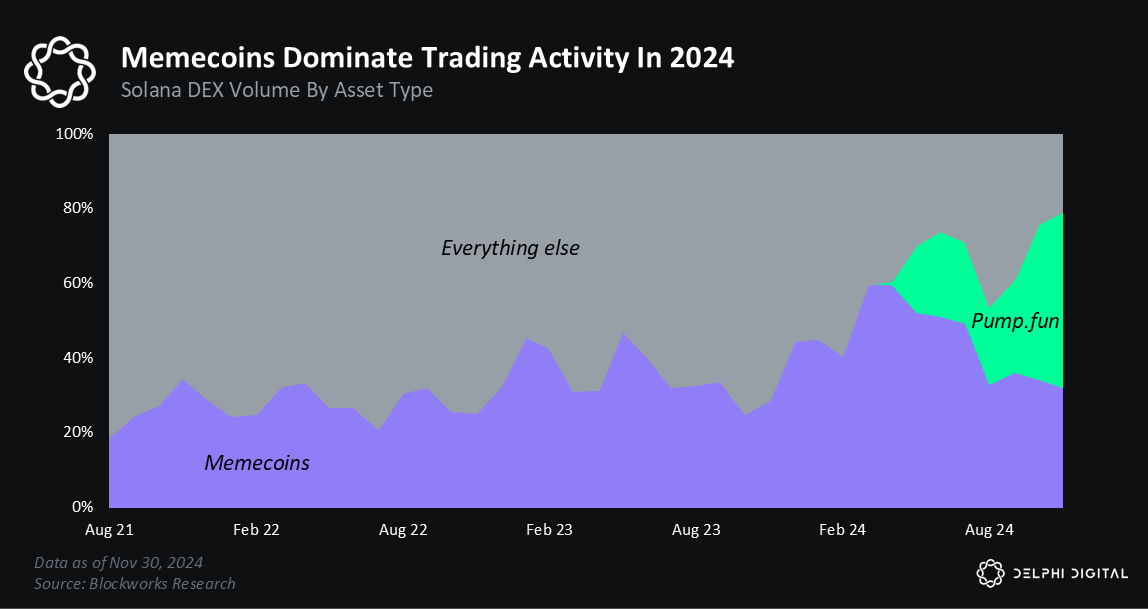

Apps like pump.fun have made token creation easy: over 4 million tokens have been issued since January 2024, with Solana's Raydium alone issuing over 50,000 tokens.

Continuation of Meme, pivot to fundamentals... or a combination of both?

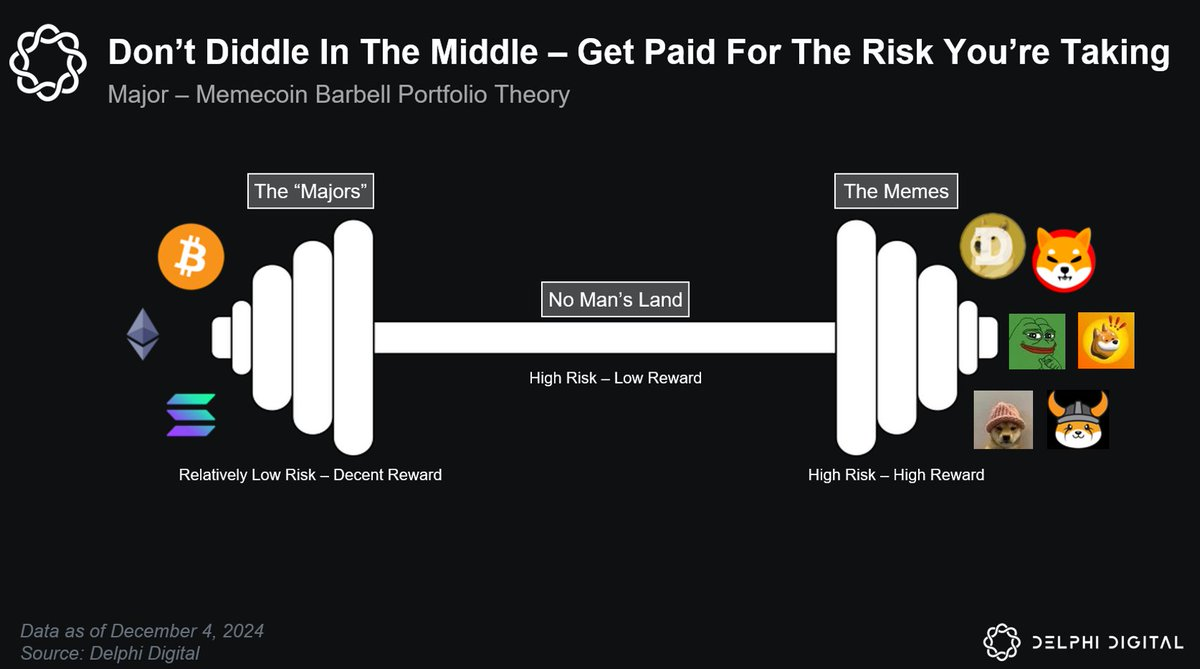

2024 saw the rise of a combined investment strategy of major coins and Memecoins. We delved into these market dynamics in our Deep Dive reports The Dog Days of Summer and Attention Is All You Need.

Will these market trends continue, ushering in another Memecoin-dominated year? Or has the cryptocurrency market shifted, returning to fundamentals?

The reality is more complex, influenced by both speculative fervor and evolving market trends.

Solana accelerates

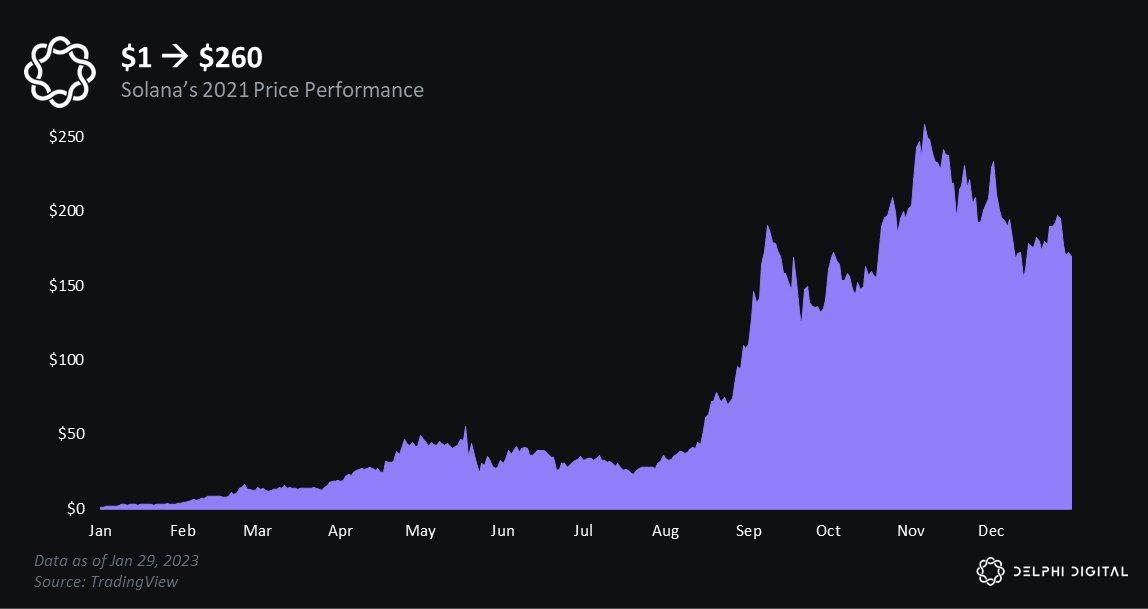

In the previous cycle, $SOL went from $1 to $260 in just one year, thanks to the "Alt L1 trade" and its "Sam coin" status.

Although the ecosystem was still in its early stages, this attracted teams like Jito, Drift, and Helium, which eventually became the backbone of the Solana network.

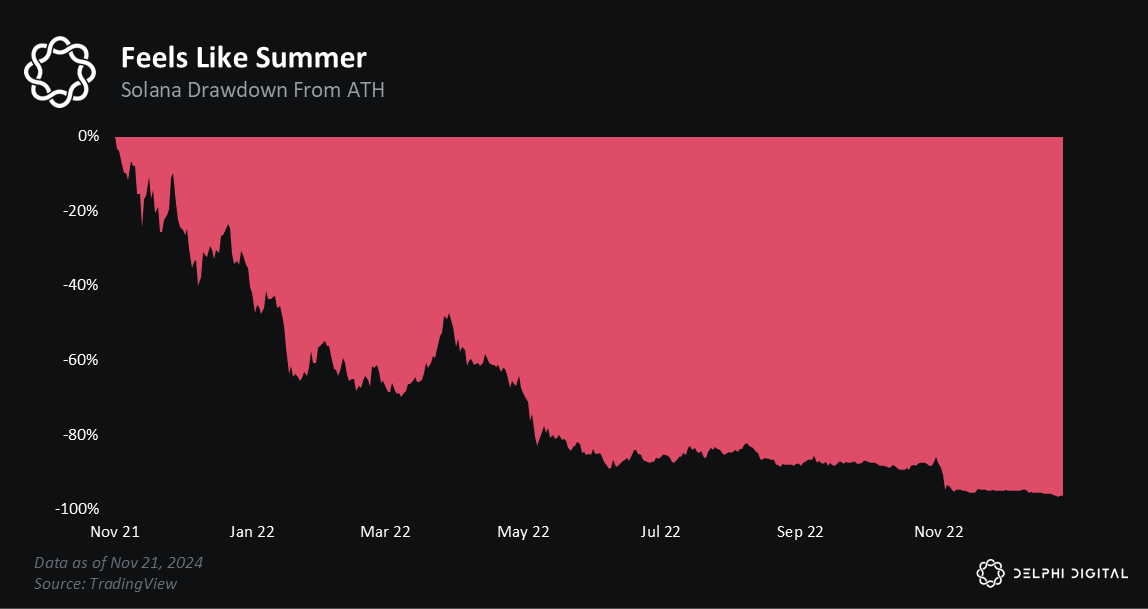

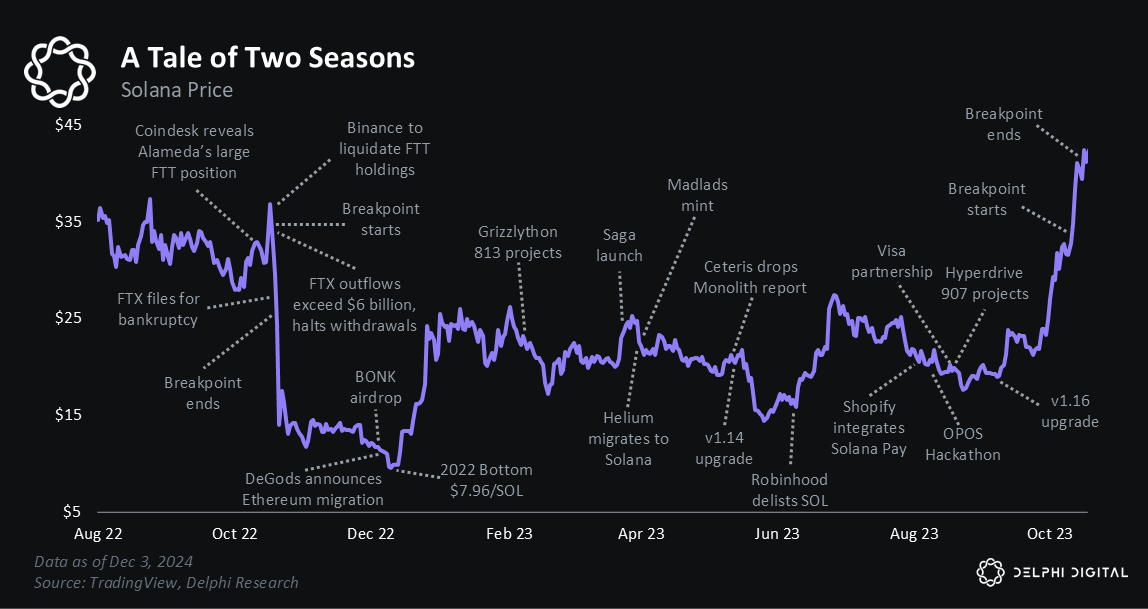

However, Solana was too focused on rapid growth. By 2022, this phoenix had fallen due to the FTX fraud, the bear market, and doubts about the chain's stability.

From peak to trough, SOL experienced a 96% decline.

On Christmas 2022, 'Bonk' airdropped half of its tokens to the Solana community. At the time, the trading price of SOL was $11, and the market sentiment was gloomy.

However, $BONK brought hope. A few days later, SOL bottomed at $8, ending a difficult year.

From the ashes, Solana began to be reborn in 2023. The core teams that weathered the challenges of 2022 redoubled their efforts.

@DriftProtocol, @jito_sol, and @TensorFdn focused on serving loyal users. Solana gradually recovered with steady innovation.

Looking ahead to 2025, there are still some unresolved questions:

Has the repricing of SOL been completed?

Will Memecoins lose their momentum?

Can Base capture market share?

Will Ethereum mount a counterattack?

While these concerns are reasonable, they overlook the core issues. Solana's 2025 story is based on two core beliefs that will determine its future development:

Solana's data indicates that SOLETH is being repriced. Underlying activity shows strong fundamentals, suggesting it still has upside potential relative to ETH.

Leadership and culture: Solana's continuous innovation and thriving ecosystem give it a unique leadership position in the cryptocurrency space.

We view 2024 as an inflection point for the industry.

While we cannot predict the exact situation in 2025, our analysts are already planning for potential opportunities and risks.