Bitwise Asset Management has just released the report "The Year Ahead: 10 Crypto Predictions for 2025", predicting the main trends that will shape the Bit market in the coming year.

Here is a summary of the key predictions:

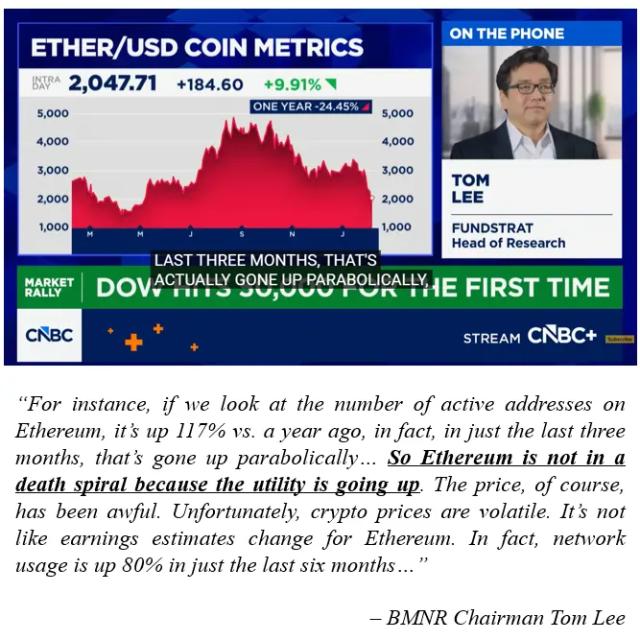

- Bitcoin, Ethereum and Solana will reach new all-time highs, with Bitcoin exceeding $200,000: Bitwise predicts that the price of Bitcoin will rise sharply, surpassing the $200,000 mark, along with significant growth in Ethereum and Solana.

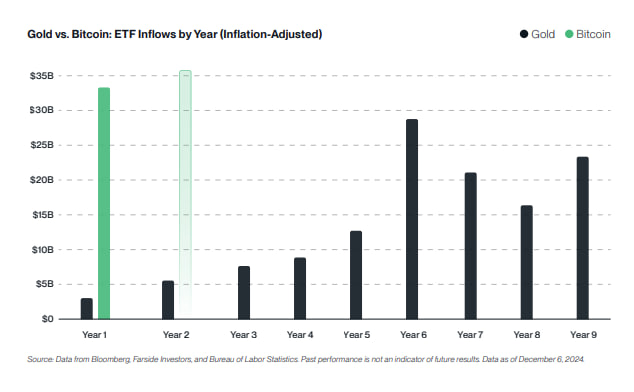

- Bitcoin ETFs will attract more Capital than in 2024: After the success of Bitcoin ETFs in 2024, the inflow of investment Capital into these funds is expected to continue to grow strongly in 2025.

BTC ETF Capital flow vs. Gold - Coinbase will surpass Charles Schwab to become the world's most valuable brokerage firm, with its stock reaching over $700: Coinbase's rapid growth could propel the company to the top position in the global financial brokerage industry.

- 2025 will be the "Year of Bit IPOs", with at least five Bit unicorns going public in the US: The market is expected to witness a surge of initial public offerings from high-value Bit companies.

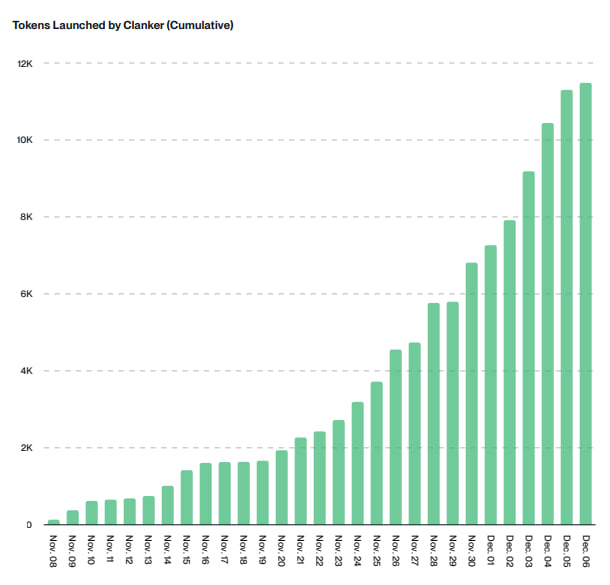

- AI-generated Tokens will lead a larger meme Bit wave than in 2024: The combination of artificial intelligence and Bits will create a new meme Bit trend, attracting widespread attention.

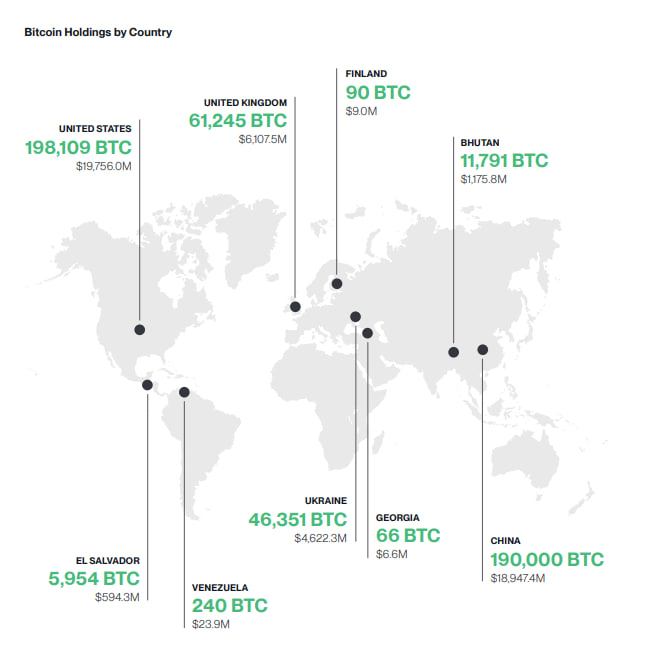

Number of Tokens created by Clanker - The number of countries holding Bitcoin will double: Increasingly more countries will adopt and hold Bitcoin as part of their national financial strategies.

Number of Bitcoin held by countries - Coinbase will join the S&P 500 and MicroStrategy will enter the Nasdaq-100, bringing Bits into the investment portfolios of most US investors: This will help make Bits more mainstream in traditional investment portfolios.

- The US Department of Labor will relax guidance on Bits in 401(k) plans, allowing billions of dollars to flow into Bit assets: This will open up Bit investment opportunities for many US workers.

- Stablecoin assets will double to $400 billion as the US passes the long-awaited stablecoin law: Legal stability will drive the development of the stablecoin market.

- The value of Tokenized real assets will exceed $50 billion as Wall Street increases Bit adoption: Tokenization of real assets will become a leading trend in the financial industry.

RWA market

Additional prediction: By 2029, Bitcoin will surpass the $18 trillion gold market and trade above $1 million per Bitcoin.