In 2024, cryptocurrencies are at a crossroads: the strong rise of Bitcoin contrasts sharply with the overall market weakness, until the regulatory changes at the end of the year make the prospects brighter.

The crypto narrative is being readjusted, and 2025 will usher in a brand new start. This article aims to briefly review the market situation this year.

Many crypto enthusiasts believe that with the launch of spot ETF products, the crypto market will rebound to new historical highs. But the reality is not entirely so, at least not as many expected.

In the first quarter of this year, with the launch of ETFs, Bitcoin rose by more than 50% to $73,000. Billions of dollars flowed in directly, and the market no longer has any concerns about institutional demand. Over about 7 months, Bitcoin mainly fluctuated between $60,000 and $70,000.

Unfortunately, except for a few outperforming tokens, most tokens have been struggling. The "failure" (or lack of liquidity) of the spot ETH launch in the middle of the year exacerbated these predicaments. The bulk of the 2024 story is gloomy market sentiment and infighting.

However, the crypto industry finally saw a glimmer of hope after the presidential election in November. The changes in market sentiment and risk appetite over the past few weeks have reflected this.

Cyclical strategy is back on track

At the end of 2022, Delphi Digital outlined the reasons for the bottom of the bear market, expressing its belief in the upcoming bull market cycle 15 months ago. In last year's report, it predicted that Bitcoin would break new highs in the fourth quarter of 2024.

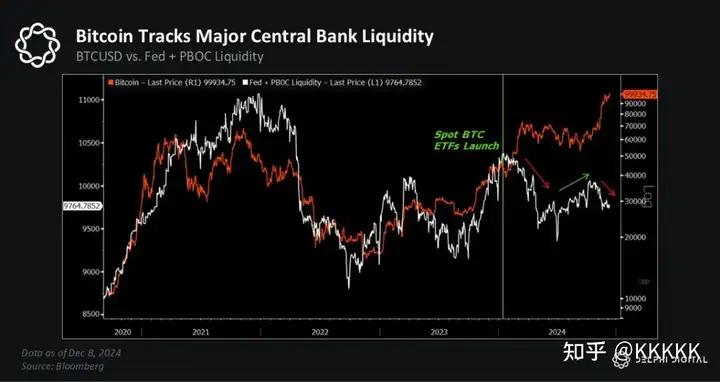

On the macro side, reality has been consistent with expectations. So far, the Bitcoin halving is not the main catalyst for the crypto market cycle, but the liquidity cycle.

At the end of last year, Delphi Digital listed the favorable conditions for Bitcoin to achieve strong performance in the first quarter, one of which was the surge in global liquidity. It also warned that the risk of a market correction would be higher from the end of the first quarter to the beginning of the second quarter of 2024, as signs of weakening liquidity momentum were seen.

So far this year, Bitcoin has risen more than 130%, and this has been achieved without much support from the Federal Reserve. In fact, Fed liquidity has been steadily declining over the past 9-10 months.

Optimism returns

2024 was a strange year for the crypto market. On the one hand, most mainstream currencies have recovered to historical highs, and the broader Altcoin market has also seen a recovery.

But the crypto community (like Twitter) has been in turmoil for most of the year. The gloomy sentiment in 2024 contrasts sharply with the positive price trend.

The first reason for the poor market sentiment is the dominance of Bitcoin. Bitcoin has soared 130% since the beginning of the year, reaching a new high in dominance in three years.

The second factor is diversification: some token prices have risen, some have risen slightly, but most token prices have fallen or remained flat.

The classic "path to Altcoin season" that many have taken for granted has not materialized.

Supply and demand imbalance

As mentioned in many reports over the past year, the crypto market is facing a huge supply and demand imbalance. In short, the demand for cryptocurrencies has not kept up with the overall supply of cryptocurrencies. The reasons are as follows.

Too many tokens

Over 10,000 tokens have been listed on aggregators, compared to only about 1,500 in 2017, a 10-fold increase.

Applications like pump.fun have made token creation simple: since January 2024, over 4 million tokens have been issued, and over 50 million tokens have entered Solana's Raydium.

Memecoin continuation

2024 saw the birth of the Major-Memecoin barbell investment portfolio.

Will these market dynamics remain unchanged, with Memecoin dominating again this year? Or will the crypto market return to fundamentals?

The reality is more complex, influenced by speculative enthusiasm and constantly changing market trends.

Solana accelerates development

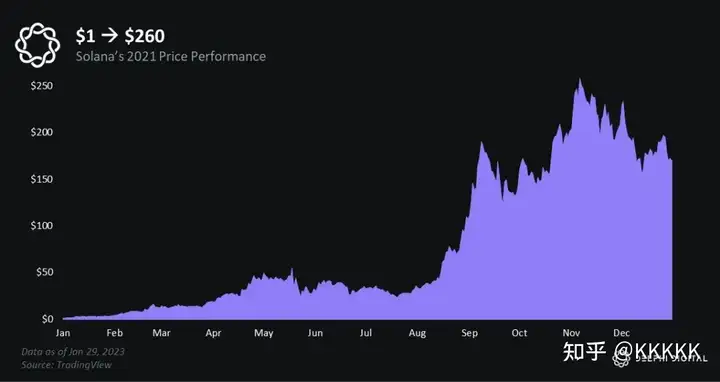

In the last cycle, SOL rose from $1 to $260 in 1 year. Although the ecosystem is still in its infancy, it has attracted teams like Jito, Drift, and Helium, all of which will become core parts of the network.

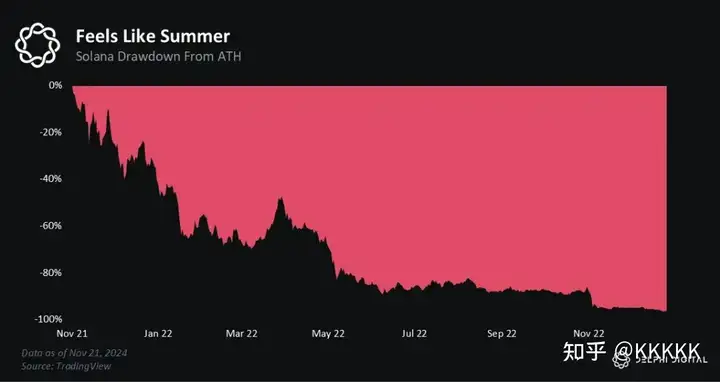

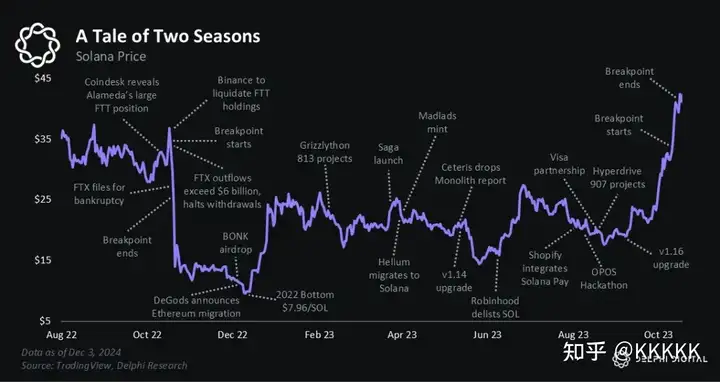

Solana ultimately rose too high. With the FTX collapse, the bear market, and doubts about chain stability, SOL fell 96%.

On Christmas 2022, Bonk airdropped 50% of its supply to the Solana community. SOL's trading price was $11, with a bleak outlook. A few days later, SOL hit a low of $8, ending a brutal year.

Solana was reborn in 2023. The core team, focusing on serving a loyal user base with Drift Protocol, Jito, and Tensor Foundation, has steadily innovated to drive the recovery.

As we enter 2025, there are still some questions:

- Has the SOL rally ended?

- Will Memecoin disappear?

- Can Base capture market share?

- Will Ethereum fight back?

While these concerns have merit, they miss the point. Solana's performance in 2025 will be based on two core beliefs:

- Solana's data shows that SOL/ETH is being repriced. Lower levels of activity indicate strong fundamentals, suggesting more upside potential compared to ETH.

- Leadership and culture: Solana's relentless innovation and thriving ecosystem give it a unique advantage in the cryptocurrency space.

2024 can be seen as a turning point for the industry, but no one knows exactly how 2025 will unfold.