Followin' the peak of BTC in late 2025, the reasonable range should be between $160,000 and $220,000. Followin' that, in 2026, it is suggested that everyone should cash out and take a break.

VX: TTZS6308

From the current perspective, the entire crypto market is at a critical crossroads. Today's digital currency industry is like the Internet industry at the turn of the century. The bubble burst is not far away in the next 1 to 2 years. With the passage of crypto-friendly laws such as the US FIT21, the compliance regulation of crypto assets will be completed, and a large number of traditional old money that once lacked understanding of crypto or even completely dismissed it will begin to accept BTC and make allocations at the 1%-10% level.

However, if blockchain and digital currencies cannot gradually integrate with traditional industries and truly usher in the "blockchain + industry" revolution, just like the way the Internet industry has integrated with and transformed consumption, social media, and media, I really can't see any new influx of capital, and I don't see any reason for this industry to see another astonishing growth opportunity.

DeFi in 2020, NFTs and the metaverse in 2021, these are all in the right direction and have sparked a wave of innovation at the time. But throughout 2024, while BTC hit new highs, the entire blockchain industry did not have enough truly innovative "business concept innovations", the market was just flooded with more meme and Layer1&2&3, without new breakthroughs. And in 2025 as I can see, the overall atmosphere of the industry has determined that I am pessimistic about the emergence of milestone "business concept innovations".

As the tide rises, the small wooden rafts are everywhere, all the boatmen are competing to row faster, even mocking the heavy, engine-powered iron ships. But when the big waves recede, the wooden boats will all be stranded, only those with persistent engine power can sail out of the port and into the open sea.

Even, it would be an interesting prediction that the peak of the crypto bubble will be marked by Warren Buffett, the world's biggest Bitcoin opponent, starting to change his tune and even participate in the industry. The stage victory of the revolution is often the moment when the crisis is most latent.

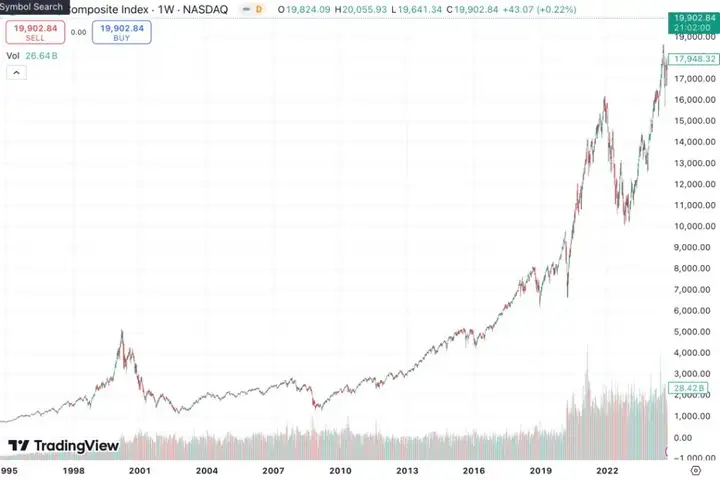

The current crypto market can be compared to the Internet era of 1999. After experiencing a rapid surge towards the right track, the digital currency industry may face a violent adjustment due to the huge bubble, starting from the end of 2025. Looking back at history, the Internet industry saw the IPO of Netscape in December 1995, followed by the listing of Yahoo in April 1996, which sparked a market frenzy. On March 10, 2000, the Nasdaq index reached a historical peak of 5,408.6 points. However, the bubble then burst rapidly, and the market entered a winter period by 2001. Although the general winter period lasted until 2004, the real bottom was in October 2002, when the Nasdaq index nearly fell below 1,000 points, marking the industry's lowest point from a financial perspective.

In 2020, MicroStrategy's purchase of BTC successfully drove the appreciation of the company's stock, realizing a significant stock-Token linkage effect for the first time. By February 2021, Tesla's announcement of Bitcoin purchase had become a landmark event of major players officially entering the market. These historical moments inevitably make people think of the "1995-1996" of the blockchain industry - the initial rise of the Internet era.

By the end of 2025, the price of BTC may reach a long-term stage peak, but it may touch a new low in early 2027. Once the FIT21 bill is passed, it may trigger a wave of mass Token issuance, just like the unprecedented prosperity of the Internet era.

If the threshold for Token financing is lowered to almost zero, and even ordinary people can easily issue their own Tokens like high school students learning to build a website, the limited capital in the market will be quickly diluted by the influx of various Tokens. In such an environment, the final "violent bull market" belonging to Token issuers may not last more than three months. Subsequently, due to the imbalance between supply and demand in the market and the depletion of capital, the industry will inevitably face a comprehensive collapse.

However, in the next 12 months, we still have the potential for a nearly 2x beta upside in BTC, and for ordinary people, countless opportunities for "100x, 1000x" gains in early Tokens due to the global liquidity gathering - why not participate?

Looking back at the turbulent Internet industry that was also criticized by many media as a "bubble". Today, the Nasdaq index has broken through the 20,000-point mark. Looking back, what seemed like a mountain peak in 2000 is now just a small hill. Even if you had entered the Internet industry in 2000 and persisted to this day, it would still be one of the most correct choices.

Many people have asked me, how high do you think BTC can go?

This question is meaningless. The price of gold has also been setting new highs these days and years.

The meaningful question is, how high can the price of BTC go before a certain point in time?