edgeX is a high-performance, order book-based perpetual contract trading platform incubated by Amber Group. edgeX is a high-performance modular financial system designed to enable users to build decentralized financial products with minimal programming knowledge. By providing plug-and-play financial modules, edgeX aims to accelerate the mass adoption of Decentralized Finance (DeFi) and ensure that DeFi is accessible to everyone.

edgeX's high-performance modular design marks a transformative shift in the DeFi space, nurturing a scalable and user-friendly financial ecosystem. By offering a comprehensive suite of plug-and-play modules, users with minimal coding experience can easily customize and build financial products. edgeX's open ecosystem and extensive module repository are poised to elevate the development and utilization of decentralized financial products, ushering in a more innovative and efficient financial future.

edgeX V1 is powered by the StarkEx Layer 2 engine, built on-chain infrastructure, and has processed over $1.28 trillion in cumulative trading volume since 2020. This powerful solution meets the high-performance and experience demands of professional traders while ensuring data transparency and asset security.

edgeX ensures that traders retain full custody and control over their funds, a key distinction from centralized exchanges (CEXs). The collapse of exchanges like FTX has highlighted the risks of centralized custody. On edgeX, users maintain self-custody of their assets, allowing withdrawals at any time without platform permission, providing a trustless and secure trading environment.

Advanced Trading Features: edgeX offers advanced trading features traditionally only available on CEXs, such as a sub-account system. This enables traders to manage their long and short positions more effectively, optimize strategies, and manage risk through hedging.

Simplest Onboarding - Social Login: Leveraging features like MPC wallets, edgeX V1 provides the simplest onboarding process for new users. Traders can register with just an email and enjoy cross-chain deposits and withdrawals, making the platform accessible to everyone.

Anti-Censorship Measures and Forced Withdrawals

edgeX's architecture includes powerful features that protect user assets through anti-censorship mechanisms, ensuring users can access their funds without interruption:

Forced Withdrawals: If, for any reason, edgeX fails to process a user's withdrawal request within the scheduled timeframe, the user can initiate a forced withdrawal. This process allows them to directly interact with the smart contract to retrieve their assets, bypassing the operator.

The edgeX Rewards Program aims to incentivize users to actively engage with edgeX products and reward loyal users who make positive contributions to the edgeX ecosystem.

Rewards are granted based on multiple performance metrics, including trading volume, referral trading volume, open interest, and feature usage frequency. As the edgeX product suite and ecosystem continue to evolve, the standards and weightings of these metrics may be adjusted accordingly.

Interaction Guide

Tip: hyperliquid has not been exploited, and now it is the poor people who are afraid of chasing the high. You should try other similar projects.

Rewards are granted based on multiple performance metrics, including trading volume, referral trading volume, open interest, and feature usage frequency. As the edgeX product suite and ecosystem continue to evolve, the standards and weightings of these metrics may be adjusted accordingly.

Work hard on these few indicators.

The activity starts on December 11th, and it has just begun, so it's not too competitive yet.

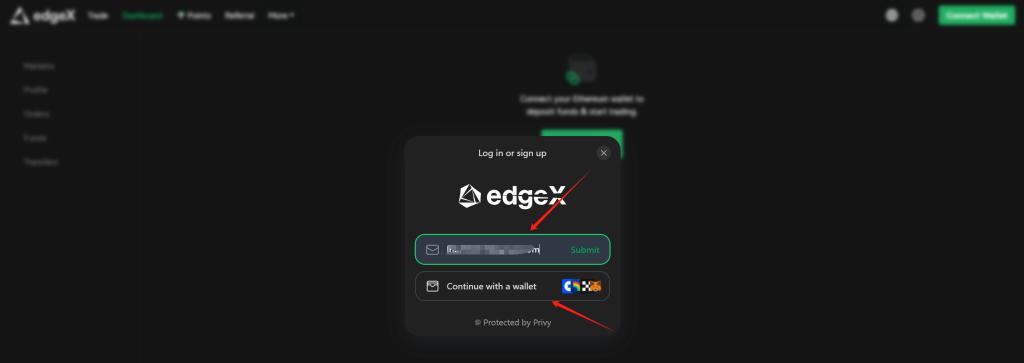

1. Visit the official website of Edgex, and use your email or wallet to connect to the website. (If you register an account with an email, you can only deposit and withdraw from ARB, while wallet users can withdraw from multiple chains. I registered with an email, so you can choose to use an email or wallet to register.)

Click the "Connect" button and enter your email address. After clicking "Submit", a 6-digit code will be sent to your email within a few seconds. Enter this code to log in.

After connecting, you need to deposit USDT. The system will automatically create a new blockchain address for your email address. Send USDT to this address via the Arbitrum network. You can easily do this from a centralized exchange or other standard wallet.

2. Make a deposit. Deposit directly from an exchange or on-chain to the deposit address. I withdrew from Binance to the address shown in the image. The Binance withdrawal interface shows that the confirmation takes 1 block to see the balance. Please note that the minimum deposit requirement is 10 USDT (to support opening margin).

You can see the account balance on the right. Then you can set limit orders, market orders, and conditional orders, as well as contract leverage settings. If you just want to safely farm volume, you can use a smaller leverage. My funds are still holding positions, and I'm using BNB. I directly placed a market order because I just saw that the 4-hour MACD on the exchange seems to be about to go up. For stability, you can wait for a golden cross before placing an order.

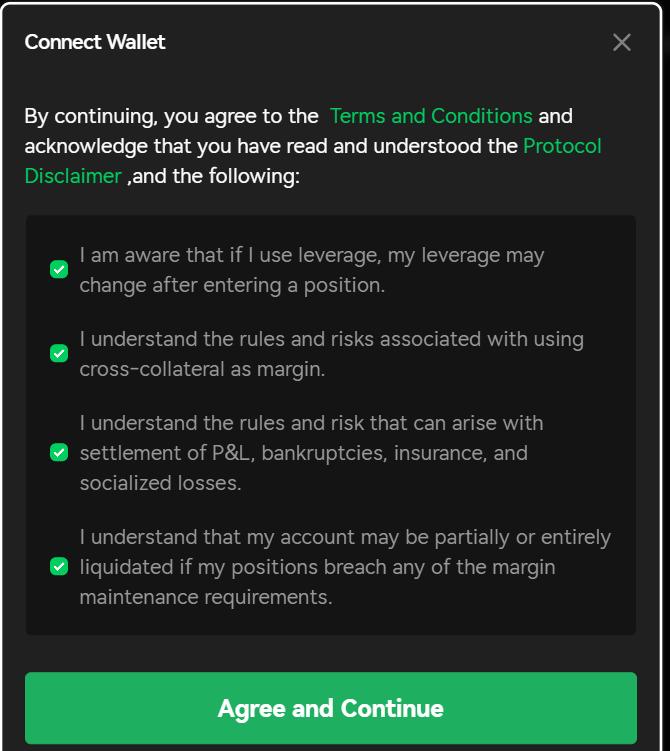

The website will pop up a window for you to confirm when you open a position.

You can check your position details and opening fees at the bottom of the page.

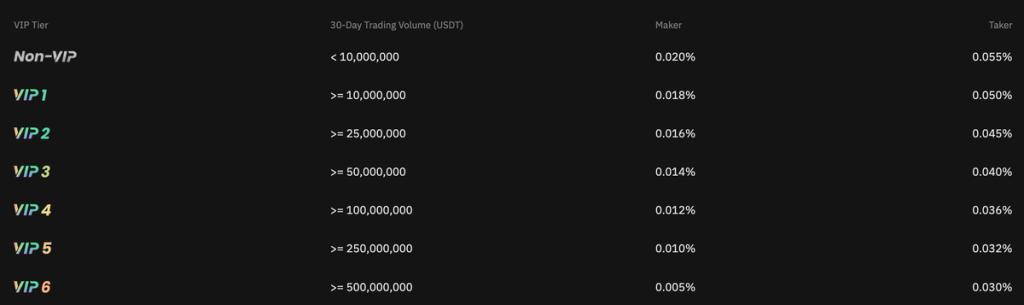

Here are the fee standards.

*Please note that regardless of the amount, Ethereum deposits will be processed immediately. However, for non-Ethereum chain one-time large deposits (over $300,000), the L1 to L2 fund rebalancing may take up to 2 hours to be reflected on EdgeX.

Users only need to bear the gas fees related to the corresponding blockchain for deposits. The platform does not charge any deposit fees.

3. Withdrawals.

Ethereum Withdrawals:

There are two types of Ethereum withdrawals on edgeX: Ethereum Standard Withdrawals and Ethereum Premium Withdrawals.

Ethereum Standard Withdrawals:

Standard withdrawals involve two steps: the user first requests a standard withdrawal. Once the next Layer 2 block is mined, the user must send an Ethereum Layer 1 transaction to claim the funds. The user must wait for the Layer 2 block to be mined before the process can be completed. These blocks are mined approximately every 4 hours, but may take up to 8 hours depending on the blockchain network conditions.

Ethereum Premium Withdrawals:

Premium withdrawals utilize liquidity providers to immediately send the funds, without the user needing to wait for the Layer 2 block to be mined. The user can withdraw the premium without needing to send a Layer 1 transaction. The liquidity provider will immediately send a transaction on Ethereum, which will be processed once the Ethereum block is mined.

Non-Ethereum Withdrawals:

Users can directly withdraw assets to different EVM-compatible chains on edgeX. When withdrawing assets to an EVM-compatible chain, the assets first transfer to edgeX's L2 asset pool for that chain. Subsequently, edgeX will transfer the corresponding amount of assets from the respective withdrawal chain's asset pool to the user's address.

Please note that the maximum withdrawal amount is limited not only by the total available assets in the user's account, but also by the maximum available amount in the on-chain asset pool.

Withdrawal Fees:

For ETH standard withdrawals, users only need to pay the gas fees themselves.

For ETH Premium withdrawals, the fee is equal to the Gas fee paid by the provider (minimum fee of 3 USDT).

For non-ETH withdrawals, the fee is equal to the Gas fee paid by the provider (minimum fee of 0.5 USDT).

Risk Warning:

Please note: The project is currently in the early stage, I observed that the DC has only 2853 people, and 4597 people follow on Twitter. Some scam bloggers are paying attention to it. The official claims that @ambergroup_io is the incubator.

Therefore, if you want to participate in this project, please evaluate it yourself, the risk is proportional to the return.

Forced Withdrawal: If for any reason, edgeX fails to process users' withdrawal requests within the scheduled time frame, users can initiate a forced withdrawal. This process allows them to interact directly with the smart contract to retrieve their assets, bypassing the operator.