The current BTC performance is still strong, with sideways consolidation.

Although there is no obvious money-making effect in the short-term market in the past two days, on Monday, the US stock market will have a spillover effect due to Microstrategy's inclusion in the Nasdaq 100, and ETFs are expected to continue to flow in. Moreover, the Fed is expected to complete the December rate cut (the probability is close to 100%), so the next big market is likely to come soon.

Regarding ETFs, the net inflow of Bitcoin spot ETFs was $2.17 billion last week, and the net inflow of Ethereum spot ETFs was $854 million.

This week, the Federal Reserve is about to announce a rate cut, which is expected to kick off the 2025 rate cut cycle, providing a positive support for the market. Whether BTC can directly break through $110,000 still needs to be observed in terms of subsequent volume release.

Let me share my views on the BTC market:

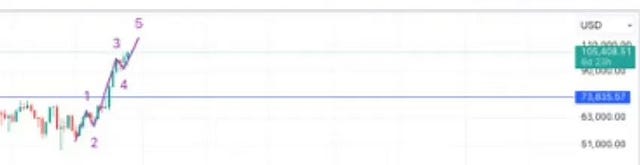

Looking at the weekly wave pattern, it is most likely that we are currently in the 5th wave of the uptrend, which means that the 11-12 range is very likely to be the end of the uptrend that started in September.

Considering the MACD, wave trend, and the corresponding target position after the breakthrough of the large-scale downward channel, I personally believe that the 11.5-12w range is most likely the end of a market cycle. Of course, the end of the market does not mean that BTC will plummet, it is more likely to see a consolidation around a range, which will be the distribution range of BTC. Unless there is a huge positive catalyst that leads to a crazy surge, BTC is unlikely to see the kind of parabolic top as in 2017.

What about the ETH market?

It will also join the 5th wave of BTC's uptrend and challenge its previous high. Considering ETH's characteristics, it is unlikely to break through the previous high at one time. During the correction process after the first attack, there will be another opportunity to add positions. Then, during the consolidation of BTC at the high level, will be the real performance time for ETH. ETH has not yet ushered in its own glory moment, but it is already on the verge of action.

Regarding Altcoins:

There are still ample opportunities to participate in the Altcoin bull market. When liquidity is rampant, even shit coins can fly, let alone the Altcoins that have been pre-positioned by the dominant forces in the exchanges.

In other words, the seeds of the Altcoin season's explosive rally have been sown during the bear market. No matter how the narrative changes, as long as liquidity is abundant, even the oldest targets will have the potential to explode, and you don't even need to find your own narrative, just keep pushing up the price, there are plenty of "investment researchers" who will write the script for you.

The coins that can explode must have once been the shit coins in the eyes of the retail investors.

Because every explosive variety must have experienced a long and bloody process of washing and liquidation.

The painful and depressed market where there is no hope is precisely the source of profit for betting. Most retail investors like the lively and instant green candles, which is the fundamental reason for their high-level bag holding and losses.

Most targets may be lifeless for years, and the explosive rally may only last a week or two, only a few targets like BTC can give people a concrete bull market process like a bulldozer.

Because most people don't believe, because most people can't see the hope and the underlying logic of Altcoins, so the Altcoin season must come, and the dormant targets that are still in operation must explode.

You should know that not many people make money in the early stage of a bull market, because this wave of the market is led by the old green series, most people used to look down on this kind of old Altcoin, and in the late stage of the bull market, the old green will also rise, and the new green and the second new green will rise in the middle of the bull market, this is the general rule of rotation.

And most of the wealth effect is in the middle of the bull market. Many people don't understand the bull markets of 2017 and 2021. Let's use the beginning of this year as an example, the AI sector like WLD, FET, ARKM, LPT, etc. first surged 10 times, then the meme sector like PEPE, FLOKI, etc. surged 10 times in a week, and basically all sectors saw a general rise. At this time, as long as you don't chase the highs and change positions frequently, you can make money.

Look at the small bull markets at the beginning of 2023 and 2024, which sector didn't see a big rise?

You should know that it was a big bear market at that time, and Altcoins still had such eye-catching performance, now it is a confirmed bull market, what is there to worry about?

Old Chen's VIP member group now has a promotion, brothers who want to join the VIP member group can scan the code to learn more, I will lead you to grasp the bull and bear trends, layout the crypto hot spots, and eat the big meat!

Lots of discounts!

Group content:

Mainly spot trading, there will be macro market trend analysis and layout of potential coins in advance, the cycle will follow the evolution of the market, recommendations of Altcoins with opportunities, mainly spot trading.

We will choose more strong coins, try to get a few small bets on big targets, as the market is surging again, we will definitely need coins with strong wealth effect to ignite the new bull market, grab one and make a big profit, grab a few and make a killing.

Reasonable control of positions, mainstream coins as the bottom, Altcoins for value-added.