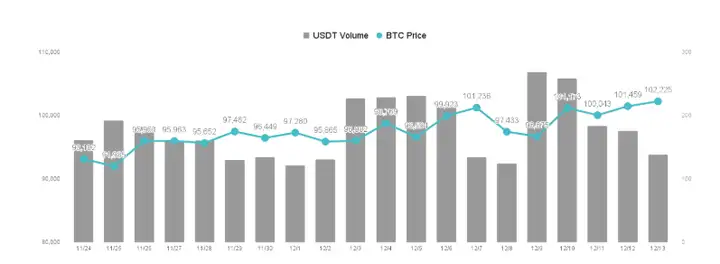

With the stable inflow of spot ETF funds, Bitcoin has finally returned to $100,000 and even broke through $106,000 earlier today, setting a new high. Ethereum has also risen above $4,000. However, the overall market rally is not as significant as that of DeFi tokens, as funds have gradually shifted from major cryptocurrencies to DeFi-related tokens, and the easing of regulations is quickly brewing a rally.

VX: TTZS6308

The inflow of spot ETF is still the main driver for the rise of Bitcoin. Last week, except for Friday, there was a net inflow of over $200 million for four consecutive days, indicating that Wall Street fund companies are continuously buying Bitcoin in response to Trump's crypto-friendly policies. Additionally, the latest November CPI remained at a year-on-year increase of 2.7%, suggesting no major issues in the overall environment. The next thing to watch out for is the upcoming U.S. GDP forecast.

It's worth noting that this trend may continue even after Trump's term, as many hedge funds were previously very reluctant to buy Bitcoin, but this sentiment is slowly changing. The overall bullish atmosphere is likely to persist, as evidenced by BlackRock's public recommendation for investors to allocate 2% of their multi-asset portfolios to Bitcoin, indicating that IBIT has been quite profitable for the company and has received a warm market response.

More fund companies are deciding to enter the Bitcoin ETF distribution and asset custody business, and we have also seen more investment institutions showing interest in Bitcoin. The U.S. Bitcoin ETF has been launched for nearly a year, with cumulative inflows exceeding $50.5 billion. On the other hand, companies are also continuously buying Bitcoin as a value investment tool, with the most well-known MicroStrategy purchasing an additional 21,550 BTC this week at an average price of $98,782, bringing its total holdings to 423,650 BTC.

It is expected that the inflow of funds into the Bitcoin spot ETF will continue, and there is no need to worry about the buying from Wall Street. However, the crypto trading market appears to be more active, with funds quickly spilling over to major cryptocurrencies, small and medium-sized cryptocurrencies, and DeFi tokens.

Regulatory environment expected to ease, funds shifting to DeFi

The biggest news recently is that World Liberty Financial (WLFI), owned by Trump, has started injecting funds into DeFi projects. WLFI was established in September this year, with a business model of providing lending and crypto asset interest income services. However, with the announcement by Justin Sun, the founder of TRON, on November 25th that he invested $30 million in WLFI and joined the advisory team, the project has immediately transformed into a more active investment company.

WLFI has recently purchased various cryptocurrencies.

Today, it spent $250,000 USDC to buy 134,216 ONDO.

So far this month, it has spent:

$30 million USDC to buy 8,105 ETH;

$10 million USDC to buy 103 cbBTC;

$2 million USDC to buy 78,387 LINK;

$1.91 million USDC to buy 6,137 AAVE;

$500,000 USDC to buy 509,955 ENA;

$250,000 USDC to buy 134,216 ONDO.

This has prompted market investors to enthusiastically chase after previously undervalued DeFi tokens. Although the amounts are not as large as the tens of millions of dollars invested by other institutions, the fact that it is a DeFi project led by the Trump family is undoubtedly sending a strong message to the market - "DeFi regulation is likely to be significantly relaxed".

WLFI previously announced a partnership with Chainlink, stating that it will adopt its price oracle and cross-chain technology, and choose to establish a lending DeFi protocol on the Aave v3 mainnet. Although the investment amount is not large, the support from Trump has caused the prices of these two tokens to surge by more than 50%, and it is expected that the capital rotation will shift from Bitcoin to DeFi tokens.

Taking LINK as an example, the price increase is mainly attributed to whales significantly increasing their holdings. Over the past two months, wallets holding more than 100,000 LINK have increased by 5.69 million, while those holding less than 100,000 LINK have decreased by 5.67 million. This pattern usually indicates the potential for further price growth, and also suggests that major investors have already completed their positioning, waiting for the WLFI news to drive the rally.

In addition to the investment news, the market is also eagerly awaiting the SEC to further relax its regulation of DeFi-related companies and allow them to obtain banking services. SEC commissioners have already spoken out, expressing a desire to assist crypto companies in obtaining financial services from U.S. banks, including account custody, transfers, and related financial business, hinting that the innovation space for DeFi companies will be greater under the new Trump administration.

The market is focusing on the positive news and policies, and is redeploying funds to DeFi tokens, such as Uniswap and SUI decentralized trading protocols, which have seen amazing rallies. However, I believe that the crypto market has just started the DeFi rally, and if the overall market does not decline, the upside potential of DeFi tokens may exceed the broader market. This is just the beginning of the DeFi rally, and it is worth following and looking forward to.