Bitcoin broke through the $100,000 mark last week, undoubtedly a historic milestone. However, as this leading Cryptocurrency celebrates its achievement, many Altcoins have already begun to outperform Bitcoin, heralding the arrival of Altcoin season.

Since the beginning of the year, 20 out of the top 50 Cryptocurrencies by market capitalization have seen gains exceeding Bitcoin's impressive 124% rise. The increase in Altcoin market capitalization, media attention, and the rise of the Altcoin Season Index further confirm this trend. Additionally, a recent CCData report shows that trading volume reached a new annual high in November, with open interest also setting a record. These signs indicate that market risk appetite is on the rise, which typically benefits Altcoins due to their higher potential upside.

Looking deeper, investing in Altcoins is actually investing in Web3 and other blockchain-related industries. This sector is highly dependent on regulatory clarity, and the market has become more optimistic about this since the US elections. Furthermore, according to the latest data from CryptoQuant, Altcoin trading volume is not driven by BTC trading pairs. This suggests that the market is experiencing genuine growth, rather than just asset rotation from Bitcoin to Altcoins. It also means that this Altcoin season may not have to wait for Bitcoin price consolidation, and we could see both Cryptocurrency assets rise simultaneously.

The Altcoin resurgence since November seems to suggest that an even larger Altcoin season may be on the horizon in 2025. Emerging Crypto trends and technologies may attract the attention of institutional investors and venture capitalists. The following is a speculation on the potential of the next Altcoin season and its key narratives, based on on-chain data and other trends.

1. Altcoin season is not just about prices

Altcoin season is typically defined as a period when Altcoins consistently outperform Bitcoin. This stage often occurs in the last year of Bitcoin's four-year cycle, when market enthusiasm spreads from Bitcoin to other coins. Large-cap Altcoins will then approach or surpass their historical highs, while new narratives drive mid- and small-cap coins to break into uncharted territory. Ultimately, this stage reaches a peak due to widespread FOMO (fear of missing out) sentiment, pushing the entire Crypto market into an overheated state. This overheating usually signals an impending market adjustment and the eventual entry into a bear market cycle.

However, Altcoin season is not just about prices; it represents a comprehensive evolution of market activity, application adoption, and innovation. To date, each Altcoin season has reflected unique technological transformations and market trends.

The first Altcoin season in 2017 was marked by the ICO craze and the rise of NFTs (remember CryptoKitties?). The second Altcoin season in 2021 combined the emergence of DeFi and the widespread explosion of NFTs and gaming. To support these developments, cheaper and more scalable Layer2 solutions also emerged. All of these innovations have withstood the Crypto Winter and continued to evolve.

Looking ahead, the third Altcoin season in 2025 is expected to bring new narratives and technologies, some of which are already in development, while others are yet to emerge.

2. Indicators of Altcoin season

Several indicators suggest that Altcoin season is approaching. Bitcoin's dominance has declined, and Altcoins have outperformed Bitcoin, with their market capitalization reaching new highs. However, the Altcoin Season Index and other related metrics indicate that the Altcoin peak may not have arrived yet.

In absolute terms, the total Altcoin market capitalization, calculated by subtracting Bitcoin's market cap from the total Crypto market cap, has reached a new all-time high. According to Coingecko data, the current market cap is $1.89 trillion, surpassing the previous peak of $1.79 trillion in November 2021. In relative terms, Bitcoin's dominance has declined from 60% to 51% since November.

However, both of these metrics include stablecoins and wrapped assets. While they are crucial for market liquidity, they may not accurately reflect the development of the Altcoin market. Furthermore, under bullish conditions, these assets tend to lean towards Altcoins due to their higher risk-return characteristics.

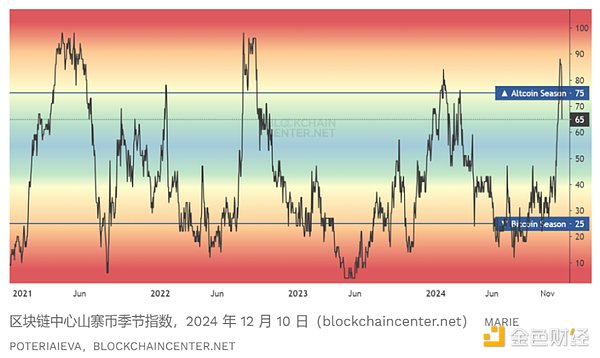

To measure the market more purely, the Altcoin Season Index from Blockchain Center excludes stablecoins and wrapped assets. This index defines Altcoin season as a period when more than 75% of the top 50 Altcoins outperform Bitcoin over the past 90 days. Recently, this index breached the 75% threshold on December 2nd and maintained it for a week. The previous Altcoin season saw the index stay above the threshold for nearly three months, supporting the view that the Altcoin season peak may occur in 2025.

The OTHERS index calculated by platforms like TradingView is another important indicator of Altcoin performance. This index tracks the total market capitalization of the Crypto market, excluding the top ten coins (including the two largest stablecoins). Although this index has risen 123% in the past 30 days (followed by a correction), it has not yet reached its previous all-time high. The last time, it surged 525% from its 2017 historical peak, suggesting there is still significant room for growth.

Finally, Google Trends also reflects people's interest in Altcoins. With a peak value of 100 in May 2021, the current search interest has risen to 87, the highest level since then.

3. Key narratives for Altcoins in 2025

As of 2024, three of the best-performing top 50 Altcoins are Memecoins: Dogwifhat (WIF +2,027%), PEPE (+1,764%), and Dogecoin (DOGE +382%). Although Memecoins are often a symbol of Altcoin season, they are unlikely to define the mainstream narrative of the Crypto market in 2025.

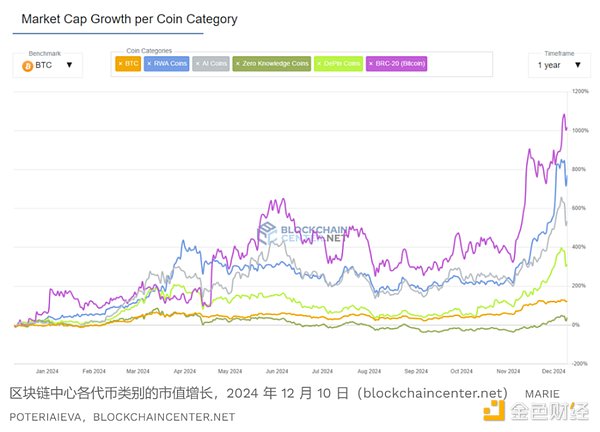

According to data from Blockchain Center, among the new technologies that emerged in 2023-2024, BRC-20Tokens performed the best. While some may not consider them true Altcoins, these Tokens issued on the Bitcoin blockchain, leveraging technologies like Ordinals or Runes, have seen gains exceeding 1000% this year. In the more traditional Altcoin categories, RWAs (tokenization of real-world assets) led the pack with a 717% annual growth rate, including tokenized versions of real-world assets and their supporting protocols. Closely following are Tokens related to Artificial Intelligence (+513%) and DePIN (decentralized physical infrastructure, +303%).

By 2025, new narratives are likely to emerge, and the direction of venture capital investments may reveal the most promising areas. According to Pitchbook data, Crypto venture capital activity was relatively moderate in 2023 ($10 billion) and reached $7.1 billion in the third quarter of 2024. Next year, its activity may rebound to the levels of 2021 and 2022, reaching $25.3 billion and $29.4 billion, respectively. This influx of capital will flow into specific projects and broader areas, driving the next wave of growth.

Finally, it is important to avoid being swept up by the hype of the Altcoin season. Every bull market ultimately ends in an adjustment (bear market), and only Tokens with strong fundamentals and real-world applications will survive the next cycle.