Once again, the price of Ethereum (ETH) has surpassed $3,900. This rebound suggests additional price increases for altcoins until the end of the year.

However, does this mean that cryptocurrencies can surpass their all-time highs in this short period? This on-chain analysis reveals whether that is possible.

ETH, Weakening Strength of On-Chain Indicators

ETH is currently trading at around $3,939 as of the 17th. This means that the ETH price has increased by 67.30% in 2024. One of the indicators that has played an important role in ETH's rise this year is the Open Interest (OI).

Open Interest represents the total value of all outstanding contracts in the market. An increase indicates that more liquidity has flowed into cryptocurrency-related contracts. In the derivatives market, this suggests increased buying pressure, which can lead to price increases.

On the other hand, a decrease in Open Interest indicates selling pressure. The decrease suggests that traders are increasingly liquidating their positions and withdrawing liquidity from the market.

According to the cryptocurrency on-chain data platform Santiment, Ethereum's Open Interest rose to $14.5 billion on December 15th. However, this figure has since decreased to $13.94 billion in just two days. This indicates a reduction in exposure to ETH. Considering the above conditions, this decrease suggests that if the Open Interest maintains this position, Ethereum's price may face another downside risk.

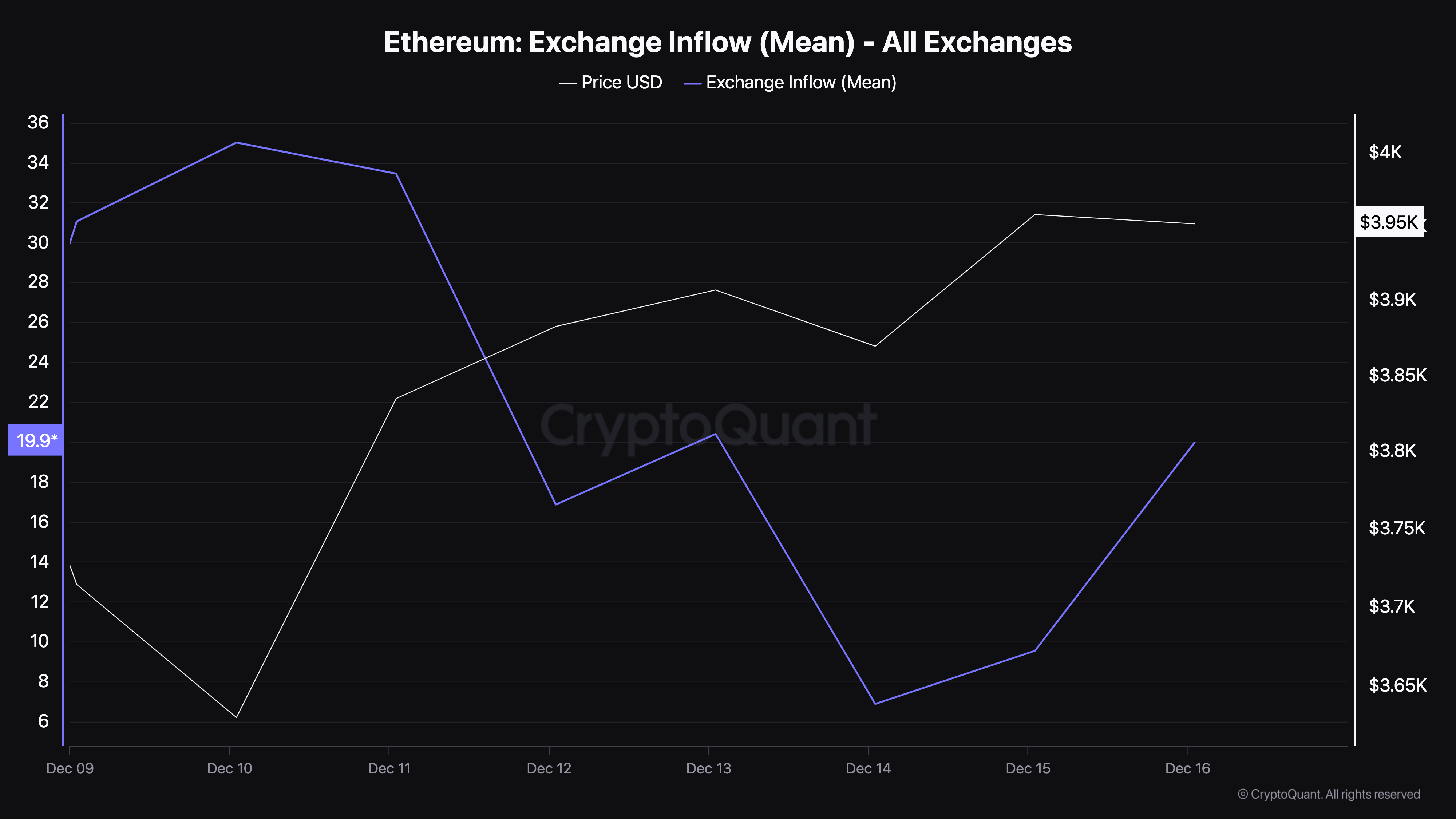

Another indicator supporting this bias is Ethereum's exchange inflow. Exchange inflow represents the average number of coins transferred per transaction to exchanges. High exchange inflow means investors are trying to cash out more coins. This can lead to a natural increase in selling pressure, which can negatively impact the price.

According to the on-chain cryptocurrency platform CryptoQuant, the exchange inflow has increased compared to December 14th. This means that the selling pressure around ETH has increased.

ETH Price Prediction: Increased Open Interest Needed for Further Gains

According to the daily chart, the Parabolic Stop and Reverse (SAR) indicator has crossed above ETH's price. SAR is a technical indicator that shows whether a cryptocurrency has encountered resistance or strong support.

When the dotted line is below the price, it indicates important support that can push the price higher. However, the dotted line is currently above Ethereum's price. Therefore, the cryptocurrency is facing resistance.

As long as ETH trades above the indicator, the price has the potential to decline, with a target of around $3,315. If this happens, Ethereum may not reach a new all-time high by the end of the year.

However, if Open Interest increases and exchange inflow drops significantly, the prediction may be invalidated.