Author: Frank, PANews

As an important driver of multi-chain interoperability, zero-knowledge proof applications, and the DeFi and Non-Fungible Token (NFT) ecosystem, Polygon shone brightly during the previous bull market cycle. However, over the past year, many public chain projects like Polygon have failed to achieve new breakthroughs and have gradually been overshadowed by new competitors such as Solana, Sui, and Base. When Polygon returned to the discussion on social media, it was not due to any major updates, but rather the withdrawal of ecosystem partners like AAVE and Lido.

The "Borrowing Chickens to Lay Eggs" Proposal Raises Concerns

On December 16, the Aave contributor team Aave Chan released a proposal in the community to withdraw its lending service from Polygon's Proof-of-Stake (PoS) chain. The proposal, written by Aave Chan founder Marc Zeller, aims to gradually phase out Aave's lending protocol on Polygon to mitigate potential future security risks. Aave is the largest decentralized application on Polygon, with over $466 million in deposits on the PoS chain.

Coincidentally, on the same day, the liquid staking protocol Lido announced that it will officially shut down its Polygon network operations in the coming months. The Lido community cited strategic refocusing on Ethereum and the lack of scalability of the Polygon PoS as the reasons for the shutdown.

Losing two major and important ecosystem applications in a single day is a painful blow for Polygon. The main reason can be traced back to the "Polygon PoS Cross-Chain Liquidity Plan" Pre-PIP improvement proposal released by the Polygon community on December 13.

According to reports, the Polygon PoS bridge holds approximately $1.3 billion in stablecoin reserves, and the community has proposed to deploy these idle funds into carefully selected liquidity pools to generate yield and promote the development of the Polygon ecosystem. Based on current lending rates, these funds could potentially generate around $70 million in annual revenue.

The proposal suggests gradually investing these funds into vaults that comply with the ERC-4626 standard. The specific strategies include:

DAI: Depositing into Maker's sUSD, which is the official yield-bearing token in the Maker ecosystem.

USDC and USDT: Using Morpho Vaults as the primary source of yield, with Allez Labs responsible for risk management. The initial markets include Superstate's USTB, Maker's sUSD, and Angle's stUSD.

Additionally, Yearn will manage the new ecosystem incentive program, utilizing these yields to incentivize activities in the Polygon PoS and the broader AggLayer ecosystem.

Notably, the proposal is co-signed by Allez Labs, Morpho Association, and Yearn. According to defillama data on December 17, Polygon's total TVL is $1.23 billion, with AAVE accounting for approximately $465 million, or 37.8%. Yearn Finance's TVL, on the other hand, ranks 26th in the ecosystem with a TVL of around $3.69 million. This may explain why AAVE has proposed to withdraw from Polygon due to security concerns.

From AAVE's perspective, this proposal is essentially using AAVE's money to generate yield in other lending protocols. As the largest application of Polygon PoS cross-chain bridge funds, AAVE cannot benefit from this proposal and instead has to bear the risk of fund security.

However, Lido's withdrawal may not be related to this proposal, as Lido's proposal to re-evaluate Polygon and the subsequent voting were released a month earlier, coinciding with this timing.

A Reluctant Move Due to Sluggish Ecosystem Development

If AAVE's withdrawal proposal is officially approved, Polygon's TVL will drop to around $765 million, falling short of the $1 billion fund reserve mentioned in the Pre-PIP improvement proposal. With Uniswap, the second-largest project in the ecosystem, having a TVL of around $390 million, if Uniswap also proposes a similar withdrawal plan to AAVE, Polygon's TVL could plummet to around $370 million. This would not only prevent the achievement of the $70 million annual yield target, but also impact various aspects of the ecosystem, such as governance token prices and active user numbers. The losses could far exceed $70 million.

From this outcome, the proposal does not seem to be a wise move. Why did the Polygon community propose this plan? What is the current state of the Polygon ecosystem?

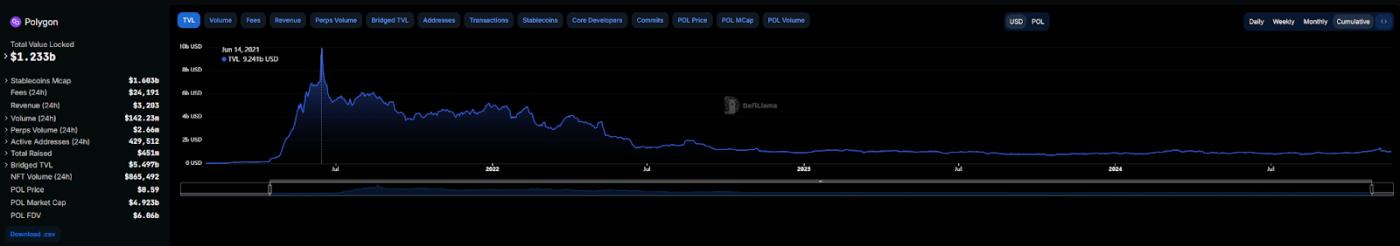

Polygon's ecosystem was most prosperous in June 2021, when the total TVL reached $92.4 billion, 7.5 times the current level. However, over time, Polygon's TVL curve has been on a downward trend, maintaining around $13 billion since June 2022 without significant fluctuations. In 2023, it even briefly fell to around $6 billion. While the market has recovered in 2024, Polygon's TVL has mostly remained below $10 billion, only barely recovering above that level since October.

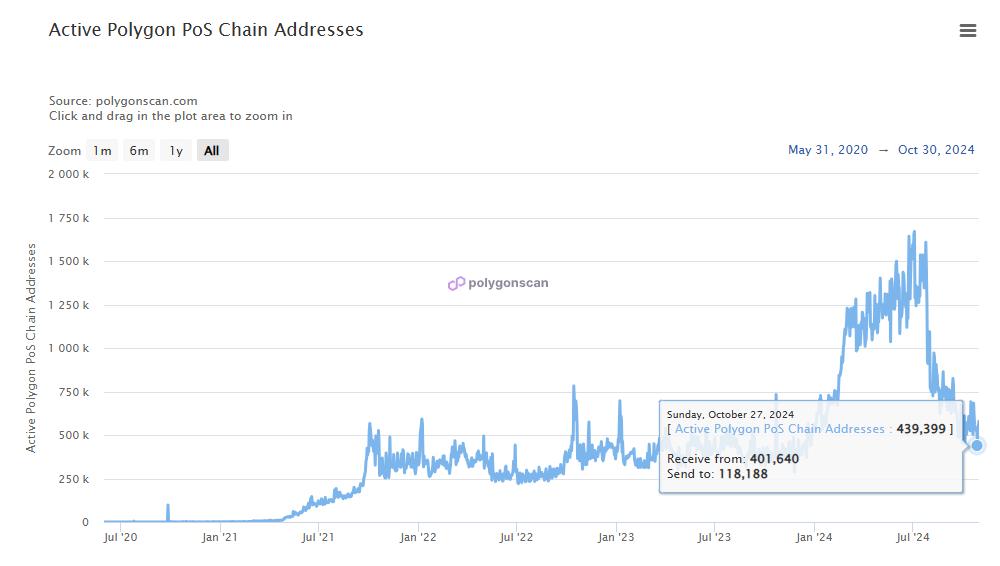

In terms of active addresses, on October 29, the Polygon PoS had around 439,000 active addresses, a level similar to a year ago, despite a significant increase from March to August 2022, reaching as high as 1.65 million active addresses. The reason for the rapid cooling during the market's hottest period is unclear.

The token's market performance has also been poor. From March to November 2024, the MATIC token price did not rise along with Bitcoin and other major assets, but instead declined steadily from $1.3 to $0.28, a drop of over 77%. It has only recently started to rebound, currently around $0.6, still far from its historical high of around $3.

Technical Innovation and Brand Upgrade Not as Effective as "Giving Away Money"

Despite the sluggish ecosystem development, Polygon has not given up on technological innovation and product deployment. In the past year, it has released several notable developments, such as the growth of the prediction market Polymarket. Additionally, in October, Polygon launched a new unified blockchain ecosystem called AggLayer, which it describes as a unification of L1, L2, and L∞. However, the positioning of this new ecosystem seems rather unclear, and Polygon even published an article in November to further explain AggLayer.

Another highlight is Polygon's Plonky3, a ZK-proof system tool kit that has become the fastest zero-knowledge proof system, with Vitalik Buterin even acknowledging Polygon's achievement on Twitter.

Beyond technology, many established public chains have recently opted for rebranding and token swaps to reshape their brands. Polygon has already undergone a brand refresh, changing its name from Matic to Polygon. However, in the current market environment, non-disruptive technological innovation seems to have lost its advantage as a compelling narrative for projects. This is a harsh reality for Polygon and other projects that are still focused on technological innovation or hoping to revitalize their brands through integration.

What often attracts users and maintains attention are reward distributions or incentive programs, as seen in the recent success of Hyperliquid. Polygon's options for reform in this area are limited, as its daily fee generation is only in the tens of thousands of dollars, an amount insufficient to engage users. This led to the "borrowing chickens to lay eggs" proposal mentioned earlier.

However, it is clear that the "mother hen" (AAVE) does not agree with this business deal, and Polygon may end up losing even more as a result. Overall, the fundamental reason for Polygon's stagnant ecosystem development is its lack of sufficient user incentives and new narrative drivers. Facing intensified market competition, Polygon needs to find more appealing market strategies beyond just technological innovation. This is a common challenge faced by many established public chains.