Followin' the ETF, on December 17, the net inflow of the Bitcoin spot ETF was $493 million, and the net inflow of the Ethereum spot ETF was $144 million

At 3 am on Thursday, the Fed will announce its interest rate decision, with the probability of a 25 basis point rate cut reaching almost 100%

The small pullback today is normal, as investors need to hedge against the Fed's policy meeting tonight. The focus of this meeting is no longer a 25 basis point rate cut, but the dot plot and Powell's speech

The Fed may only execute 2 to 4 rate cuts by 2025, and the higher the interest rate in 2025, the higher the probability of a black swan event, and the market will be more concerned about the delay of the loose monetary policy, so investors' risk awareness is increasing

In addition to the policy meeting, whether Japan will raise interest rates in December will also have a result on the 19th. Although the probability of a rate hike is indeed not high, it is normal to hedge a bit, and these two events today are very likely to be related to next week's Christmas

The overall problem is not big

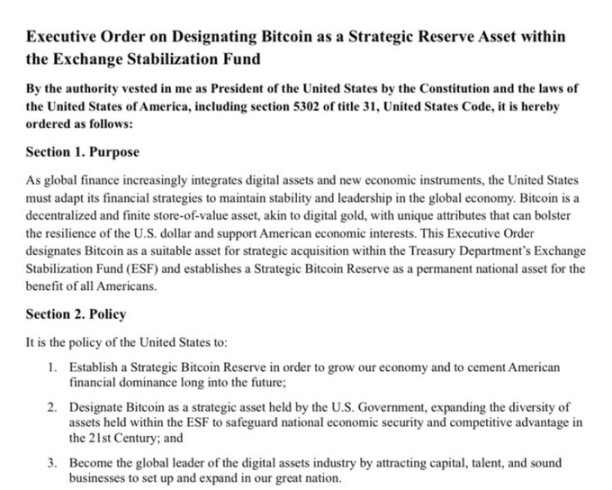

On December 17, 2024, the Bitcoin Policy Institute drafted an executive order proposing to establish a strategic Bitcoin reserve under the Treasury Department's Exchange Stabilization Fund (ESF) in the Trump administration, which would need to be signed after Trump's inauguration to take effect

This executive order will designate Bit as an asset suitable for strategic acquisition within the Treasury Department's Exchange Stabilization Fund (ESF), establish a strategic Bit reserve, and make it a permanent national asset

The US policy is:

1. Establish a strategic Bit reserve to develop our economy and consolidate the US's future financial dominance

2. Designate Bit as a strategic asset held by the US government, diversify the assets held by the ESF, to ensure the national economic security and competitive advantage of the 21st century, and promote industry development by attracting capital, talent and voice

It is currently difficult to find reasons to be bearish on Bit, as the first accounting standard for crypto assets issued by the FASB has just taken effect, allowing enterprises to record their digital assets at fair market value, which may drive US companies to more actively embrace and adopt digital assets. In a friendly regulatory environment, institutional demand for Bit will be stimulated and grow!

Followin' a set of data

Recent coin listings on Bit:

PENGU is currently priced at 0.0285, with a market cap of $1.869 billion and a fully diluted market cap of $2.662 billion

1000CAT is currently priced at 0.0423, with a market cap of $292 million and a fully diluted market cap of $389 million

VANA is currently priced at 16.5, with a market cap of $500 million and a fully diluted market cap of $2 billion

VELODROME is currently priced at 0.186, with a market cap of $164 million and a fully diluted market cap of $360 million

ME is currently priced at 3, with a market cap of $400 million and a fully diluted market cap of $3.079 billion

Lookin' at it now, the frequency of new coin listings in the past month has been super high, and most of the coins listed on Bit have very high market caps, many of which are VC coins. Each new listing is a dilution of liquidity! Without any new USDT issuance, users who want to buy new coins must sell their old coins, and the market size is so crazy with all these new listings, it's definitely not conducive to the development of the crypto!

Moreover, the price movements of these new VC coins are truly heartbreaking, with so many people being trapped in new coins and having their pockets picked, which is also why there has been so much online criticism of Bit recently!

We need to focus on strategy, not prediction:

When the overall trend hasn't changed, and the pullback of the coins you're bullish on is deep enough, that's when we need to act. Execution is difficult, but the harder part is often patience.

Don't panic, brothers, hold on to the valuable coins, and every time there's a dip, bravely seek out the valuable coins and grip them tightly without being shaken off!

Remember that every dip now is for a better future rise, and selecting the right targets is more important than anything else!

The bull market can basically be confirmed to have started, and with the loosening of policies, there will be many opportunities waiting for us to layout. The group will recommend wealth codes from time to time, and let's work together to seize the upcoming bull market and realize our goals and dreams in the crypto!

Group content:

Mainly spot trading, with macro market trend analysis and early layout of potential coins, following the cycle of the market. Recommendations of promising altcoins when opportunities arise, with a focus on spot trading

We will choose more strong coins, trying to get a few targets for small bets on big wins. As the market is stirring again, we definitely need coins with strong wealth effect to ignite the new bull market. Grab one and make a big profit, grab a few and make a killing

Reasonable control of position size, mainstream coins as a bottom, altcoins for value-added