Author: Stacy Muur, Web3 Researcher; Translated by: Jinse Finance xiaozou

The end of the year is my favorite time, as the big names in the Web3 industry start sharing their highly credible thoughts and predictions for 2025. This is an exciting moment, which may outline the prospects for the crypto thought leadership in the coming year.

Earlier this month, a16z crypto released a list of Big Ideas for the crypto industry in 2025. What projects are currently developing in these key areas? Let's explore further in this article.

Big Idea 1: AI Agents Managing Wallets

In short, AI agents have proven their ability to trade independently and operate with complete autonomy. Many new use cases may emerge in this field. AI agents can play new roles in Web3, participating in transactions, investments, bridging, and realizing other intents.

In this area, there are several projects on my observation list:

● NEAR Protocol: NEAR now positions itself as an "AI blockchain". It has recently launched several major products, including Near AI and Near Intents. NEAR has already gained some quite impressive thought share and is poised to be one of the leaders in this field by 2025.

● Fetch.ai: Fetch.ai is a platform built for the AI economy, providing tools to build, deploy, and monetize AI services. Its ASI wallet can integrate Fetch's best features and advancements in AI, potentially becoming one of the first "AI x wallet" integrations.

● Armor Wallet: This is an AI-driven crypto wallet and trading assistant. The Armor wallet is a non-custodial wallet that uses AI to trade across multiple blockchains and can execute complex transactions quickly and easily. Note that Armor is still a relatively early project.

● Coin98 Super Wallet: In late November, Coin98 released their AI wallet, with an AI assistant that can recommend tools and simplify complex tasks. It also supports human-like natural interactions.

Big Idea 2: Enhancing Information Aggregation

This idea revolves around new mechanisms based on prediction markets, aimed at more effectively collecting information and strengthening decision-making processes across sectors.

This is a relatively new idea, and for this area, I recommend reading Delphi Digital's article "Markets Will Save the World".

Here is an excerpt from the article:

My observation list includes:

● MetaDAO: MetaDAO is the first project to implement Futarchy on a large scale within a DAO. Futarchy is a governance system that combines prediction markets with democratic voting. In a Futarchy system, participants trade based on the outcomes of various decision choices. This approach allows them to "vote" with their own money on the decisions they believe will produce the best results.

● Futarchy: The idea of Futarchy is very similar to MetaDAO: using markets for governance, reflecting the potential impact on the value of shares (tokens).

Big Idea 3: Widespread Adoption of Stablecoins

This idea focuses on the growing prevalence of stablecoins, whose trading value has already surpassed that of Visa, Mastercard, or PayPal. This shift will benefit many market participants, including stablecoin issuers, crypto card companies, and crypto-asset acquisition services.

To better illustrate the prospects of stablecoins, here is an ecosystem diagram from the aforementioned research. You may consider adding these projects to your observation list.

In this field, I believe it is crucial to emphasize that infrastructure that facilitates transaction volume growth will be the primary beneficiary of more widespread stablecoin adoption.

In addition to TRON (a well-known USDT transfer engine), another protocol worth highlighting is Noble. This new project has developed liquidity infrastructure that allows asset issuers to participate in the cross-chain economy.

Big Idea 4: Modularization of Everything

Modularization is not a new concept, but a16z crypto predicts that more modules will see mainstream adoption next year. I've thought of several noteworthy vertical areas:

● RaaS (Rollup-as-a-Service): Gelato, Caldera, AltLayer, Conduit, Bison Labs.

● Interoperability: Hyperlane, Polyhedra, Omni.

● Shared Ordering: Espresso, Radius, Zellular.

● Privacy Preservation: Nillion, Brevis, Automata, Fhenix, zkMe.

● Intents: Anoma, Aori, Native.

● Storage: Arweave, Storj, Filecoin, Zus.

● Oracles: Pyth, RedStone, Supra, Chainlink, and more.

In summary, the focus on infrastructure solutions will remain crucial in 2025.

Big Idea 5: Seamless User Experience

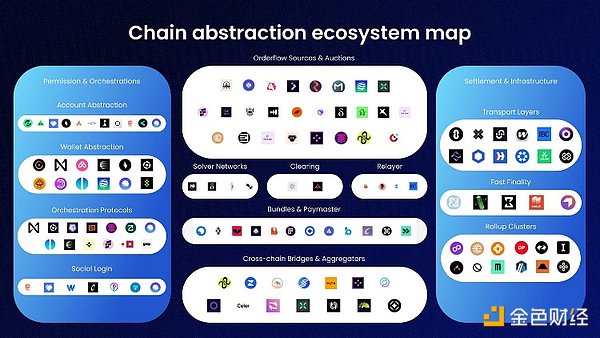

In my view, this is the most compelling bet. Chain Abstraction has always been a hot topic, and we are finally approaching the moment when abstracted user experience becomes a reality, not just a concept.

Here is a great chain abstraction diagram from The Defiant:

All of these are absolutely worth your attention, but I want to emphasize that Particle is the one I'm most optimistic about. Their first Universal Accounts deployment went live recently, allowing users to seamlessly trade assets from any chain through UniversalX.

Another bet in this area is Everclear, which is the primary clearing layer for Web3. As the solver economy (crucial for chain abstraction) expands, solvers need to rebalance across chains. Everclear is the most cost-effective facilitator of this process.

Big Idea 6: Crypto App Stores

The original a16z crypto article highlighted several notable crypto app store developers, including Telegram apps on TON, Alchemy, Solana's mobile (Seeker) dApp store, and Worldcoin's mobile app.

In fact, many wallet providers can seamlessly transform into crypto app stores.

And I also want to highlight a few more: Glue, DeFi App, and VeBetter.

Big Idea 7: Tokenization of Everything

Tokenization is a broad topic, especially regarding the tokenization of "unconventional" assets. In this area, I've thought of several projects worth keeping an eye on:

● Kaito AI: Tokenization of influence (attention economy).

● GAIB: Tokenizing enterprise-grade GPUs to provide economics for an AI-driven future.

● Compute Labs: Supporting fractional ownership of GPUs (a direct competitor to GAIB).

● ShopX: Tokenizing goods and products (RWA for e-commerce).

● Eaas: Tokenizing carbon footprint.

● AI Agents and DeSci: Dolz (tokenization of porn stars), PsyDAO (tokenization of psychedelic science and art), Molecule (tokenization protocol for biomedical IP), etc. (high risk, peak hype curve).

The protocols listed above are some on my personal observation list, but please don't limit your research to these. The Web3 space is vast, and there are many more protocols worth keeping an eye on!