Author: 1912212.eth, Foresight News

This morning, the Federal Reserve lowered interest rates by 25 basis points as expected. However, the cryptocurrency market has undergone dramatic changes, with BTC sliding from $105,000 after the Fed's decision to a low of $99,000. Ethereum also fell from around $4,000 to around $3,500.

Except for a few altcoins, the altcoin market is mostly in a downward trend, especially in the AI, MEME, and L1 sectors. In the 24-hour decline, the AI sector saw WLD drop over 13%, ARKM over 17%, and RENDER over 11%; the L1 sector saw SOL drop over 8%, SEI over 13%, and SUI over 9%. In the meme sector, PEPE/BONK/FLOKI/WIF all fell over 18%.

In terms of contract data, the 24-hour total network liquidation was $674 million, with $577 million in long positions liquidated. The total number of liquidated positions exceeded 237,000, with the largest single liquidation occurring on Binance's ETH/USDT, worth $4.0677 million.

The cryptocurrency market is in a state of lament, with Placeholder partner Chris Burniske stating: "If you're frustrated that you didn't sell before the market pullback after the FOMC meeting, understand that you really didn't have a big edge in predicting the market's reaction. Take this as an opportunity to slow down. Don't overtrade. In the long run, as long as you're patient, you'll be fine."

Why is the market experiencing a significant decline at this moment, when the much-anticipated bull market cycle was expected?

The Federal Reserve's Hawkish Rate Cut

Cryptocurrency assets are increasingly influenced by macroeconomic factors.

On Wednesday, the Federal Reserve announced a 25-basis-point rate cut, as expected by the market, but Federal Reserve officials significantly raised the median of their future policy rate target range and their inflation expectations for next year and the following year, indicating that there will only be two rate cuts next year.

Powell stated that the decision to cut rates in this meeting was "quite difficult," and that the risks facing the Federal Reserve in achieving its dual goals of controlling inflation and promoting employment are roughly balanced, with significant progress made in controlling inflation. Although rates have been cut by 100 basis points, they are still significantly suppressing economic activity, and the Federal Reserve is "on a path of continuing to cut rates." However, before further rate cuts, officials need to see more progress on the inflation front.

Additionally, Powell stated that the policies of the new U.S. administration have not yet been formally implemented, but the Federal Reserve has already done a considerable amount of preparatory work, and when the specific policies are finally seen, it will be able to conduct a more careful and thoughtful assessment and formulate appropriate policy responses.

In his opening remarks, Powell stated that the U.S. economy is generally performing strongly and has made significant progress towards the Federal Reserve's targets over the past two years. The labor market has cooled from its previous overheating state but remains robust. Inflation levels are now closer to the Federal Reserve's 2% long-term target. He stated that even if the inflation rate next year only declines to 2.5%, the Federal Reserve may still cut rates as indicated in the dot plot, as inflation will be moving in the right direction.

As Powell hinted at a slower pace of rate cuts, the U.S. stock market declined, with the Dow Jones Industrial Average potentially extending its losing streak to 10 consecutive trading days, which would be the longest single-day losing streak since October 1974. All 11 major sectors of the S&P 500 index were down, with real estate leading the decline.

However, some remain optimistic about next year's rate cuts, with Kathy Bostjancic, chief economist at Nationwide, stating that the focus next year will be on Trump. Based on our forecasts for potential anti-inflationary trends (especially in the service sector), we expect the Federal Reserve to cut rates by an additional 75 basis points next year.

BitMEX Co-Founder: Experiencing a Crash Around Trump's Inauguration

Arthur Hayes, co-founder of BitMEX and chief investment officer of Maelstrom, stated in his latest article that while he is optimistic about Bitcoin's future performance, this does not mean that Bitcoin will rise to $1 million without any significant corrections.

"I believe the market has not fully grasped how limited Trump's actual time to get things done is. The market currently has overly high expectations for Trump and his team."

Arthur Hayes said, "Before entering the bull market's collapse phase, the cryptocurrency market will experience a painful crash around January 20, 2025, the date of Trump's inauguration. Maelstrom (Arthur Hayes' fund) will reduce some positions in advance and hopes to re-enter at a lower price sometime in the first half of 2025. If the market breaks through strongly around January 20, we will also acknowledge our misjudgment and get back on board after licking our wounds."

MicroStrategy, the "Biggest Bitcoin Buyer," May Temporarily Suspend Purchases

MicroStrategy, the frenzied Bitcoin buyer, may temporarily suspend its purchasing activities, leaving the market without a major buyer for the time being. According to a report by Protos, MicroStrategy (MSTR) may enter a lockup period in January 2025, during which it will temporarily suspend raising funds through "at-the-market" (ATM) stock and convertible debt issuance to purchase Bitcoin. This information comes from a venture capitalist's leak, who said that Executive Chairman Michael Saylor "will be in a lockup period throughout January and unable to issue new convertible debt to buy Bitcoin."

While the SEC has not explicitly prohibited insider trading during the period between the end of a quarter and the release of financial reports, many companies voluntarily implement self-imposed blackout periods ranging from 2 weeks to 1 month to avoid suspicions of insider trading. MicroStrategy plans to release its financial report on February 5, 2025, and will join the Nasdaq-100 index on December 23.

There are various opinions on the specific duration of the blackout period, with some believing it will be a full-month blackout and others predicting it will start on January 14 for 30 days. MicroStrategy has not yet officially responded.

Summary

Although the market is in a pessimistic state, there are still catalysts to look forward to in January. On January 20, Trump will officially take office as president. With policy tailwinds, institutions will be more willing to channel funds into the cryptocurrency market, which will boost cryptocurrency asset prices. The cryptocurrency market often follows certain market superstitions, such as typically experiencing a significant price increase around the Lunar New Year.

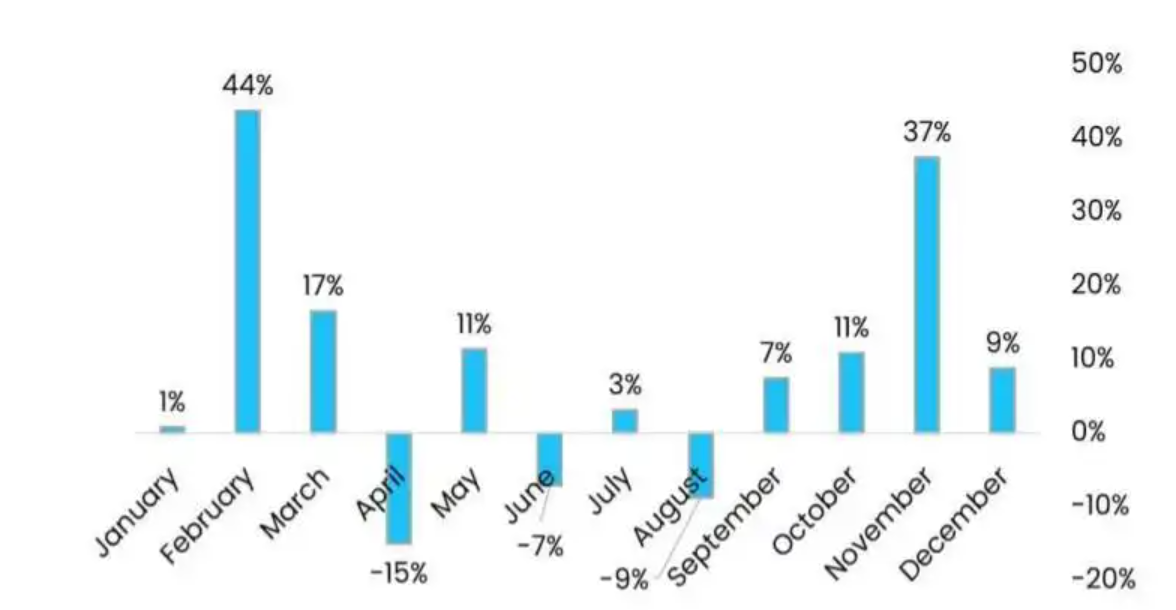

For example, Bitcoin's monthly return rate exceeded 44% during the Lunar New Year in February this year. January 29 next year will be the Lunar New Year. Perhaps the market will see a turnaround in January.

Additionally, the FTX restructuring plan will take effect in early January, and the compensation funds will be distributed in fiat and stablecoins, bringing billions of dollars back to the market.

While January 2025 holds promise, investors should not be complacent. The market cycle fluctuates greatly, and investors need to pay attention to risk control.