Author: Luke, Mars Finance

What is Binance Alpha?

As one of the world's largest cryptocurrency trading platforms, Binance has always been at the forefront of the market, constantly adjusting its own strategies to adapt to the rapidly changing industry environment. Recently, Binance has launched Binance Alpha, an entirely new listing mechanism that is undoubtedly a profound insight and response to the current state of the crypto market. Its main purpose is to screen and promote potential tokens that have not yet been widely circulated, providing these projects with a stage, while also providing more investment opportunities for platform users.

Binance Alpha is essentially an innovative mechanism proposed by Binance to address the issue of token listings. Unlike its traditional listing process, the Alpha market allows users to "vote" and trade on new tokens in a more open and speculative manner. This not only enhances the liquidity of the Binance platform itself, but also attracts more investors to participate in the price discovery process of the tokens through a "crowdfunding-like" approach. Each period, Binance will launch several potential tokens for users to participate in trading, and the growth in trading volume is directly related to the price fluctuations of the tokens - the platform uses trading volume to screen the most promising projects and promote them to the mainstream market.

This mechanism has an extremely high level of participation, just like a large racetrack, where users are like gamblers, betting on Binance Alpha, guessing which tokens will become the stars of the future. This "speculative and betting" style of operation immediately attracted a large number of active users to the platform, especially in the context of a sluggish market, this method has brought a surge in trading volume in the short term.

Alpha? Drama!

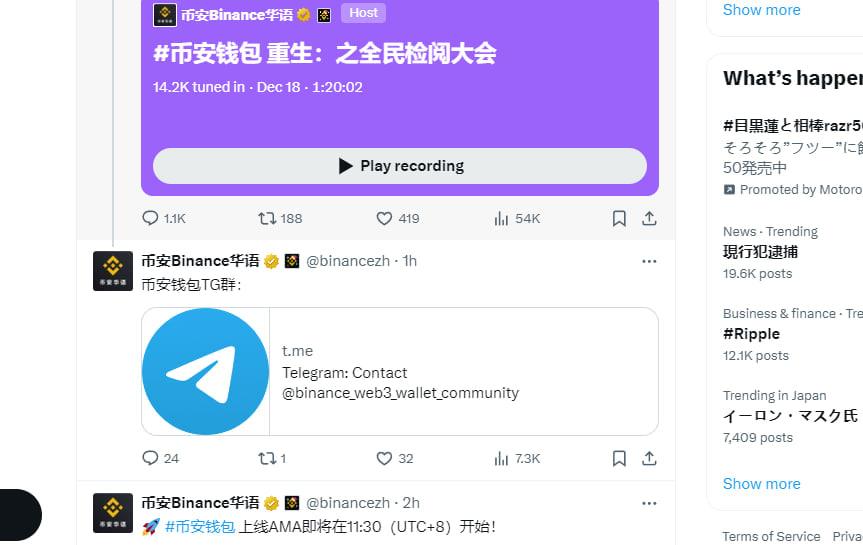

This noon, Binance held a Space called "Binance Wallet Rebirth - A Grand Review for All" on Binance Alpha. He Yi introduced the future innovation plans, and mentioned in the Space that they would establish a Telegram group related to Binance Alpha, so that community members could timely report potential "Rug Pull" projects. This move is obviously intended to bring more community interaction and transparency to the Binance Wallet, but the host immediately responded: "In fact, this group already exists." Shortly after, the Official Twitter of Binance posted a group link in the comments, which seemed to be the "official platform" for Binance Alpha.

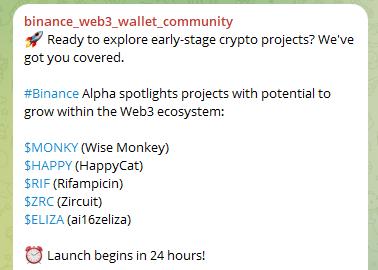

At this time, thousands of investors quickly flooded into the group chat, but who could have thought that this simple link would turn into a "Waterloo" in the next few minutes. Within this Telegram group, the official announced the first batch of projects to be launched on Binance Alpha, which were: $MONKY, $HAPPY, $RIF, $ZRC, $ELIZA.

As soon as the information was released, the market reacted quickly and violently: the token prices of these 5 projects soared, especially ELIZA, which skyrocketed several times within a few minutes. This seemingly windfall opportunity quickly attracted a large number of short-term speculators, and almost everyone felt they had grasped an excellent trading opportunity.

The holders of the mentioned projects cheered, "Great, it's Binance, we're saved," but at this point, Binance officially issued a clarification statement, stating that the Telegram group was not an official release. At this time, the once soaring coin prices quickly suffered a heavy blow, and the prices of all projects began to plummet rapidly, especially ELIZA, which plummeted from its previous high point. The original "lucky investors" began to suffer losses, and the market sentiment instantly changed from excitement to panic. Investors' confidence quickly collapsed, and Binance obviously became the fuse of this chaos.

At this point, the truth of the incident surfaced. Binance officials stated that the Telegram group link that was mistakenly released was indeed officially released by Binance Wallet, but it was accidentally released incorrectly. Subsequently, a new Telegram group link was released, which was quickly discussed by investors and became a new "petition base".

In this group, users expressed their dissatisfaction and anger at the official's operations, accusing Binance Wallet of being hasty and irresponsible. Some even described the incident as a "sloppy team," criticizing the Binance team's capabilities without mercy.

A launch event that should have been a market highlight turned into a public relations disaster about trust and transparency within a few hours, and Binance Wallet and Binance Alpha have been questioned as a result.

There are many victims of this fiasco, but the funniest one is this:

This unlucky guy sold 1.76 million $arc (about $170,000) and bought 1.42 million $ELIZA at a cost of $0.0.1376 after the news release and the false information release.

Subsequently, he realized that ai16zeliza was the lowercase $eliza, and he sold all the tokens at $0.09567, losing $59,600. Finally, after the official announcement of the blunder, $eliza also plummeted, and he had to sell at a loss again, losing another $43,000 (cost price $0.01693, selling price $0.01157), with an overall loss of 52.5%.

Although this "official mistake" incident ended with a simple explanation of "the link was sent incorrectly," its impact is far from over. With the launch of Binance Alpha, the "wolf is coming" effect seems to be continuing.

The first batch of Binance Alpha projects have varying degrees of increase

The first batch of Binance Alpha projects are: KOMA, Cheems, APX, ai16z, AIXBT.

KOMA

Koma Inu (KOMA) is a MEME coin themed around dogs, inspired by Dogecoin (DOGE) and Shiba Inu (SHIB), committed to becoming the "faithful guardian of BNB." The KOMA project team has rich experience and has successfully incubated several crypto projects with a market capitalization of over $100 million, laying a solid foundation for the development of KOMA. The project promotes the continuous growth and evolution of the BNB ecosystem by building community consensus.

Cheems

Cheems is a Meme project built around the classic internet meme "Cheems", this small and cute Shiba Inu, known as the "Meme King", carries the humor and emotion of global internet culture, and has now successfully penetrated from Web2.0 to the crypto world, becoming a paradigm of community-driven projects. Cheems not only attracts a large number of fans with its powerful IP endorsement, but also aims to build a truly decentralized cultural symbol with the community at its core in the Meme ecosystem.

Cheems' development history is full of drama and comeback. Since its first issuance on ZKSync in 2023, it has quickly become one of the hottest Meme projects in the ecosystem, despite experiencing contract FUD and near-zero setbacks. But Cheems did not sink, but rather, relying on the resilience of the team and community support, it replaced the contract and completed the migration, and even reached an exclusive cooperation with Syncswap, the mainstream Dapp of ZKSync. In 2024, Cheems successfully migrated to the BNB Chain and quickly attracted more users, with community activity continuing to rise.

APX

APX (apollox.finance) is a decentralized derivatives DEX that supports multiple chains. APX received investment from Binance Labs in 2022, supporting BNB Chain, Arbitrum, opBNB, zksync, Manta Network and Base Chain, among others. As of now, APX's TVL has reached over $350 million.

The main advantages that attract users to APX are:

- Classic perpetual contracts can reach 250x leverage, and in Degen mode can provide up to 1001x leverage;

- Low slippage, as low as 0.01% slippage, and 0 slippage in V2 Degen mode;

- High trading performance, used by over 30 partner platforms including PancakeSwap;

- Position isolation, so if one position is liquidated, it will not affect other positions.

a16z

a16z is a decentralized AI trading fund based on the Solana blockchain. As an "AI investment DAO", the core of a16z is to use AI agents to obtain market information on-chain and off-chain, analyze community consensus, and automatically conduct token trading. This new model aims to combine AI trading strategies and decentralized governance through tokenization, providing investors with more transparent and trustworthy investment opportunities. In addition, the project has received the "endorsement" of Marc Andreessen, the founder of a16z, who posted the concept image and official Twitter link of a16z on his Official Twitter.

AIXBT

AIXBT is a project created on the AI agent creation platform Virtuals Protocol, focusing on cryptocurrency native agents for discussion and token analysis.

Ironically, the trends of Binance's own projects are mostly bullish-to-bearish, with ups and downs, while other on-chain AI Agent projects have firmly grasped this bullish trend and are showing stable upward momentum.

A Quick Look at the Second Batch of Projects

At 8 pm, the second batch of Binance Alpha projects was also announced, including:

- BNBChain: CKP;

- Ethereum: GEAR, SD, SYRUP;

- Solana: FARTCOIN

CKP

Cakepie is launched by Magpie, aiming to specifically support the long-term development of PancakeSwap. The main goal of Cakepie is to accumulate CAKE tokens and lock them as veCAKE to obtain enhanced rewards and governance power within the platform.

Cakepie provides CAKE holders with an opportunity to earn enhanced CAKE rewards as passive income. It also offers cost-effective voting power for PancakeSwap voters and allows liquidity providers to enjoy higher annualized percentage rates (APRs) without the need to lock any CAKE tokens as veCAKE.

GEAR

Gearbox is an Ethereum-based leverage protocol that enables leveraged borrowing and composability through the introduction of CreditAccounts, to promote capital efficiency in the DeFi world. Users can obtain leveraged borrowing funds on this protocol and enter mainstream DeFi protocols. CreditAccounts are independent smart contracts with specific whitelisted operations and assets, ensuring a higher degree of security for user funds and borrowing funds in each account.

SD

Stader Labs focuses on providing convenient staking solutions and maximizing user staking returns. The platform, through its suite of DeFi products including a simplified one-click staking solution, allows users to easily invest in multiple validators, leading the future direction of staking. Stader has developed liquid staking solutions that allow users to concentrate assets without meeting full staking requirements, while minting tokens representing the staked assets, whose value grows with the increase in staking rewards. In July this year, Coinbase announced that it would list Stader (SD) on its roadmap.

SYRUP

SYRUP is a lending platform launched by Maple Finance, where $SYRUP is the key to Maple Finance's transformation of the institutional lending market. Users can convert their existing MPL tokens to staked SYRUP at a ratio of 1 MPL : 100 SYRUP, immediately participating in Maple Finance's governance and growth. Staking SYRUP will provide participants with reward opportunities related to the ecosystem's performance.

FARTCOIN

Fartcoin is an AI meme concept. In a user interaction event hosted by Truth Terminal, the platform asked the public what topics they wanted to focus on, and its first response was to continue generating endless Fart Jokes in tweets. This absurd and lighthearted humor quickly attracted a lot of attention, with Tesla even adding fart sound effects to its software, further promoting the spread of this cultural phenomenon. Against this background, Fartcoin was born. It is not only known as the "best $GOAT beta", but also an experiment on the future potential of AI technology. Fartcoin, with a cynical attitude, brings Fart Jokes to the blockchain, combining technology and entertainment with a relaxed, humorous and satirical cultural attitude, becoming a unique representative of modern internet culture.

Future Outlook

The launch of Binance Alpha reflects Binance's concerns about its market position. On the one hand, OKX's web3 wallet has shone brightly in the previous Bitcoin ecosystem boom, attracting a large number of users, while Binance's own wallet has been relatively flat in response. On the other hand, the recent transparent listing strategy and public discussion of HyperLiquid have also put considerable pressure on Binance, so the launch of Binance Alpha is not an exaggeration at all in the face of a defeated army.

Over the past few years, Binance's listing strategy has been centered on two main lines: one is to choose VC-backed tokens with high risk but great potential, and the other is to list low-market-cap tokens that have already been traded on other platforms. However, the first path has not yielded ideal results, as many VC-backed tokens often show a downward trend after an initial surge, and the market's speculative sentiment gradually cools down. On the other hand, in the screening and launch process of such tokens, Binance still has not found a truly stable breakthrough.

Therefore, Binance has chosen the second path: listing low-market-cap tokens that already have a certain trading volume in the market. Project teams and communities indirectly drive the trading volume of these tokens on the Binance Alpha platform by competing for the opportunity to be listed. For example, the recent MEME token on the Solana chain and the CAT token on the BNB chain are typical representatives of this strategy. By introducing these tokens, Binance hopes to create more trading pairs and attract more users to participate in trading.

However, this strategy also brings some significant challenges. On the one hand, Binance is facing a balancing act between VC-backed tokens and low-market-cap tokens. Although the choice of low-market-cap tokens may attract more attention and participation, due to the relatively weak liquidity and absorption capacity of the market, these tokens often fall into a cycle of market fatigue once they encounter price declines after a period of hype. As for high-market-cap tokens, although they can initially attract a large number of investors, due to the lack of recovery of overall market liquidity to the peak period, the price volatility of these tokens is still very high, often resulting in a "high open and low close" situation, making it difficult for investors to maintain sustained confidence.

The launch of Binance Alpha has undoubtedly increased the short-term activity of the platform, but its sustainability is still questionable. With the market downturn, this high-frequency token screening and trading promotion may make investors feel fatigued. In addition, Binance's strategy will also force project teams to pay more attention to "volume manipulation" and community mobilization. In order to gain Binance's favor, project teams will have to adopt a series of aggressive measures to increase trading volume, including volume manipulation, community voting, and event organization, which may also lead to a vicious cycle in the market ecosystem. Some low-quality projects or "air coins" may temporarily gain attention through hype under this mechanism, while truly promising projects may be buried in the din.

In summary, Binance Alpha is a bold attempt, but whether its effect is "leading the trend" or "a fleeting phenomenon" remains to be seen. In this process of gaming, Binance is not only betting against the market, but also racing against time, trying to bring new vitality to the cryptocurrency industry. However, any game may lead to unexpected outcomes.