Author | Jason Jiang & Hedy Bi

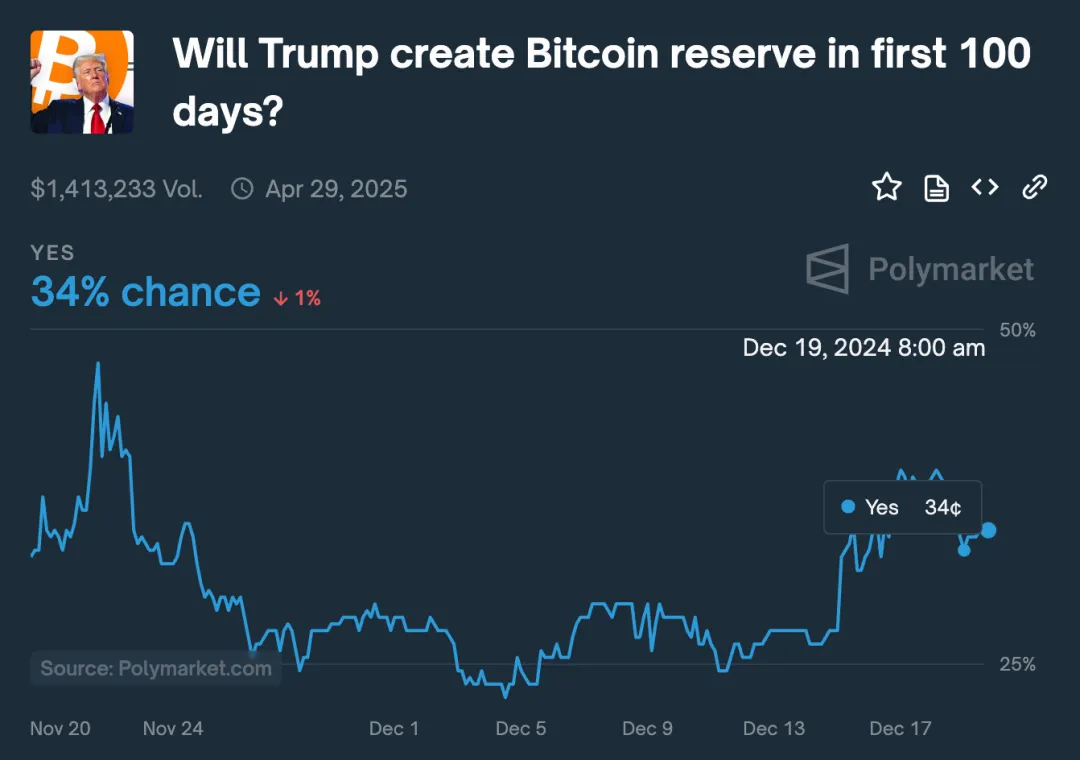

In the early hours of today, Federal Reserve Chairman Powell clearly stated in a press conference after the monetary policy meeting that the Federal Reserve has no intention of participating in any government plans to hoard Bit. He emphasized that such issues fall within the jurisdiction of Congress, and the Federal Reserve has not sought to change existing laws to allow holding Bit. Powell's remarks immediately triggered market turmoil, and the Bit price quickly retreated from its weekly high. According to the information prediction market Polymarket, the likelihood of a Bit strategic reserve after Powell's speech fell from a high of 40% on the 18th to 34%. The overall market capitalization of the crypto market also plummeted, with a total market value evaporation of about 7.5%.

Image source: Polymarket

This statement not only makes the market doubtful about the prospects of the "Bit Strategic Reserve (BSR)", but also focuses people's attention on a deeper question: does the Federal Reserve really have the right to prevent the BSR plan?

First, we need to clarify the position of the Federal Reserve in the US financial system. The Federal Reserve's superior agency is the US Congress: Congress is the highest authority of all financial regulatory agencies, which formulates financial laws and policies through legislation and authorizes other financial institutions (such as the SEC and the Federal Reserve) to exercise their functions. In the US financial market, monetary policy and fiscal policy, as the two core tools of government economic management, are respectively responsible by the Federal Reserve and the Treasury Department. These agencies maintain a balance of power and independence to ensure the stable operation of the US economy and finance.

The Federal Reserve enjoys a high degree of independence in monetary policy and national economic stability, but it cannot "veto" the decision to establish the BSR.

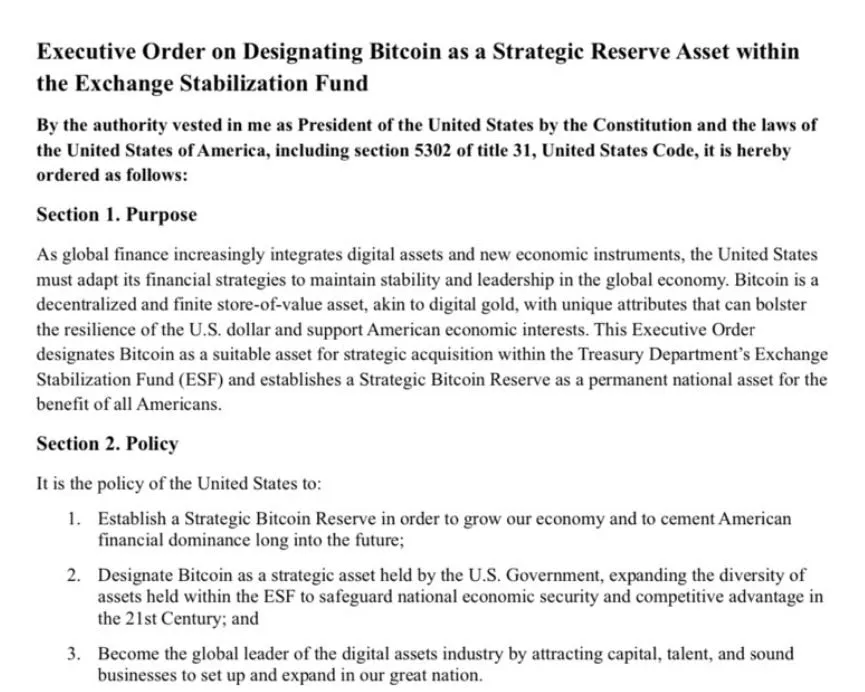

If the Trump administration wants to quickly establish the BSR, the most direct way is to sign an executive order after taking office, instructing the US Treasury Department to use the Exchange Stabilization Fund (ESF) to directly purchase Bit. The ESF is a special fund managed by the US Treasury Department, mainly used for foreign exchange market intervention, support for the stability of the US dollar, and response to international financial crises, and currently includes assets such as the US dollar, Special Drawing Rights (SDR), and gold. The operation of this fund is not subject to the control of the US Congress, and the President and the Treasury Department have a lot of autonomy in its use. The President theoretically can directly instruct the Treasury Department to adjust the allocation of ESF funds through an executive order to purchase or reserve specific assets, bypassing the direct appropriation review of Congress, and reducing political resistance. The Bitcoin Policy Institute recently drafted an executive order in the hope of establishing the BSR in this way.

Image source: Bitcoin Policy Institute

This approach is the easiest to implement, and the use of ESF funds does not require prior approval from Congress, but Congress can limit its operations through investigations or legislation. In 2020 during the COVID-19 pandemic, Congress has imposed strict restrictions on some of the Treasury Department's fund operations. In addition, the sustainability of the BSR established through executive order is doubtful, because an executive order is essentially an extension of executive power, and the successor may revoke or modify the previous relevant decisions through a new executive order.

If you want to establish and maintain the BSR in the long term, another path needs to be chosen, that is, through congressional legislation, to include Bit in the "Strategic Reserve Act" or similar laws, and clearly define the status of Bit as a national strategic reserve asset. This approach has stronger legality and can establish a long-term framework for Bit reserves. The "American Bit Strategic Reserve Act" previously proposed by Republican Senator Cynthia Lummis chose this path. The bill has now been formally submitted to Congress and referred to the Senate Banking Committee for review, and will then go through the Senate, House of Representatives, and the President's review and approval before the legislation is officially completed. So establishing a strategic Bit reserve through this path will take longer and may face various obstacles along the way.

Whether it is through a presidential executive order or congressional legislation to establish a strategic Bit reserve, based on the currently disclosed plans, the Treasury Department will ultimately be the one to lead the implementation, rather than the Federal Reserve.

Image source: Congress.gov

In addition to the above plans, the Federal Reserve and the Treasury Department can also theoretically choose an intermediate path for Bit allocation. The Federal Reserve can purchase Bit through open market operations and include it in its balance sheet. Due to its relative independence, the Federal Reserve's actions do not need to go through Congress, but a clear policy framework is needed to support its purchase of Bit, and given the Federal Reserve's recent stance, the possibility of this plan being realized in the short term seems not high. The Treasury Department can also invest in Bit by setting up a dedicated fund as part of its fiscal investment plan, which, although does not change the existing legal framework, requires congressional approval for related financing.

Regardless of the path taken to advance, the "Federal Reserve says no" cannot definitively negate the BSR proposal, and the Trump pragmatists have taken action to support it. According to on-chain data, just two minutes after Powell started his speech, the Trump family's crypto project World Liberty quietly took action and started buying altcoins. This scene undoubtedly reveals a deeper game: on the one hand, the Federal Reserve's lukewarm response to the Bit strategic reserve plan reflects the government's cautious attitude towards emerging assets; on the other hand, the pace of the Trump family's crypto project reveals the subtle struggle between traditional power and market innovation. The subtle game between the government, traditional finance, and the crypto market may be the prelude to the future fate of the crypto market.