Bitcoin has been positioned as a peer-to-peer payment system since its inception, but its biggest problem is that the price volatility is too large, making it unable to serve as a payment currency in specific application scenarios. The emergence of stablecoins can just make up for the shortcomings of Bitcoin.

Bitcoin has been positioned as a peer-to-peer payment system since its inception, but its biggest problem is that the price volatility is too large, making it unable to serve as a payment currency in specific application scenarios. The emergence of stablecoins can just make up for the shortcomings of Bitcoin.

Stablecoin application scenarios are exploding

In October 2024, Stripe acquired the stablecoin platform Bridge for $1.1 billion, setting a record for the largest acquisition in the crypto field, indicating the imaginative space generated by the combination of stablecoins and payments. In addition, countries such as the European Union, Hong Kong, the United States, the United Kingdom, and Singapore have introduced policies related to stablecoins, providing policy guarantees for the development of the market. As of December 16, 2024, the total issuance of stablecoins has exceeded $200 billion, and according to VanEck's forecast for 2025, the global stablecoin daily settlement volume is expected to reach an astonishing $300 billion, and the potential of applications based on stablecoins such as PayFi is increasing day by day.Foreseeable stablecoin payment market size

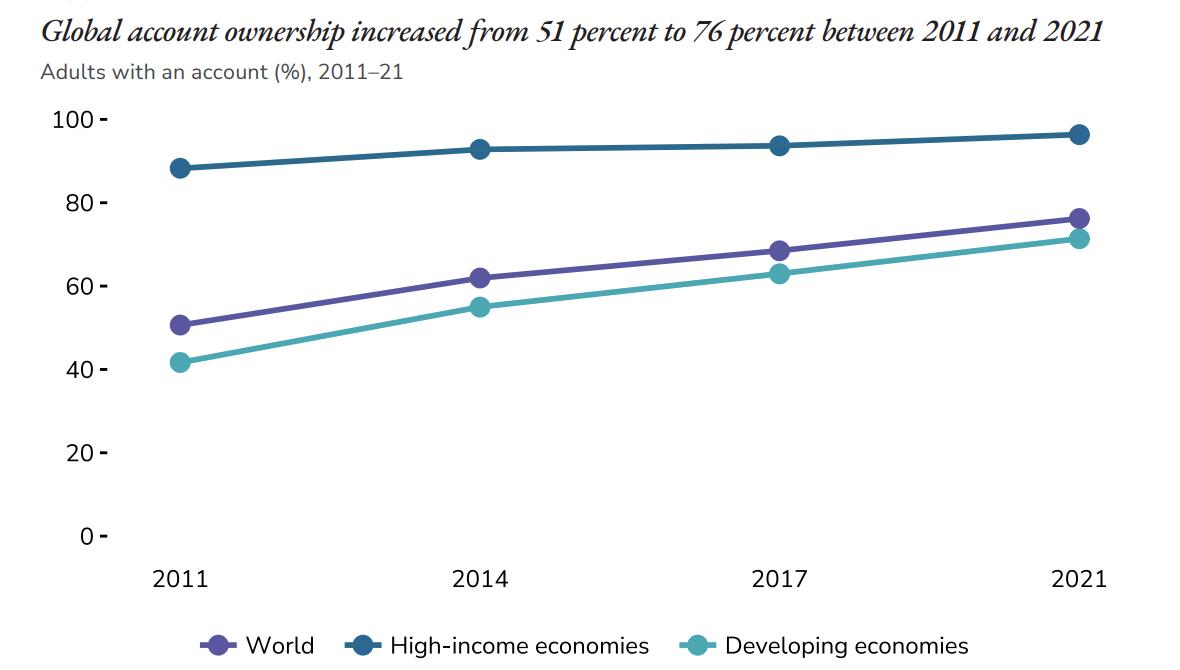

According to World Bank data, the number of people aged 15 and above with a bank account or mobile account accounts for only 76.2% of the total population, which also means that there are still 23.8% of the population (15+), about 2 billion people, who do not have a bank account. This group of people can enter Web3 through applications like PayFi and become users of applications like CEX and DeFi, greatly promoting the progress of Mass Adoption.

Population with a bank account in 2021 Source: World Bank Database

In terms of cross-border payments, stablecoin cross-border payments also have great potential. According to the Bank for International Settlements (BIS), the global cross-border payment amount exceeded $29 trillion in 2022. Traditional infrastructure is expensive and slow, while cross-border payments based on blockchain stablecoins are fast, low-cost, and can provide 7/24 service.We believe that stablecoin payments will gradually occupy a large share of cross-border payments. If they occupy 50% of the share, it will expand the overall volume of stablecoin payments by 1.88 times; and if they occupy 80% of the share, it will expand the payment volume by 3 times.

Stablecoin payment as a percentage of global cross-border payment volume * The current payment volume data is from Artemis |

||||

Current annual payment volume (Between EOA and EOA addresses) |

Cross-border payment volume | Stablecoin payment share assumption | Stablecoin payment volume | Market expansion |

| $7.7 trillion | $29 trillion | 10% | $2.9 trillion | 37% |

| $7.7 trillion | $29 trillion | 20% | $5.8 trillion | 75% |

| $7.7 trillion | $29 trillion | 50% | $14.5 trillion | 188% |

| $7.7 trillion | $29 trillion | 80% | $23.2 trillion | 301% |

Non-USD stablecoin market also has great potential

Recently, a report from Standard Chartered Bank also pointed out that non-USD stablecoins are also gradually gaining attention, including some economies with relatively large foreign exchange fluctuations, such as Turkey, where developing stablecoins can reduce exchange rate fluctuations. At the same time, it can also reduce dependence on the US dollar. In addition to issuing USD stablecoins, the BenFen ecosystem also issues stablecoins based on other currencies to occupy this market, such as BJPY and BINR.The first decentralized native stablecoin that can directly pay Gas fees

This sub-chain uses a completely new decentralized global collateral method to mint multi-currency stablecoins such as BUSD, and endows stablecoin holders with the identity of "first citizen", that is, the native stablecoin BUSD supports Gas fee payment, without the need to hold the native token of the chain like other public chains to transfer or trade, truly realizing and meeting the traditional payment and transfer habits of most Web2 users for the first time in Web3, making it smoother and more convenient. Compared to the centralized issuance model of the large number of stablecoins like USDT currently on the market, BUSD adopts a decentralized issuance method, forming a differentiation from USDT, DAI, and USDe. In addition to BUSD, this sub-chain will also issue stablecoins pegged to other major currencies based on oracles, such as BJPY pegged to the Japanese yen and BINR pegged to the Indian rupee.| Comparison of BUSD and other stablecoins | ||||

| BUSD | USDT | DAI | USDe | |

| Issuance | Decentralized issuance | Centralized issuance | Decentralized issuance | Centralized issuance |

| Pay Gas fees | Supported | Not supported | Not supported | Not supported |

| On-chain collateralization | Supported | Not supported | Not supported | Not supported |

| Collateral | 50% BFC in the treasury and BFC paid by users | US dollars | Native crypto assets | Derivative portfolio positions |

| Stabilization mechanism |

|

|

Overcollateralization mechanism | Spot derivative hedging mechanism |

| Relationship with the chain | Integrated global collateralization | Not integrated | Not integrated | Not integrated |

Issuance mechanism: 50% treasury asset collateralization

During the initial public chain initialization, this sub-chain will permanently use 50% of the BFC as a treasury to collateralize the issued stablecoins, which can greatly improve the security and stability of the system, which is something that other public chains do not have. For example, it's like Ethereum permanently putting ETH tokens into the treasury to issue stablecoins. After the user's wallet is connected, they can choose to pay BFC to mint the stablecoin BUSD, and when they want to exit, they can burn the stablecoin to redeem the BFC. Off-chain users can also use their own USDT/USDC to exchange BUSD at a fixed 1:1 ratio, and when they want to withdraw, they can also exchange it back to USDT/USDC at a fixed 1:1 ratio.Stability: Multiple efficient BUSD price stabilization mechanisms

This sub-chain has designed multiple price stabilization mechanisms, such as the elastic money supply mechanism, which dynamically adjusts the money supply based on market demand fluctuations to maintain price stability. The stablecoin protocol of this sub-chain automatically executes through specific algorithms and trigger conditions to dynamically increase or decrease the circulating BUSD. There is also an exchange rate reversion mechanism that relies on the price difference between the assets in the stablecoin treasury and the secondary market. When there is a significant price difference between the two, traders can buy the asset at a low price and sell it at a high price to realize arbitrage profits. This not only provides profit opportunities for traders, but also helps maintain market price stability and ensure that the stablecoin value is close to its pegged value.The first public chain born for the stablecoin payment scenario

In terms of technical performance, compared to other commonly used public chains for stable coin transfers, this sub-chain also has outstanding advantages in various aspects, truly the first public chain born for the stable coin payment scenario: in addition to the fully embedded decentralized stable coins, it also has better security, higher performance, lower Gas fees and a robust consensus mechanism.

| This sub-chain: a public chain suitable for stable coin application scenarios | ||||

| BenFen | Ethereum | Tron | Solana | |

| Application development language | Move | Solidity | Solidity | Rust |

| First citizen | Stable coin BUSD | Governance token ETH | Governance token TRON | Governance token SOL |

| Performance | High | Low | Relatively high | High |

| Security | High | Ordinary | Ordinary | Ordinary |

| Gas fees | Low | High | Low | Low |

| Chain-native stable coins | BUSD, BJPY and other stable coins | None | None | None |

| Governance token issuance mechanism | SFT mining machine staking output | Pos | Pos | Poh |

More secure: using a safer programming language (Move language)

This sub-chain uses the Move language to write code, Move has a strict type system that can capture many common errors at compile time, such as type mismatches and null pointer references, thereby improving the security of the code. In addition, Move manages assets through the concept of resources, and these resources have strict lifecycle management, ensuring that resources can only be used and transferred as expected, avoiding many security vulnerabilities such as reentrancy attacks and resource leaks. In addition to the above advantages, Move also has its own advantages in terms of permission control, immutability, and formal verification, greatly improving its security.

Higher performance: using an enhanced consensus mechanism to achieve sub-second latency and tens of thousands of transactions per second

This sub-chain innovatively adopts an enhanced consensus mechanism, combining DAG-based consensus and non-consensus methods to achieve low latency and high TPS, while still maintaining the ability to support complex contracts, generate checkpoints, and reconfigure the validator set across epochs.

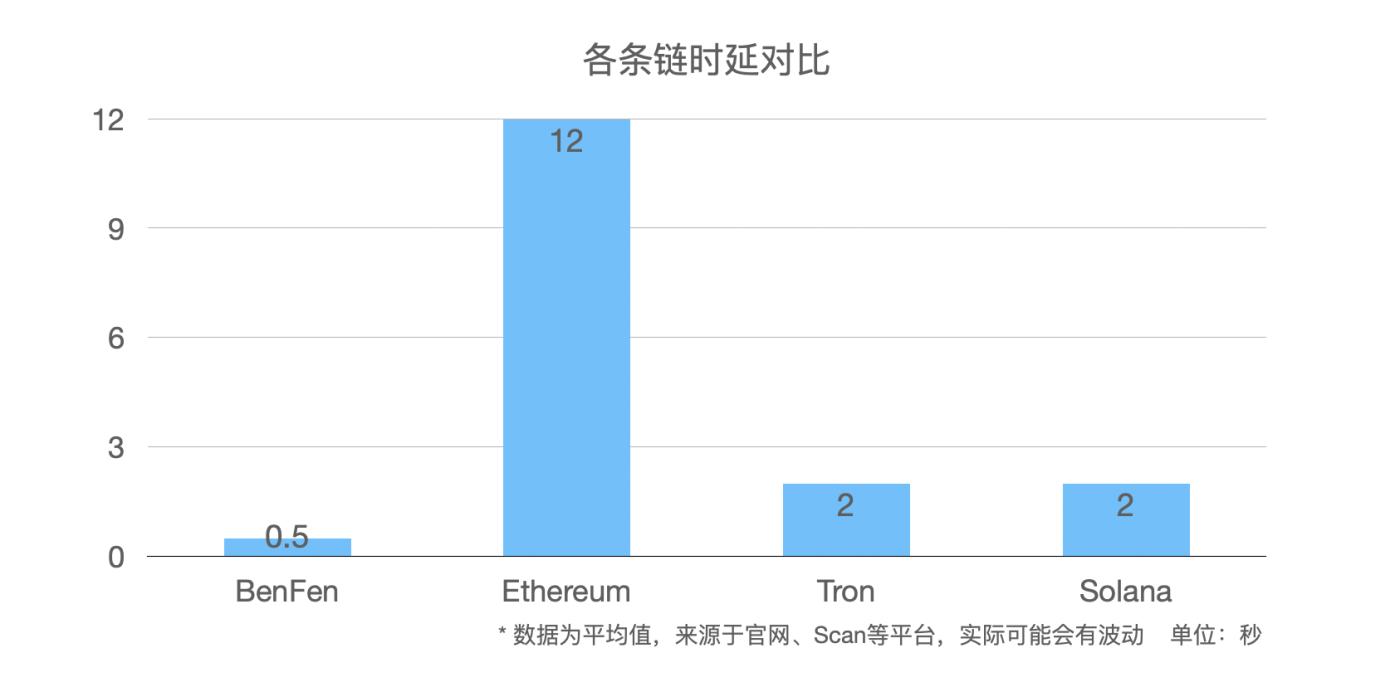

In terms of latency, the BenFen chain can achieve a latency of 0.5 s, far faster than Ethereum's 12 seconds, and also faster than Tron and Solana.

Comparison of latency across chains

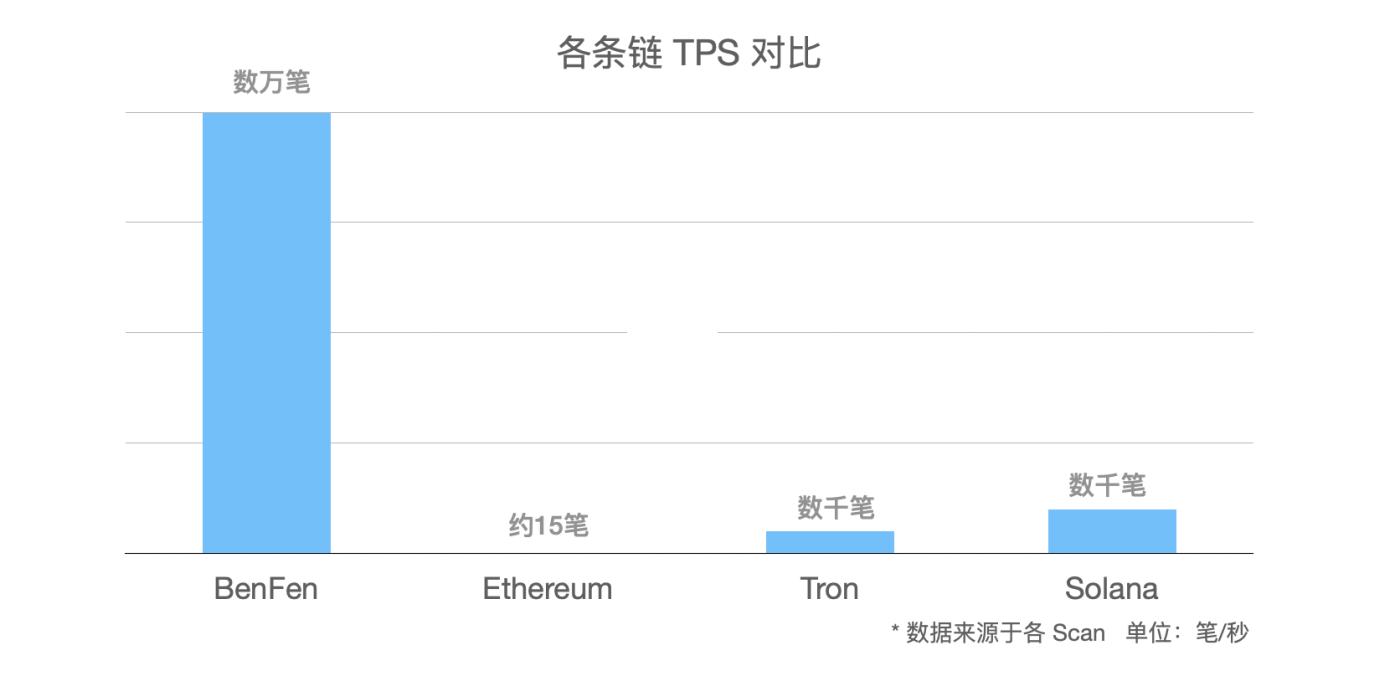

In terms of TPS, the BenFen chain can achieve tens of thousands of transactions, also higher than Ethereum, Tron and Solana.

Comparison of TPS across chains

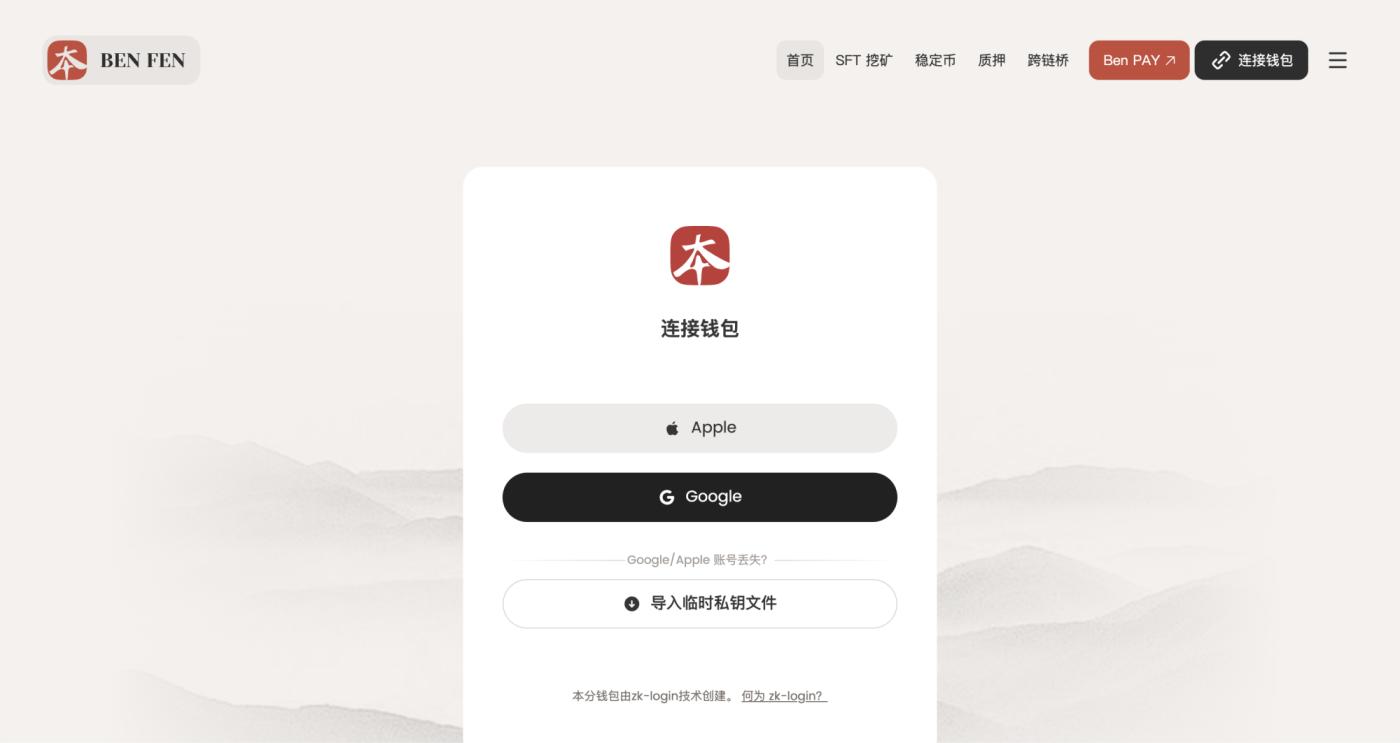

More convenient login: this sub-chain provides users with a more convenient and secure login experience through zkLogin

This sub-chain innovatively introduces the design of zkLogin, providing users with a way to generate addresses and sign transactions based on third-party authorization. Users can log in quickly through Apple and Google accounts without the need for a seed phrase, making it more convenient and faster.

The zkLogin login interface of the BenFen chain

Lower Gas fees: reducing Gas fees in multiple aspects

This sub-chain has optimized Gas fees in multiple aspects to achieve low Gas fees. For example, each validator node submits the minimum price they are willing to process transactions in each epoch. This sub-chain will automatically sort the prices submitted by each validator node and select the price at the 2/3 position calculated based on the staking ratio as the reference price.

In addition, when the user's submitted Gas price is higher than the reference price, the difference is considered a tip paid to the network, and paying a tip can give the user a higher priority.

Finally, the storage mechanism of this sub-chain provides a storage fee refund when transactions delete previously stored objects.

The first public chain focused solely on the expansion of the stable coin application scenario

| Comparison of this sub-ecosystem and other ecosystems | ||||

| BenFen | Ethereum | Tron | Solana | |

| First citizen | Stable coins | Governance token ETH | Governance token Tron | Governance token SOL |

| Expansion focus | Focused | Diversified | Diversified | Diversified |

| Core scenarios | Scenarios centered on stable coins, such as payment, Bridge, 2C2, Pay, Card, etc. | Various DeFi applications | Transfer of stable coins | Issuance and trading of MEME coins |

| Scenario attributes | Combination of on-chain and off-chain | Mainly on-chain | Mainly on-chain | Mainly on-chain |

Compared to other chains that focus on multiple ecosystems, this sub-chain is more dedicated to the ecosystem scenario based on stable coin applications.

- BenFen Bridge is the native asset cross-chain bridge planned to be launched on this sub-chain in the near future

- BenFen Card is a compliant payment solution integrated into our daily consumption

- BenFen Pay is a comprehensive payment ecosystem that can realize direct payment of cryptocurrencies, seamless exchange between digital currencies and fiat currencies, and on-chain escrow payment and other diversified functions

- BenFen KYC is an on-chain identity authentication and authorization system that realizes one-click query of multi-platform KYC records and point-to-point identity information verification channel by aggregating the authentication results of various KYC providers

- BenFen C2C is an innovative decentralized escrow trading platform

In addition, we will also work with partners to develop various ecosystem applications for users, promote the development and prosperity of the BenFen chain ecosystem, and provide greater value to users.