The heat of RWA and DePIN continues to increase, BTC continues to fluctuate around the 100,000 mark and is about to hit a new high.

Crypto Market Summary

1. BTC has broken through the $100,000 mark and continues to consolidate, and is about to hit a new high;

2. With the endorsement of Trump and Baylor, the heat of DeFi and DePIN has started to rise;

3. Meme is still the hottest narrative, and the BSC and Sui sectors are seeing a flourishing of Meme applications;

4. European countries have also started to advance the crypto currency process, and the market environment will be the most crypto-friendly in the next few years.

I. Market Overview

1.1 FutureMoney Group DePIN Index

The FutureMoney Group DePIN Index is a DePIN quality portfolio token index constructed by FutureMoney, selecting the most representative 24 DePIN projects. Compared to the previous report, this Index has retreated slightly, as the market has started to re-enter the breakthrough zone and altcoins have been absorbed.

1.2 Crypto Market Data

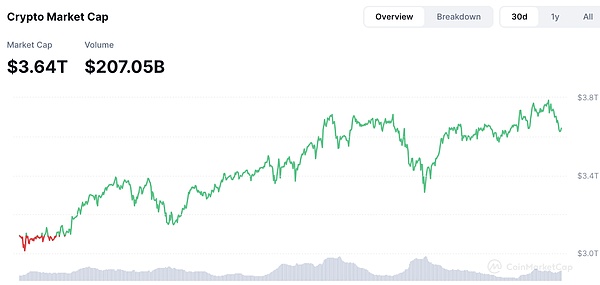

We can currently see that the total market capitalization of cryptocurrencies is still at a relatively high level, although it has declined slightly from $3.69 trillion to $3.64 trillion, but overall it is still showing an upward trend.

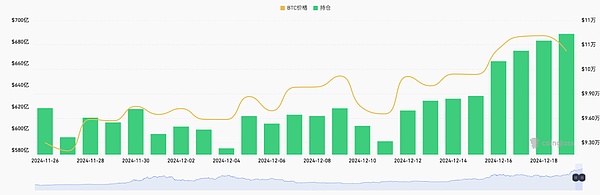

Observing the trend of Coinglass contract holdings, since entering December, the unfinished BTC contract positions on the entire network have continued to rise, from the previous $65 billion to $68.7 billion, indicating that after the market experienced the panic of Bitcoin breaking through $100,000, it has started to continue to be bullish on BTC.

Currently, the overall BTC trend is still strong, with a net inflow of funds from outside the market in the past few days, indicating that off-market capital is optimistic about the future development of BTC, and this trend is largely in line with Trump's inauguration on January 20.

1.3 CPI and other data, as well as market response and market judgment

1. Macro level: The expectation of interest rate cuts has heated up, and the Nasdaq has broken through 20,000 points for the first time. This week, the Nasdaq rose 0.3%; the 10Y US bond yield rose 25bp to 4.40%;

The number of non-farm payrolls increased by 227,000 in November, and after the data was released, the market's expectation of a 25bp rate cut by the Fed in December rose from 67% to 85%, and the possibility of further rate cuts in December increased. At the same time, the three major US stock indexes rose more than they fell, US bond yields fell, and the US dollar index fell in the short term.

As of December 7, the number of initial jobless claims in the US was 242,000, slightly higher than market expectations.

The US dollar index rose, with most other currencies depreciating against the US dollar. The US dollar index rose 0.9% to 105.97, the euro fell 0.6% against the US dollar, the pound fell 0.9% against the US dollar, the yen fell 2.4% against the US dollar, and the Canadian dollar fell 0.6% against the US dollar.

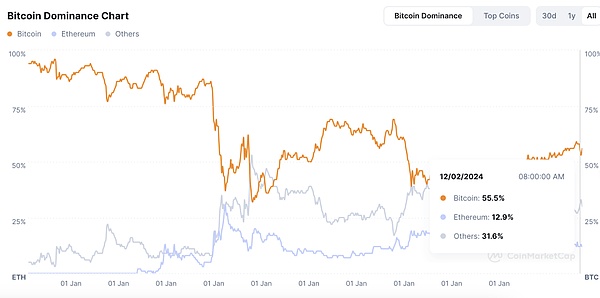

2. In terms of crypto, BTC broke through the $100,000 mark on December 5 and completed the test of a new high. It is currently continuing to consolidate around $100,000 and is likely to test a new high in the future.

3. Sectors worth investing in: The Meme narrative is still strong, and there are signs of spillover from the SOL ecosystem at the moment, with the BSC and Sui ecosystems both seeing a surge in Meme fever; in addition, due to Trump's friendly stance on DeFi and DePIN, and the good performance of a series of DeFi and DePIN projects invested by Baylor, the above two tracks are starting to see a real sector rotation frenzy. This is also in line with the pattern of capital flows in each cycle, from mainstream coins to ecosystem coins, and then to niche tracks.

II. Hot Market News

2.1 Trump promises that Bitcoin and cryptocurrencies will thrive in the US, and says DePIN use cases will legitimize cryptocurrencies

US President-elect Trump attended the Blockchain Association's annual gala dinner and gave a speech: He affirmed the efforts of the Blockchain Association in crypto legislation in the US; said that use cases like DePIN make cryptocurrencies legitimate and are a priority for legislation; and promised to ensure that Bitcoin and cryptocurrencies will thrive in the US.

2.2 Nansen: Institutional interest in crypto products to surge by 2025

According to the on-chain analysis platform Nansen, the crypto industry may experience a surge in institutional interest in listed crypto products by 2025, and Bitcoin may become a default balanced asset allocation for asset management companies and pension funds. In the short term, the market has seen a healthy rotation between outperforming cryptocurrencies after the election, and the environment in December is generally positive, but volatility may increase as the new US government takes office in January.

2.3 Sui sector Meme concept is hot

Meme is still hot, with the animal Memecoin AXOL on Sui reaching a peak of over 1034%, with a current market cap of about $68 million. And the AI Memecoin ARC, which emerged five days ago, reached a peak of over 612%, with a current market cap of about $11 million. The FARTCOIN, which had a strong rally last week, has already surpassed GOAT in market cap and is now ranked second in the AI Meme sector, with AI16Z still in first place.

2.4 RWA total market cap exceeds $14 billion

According to data from the RWA monitoring platform RWA.xyz, the total market cap of RWA has exceeded $14 billion, with a 30-day increase of 5.56%, reaching a new high. RWA is definitely one of the brightest spots in 2024, and recently the Trump family's crypto project World Liberty has bought a large amount of non-stablecoin assets, half of which are top DeFi applications and half are RWA assets. The decentralized stablecoin USUAL on Binance's pre-trading has also been very active, nearly doubling from the initial pre-trading price, reaching a high of over $0.8, which is also worth watching.

III. Regulatory Environment

European countries have also caught up with the progress of cryptocurrency, with French MEP Sarah Knafo urging the EU to also establish a strategic Bitcoin reserve, arguing that the EU's current financial strategy puts member states at a disadvantage in the rapidly evolving currency landscape (especially with crypto-friendly governments like the US taking office), and criticizing the existing regulatory measures as too strict. Meanwhile, Deutsche Bank is trying to solve the compliance hurdles of public blockchains, with the pilot project Project Dama 2 incorporating L2.