The price of Dogecoin (DOGE) experienced a sharp reversal after surpassing Porsche's market capitalization in early December. After a strong rally, DOGE is currently in correction mode, having declined by around 20% in the past 24 hours and nearly 30% in the past 7 days.

This sharp decline indicates that bearish pressure is intensifying, and technical indicators are signaling further downside risks. As DOGE's price hovers near crucial support levels, traders are closely monitoring for signs of stabilization or potential recovery amidst the high volatility.

Ichimoku Cloud Signals Bearish Trend for Dogecoin

The Ichimoku Cloud chart for Dogecoin emphasizes a clear bearish trend. The price is trading below the Ichimoku Cloud, and the red (Senkou Span A) and green (Senkou Span B) lines of the cloud are forming a thick downward structure. This configuration suggests strong resistance and reinforces the dominance of bearish momentum.

Additionally, the blue Tenkan-sen line remains below the red Kijun-sen line, which is a bearish crossover reflecting short-term and medium-term weakness. The green Lagging Span (Chikou Span) is positioned below both the cloud and the price action, further confirming the bearish sentiment.

Going forward, the downward slope of the red (Senkou Span A) and green (Senkou Span B) cloud lines suggests the bearish trend is likely to persist.

If the downward momentum continues, the DOGE price may face further declines towards the recent lows and nearby support levels. A reversal would require the price to break above the cloud and the blue Tenkan-sen line to cross above the red Kijun-sen line, which does not appear imminent at the moment.

DOGE Currently Exhibiting Strong Bearish Trend

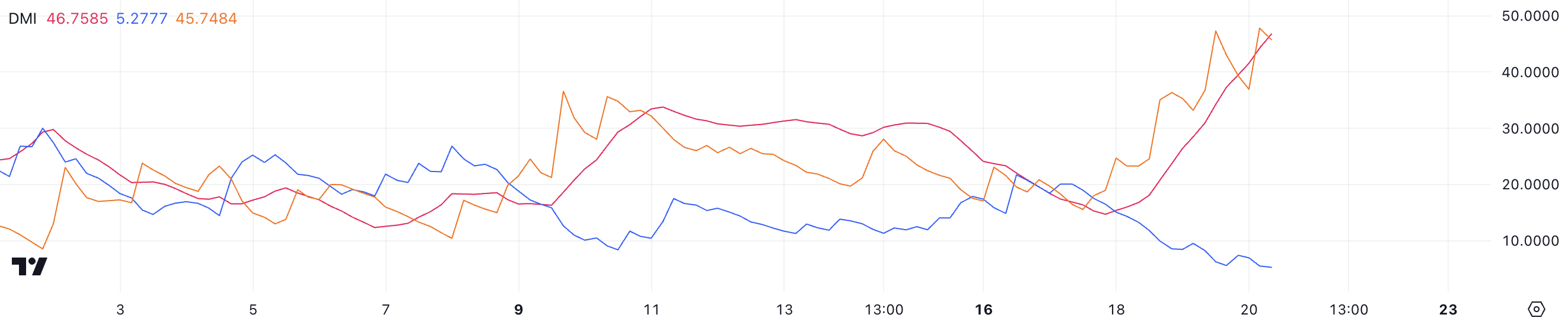

The DOGE DMI (Directional Movement Index) chart is showing significant bearish strength in the current trend. The ADX (Average Directional Index) value has surged from 14.7 to 46.7 over the past 3 days, indicating that the strength of the trend, regardless of direction, has significantly increased.

The orange D- line, representing negative directional movement, is currently at 45.7, significantly higher than the blue D+ line at 5. This imbalance suggests that the bearish trend is dominant, and sellers are overwhelmingly in control of the market.

ADX measures the strength of the trend, and key thresholds provide insights: ADX below 20 indicates a weak or directionless trend, values between 20 and 40 represent a medium trend, and above 40 reflects a strong trend. At 46.7, the ADX emphasizes the sustained downward momentum that DOGE is experiencing.

In the short term, the combination of high ADX, a dominant D- line, and a suppressed D+ line suggests that the market lacks significant buying pressure to offset the selling dominance, implying the potential for further bearish price movements.

Dogecoin Price Prediction: Further Correction Expected

If the current downtrend persists, the DOGE price could decline to the next crucial support level of $0.219. This level is an area where buyers may attempt to stabilize the price. However, if the selling pressure continues and this support is breached, the price could drop further to $0.14.

Such moves would represent an additional 48% correction from current levels, highlighting the severity of the bearish momentum. Considering the selling dominance and the strong downtrend emphasized by recent technical indicators like the DMI, this scenario is plausible unless significant buying interest emerges.

Conversely, if the DOGE price manages to regain positive momentum, it could target the first resistance level of $0.34 as a recovery objective. Successfully breaking above this zone could lead to an additional rise towards $0.43, representing a potential 59% upside from the current price.

Achieving this recovery would require strong buying pressure and a shift in sentiment due to a decrease in the bearish dominance.